Summary:

- Disney+ subscriber growth has plateaued, indicating a potential problem with the content library and a lack of new releases.

- The higher churn rate and lack of original shows on Disney+ compared to Netflix contribute to the subscriber growth issues.

- Disney’s financial success relies heavily on Disney+, but the current strategy may not be sustainable for long-term growth. Investors should be cautious.

Neilson Barnard

Investment Thesis

While Disney’s (NYSE:DIS) flagship streaming service, Disney+, was originally launched as a competitor to Netflix (NFLX) in 2019, the platform’s growth has plateaued. While the platform had an initial period of strong growth, I predict their subscriber growth plateau is a bigger problem than it appears and it is a symptom of the style of content Disney chose to put on their platform.

Their content library consists of classic and (for many Americans) already viewed content, rather than a more steady stream of new releases that we see from streaming platforms like Netflix. While this content increases the appeal to audiences in search of nostalgia, their lack of new content may negatively affect their long-term appeal and competitiveness. Disney’s efforts with growing Hulu have run into issues as well.

While the house of mouse has seen a large surge in operating income since 2022, with net income increasing to $1.911 billion in FY Q1 2024 from $1.279 billion in FY Q1 2023, these impressive numbers are credited to Disney losing less money on streaming services, which is at the heart of my concerns.

The role of TV/digital assets for Disney’s is pivotal. As their TV assets generate a large part of the company’s revenue and over half of their operating income, older content affecting subscription rates is becoming a bigger issue. I believe profitability on their streaming services will drop as Disney will either have to pay up for more content to keep their library of content fresh, or suffer with subscription-churn rates being an issue. Either way, this makes me a hold on Disney stock.

Background

One of the key features setting Disney+ apart from their competitors is the ability to cater to a specific audience searching for family-friendly and nostalgia-driven content. Disney’s platform consists of old and new content from Disney franchises like Marvel, Star Wars, and Pixar titles, gaining the label as “paradise for kids and a home run on nostalgia for adults”. When Disney was first released in November of 2019, the initial launch was very successful. Within the first year, Disney+ reached 73.7 million subscribers (for reference, Netflix (NFLX) had 204 million subscribers as of the end of 2020 as a result of having their streaming service for over a decade according to their 10K). As of the start of 2024, Disney+ is at roughly 149.6 million subscribers as of their most recent 10Q. Like other services, in order to further grow this consumer base, Disney has created ad-supported tiers. These programs allow their users to pay at a lower price and watch the same content, but with advertisements.

Despite their ability to appeal to those looking for nostalgic, family-friendly options, the lack of variety and updated content reduces their competitiveness. In order to combat this, Disney+ implemented the integration of Hulu content in December 2023. This merger allows subscribers to gain access to Hulu’s more adult-oriented programming, like the FX drama “The Bear” and “The Kardashians”. While this grows Disney’s content library, limitations remain due to licensing rights and the exclusion of certain Hulu titles and live TV channels from the Disney+ platform.

