Summary:

- ROKU struggled in the media and entertainment space in 2023 as streaming services prioritized profitability over spending.

- ARPU is likely to remain constrained as it adds more international users.

- Competition in the space, meanwhile, could be picking up.

Iryna_L/iStock via Getty Images

I started coverage on Roku (NASDAQ:ROKU) last April, saying that numbers looked poor for the company, that it had kitchen-sink guidance. More recently in December I said that ROKU’s high household penetration in the US and lower ARPU in international markets may pose challenges for future growth and that the stock could get punished if it tried to lowball guidance again. The stock is down -32% since that last write-up. Let’s catch up on the name.

Company Profile

As a refresher, ROKU sells its own streaming devices, smart TVs, and other consumer electronic devices. However, its main business is its streaming platform business from which it generates revenue from advertising and content distribution services.

ROKU has revenue-sharing agreements with streaming services outside of Netflix (NFLX). It will get a percentage of the monthly subscription when consumers sign-up for them on its platform, while for ad-supported services, it receives a portion of the ad inventory spots. It also operates its own ad-supported streaming service, the Roku Channel, and has an ad buying platform called OneView.

KeyBanc Conference and Q4 Earnings

One area ROKU struggled with in 2023 was in the media & entertainment (“M&E”) space. The vertical saw huge growth a few years ago as new streaming services raced to add subs. However, with profitability for these services becoming a key priority, they cut back on their spending.

Discussing the M&E space at the KeyBanc conference earlier this month, CFO Dan Jedda said:

“So 2022 was a peak in the very high-powered M&E space. I mean, a lot of money was being spent in M&E. In other words, it was growth at all costs for a lot of the content providers. That’s changed. I don’t need to tell you that, that has changed. And now it’s a combination of, yes, we need subscribers, but we’re going to do it. We also need to focus meaning the content companies on profitability. So it’s again a balanced approach that they’re taking. So M&E for us and the business we have, it’s certainly stabilized. It’s not this big reduction that we see. But, we’re also not convinced it will ever go back to those 2022 days, where it was like just growth at all costs. And so we have focused heavily on diversification into new ad verticals. We’re constantly focusing on building out our CPG verticals, our health and wellness verticals, insurance, et cetera. And we’ve done a pretty job of adding new advertisers on. So we’re not as reliant now, as we were, back in 2022.”

Now while ROKU’s numbers suffered from this shift in M&E activity, what the company did do to help the stock has set a low bar with guidance and then leap over it throughout 2023.

However, in my last write-up on the stock I said if it went that route again, the stock likely would get punished when it reported its Q4 results. Expectations were clearly raised going into the report, and the stock fell -21.1% the next session.

For its Q4 reported in mid-February, ROKU grew its revenues nearly 14% to $984.4 million. That topped the consensus of $967.1 million. Adjusted EBITDA of $47.7 million, meanwhile, was much better than its guidance calling adjusted EBITDA of $10 million. The company had $92.8 million in stock comp expense in the quarter that was not reflected in adjusted EBITDA.

In Q4, the company saw its device revenue rise 15% to $155.6 million. Device gross margins were -13.2%, but that was an 1,890 basis point improvement over the prior year.

ROKU’s platform numbers, meanwhile, were once again a mixed bag. Revenue rose 13% to $828.9 million, while ARPU dropped -4% year over year to $39.92 and -3% sequentially from $41.03. Platform gross margins dipped -50 basis year over year to 55.3%.

Active accounts rose by 4.2 million sequentially to 80.0 million. The company said much of its user growth is coming from international markets, which hurts ARPU.

On the cost side, meanwhile, ROKU’s sales and marketing expenses fell -11% year over year to $264.6 million. G&A expenses slipped -2% to $93.7 million, while R&D expenses dipped -17% to $183.8 million.

Turning to the balance sheet, ROKU ended the year with $2.0 billion in cash and no debt.

It generated $255.9 million in operating cash flow this year. Its stock-based comp expenses were $370.1 million for the year.

