Summary:

- Home Depot stock has performed well despite reporting lackluster results over the past year.

- The company will continue to face a difficult repair and remodel market in 2024.

- Home Depot shares currently look overvalued compared to its historical averages.

felixmizioznikov/iStock Editorial via Getty Images

Last March, I placed a “Sell” rating on Home Depot (NYSE:HD), arguing the stock was overvalued and that the repair and remodel market would start to slow while the company faced pressures from wage inflation and lumber deflation. The stock, however, has been a strong performer, up over 32% versus 28% for the S&P. More recently in September, I noted that remodeling activity was expected to start to decline in 2024, which could hurt the stock.

Company Profile

As a reminder, HD is a home improvement retailer that operates warehouse type stores that typically stock between 30,000 to 40,000 items in a year. Among the items it sells include home improvement products, tools, building materials, lawn & garden items, repair & maintenance, and home décor. The company serves both do it yourself (DIY) and professional customers. It also offers installation services in several areas.

Q4 Overview

For fiscal Q4, HD saw revenue drop -3% to $34.79 billion. That topped the analyst consensus by $120 million.

Same-store sales fell -3.5% overall and -4.0% in the U.S. Transactions fell -2.1% in the quarter, while average ticket edged decreased -1.3%.

Comps were particularly poor in January, down -8.5%, including decreasing -9.1% in the U.S. December was solid with comps up 1.1%, including up 0.6% in the U.S.

The company said deflation from core commodities, largely lumber and copper wire, negatively hurt average ticket by -35 basis points. However, the company said framing lumber was the most stable it has seen it quite some time, down only -7%.

Only two of HD’s 14 departments saw positive comps, building materials and outdoor garden. Big ticket comp transactions were down -6.9%.

The company said Pro and DIY customer sales performed relatively in line with each other.

Gross margins were 33.1%, down -30 basis points. OpEx was 21.2% of sales, up 120 basis points.

Earnings fell nearly -18% to $2.8 billion, while EPS dropped nearly -15% to $2.82. Analysts were looking for EPS of $2.78.

Overall, HD didn’t have a great quarter, or a very good year operationally. Same-store sales were down -3.5% for the quarter and -3.2% for the year, as consumers pulled back, especially on bigger ticket purchases. The company ended its fiscal year on a big down note with a particularly difficult January.

Operating margins were also pressured in the quarter and throughout the year after the company raised wages. Meanwhile, lumber prices weighed on sales and gross margins throughout the year.

FY2024 Guidance

Looking ahead, HD is looking for same-store sales to decline by about -1% in fiscal 2024 and total sales to rise 1.0%. It’s looking for an operating margin of about 14.1%. It expects EPS to grow 1%, although an extra week will add 30 cents to EPS. It plans to open 12 stores during the year.

On its Q4 earnings call, CFO Richard McPhail said:

“We considered several factors that informed our outlook for fiscal 2024. On the positive side, we faced a number of pressures in fiscal 2023 that are unlikely to repeat in fiscal 2024. In 2023, we saw 4 increases in the Fed funds rate, a sharp decline in existing home sales and approximately 110 basis points of comp pressure from lumber deflation. However, we still expect pressures to our business in fiscal 2024. Personal consumption growth as measured by PCE is expected to decelerate compared to 2023. Our share of PCE also remains slightly elevated relative to 2019 and has been on a glide path towards 2019 levels. Higher interest rates at the beginning of 2024 relative to last year will likely continue to pressure demand for larger projects. And the effects from pull forward of demand during the pandemic as well as some project deferral could impact demand into 2024. As we consider these influences on home improvement demand, we are planning for a year of continued moderation but with slightly less pressure to comp sales than what we faced in fiscal 2023. … We expect that the macro pressures we called out to point towards low single-digit negative growth from improvement demand and then for us to outperform the market. And that’s how we got to the negative 1% comp guide. … Again, we face macro headwinds, albeit at a lesser degree than we faced in 2023. And so again, just to quickly tick through them, PCE is expected to decelerate. … The interest rate environment is still one where while we see our customers have the means to spend, they are taking more of a deferral stance with respect to large project demand. And we believe there was some pull forward of certain spend during the period of 2020 to 2022 that we’re working out.”