Why Retention Rates & Subscriber Growth Have Been More Anemic Than Netflix

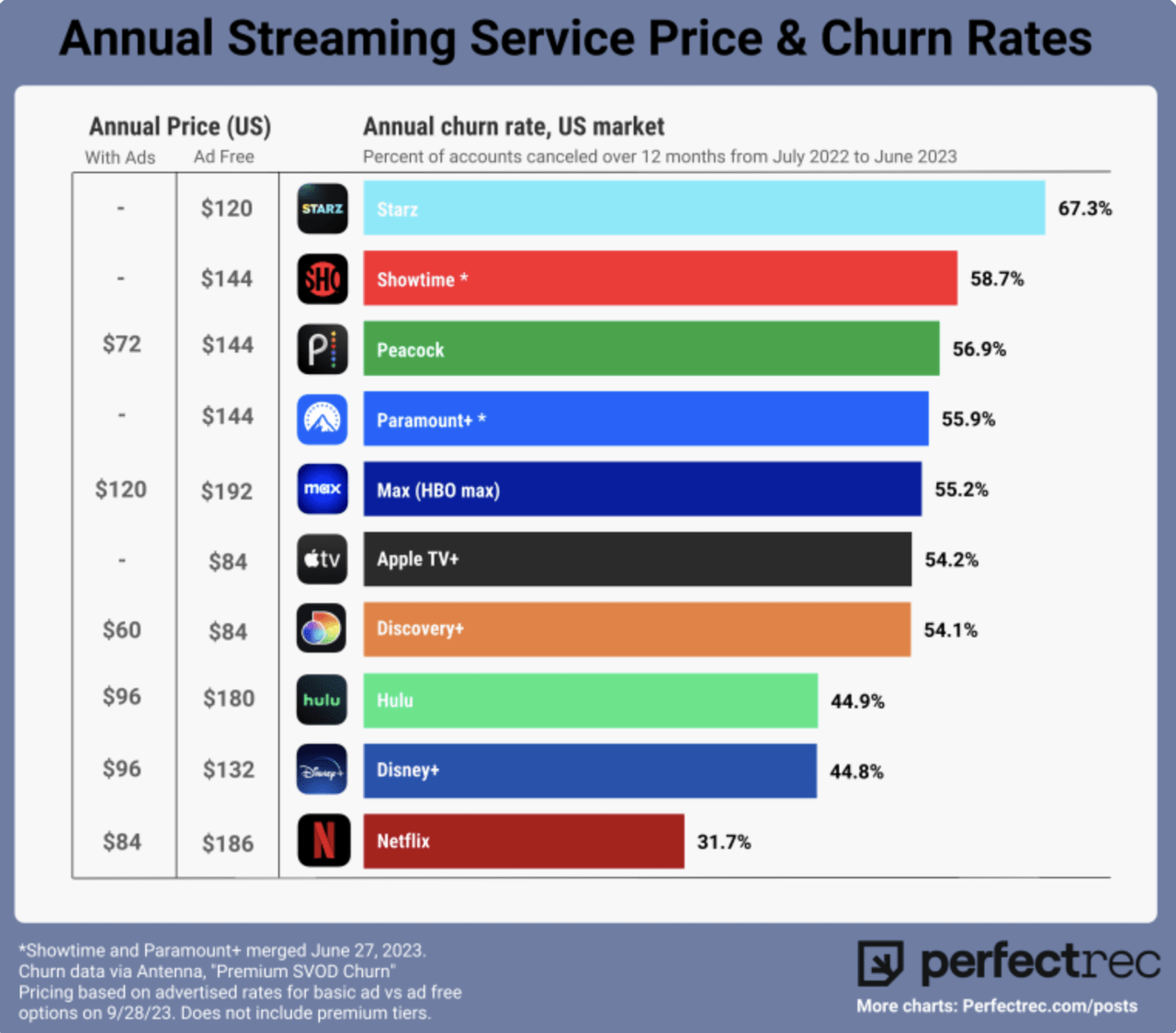

Annual Churn Rate of Streaming Services (perfectrec)

Likely due to their lack of new content, Disney+ has faced challenges in maintaining subscriber growth compared to Netflix and other competitors. As of Q1 2024, Disney+ has experienced a monthly churn rate of 4.8% compared to Netflix’s 2%. This higher churn rate indicates that a larger percentage of Disney+’s subscriber base cancels their service each month compared to Netflix. When looking more long term, in the graph above from July 2022 to June 2023, Disney+ experienced an annual churn rate nearing 45%. The chart also shows the churn rate for Hulu, owned by Disney, to be near 45% as well. This is much higher than the churn rate of Netflix, which stood at 31.7% in the same time period.