ROKU guided for Q1 revenue of $850 million, a gross profit of $370 million (margins of 43.5%), and breakeven adjusted EBITDA. It is looking for positive adjusted EBITDA for the full year.

In a letter to shareholders, CEO Anthony Wood wrote:

“For 2024 and beyond, there are two industry trends that are particularly important for Roku. The first is the enormous volume of content and live events on streaming. We have an inherent advantage as the programmer of the home screen to help our viewers find what they want to watch, while simultaneously growing our monetization. This is a big opportunity for Roku. Second, streaming services are focused on building successful ad-supported options for consumers, and this will further accelerate the overall shift of ad dollars from traditional TV to streaming. Roku has the tools and expertise to drive engagement, which is critical in an ad- supported environment. With our platform advantages, first-party relationship with 80 million Active Accounts, and deep user engagement, we are well-positioned to accelerate revenue growth in future years.”

In the past, ROKU has talked about being in about 50% of U.S. households, while this quarter it noted that much of its user growth is coming from international users. This will likely continue to pressure ARPU moving forwards, as most ad-based business see much lower ARPU internationally than in the U.S.

Meanwhile, it doesn’t appear that ROKU’s prior high-margin M&E vertical will ever get back to where it was a couple years ago. And while the company was adjusted EBITDA profitable, if you believe like I do that stock comp is a real expense, then on that basis it actually wasn’t close to being profitable.

ROKU once again looks like it has very conservative guidance, but there also becomes a point where investors start to tune out such low-balled forecasts. That appears to be what happened this quarter, and investors were clearly not happy with the declining ARPU and weaker gross margins.

What the company did do well in the quarter was control expenses outside of stock comp. However, it needs to address stock comp as well.

Valuation

ROKU trades at an 82x EV/EBITDA multiple based on the 2024 EBITDA consensus of $94.0 million. Based off of the 2025 EBITDA consensus of $239.3 million, it trades at around 32x.

It’s projected to see revenue grow 11.6% in 2024 and then grow nearly 13.3% in 2025.

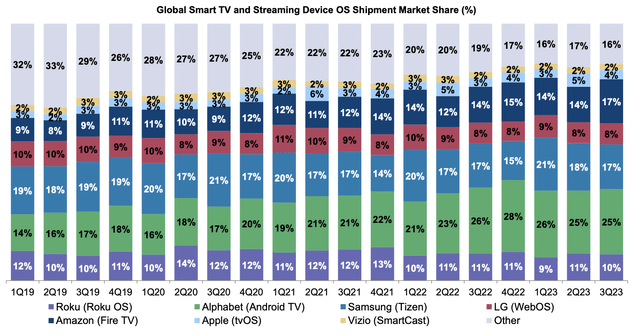

I think the 2025 consensus could be too high, as it bakes in some nice account growth without not much pressure to ARPU. However, with some new competitive pressures emerging in the U.S., most sub growth will likely come from lower ARPU users.

VIZIO (VZIO), meanwhile, was just acquired for 1.2x 2024 EV/revenue and 24x adjusted EBITDA. At that valuation, ROKU would trade between $25-42. VZIO is growing at a slightly slower revenue pace, but is profitable and doesn’t have the same stock comp issues as ROKU.

Conclusion

Given its household penetration levels in the U.S. and the lower ARPU that comes from international markets, it could be difficult for ROKU to grow both active accounts and ARPU. While many bulls will argue that ROKU is under-monetizing its users, I think the growth in international users and the shift in the M&E industry will likely only keep ARPU constrained.

Meanwhile, Walmart (WMT) just acquired VIZIO for its smart TV OS and connected TV offering. Given WMT is one of ROKU’s largest retailers, the company could begin to push its own connected TVs over those of ROKU, which could impact user growth in the U.S. This is a competitive market already, and one of the smaller players in VZIO got a big boost.

Morgan Stanley & SNL Kagen

Overall, I remain neutral on ROKU and while leaning towards being negative on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.