Summary:

- According to recent news and the company’s last presentation, a $2.26bn loan from the Department of Energy could be imminent.

- This news is material and unlocks the funding of the phase I project, associated with a 40k/year expected production of Lithium LCE by 2028.

- Using a long-term Li price of 25k/t, calibrated on the marginal producers of the cost curve, and a WACC of 9%, I estimate the NPV of phase I at $1.5bn.

- This represents a $10/share price target and a 59% upside on the current price. On top of that, you have a free option on phase II.

- I rate the company as a strong BUY.

gchapel

My thesis

The purpose of this article is to discuss recent trends in the Lithium market and the latest developments on Lithium Americas’ (NYSE:LAC) Nevada project. I will implement a company valuation on the phase I project given a medium-term market price of Lithium of $25k/t, consistent with the level needed for marginal producers to be active in the market. My calculations indicate there is a material upside potential. To finance the project, LAC is expecting a DoE loan announced on March 14th. Considering the strategic value of such an asset for the US supply chain, the quality of the project, and the upside potential, I rate the company as a strong BUY.

Investment overview

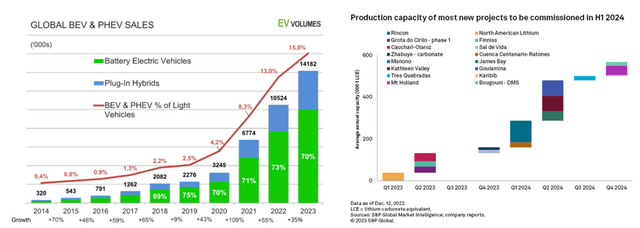

Let’s start with global trends in the Lithium market. On the demand side, EV growth has significantly slowed recently, mainly impacted by high-interest rates on elevated selling price cars. We can also cite economic uncertainties, especially in China and Europe which have been the main growth drivers of electrification over recent years. In the meantime, excessive inventory pile-up in China and the completion of new production worldwide has led to an oversupply situation.

EV volumes / S&P

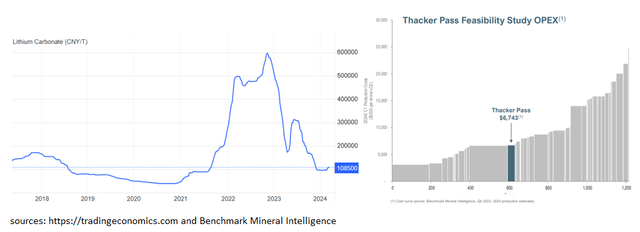

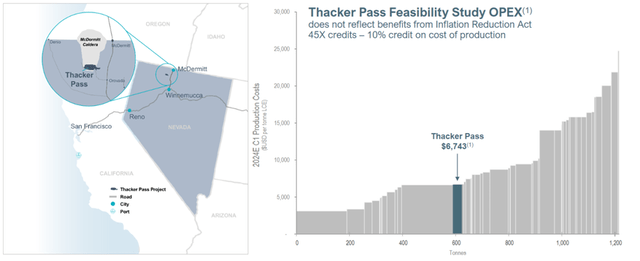

Lithium carbonate prices are approaching 10k/t and have fallen well below the marginal cost of many producers. As can be seen in the following graph, the last quartile of producers has a C1 cost above 15k/t. Note that such a level has significantly increased since 2020 due to inflationary pressures. Only the best mines can operate in such an environment without losing money. The best Australian Spodumene and Chilean brine productions can operate below 8k$/t.

The question remains on high-cost mines in China (Lithium Lepidolite deposits). It is hard to anticipate when such players will reduce their supply. Indeed, it is possible that some operations are financed by local authorities to chase market share and control a part of the world supply.

Tradingeconomics / LAC

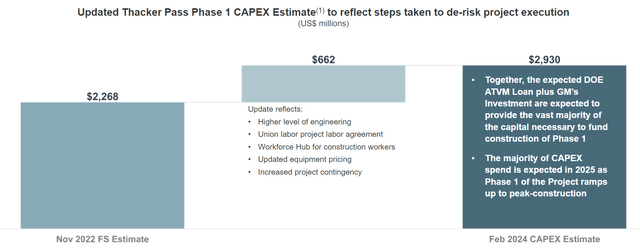

Before going to the project’s valuation, let’s give a quick reminder of its main characteristics. The Thacker Pass mining site is composed of two phases. Phase I should produce 40kt of Lithium LCE per year at full capacity by 2028 and requires financing of $2.9bn. LAC just confirmed in its updated presentation that it has received a conditional commitment from the DoE to get financing of $2.26bn with a Tenor of 24 years and zero spread on the US Treasury rate. General Motors (GM), in exchange for its capital injection, will purchase at the spot the first ten years of production (+ an option of an additional five years). LAC plans to develop a phase II, after 2028, equivalent to an additional 40kt of production.