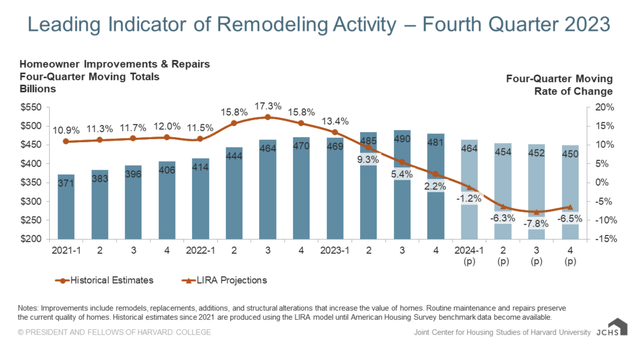

HD’s guidance does not look particularly conservative in my view, even though it is looking for another decline in same-store sales. The Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University is projecting that remodeling spending will fall -6.4% in 2024 from $481 billion in 2023 to $450 billion. Remodeling spending rose 2% last year according to JCHS, so the environment is expected to be getting worse, not better.

Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University

While lower interest rates could help with financing large projects, they will continue to remain elevated this year, and I would not expect a big increase in housing turnover, which often leads to more remodeling projects. At the same time, the pandemic saw a lot of pull-forward to remodel demand, and 2023 still benefited from prior robust contractor backlogs.

Valuation

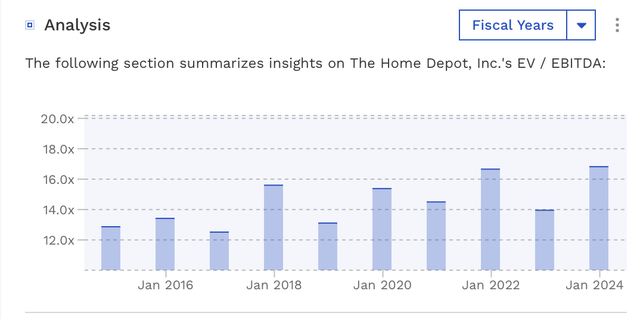

HD stock currently trades around 16.5x the FY2024 (ending January 2025) consensus EBITDA of $25.48 billion and 16.0x the FY2025 (ending January 2026) consensus of $26.16 billion.

It trades at a forward PE of over 24x the FY24 consensus of $15.38.

Revenue growth is expected to be flat this year, and then grow around 7% next year.

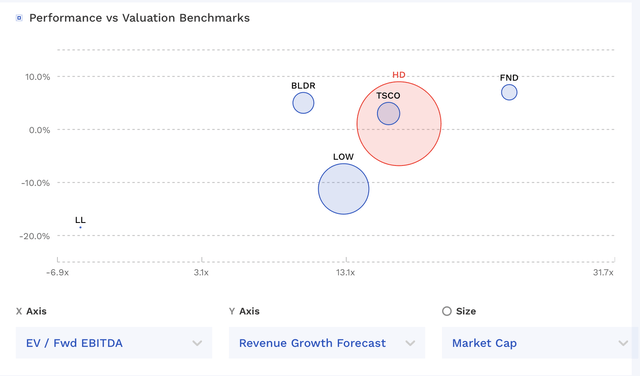

HD Valuation Vs Peers (FinBox)

HD trades in the middle of its peer group and at a moderate premium to its closest rival Lowe’s (LOW). The company has generally traded at a premium due to its better historical performance and stronger ties to the Pro market.

HD Historical EV/EBITDA Valuations (FinBox)

From a trailing EV/EBITDA standpoint, the stock is trading at a premium to where it has historically traded prior to the great recession, when it typically traded between 13-14x EBITDA. Based on that multiple on FY25 estimates, I’d fairly value HD at between $292-$319.

Conclusion

If I were given HD’s 2023 results ahead of time, I would have gotten the direction of the stock wrong. After all, the company entered the year trading at its historical valuation level and put up some lackluster results throughout the year, including pretty significantly cutting its full-year guidance in May. Yet, the stock certainly defied by “Sell” rating, despite a lackluster year, following the overall market up.

As a result, the stock is now trading at a large premium to its historical value, while projecting another lackluster year of results. I also don’t think the company is being particularly conservative with its guidance, and could continue to feel more pressure from a weak repair and remodel market.

As such, I will keep my “Sell” rating. My target price is $300.

The biggest risks to my “Sell” rating is if the market for remodel rebounds as interest rates decline, which leads to much stronger comps. The company could also see a boost if lumber prices start to rebound strongly.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.