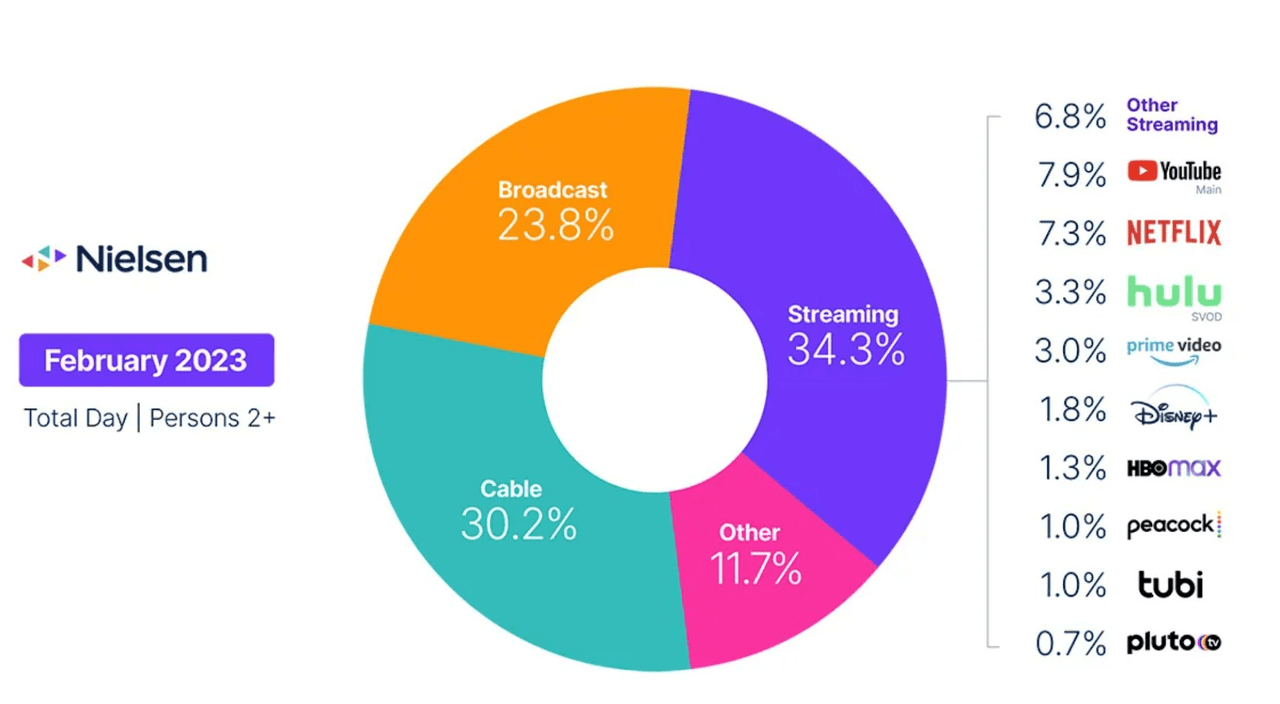

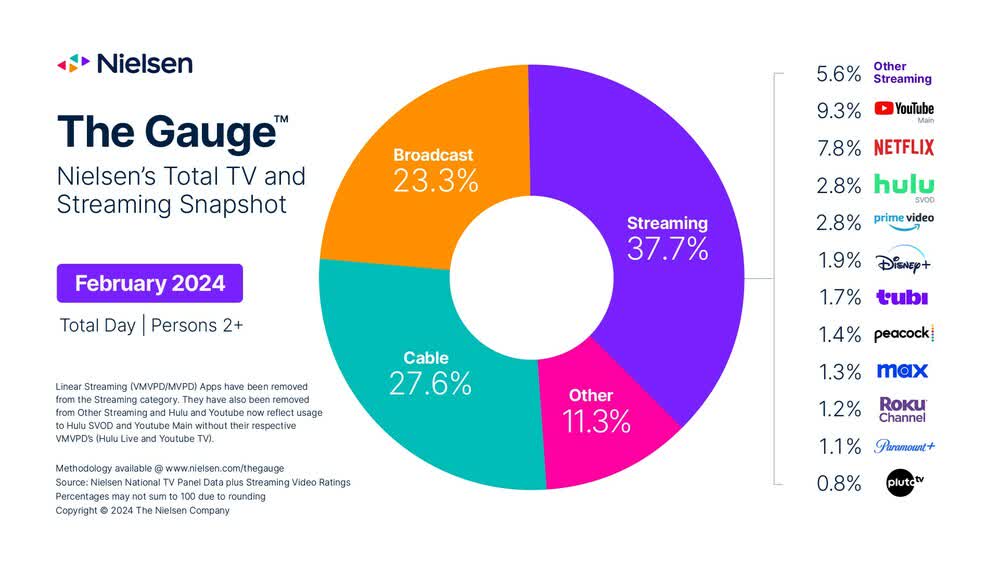

Their lack of new content contribute to their churn rate, but the number of original shows also likely plays a role. Disney+ has only around 80 original shows (called Disney+ originals), which is much smaller compared to Netflix’s worldwide library of over 3,500 original titles and over 6,600 in the US (original meaning original to the platform and never before seen content). This disparity in original content offerings directly affects subscriber engagement and retention, playing a large role in reducing churn rates. As I mentioned earlier, in order to increase their content library Disney has merged a large part of their content base with Hulu. Despite this, according to the charts from 2023 and 2024 below, Hulu appears to be losing their market share, and Disney plus does not really seem to be gaining it.

In February of 2023, Hulu captured 3.3% of the market, which decreased to 2.8% in February of 2024.

Nielsen Snapshot February 2023 (Neilsen)

Nielsen Snapshot February 2024 (Nielsen)

