Summary:

- Etsy positions itself as a unique alternative to Amazon and other e-commerce platforms, with a focus on offering a different experience.

- The leadership at Etsy knows what the business is all about.

- In the article, I provide my perspective on what we need to observe in the earnings report for it to be considered a buy.

- The price may be questionable, but I believe there is an opportunity here.

Michael M. Santiago/Getty Images News

Opener

Here is how Josh Silverman described Etsy’s (NASDAQ:ETSY) business:

Almost everyone in ecommerce is trying to do Amazon one better; sell the exact same product that’s available for sale on Amazon, but sell it just a little cheaper or ship it just a little faster. We do something genuinely different, and we know there’s a big role for that. And the bigger the Amazons and the TEMU’s get in the world, the more people will be desperate for an alternative. I think we’re well positioned to be the leading alternative to that and that we think, is a very big opportunity.

Etsy is all about uniqueness, being different, and selling differently. Apparently, people want that. Yes, it surged during the pandemic, and yes, it may not maintain the same CAGR as the past 5 years, but it still exhibits indicators of a strong business. For example, management claims that Etsy has the best momentum outside of COVID.

So we’ve held almost all of it. So now the opportunity is just how do we grow again from here? And the CAGRs, by the way, our GMS CAGR from pre-pandemic is about 24%, amazon is about 13, Wayfair is about 6 and eBay is negative 3. So Etsy truly is in a category of its own in terms of our ability to retain share.

Management continues to emphasize that we are currently experiencing the aftermath of the COVID-19 jump, and we should not be surprised as they had forewarned us about this beforehand. They mentioned that there are headwinds at present, but they expect long-term growth to be stellar.

And you heard Etsy in the peak pandemic keep saying, we think some of this is — some of this is going to dissipate and we’re going to be thoughtful about managing our expenses. And now when we’re in a much more challenging part of the cycle, don’t be too despondent.

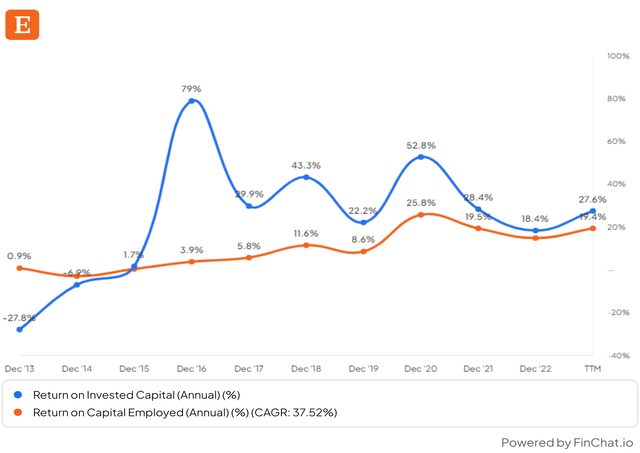

I also appreciate how Etsy’s focus is on making profits rather than growing at all costs. I don’t invest in companies that can’t demonstrate a high ROIC, and Etsy excels in this aspect. In my opinion, the combination of high ROC and strong top-line growth is a winning formula, especially if you manage to buy before multiple expansions.

we are not a growth at all cost company, and we’ve never been that way. We have a very strong ROI lens on every dollar we spend. And we look at every dollar we spend on employees, on marketing, and say, is that delivering good returns? Is that making the marketplace better in a way that delivers values for sellers, buyers and for our shareholders?

The Business & Industry

Etsy is trying to differentiate itself in a highly competitive and growing industry, dominated by Amazon (AMZN). However, as we saw earlier, it has a unique value to offer consumers and occupies its own niche. It really does not have a direct competitor. If you want something special, you should go to Etsy, not Amazon. The e-commerce industry is projected to grow at a high single-digit CAGR or low double digits. This means that if Etsy can maintain its market share or perhaps increase it over time, it can achieve solid top-line growth.

We continue to focus on our goal of growing at a faster rate than e-commerce, on average and over time, and on gaining share through further penetration of certain categories and driving frequency of purchases on Etsy from existing and new buyers.

As we observed before the pandemic and when we examine the product itself, Etsy possesses the capabilities to gain market share. It offers what others don’t: it is the marketplace for special occasions, not aiming to be the cheapest or the fastest. Additionally, it has barely scratched the surface of international expansion.

If we think about awareness in the U.S. and the UK now, if you ask people, do you know the brand Etsy? Most people will say, yes. That’s not so true in Germany, France and other places.

Since the Etsy platform generates the majority of revenues for the business, my primary focus will be on it. However, in my opinion, the Reverb acquisition is a good move because it preserves the specialty and differentiation of the business, even though it is relatively small. On the other hand, the Depop platform appears less favorable to me simply because there are numerous similar platforms with no distinct differentiation, akin to how Silverman described the TEMUs and the Sheins of the world.

