Summary:

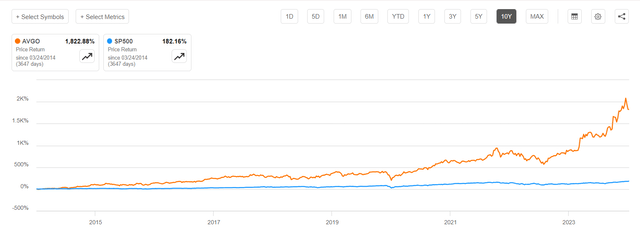

- Broadcom Inc. has consistently outperformed the S&P 500 Index over the past 10 years. Should this dynamic continue? I think yes – read on.

- The company’s strong financial position, new sales structure, and AI prospects suggest continued outperformance in the future, in my opinion.

- AVGO’s very generous shareholder policy is likely to attract even more investors looking for value opportunities in the AI field.

- Assuming AVGO maintains its current premium – the TTM P/E ratio of 29.74x – the implied price target is $1,713, which gives us ~27% upside from the recent close.

- Despite the many investment risks surrounding Broadcom today, I also see many opportunities for the stock to continue to rise. AVGO is a “Buy”.

SvetaZi

My Thesis

Over the past 10 years, Broadcom Inc. (NASDAQ:AVGO) stock has outperformed the return of the S&P 500 Index (SPY) by 10 times, and that wasn’t just the result of the last couple of years. The stock gradually increased its returns and proved its strength to the market year after year:

Given the company’s steadily improving financial position, its new sales structure, and AI prospects, I believe that this outperformance will continue for at least the next few years. Furthermore, in terms of the combination of value and growth, I think AVGO is one of the best stocks to buy right now for investors looking for AI investments.

My Reasoning

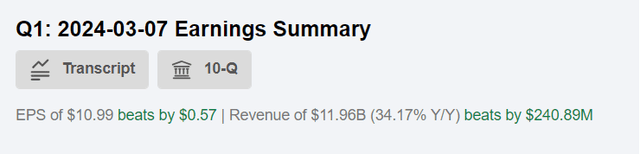

In fiscal 1Q 2024 (ended on February 4, 2024), Broadcom reported robust revenue of $11.96 billion, marking a remarkable 34% YoY increase and a substantial 29% QoQ growth. This revenue figure beat the consensus estimate of $11.72 billion (i.e. by about 2%), as did non-GAAP earnings per share of $10.99, up 6% year over year.

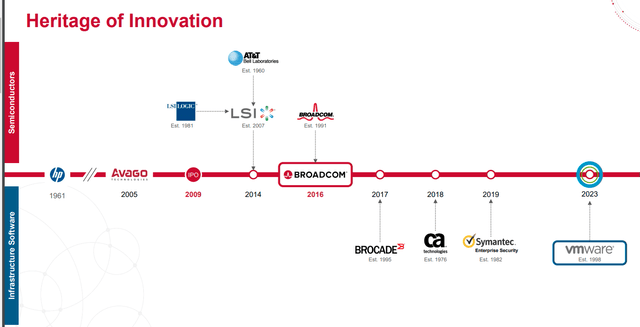

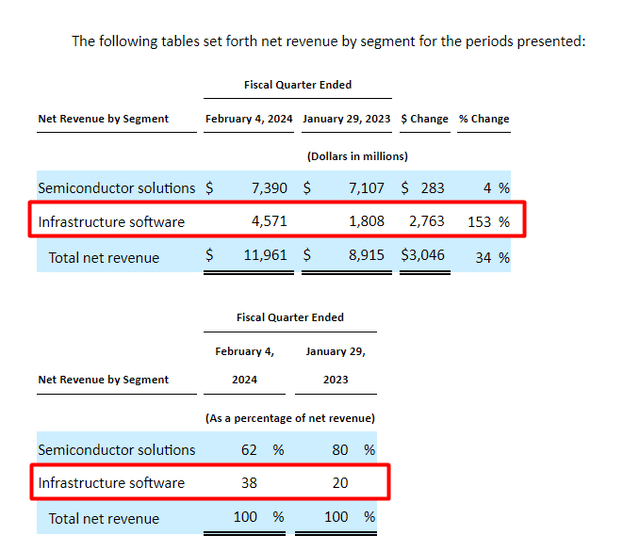

One of the significant highlights of Q1 2024 was that this was the 1st quarter that VMware was included as a core part of Broadcom’s business, positively impacting the Infrastructure software segment. The acquisition, valued at $61 billion, along with assuming $8 billion in VMware debt, positions Broadcom to expand its offerings and strengthen its position in creating private and hybrid cloud environments, Argus Research analysts noted (proprietary source). And based on the results of the last fiscal quarter, we can see that this is most likely the case. AVGO has now become a more diversified company in terms of revenue structure while continuing to actively increase sales in its Semiconductor solutions segment.