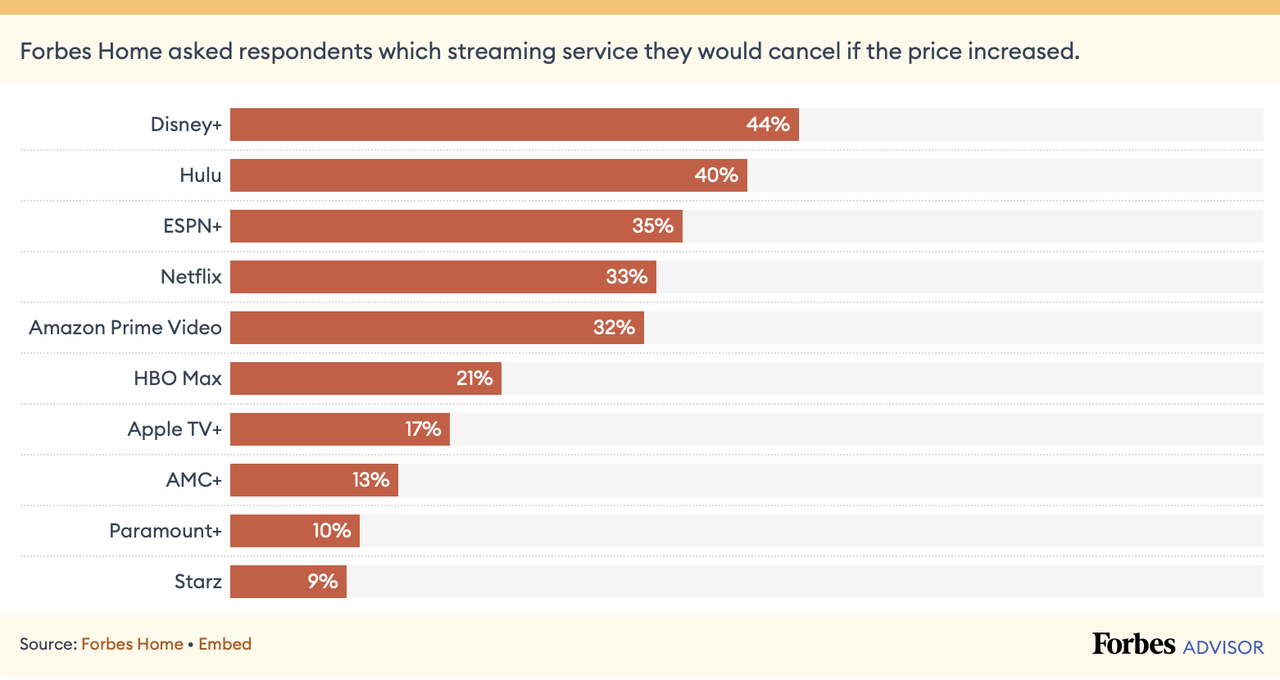

Even with Disney’s newer content releases, these theatrical releases have not performed as expected, which could indirectly affect their streaming service’s attractiveness. In 2023, out of eight major theatrical (movie) releases, seven significantly underperformed both in the U.S. and overseas. Consequently, Disney+ has lost 1.3 million subscribers after a price increase in the first fiscal quarter of 2024 from $10.99 to $13.99 in late 2023. Year over year, this means their subscriber base declined by 12 million. Part of this 12 million decrease was caused by the price increase. But this creates a new problem: Disney+ is losing money and will likely have to raise subscription prices to grow revenue and become profitable. But this is resulting in subscribers canceling, creating a vicious cycle.

Forbes recently conducted a survey to test this hypothesis. The results of their survey determined that if major streaming services subscription prices rise, 44% of streaming users stated that the first service they would unsubscribe from would be Disney+. The second and third? Disney’s other streaming services (Hulu and ESPN+).

Survey of Which Streaming Services Consumers Would Cut (Forbes)

