Summary:

- UnitedHealth Group has had double whammy headwinds over the past few weeks, with the regulatory probe and cyberattack triggering a drastic -10.3% loss of value at its worst.

- However, we believe that the stock is an even more attractive Buy now, as the discounted valuations and pullback offer expanded upside potential and dividend yields.

- At the same time, the consensus forward estimates remain optimistic, with UNH expected to sustain its profitable growth trend through FY2026.

- While there may be near-term headwinds, attributed to the potential regulatory fines, lawsuits, M&A uncertainty, and increased cybersecurity spending, these issues are likely to be temporal.

- Interested readers may want to pay close attention to the company’s upcoming earnings call, with the management likely to offer more details.

da-kuk/E+ via Getty Images

We previously covered UnitedHealth Group (NYSE:UNH) in October 2023, discussing why it deserves its profitable growth premium, attributed to its relatively low Medical Care Ratio and vertically integrated operations across different healthcare segments.

Combined with its healthy balance sheet and moderating EBITDA to debt ratio, we were optimistic that UNH might continue to outperform, resulting in our Buy rating.

In this article, we shall discuss why UNH is an even more attractive Buy after the regulatory probe/ cyberattack, as the discounted valuations and stock pullback offer expanded upside potential and dividend yields for an improved margin of safety.

While there may be near-term headwinds ahead, attributed to the potential regulatory fines, lawsuits, and increased spending on cybersecurity, we maintain our belief that these issues are likely to be temporal, posing little challenges to its long-term prospects.

UNH’s Regulatory Probe/ Cybersecurity Events Trigger The Much Needed Correction For A More Attractive Entry Point

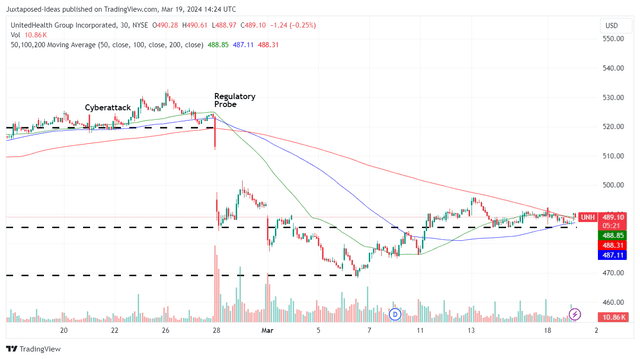

UNH 1M Stock Price

For now, UNH has lost a drastic -10.3% of its value and approximately -$37.18B of its Enterprise Value at its worst from the Change cyberattack on February 22, 2024 and the regulatory anti-trust probe on February 27, 2024, triggering a double whammy impact on the company’s near-term prospects.

While Optum Insight, of which Change is a part of, only reports $18.93B in FY2023 sales (+29.8% YoY), the segment is the company’s bottom line driver with $4.26B in earnings from operations (+18.9% YoY) and rich profit margins of 22.5% in FY2023 (-2 points YoY).

With the security breach likely to have a material impact on UNH’s bottom lines, we can understand why the stock continues to languish after nearly four weeks.

Interested readers may want to pay close attention to the company’s upcoming FQ1’24 earnings call on April 16, 2024, with the management likely to offer more details after the eventual resumption of its full service.

Moving forward, UNH investors may want to monitor the developing cybersecurity situation for a little longer, with a certain shake up in the management very likely as the president/ COO also retires.

There may be near-term bottom-line headwinds from the potential regulatory fines, lawsuits, and increased spending on cybersecurity as well, as the giant recovers from the attack while improving its systems.

This is especially since Change handles approximately “50% of the nation’s medical claims,” highlighting the enormity of the health care company’s challenges ahead.

At the same time, UNH continues to face a probe surrounding a potential health care monopoly, with “the relationship between UHC (insurance) and Optum (supposedly) restricting competition in the marketplace.”

With the investigation still ongoing and no clarity expected in the intermediate term, we concur with market analysts in that the stock may continue to sell off moving forward.

This is especially since UNH’s (yet to be completed) acquisition of Amedisys may be at risk, with its future growth (through the acquisition of smaller companies) likely to be stunted as the regulators attempted to tamp down on further consolidation within healthcare.

As a result of the potential uncertainty and volatility, investors whom continue to hold on may also want to temper their near-term expectations.

Nonetheless, we remain convinced about UNH’s long-term prospects, based on the reiterated revenue guidance of $401.5B (+8% YoY) and adj EPS of $27.75 (+10.4% YoY) in FY2024, after adjusting for the sale of its Brazilian operations.

At the same time, the management reaffirmed its FY2024 Medical Benefit Ratio of ~84% (+0.8 points YoY), relatively in line with FY2023 levels of 83.2% (+1.2 points YoY) and FY2019 levels of 82.5% (+0.9 points YoY).

Readers must also note that UNH has been able to achieve one of the market leading Medical Benefit ratios.