AVGO’s press release, Oakoff’s notes

AVGO’s Infrastructure software revenue surged 153% YoY, reaching $4.57 billion, now accounting for 38% of total revenue. About 132% of that growth came from VMware. The management said it expects continued strong bookings at VMware this year with this segment’s booking growing to >$3 billion in 2Q 2024. On the other front we see, that in Semiconductor Solutions, AVGO’s revenue reached $7.39 billion, representing a 4% YoY increase and (+1% QoQ growth) with AI-related revenue now comprising 31% of the segment’s total revenue after quadrupling to $2.3 billion last quarter.

As I understand from numerous reviews by various analysts, Broadcom’s focus post-acquisition is to refocus VMware on its core business while divesting non-core assets, a strategy consistent with its approach to previous acquisitions like Agere, LSI Logic, Brocade, or Emulex.

Broadcom maintains leadership in Ethernet products. As J. Safra Sarasin (a Swiss private bank) wrote recently in its note to clients (proprietary source), competition is intense in the data center networking market, with various switching standards and the growing use of electro-optical connections today. Ethernet, known for its cost efficiency, is prevalent, while InfiniBand, led by Nvidia (NVDA), offers high bandwidth but faces compatibility issues. This is why Electro-optical interconnects – led by Broadcom and Marvell Technology (MRVL) – are so crucial for AI workloads. The company’s many years of experience and its relatively broad diversification against the background of a dominant position in this niche should therefore enable AVGO’s business to grow even more strongly if the market keeps developing actively. According to 650group, the merchant silicon market saw its capacity pick up by 40% in 2023 alone – and this could be just the beginning of the AI revolution.

The management expects networking revenue to grow by 35% YoY in FY2024, driven by “the deployment of standard networking connectivity and expansion of AI accelerators by hyperscalers“, therefore, I think my assumption about the presence of a fundamental driver on the part of Ethernet products is justified.

In my opinion, AVGO has several growth drivers in play.

First, it’s the leadership in Ethernet products – I wrote about that above. And my take is supported by some brokerage firms like Oppenheimer:

According to Oppenheimer, Ethernet is the de-facto networking standard for cloud, deployed widely by hyperscalers. Brokerage believes Ethernet will gain market share due to its open nature and scalability.

Source: SA News

Second, it is the better business diversification and growth potential through software. According to management projections, Broadcom will generate more than $50 billion in annual revenue this fiscal year, with up to 40% coming from software. Theoretically, this should lead to an increase in margins, as software revenues are known for their relatively lower COGS compared to hardware revenues.

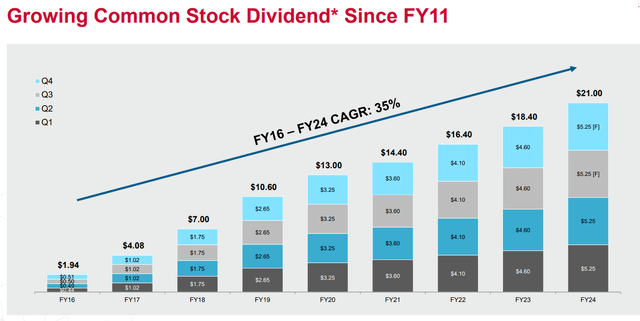

Third, a very generous shareholder policy is likely to attract even more investors looking for value opportunities in the AI field. Not all investors are willing to take risks and buy growth stocks in the midst of the current technology boom. Value-oriented investors want stable large companies with good dividends, preferably growing steadily over time. All of this is the case with AVGO:

Because of these growth drivers, Broadcom is the best AI stock out there (at least for me). The combination of clear tailwinds and an attractive shareholder policy creates a more favorable and understandable soil for all investors at once, and not just growth investors. This is also a difference from most of its peers – AVGO has attractive characteristics for both value and growth investors as a financial vehicle to allocate to AI right now, which cannot be said about, say, AMD or NVDA. Therefore, I expect that at least on the volatility side, AVGO should be viewed as one of the best candidates for long-term investors seeking exposure to AI.

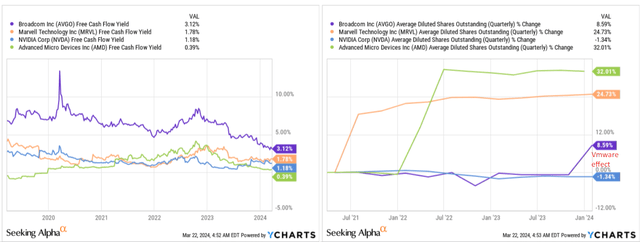

Furthermore, AVGO appears to be one of the cheapest companies in its niche based on the FCF yield valuation metric. AVGO’s FCF per share has grown at an insane CAGR of 30.42% over the last 10 years according to Seeking Alpha Premium. This has been the result of expanding the company’s footprint in its addressable markets as well as regular mergers and acquisitions and rapid, high-quality integration of the target companies into the ecosystem (otherwise we wouldn’t have seen such rapid growth in the bottom line figures). At the same time, the number of shares outstanding has increased by only ~8.6% over the last 5 years, mainly due to the company’s largest purchase – VMware. During the analyzed period, the company has continued to make buybacks, so the number of shares outstanding at AVGO has not increased significantly, unlike its high-growth peers NVDA or Advanced Micro Devices (AMD). All of this suggests that AVGO stock is, in my opinion, most in line with the needs of value investors.