LAC

FY2023 financial figures have just been released. Phase I CAPEX has been revised upward, from $2.3bn to $2.9bn, to take into account inflation differential since November 2022. CAPEX reached $194m in 2023, leaving $2.7bn to be spent. Concerning the timeline, the management said: “Thacker Pass Phase 1 is targeted for 2027 following a three-year construction period. Major construction is expected to commence in the second half of 2024 following the anticipated closing of the DOE Loan and issuance of FNTP.”

LAC’s balance sheet ended with $194m of cash, down from $275m during the last quarter, as site construction started. Waiting for the DOE loan in the second half of 2024, the firm has decided to cut SG&A expenses to preserve its liquidity position: this is a wise decision.

LAC

What valuation can we expect?

In my model, I only take into account Phase one of the project. I expect the production to reach full capacity, equivalent to 40kt/year, starting in 2029. I used OPEX assumptions from LAC in its most recently published report to assess a terminal EBITDA margin at full regime.

I assume LAC will receive a $2.26bn loan from the Department of Energy and that GM will add $330m as its second investment tranche. All in all, LAC should have $2.26bn + $0.33bn + $0.28bn (Cash position in November) = $2.9bn, which looks sufficient to fund the project. This is in line with the updated cost estimation of the project seen below.

own calculations

Given a WACC of 9%, I get a net present value of phase I at $1.5bn, representing a 59% upside to the current market price. With a WACC of 8%, the NPV goes to $2bn while it falls to $1.2bn using a WACC of 10%. Due to the long duration of the cash flows, we see how the valuation is sensitive to the discount factor.

The completion of Phase II would require an additional $2bn budget but is unlikely to produce an additional 40kt/year before 2030. This option would activate only after Phase I is in full production. I feel it would not be reasonable to take it into my model.

Technical analysis

The stock has skyrocketed after the release of the news but gradually gave up gains during the intraday trading session. LAC has been attempting a rebound from recent lows (Feb 2024) so some profit-taking can be understandable. We can add that bad news on the EV market, the announced bankruptcy filing from the car maker Fisker, and the downgrades of Tesla added to the negative sector sentiment. All these confusing signals should not understate the positive impact on LAC likely financing.

Seeking Alpha

Seeking Alpha

Risks and opportunities

As the financing seems to be validated, the main company-specific risk left is the execution risk. While the management team looks solid, with Jonathan Evans previously serving as General Manager of the Lithium division of FMC (which span off into Livent (LTHM)), the Thacker Pass project is not without risks. First, the Lithium deposit is in the form of a mixture of hard rock and clay, which could face extraction and refining challenges. Secondly, any project delay or cost inflation could pressure the stock.

On a top-down view, important risks could be highlighted. Price uncertainty on the commodity is the main factor. Weak EV trends or a Chinese oversupply could delay a price rebound necessary to make this project profitable. The project has a relatively low breakeven level but is not placed at the lower end of the cost curve.

On the upside, I see central banks’ rate cuts and lower production costs from EV car makers (J-curve) helping the penetration of EVs in the near term. In the longer term, the adoption of solid-state batteries should further increase the need for Lithium to satisfy higher energy density. Samsung SDI just confirmed it will mass produce such kinds of batteries. Other battery makers are expected to follow the trend.

LAC

Conclusion

All conditions seem to be aligned to unlock the project value. Strategically, this asset is key to America’s goal to secure a robust supply chain in critical metals. Phase II is not priced in my model but could add at least another $1bn to the project NPV and set up long-term contract agreements with other US car makers.

What could go wrong? My thesis nevertheless requires Lithium prices to gradually increase toward $25k/ton, in a three-year horizon. I think this is possible, given such a level represents the cost of doing business for marginal producers in the industry. The management is experienced but execution could face delays and require additional funding at some point in time.

I believe the risk and reward profile is very attractive. I therefore rate the company as a strong BUY.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.