Valuation

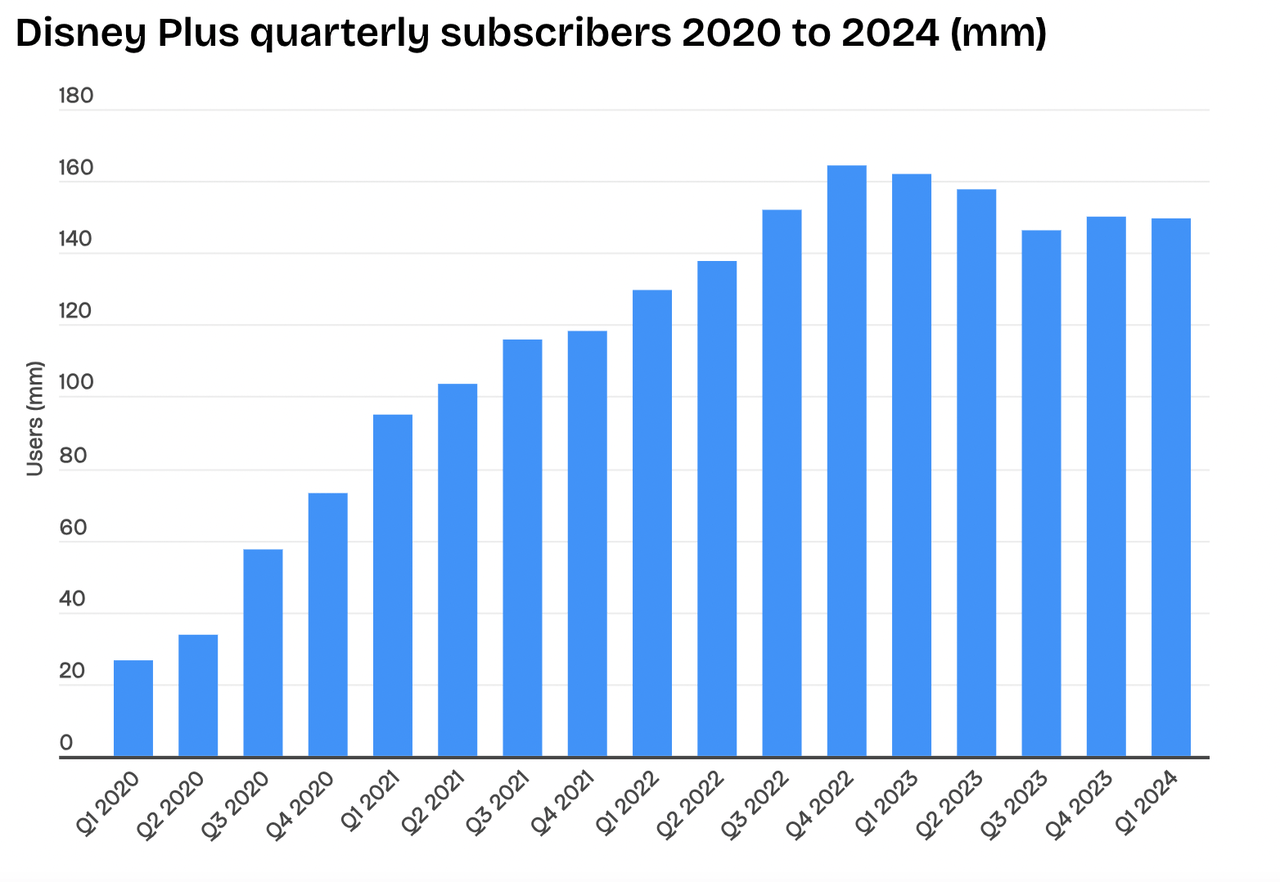

As I said before, Disney lost 1.3 million subscribers in Q1 2024 after a price increase. The graph below does a good job of showing how subscriber count has plateaued (after dropping) since their FY 2023 Q3.

Disney+ Subscriber Count By Quarter (Business of Apps)

Right now, Disney trades at 25.04 times forward earnings, rating a ‘D’ in the technology sector median for forward P/E ratio. I think the technology sector is a good comparison here because Disney is trying to evolve itself with their streaming service.

While the company’s forward revenue growth is rated a ‘B’ due to their expected forward revenue growth of 5.34% YoY (compared to the sector YoY 2.90% growth expectations) I think this growth rate may be overestimated. As we saw, the company continues to stagnate with Disney+ subscribers and any price increase to drive growth will likely result in more cancellations.

Given this, I think the stock’s valuation looks rich right now. I am not saying it’s a sell because I do not know how much of a retracement we could see from here. But given the fundamentals for Disney plus show some weakness (and because streaming is supposed to be the future of the company) I am cautious.

Bull Thesis

While I believe Disney’s streaming service will likely fall short to competition in the near future, there are still notable aspects of Disney’s strategy that may keep them afloat in the TV streaming market. Disney’s model, which includes streaming movies simultaneously in theaters and on Disney+ may lead to subscriber growth and offsets traditional box office revenue streams. We saw this strategy in action with the release strategy of “Black Widow” a few years ago. It’s reported that this film, on its first domestic weekend, could have opened $97 million to $130 million in box office sales. The actual number was $80 million. Although these numbers resulted in Disney making less money from the box office, the purchase of a Disney+ subscription brings in more money than the purchase of one ticket.

