Summary:

- Down nearly 30% year to date, 3M is trading near 2020 prices, a great entry point for a quality dividend aristocrat.

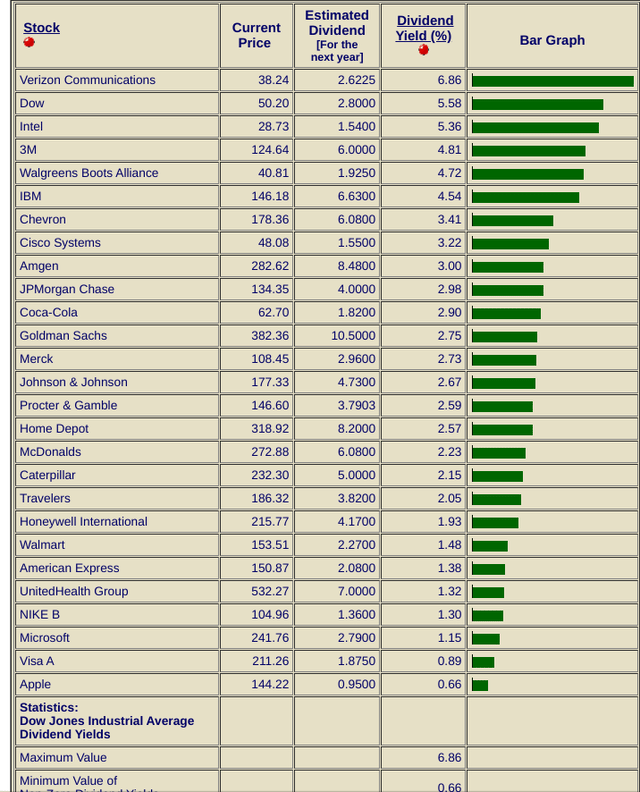

- 3M is one of the top yielding stocks in the DJIA Index, a Dog of the Dow.

- As inflation begins to subside, free cash flow should begin to normalize as cost of goods sold is highly predicated on raw commodities for 3M.

josefkubes

A True Dog of The Dow

3M (NYSE:MMM) is a company I have been accumulating this year on the downturn. The company has seen a larger dip in its share price than other Dow components, more akin to what we’ve seen in the larger NASDAQ retrenchment. To me, this is an opportunity. 3M creates products that are essential to an everyday functioning society and are typically able to grow revenue along with inflation. I also love companies like 3M because they are both DJIA constituents and dividend aristocrats. I tend to treat these sorts of stocks more like REITS than I do common equity with growth stories attached, I want to see a fair P/E ratio and free cash flow above its’ dividend payouts.

3M is currently the 4th highest yield available in the DJIA at nearly 5%. If stagflation persists on through next year and the indexes remain flat from where they are, a nice portfolio of dividend aristocrats should provide some decent alpha. Major lawsuits are pending which we will examine closely. That being said, no deal comes along without a negative headline attached. Negative narratives have to be expected and welcomed if we are to swoop up deals of quality names. Tides will ebb and flow and we should give credit where it’s due, evaluating a company’s quality over the life of its operations is more important than near-term issues. At a price-to-earnings ratio of 11, 3M is a buy to go along with my other beaten-down aristocrats.

The story

What they do:

3M manages its operations in four business segments. The reportable segments are Safety and Industrial, Transportation and Electronics, Health Care, and Consumer. 3M’s four business segments bring together common or related 3M technologies, enhancing the development of innovative products and services and providing for efficient sharing of business resources-3M 2021 10K

In addition to all the things that 3M does, they also hold lots of patents and have a nice moat of in-house industry secrets. However, a story about a stock down almost 30% would not be complete without the lawsuit causing the crater. AFFF, Aqueous Film Forming Foam, and PFAS lawsuits are pending in North Carolina and now California. In addition to any fines that might be levied around 3M, congressional regulation changes that result in 3M having to curtail or change a significant part of their business would result in large costs going forward needed to reconfigure their business.

A separate lawsuit has put one of 3M’s subsidiaries, Aearo Technologies into bankruptcy proceedings. A Reuter’s article from October outlines some of the goings on in the courtroom:

The 7th Circuit order means that Aearo will not have to first challenge the ruling by U.S. Bankruptcy Judge Jeffrey Graham of Indianapolis in federal district court, which is usually the first stop for bankruptcy appeals. Instead, Aearo can tell the 7th Circuit directly why it believes that more than 200,000 combat veterans should not be permitted to continue litigating their claims against 3M for selling allegedly defective earplugs in an MDL in Pensacola, Florida.

As companies with massive and diverse product lines that may produce individual product lines under subsidiaries take on these lawsuits, they are going to try their darnedest to cut ties with the product line and avoid litigation against the parent. Johnson & Johnson (JNJ) is facing a similar situation in its’ talc subsidiary. This is covered in the same Reuters article from above:

The 3rd Circuit, as you probably recall, is weighing a parallel case. That court heard oral arguments last month about whether the bankruptcy of a Johnson & Johnson subsidiary can halt nearly 40,000 claims that J&J’s talc products contained carcinogenic asbestos.