The AVGO stock is trading at 27 times the expected earnings, but I think a fair multiple might be higher. Why? The main reason is the buybacks, which help the stock maintain its premium over the long term. And of course the strong business growth – as long as the AI revolution needs AVGO’s products and software, the company should theoretically continue to thrive.

By the end of fiscal 2025, AVGO should generate a net income of $57.59 per share, according to consensus figures from Seeking Alpha. Assuming AVGO maintains its current premium – the TTM P/E ratio of 29.74x – the implied price target is $1,713, which gives us ~27% upside from the recent close. And since AVGO tends to beat the consensus figures – it has done so in all 8 quarters of the last 2 years – this upside potential I have calculated could prove to be quite conservative. Just take a look at Argus Research’s DCF calculations, which lead to an upside potential well exceeding mine:

Discounted free cash flow analysis points to a value above $1,800, in a rising trend and above current levels. Cash flow generation should accelerate further as the company integrates high-margin assets and achieves volume leverage and greater synergies across its operations.

Source: Argus Research (proprietary source)

Given all that, I think Broadcom deserves a “Buy” rating.

Risk Factors To Factor In

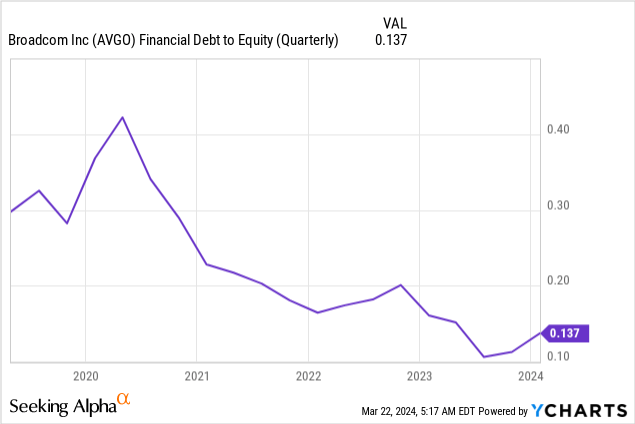

It’s important to mention here what I missed above – the discussion of Broadcom’s debt burden, which rose significantly after the VMware acquisition. While the company has demonstrated diligence in paying down debt and leveraging strong cash flows, the high debt of ~$73.4 billion on the balance sheet poses financial risks. On the other hand, I’m not too worried because AVGO’s debt-to-equity ratio comfortably stands at less than 0.14 and keeps going down. Given all the prospects described above, this ratio is likely to stay its course, in my view.

Another risk factor to consider is that Broadcom operates in over 20 distinct end markets, exposing it to fluctuations in demand and macroeconomic conditions. The loss of business from Huawei in 2019 due to the trade war had a profound negative impact on the company’s financials and significantly worsened its outlook at the time. So there is a risk that something similar could happen this time.

Another risk is the conclusions of my assessment. I assume that AVGO will maintain its P/E premium, but this assumption could be wrong. Especially when you consider how expensive the entire market is currently trading, both the S&P 500 index and individual companies like Super Micro (SMCI) or Nvidia. If the market starts to sell off, AVGO could easily lose its premium, which would render my target price calculations useless.

Your Quick Takeaway

Despite the many investment risks surrounding Broadcom today, I also see many opportunities for the stock to continue to rise despite its seemingly high valuation multiples.

I like the M&A-driven strategic approach to corporate development that Broadcom once chose for itself and still pursues today. Thanks to the acquisition of VMware, which is not yet fully integrated into the company’s business structure, AVGO is perhaps only in the early innings of supporting generative AI models. The growth potential seems huge, and if the company does not change its approach, I expect more M&A activities going forward with more top-line expansion amid margin stability. In fact, this is what I would be looking at most closely in the foreseeable future – particularly the integration of VMware (how the cost structure, growth rates, etc will change) and Broadcom’s consolidated margins. The extent to which my valuation calculations make sense depends on that.

In my opinion, AVGO is doing everything right to date: the development of software over the next few years should lead to higher margins, giving earnings per share a boost. At the same time, the stability of FCF, which ensures constant buybacks, should only reinforce this boost and give AVGO room for growth. According to my calculations, which may ultimately prove to be a bit of an underestimate, AVGO is undervalued by ~27%. This is my price target until the end of the 2025 financial year.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AVGO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.