This is compared to its direct competitors, such as CVS Health (CVS) at 86.2% in FY2023 (+2.4 points YoY), Centene (CNC) at 87.7% (in line YoY), Elevance Health (ELV) at 87% (-0.6 points YoY), and Humana (HUM) at 87.2% (+1 points YoY).

UNH continues to report high growth as well, particularly the Optum Health segment as the top-line driver with revenues of $95.31B (+33.9% YoY), comprising the giant’s overall top-lines at 33.8% (+5.4 points YoY).

Much of the top-line tailwinds are attributed to the growing value-based care patient base to over 4.1M (+0.9M YoY) and expanding consumer base to over 103M consumers (+1M YoY).

At the same time, UNH’s Optum Insight reports growing earnings (as discussed above) and expanding multi-year revenue backlog of $32.1B (+7% YoY), attributed to its well-diversified product portfolio across different healthcare providers and organizations.

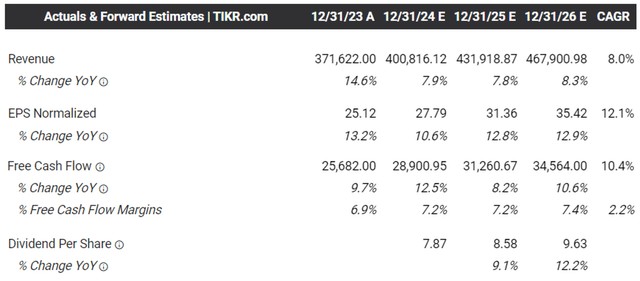

The Consensus Forward Estimates

UNH’s lower Medical Benefit Ratio and high growth cadence naturally demonstrate why the health care company has been able to report an excellent top/ bottom line growth at a CAGR of +10.5%/ +17.7% between FY2016 and FY2023, respectively.

At the same time, the management’s promising FY2024 guidance also contributes to the optimistic consensus forward estimates, with the health care company expected to generate a raised top/ bottom line expansion at +8%/ +12.1% through FY2026.

This is compared to the previous consensus estimates of +7.1%/ +11.7%, further implying that the market may consider the regulatory probe/ cybersecurity issues to be temporal.

Even if UNH is barred from engaging on further acquisitions, we believe that the vertically integrated healthcare giant remains well positioned to generate alpha moving forward.

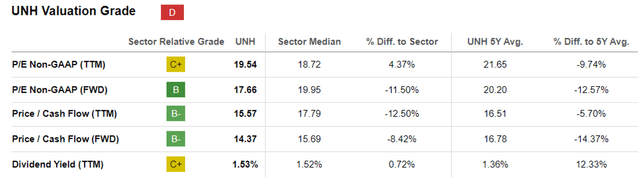

UNH Valuations

As a result, UNH’s temporarily discounted FWD P/E of 17.66x and FWD Price/ Cash Flow of 14.37x are highly attractive, compared to its 1Y mean of 19.05x/ 15.81x and the sector median of 19.95x/ 15.69x, respectively.

At this point of time, we believe that the market has over-reacted to the temporal headwinds, giving opportunistic investors with an attractive point to dollar cost average this market leader.

So, Is UNH Stock A Buy, Sell, or Hold?

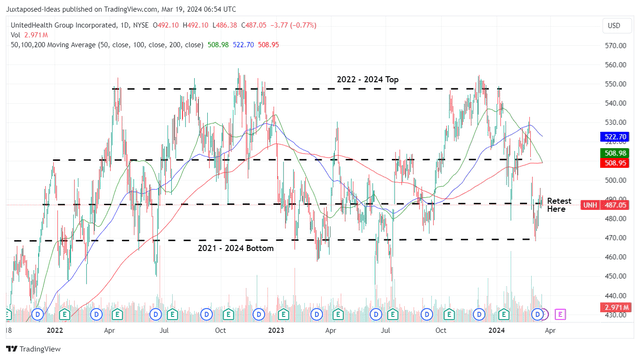

UNH 2Y Stock Price

For now, UNH has dramatically retraced after the recent regulatory probe/ cyberattack, with it trading below its 50/ 100/ 200 day moving averages.

However, it is apparent that bullish support has swopped in at the previous 2021 – 2024 bottom of $470s, with the stock successfully bouncing off those support levels.

Based on its 1Y P/E mean of 19.05x and FY2023 adj EPS of $25.12, it is apparent that UNH is trading near our fair value estimate of $478.50, thanks to the recent pullback.

Based on the FY2026 adj EPS estimates of $35.42, the stock also offers an expanded upside potential of +38.5% to our long-term price target of $674.70.

The recent stock correction triggers an expanded forward dividend yield of 1.53% as well, compared to UNH’s 4Y average yields of 1.33% and the sector median of 1.57%.

As a result of the robust profitability, we expect the health care giant to sustain its robust shareholder returns ahead, building upon the 5Y Dividend Growth rate of +15.87% compared to the sector median of +6.06%, with Seeking Alpha Quant also grading its Dividend Safety as A+.

As a result of the (prospective) dual pronged returns through capital appreciation and dividend incomes, we are maintaining our Buy rating for the UNH stock here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.