Leadership

Josh Silverman has been the head of Etsy since 2017. He has done a great job in understanding what Etsy is and what challenges it faces, whether it’s search challenges or expanding brand recognition. I appreciate the acquisition of Reverb, and I also respect the management team’s admission of their mistake with Elo7.

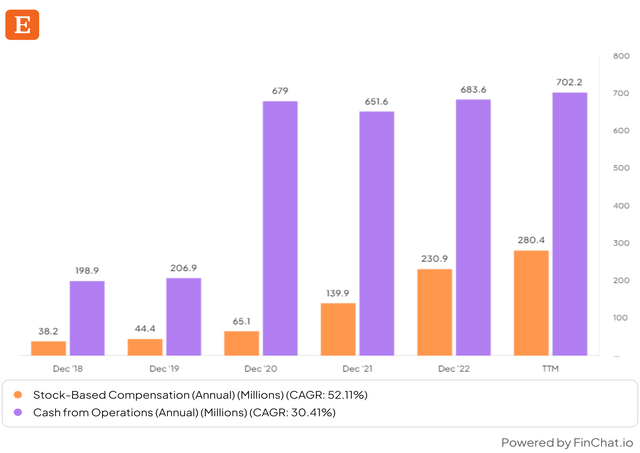

However, what concerns me is the excessive Stock-Based Compensation (SBC) for employees, which accounts for almost 40% of operating cash flow-twice as much as Google. This high number significantly dilutes shareholders and requires excessive cash for buybacks just to maintain the same number of shares outstanding, resulting in a significant opportunity cost. In my view, Silverman needs to address this issue in recruiting.

While compensation for executives is primarily through equity, which is a positive practice, there is no significant insider ownership from leadership, nor any recent insider buying.

Q4 Earnings

What would need to happen for me to get really interested in the stock?

- New Boots in Store: User Growth; I want to see at least 7% growth in the number of users because there is a limit to how much you can squeeze revenue per user.

- GMS Growth: I want to see growth in the Gross Merchandise Sales numbers, at least 5% year over year (YOY), and also growth sequentially.

- Reactivated Buyers Trend: I want to see the trend in reactivated buyers continue to be in double digits.

- Habitual & Repeat Buyers: Another important point is the growth in habitual buyers and repeat buyers. Where the growth has been non-YOY, I need to see this number with at least low single-digit growth.

- GMS per Active Buyer: The GMS per active buyer needs to return to positive growth territory.

- Revenue Growth: Finally, revenue growth sequentially and YOY should be at least high single digits.

These are the factors that, if most of them are positive, make me think more seriously about buying.

Numbers

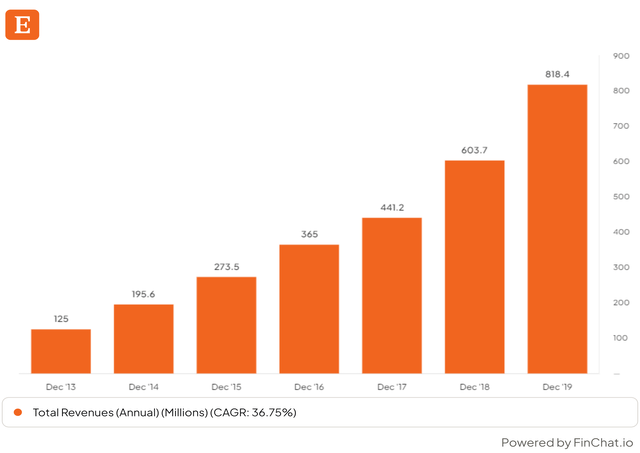

When we look at Etsy’s numbers, we need to consider the COVID-19 jump with a discerning eye because future growth will not be near those numbers. The pre-COVID CAGR for Etsy was amazing, with a 36% top line.

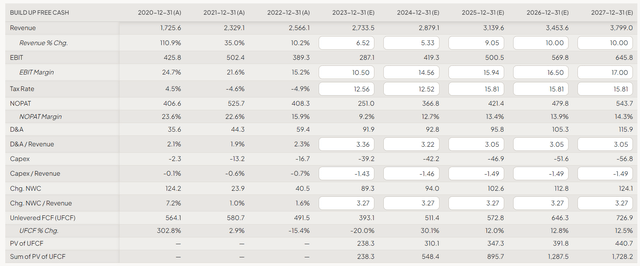

However, since we buy future cash flows, we need to estimate those. As Silverman noted, we are now in a tougher part of the cycle, and revenue growth is scratching the high single digits, nowhere near past numbers, which led to the drop in the stock price last year. Analysts project this growth to be even lower by the end of 2024 and then to jump back to high single digits.