In efforts to increase their content catalog, Disney has begun combining their content with Hulu’s content. A beta model of their combined streaming service “Hulu on Disney+” has now launched and is accessible to those who are individual subscribers of both streaming services or Disney Bundle subscribers. This new launch not only aims to grow their content library number wise, but it also combines Disney’s nostalgic content with TV shows/movies catered towards adults.

The financial results of Disney showcase that as of right now, Disney is keeping up (my concern is what is the long run trend). Disney+ generated $8.4 billion in revenue in 2023, a 13% increase from the previous year. However, it appears a lot of this growth came from price increases, not subscription growth (as evidenced by the declining subscriber count in Q4). Disney can only raise prices so high (as I mentioned before). At some point, customers will cut their subscription.

Finally, while the firm is facing an activist investor (Nelson Peltz) who has a history of turning around companies, his more recent track record has not been as encouraging. Activist investors are not always an indicator of buying opportunity.

Bottom Line

Given that a large portion of Disney’s future financial success is in the hands of their streaming platform, Disney+, I believe investors should be cautious and wait until we can see more information. For me, their heavy reliance on nostalgic content, coupled with less fresh and original offerings (compared to Netflix’s content schedule), it’s hard to imagine they will be able maintain long-term subscriber growth and engagement with the current strategy. With that, investors may find better opportunities in more dynamic and content-rich platforms like Netflix (I wrote about this last week). Given Disney stock is up 28.56% YTD (as of the time of this writing) I think investors should hold off investing for at least the short term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the Managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.