Summary:

- GameStop Corp. is set to report earnings, with the stock facing potential downside risk amid a bearish technical pattern.

- The company’s core business of selling video games has become obsolete, and its attempts to diversify have had little sustained success.

- Revenue performance and operating margins will be critical factors to watch in the upcoming report, but the stock’s valuation is still questionable.

Michael M. Santiago

It’s that time again for meme stock OG GameStop Corp. (NYSE:GME); the company is due to report earnings in a few days’ time, after the market close on Tuesday March 26th. Earnings reports have been full of surprises in recent quarters as the company desperately tries to reinvent itself and diversify away from a core business that has been dying for many years, with varying degrees of success. We’ll get the latest read on these efforts early next week.

I last covered the stock ahead of the Q3 report nearly four months ago, and at the time, shares had rallied hard into the report. I said the rally was overcooked and unjustified, and shares are down about 16% since then. I see many of the same issues heading into the Q4 report, although there’s been some fundamental progress that we’ll cover below. Still, on balance, I don’t like GameStop here and believe the odds favor the bears going forward. Let’s dig in.

Is a larger breakdown coming?

We’ll start with the technical picture, and in my view, the bulls have a lot of work to do here. I’ve drawn in a descending triangle into the daily price chart below, which is close to completion. This is a bearish pattern of lower highs and if it completes, projects downside risk into the area of $7 or $8. I will reserve downside price targets until we actually see a breakdown, but right now, I believe it is quite likely we’ll see GameStop in the single digits in 2024.

The line in the sand is just above $13, so the stock is rather precariously perched heading into the earnings report. On the plus side, we see the PPO and the 14-day RSI both proving buoyant at the moment, offering some solace to the bulls. The accumulation/distribution line, however, has been absolutely awful for the past 10 months or so, and is deteriorating further into earnings. As I said, on balance, this chart looks like it wants to break down and go potentially a lot lower. Is the earnings report the catalyst for that? We’ll find out in a few days.

Mixed fundamentals, and more strange decisions

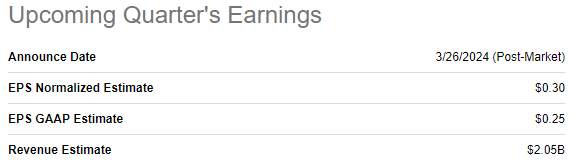

Looking ahead to the report, analysts are seeing 30 cents in adjusted EPS for the fourth quarter, as well as just over $2 billion in revenue. Remember that Q4 is absolutely critical for GameStop’s year as it’s by far the most important for both revenue and earnings given the extreme seasonality of its sales.

Seeking Alpha

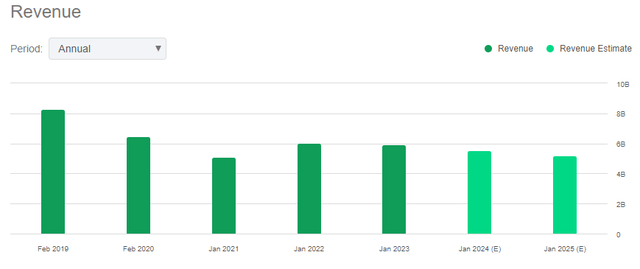

Revenue has been weak for years, having topped out in 2019 and producing only a small blip higher in 2022 before declining once more into fiscal 2024. As we can see below, more weakness is expected next year.

This is obviously the core fundamental issue with GameStop; as I mentioned above, it’s core business of selling new and used video game systems, games, and accessories became obsolete years ago. Recent data shows some stabilization industry-wide, but remember GameStop is beholden to release cycles of both major game titles, and gaming systems themselves. To management’s credit, GameStop has tried all kinds of things to arrest these declines, but with little sustained success in my view.

The company has tried to make in-roads in flavor-of-the-week places like NFTs, which it abandoned a couple of months ago. The fact that this didn’t work surprises no one, but it does speak to what I view as desperation on the Board’s part of trying literally anything to generate revenue.