The two appellate cases present essentially the same questions, albeit in opposite postures. The bankruptcy judge overseeing the Chapter 11 of the J&J subsidiary stayed litigation against the parent company, while Graham allowed MDL plaintiffs to continue litigating against 3M.

These create lots of negative headlines and downward price action. Whether or not the settlement amounts will be headline-worthy is another story. These companies will continue an attempt to avoid litigation of the parent and impair subsidiaries or liquidate them through bankruptcy. With the additional costs abound, all the important bottom lines will take a hit in the near term, especially if Congress takes action to regulate their businesses.

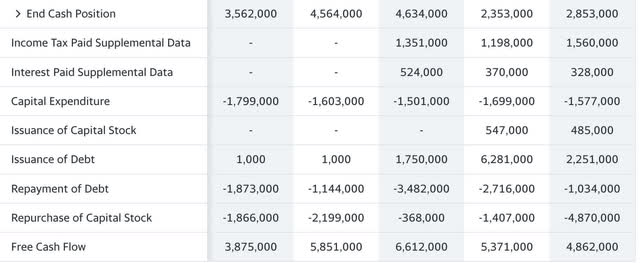

Free cash flow

Any good dividend story should start with free cash flow. Free cash flow is currently trending below its’ 5-year average, partly to do with losses on sales of businesses and divestitures. The recent Oct. 25 10-Q outlines some of the divestitures that have occurred during the last year:

2022 divestitures and previously announced divestitures:

In March 2022, 3M completed the sale of its floor products business in Western Europe, formerly part of the Consumer business, for immaterial proceeds that approximated the business’s book value.

In July 2022, 3M announced its intention to spin off the Health Care business as a separate public company. 3M expects to initially retain an ownership position of 19.9% in the business, which 3M intends to monetize over time. The Company expects to complete the transaction, which is intended to be tax-free for U.S. federal income tax purposes, by year-end 2023. Because the intended transaction is a spin-off, the Health Care business is not classified as held for sale.

3M Cash Flow Statement (yahoo finance)

Observing from the above, operating cash flow has trended lower TTM combined with a large hit on the line “Gain Loss / On Sale of Business”. This all trickles down to a reduction in free cash flow.

3M Free Cash Flow (yahoo finance)

We can observe that free cash flow is 33% lower than the previous year. The average 5-year free cash flow stands at $5.3 Billion. With a forward dividend yield of $5.96 a share and 552 Million shares outstanding MRQ, that creates a dividend liability of $3.28 Billion upcoming. The dividend is barely covered by TTM free cash flow but is 62% of the 5-year average. Looking at it from an earnings perspective, TTM EPS is $11.96, which is a coverage of almost 2X in that regard. Over time, a quality operator should see free cash flow normalize with earnings trends, not having too large of a gap.

Looking at 3M’s earnings from an EBIT perspective, a good proxy for free cash flow, they have been relatively flat since 2018. EBIT has grown slightly from $7.35 Billion in 2018 to $7.8 Billion currently. One positive note for dividend investors is that 3M has bought back 24 million shares since 2018, decreasing dividend liabilities going forward and providing more cushion for shortfalls in free cash flow should they continue.

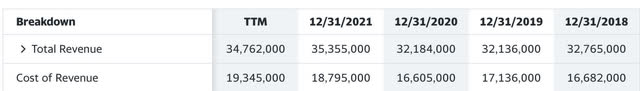

The final issue of concern we can see with 3M, is their sheer reliance on raw goods and materials to produce their products. Petroleum byproducts and other raw materials used to make 3M products have increased by almost 16% from 2018 to TTM. At the same time, revenue has been almost flat, increasing at a rate of 1.192% per annum. Inflation is hurting 3M, but inflation doesn’t last forever. 3M will be a big beneficiary of deflation once it begins to occur. Times like these run in cycles. They also create buying opportunities in stocks like 3M.

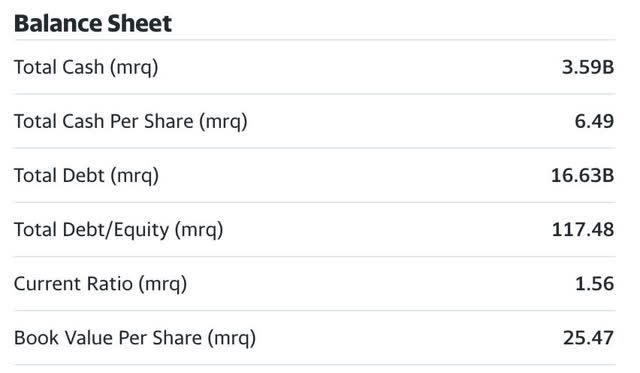

The debt

With a TTM total debt of $16.6 Billion, we see a bit of ebb and flow in the debt trends for 3M. Standing at only $14.7 Billion in 2018, we see a spike up in 2019-2020 hovering around $20 Billion, and then being reduced by almost $4 Billion to where we stand today. Peter Lynch liked to see both current assets trending up and total debt trending down to gauge a good economic situation for a company going forward, and in this sense, 3M is trending in the right direction.