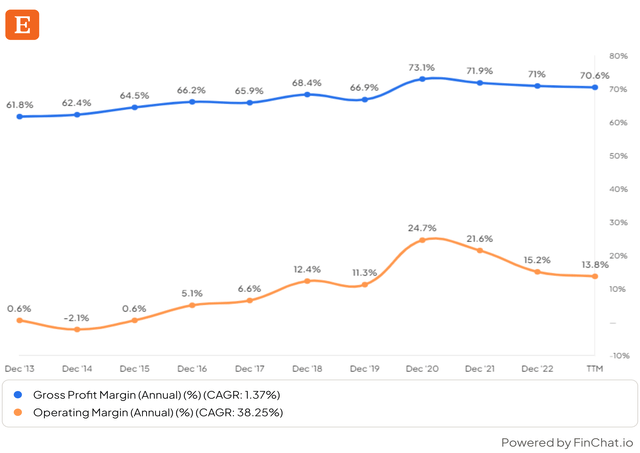

Another strong avenue for free cash flow generation for Etsy is its ability to achieve higher margins, as we have seen in the COVID era. It is also an indicator of future operating leverage.

Growing margins will also benefit Return on Capital (ROC) growth, which is, in my view, the most important factor besides revenue growth. Etsy’s ROC numbers are very impressive, and I see it in the execution of the ROI statement from earlier.

In terms of solvency, well, Etsy does not have the strongest balance sheet I’ve seen, but I think it is in good shape. Most of the debt is maturing after 2026, and with $1 billion after 2028, all with low-interest rates, under 1%. It can cover its net debt within two years of free cash flow, so I don’t think this is a big problem here, although it is not the strongest I’ve seen.

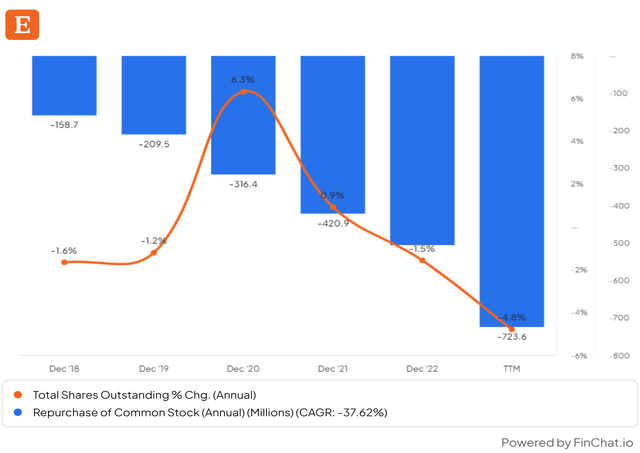

Etsy is buying back almost all of its own stocks with its free cash flow, and with that, despite the dilution, it manages to stabilize the share count and even decrease it. Still, most of this cash is only to compensate for the huge Stock-Based Compensation (SBC) figures.

Valuation

Etsy is not cheap, but it doesn’t appear too expensive either. Trading at 16 times NTM earnings is reasonable for a company that can grow EPS in the low teens long term, giving it a forward PEG ratio of around 1.3. This ratio is not a bargain at all, but also not out of the roof like many other tech stocks. Free cash flow yield is also above 5% TTM, which is a good price for a high ROC company; you won’t find many at such yield.

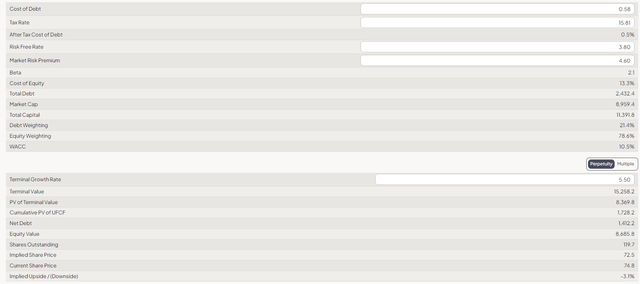

Turning to a Discounted Cash Flow analysis with analysts’ estimates until 2025, and assuming 10% optimistic revenue growth thereafter, along with a 0.5 basis point increase in EBIT margin, and a WACC of 10.5% (due to the high beta), we need a 5.5% terminal growth to justify the current price. This seems to be very ambitious, especially when considering projected growth for 2023 and 2024. However, on the other hand, Etsy can achieve high returns on capital. It’s a real dilemma if the current price is low enough for the growth.

Conclusions

In my view, Etsy is not a clear buy. However, because I’m looking longer-term and I see the potential in the business, I conclude that it’s a BUY. But actions will need to be taken from management’s side, particularly addressing the SBC dilution, as well as reviving growth again.

Looking towards comments.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information provided here is for informational purposes only and should not be considered as financial advice. I am not a financial advisor, and the content presented is not intended to serve as a recommendation to buy or sell any securities. Investments involve risks, and past performance is not indicative of future results. It's crucial to conduct thorough research and consider individual financial circumstances before making any investment decisions. Any actions taken based on the information provided are at the sole discretion and responsibility of the reader.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.