Investors were notified in December that GameStop is trying to become a mutual fund of sorts, noting it altered its investment policy to include any stock it wants to buy. This absolutely reeks of a company that has no confidence in itself, as companies that believe in their business tend to pay dividends, or buy back their own stock (or both). The fact that GameStop is choosing other companies rather than buying its own shares is all the validation I need to know I don’t want to own this thing.

What to look for in the report

On to the company’s existing business. What I’m looking for in the report is a couple of things. First, revenue is obviously absolutely critical. You may roll your eyes and think that’s obvious, but for GameStop, it absolutely needs a strong top line performance to help its margin situation. This is not simply about a higher top line; it’s about operating leverage, and that’s what I’m watching.

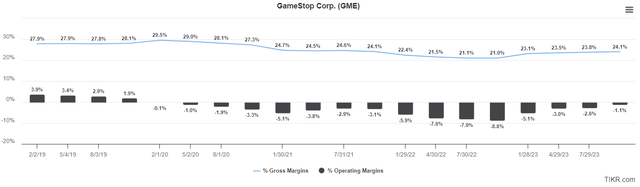

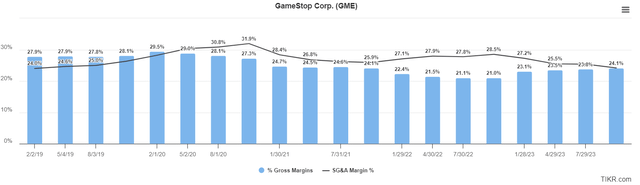

Above we have trailing-twelve-months gross margins and operating margins, and we can see there has actually been some material improvement. Gross margins are terrible for GameStop, as they remain in the mid-20s. However, it’s been enough to see improvement from very negative levels in recent quarters, and GameStop has a shot at full-year profitability in the near future if this continues.

The key is going to be SG&A costs, which we can see above in relation to gross margins. Notice that since 2020, SG&A costs have actually been higher than gross margins, which is completely unsustainable for any business. To its credit, that gap closed as of last quarter, so we need to see further progress in the upcoming earnings release. SG&A costs depend heavily upon revenue performance, so I’ll go back to saying revenue numbers are critical here, as they heavily impact margins. If we see a good performance on the top line, margins should improve materially. If not, well, you know.

An improved valuation, but is it enough?

GameStop doesn’t have sustainable earnings, so we cannot value it that way. However, we can value it using price-to-sales, and we’ll do that below to get a sense of what we’re dealing with.

It’s P/S ratio is currently 0.73, which is well down from its average in the past year, as we can see above. Does that make it cheap? If we consider that operating margins have improved substantially in the past couple of quarters, that would lend efficacy to the idea that perhaps it is much more favorably valued today that it has been. The logic there is that each dollar of sales is more valuable as margins rise, which would lead to a higher P/S ratio, all else equal.

However, I take the view that the prior P/S values were extremely inflated given the company’s massive fundamental issues, so the decline in the valuation is simply a reversion to the mean rather than the stock becoming “cheap” on a fundamental basis. As always, valuation is in the eye of the beholder, so it’s subjective, but I don’t see this as a reason to buy the stock ahead of earnings.

Putting a bow on this, I see a pattern in the price chart that looks extremely bearish. I also see a company that has so little faith in its future that it’s attempting to own other companies’ stock instead of its own to right the ship. On the plus side, margins have seen substantial improvement, but with revenue set to decline even further in the coming quarters, I wonder what kind of staying power that has. Operating margins are at risk of further deterioration on lower revenue, absent new, substantial cost savings.

I’m keeping my sell rating for GameStop Corp. stock ahead of the upcoming report, as I simply see no reason to own this stock. If it goes up without me after the report, so be it; the risk of a further breakdown in the stock is greater than the risk of a renewed rally, in my view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.