The debt-to-equity ratio is a bit concerning for 3M at 117%, but that didn’t seem to concern buyers during the COVID euphoria when everyone assumed that we’d all be wearing 3M N95 masks for the rest of our lives. The truth is the debt situation was worse during COVID and now that assets and liabilities are trending in the right direction, the price is cheaper than it was in January 2020. Go figure.

10 Years of compounding

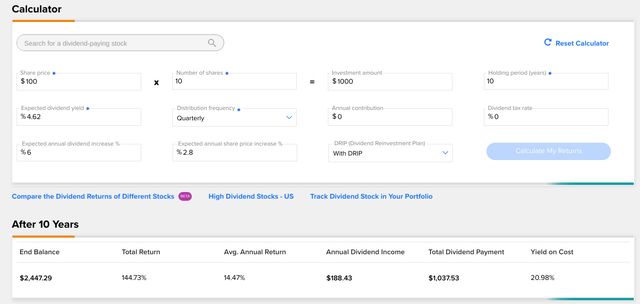

10 Year Hold Assumption (tipranks)

On all large dividend payers, I like to run a 10-year $1,000 invested assumption. This assumption is with DRIP (all dividends reinvested over the length of the ten years). 3M has been paying their dividend uninterrupted for 60 years without a cut. In 1962, the initial dividend was .0375 a share for the year, and in 2022 we stand at $5.96 a share. This is a dividend CAGR of 8.815% over the 60 years. For this assumption, I will default to a more conservative 6% increase per year. For the appreciation assumption, I am simply giving 3M 10 years to return to its’ previous high 28% percent ago. Thus, the estimated annual appreciation input is 2.8% per year, both rational and conservative.

Even with very conservative estimates of 3M way underperforming the market average over this period and raising their dividend at a slower than historical rate, we still get a total return of 144.73% over this period, turning $1,000 into $2,447. This is an average annual return of 14.47% and a yield on cost of 20.98%. That is the magic of compound interest in the realm of dividend aristocrats. Even if they unperformed the market on an appreciation basis, they can still outperform in the long run if you get a high enough starting yield and dividend increases remain consistent. These are long-term bets I love to take.

Catalysts

Inflation subsiding. Catalyst one for me lies in this realm. The products they sell are used in both household and industrial applications, remaining a constant necessity of everyday life. We can observe that revenue still grows, albeit slowly. The main issue will be the cost of goods or the cost of revenue. Expecting revenue to remain nearly static but costs to improve as supply chains uncork their bottlenecks.

Risks

Stagflation or increasing inflation. If the current trends reverse course and inflation ticks back up, 3M will have problems. Stagflation will probably result in a long period of flat growth. However, as we can observe from the 10-year DRIP dividend model, only appreciating at 2.8% per annum from here combined with business as usual for the dividend and dividend increases could result in a 14% return per year for a 10-year hold period. At 11 X earnings for a dividend aristocrat, this seems like a pretty safe bet.

The lawsuits are going to remain in the headlines for the next year or so at least. Congressional legislation regulating 3Ms’ overall business activities will be a bigger risk than the settlements in my opinion.

Dow Jones Index Strategy

As part of my one quartile portfolio strategy, I attempt to match and slightly outpace beta through self-indexing the Dow 30. It is a very easy index to replicate as it is the only price weighted index versus market cap weighted index to my knowledge. That means if you buy all 30 stocks one by one over and over, you will be able to achieve par or better to the DJIA with this strategy. You can achieve better by controlling your flow of funds to go into the most beaten down names first and over priced ones on subsequent rounds. As a result, I own all 30 Dow names. 3M is one of the few that I am currently overweighting separately in my value based portfolio.

This was the indexing strategy taught in the original Intelligent Investor before the advent of index funds. If your brokerage offers zero commission trades, this strategy is highly recommended. If a constituent is booted and replaced, just follow suit and discontinue buying the name if you want to keep it, or liquidate it and move the funds into the new entrant. The Dow over long periods nearly matches the S&P 500 and beats it in many years, such as 2022. You will also avoid 100% of fees and be assured to collect 100% of your dividends.

Summary

Negative headlines have driven a Dow Jones component and dividend aristocrat down 30%. Free cash flow has decreased and the cost of revenue has increased above the point where 3M can pass all the additional costs to the consumer without damaging their business. Negative headlines and regulatory changes will eventually come to pass. In the meantime, we have a dividend aristocrat trading below the long-term market multiple of 15 X earnings. When it comes to the aristocrats, I don’t overanalyze the price targets, if I can get it cheaper than the market multiple, I’m in. If it ever gets back to the market multiple of 15 X, it’s a $171 stock with a TTM EPS of 11.46. I’m adding here and will be more aggressive if their cost of revenue begins to taper.

Disclosure: I/we have a beneficial long position in the shares of MMM, JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.