Summary:

- Energy Transfer LP stock is still a buy in my view despite a price near multi-year peak levels.

- It has a projected EPS annual growth rate of 7%+, which I think is feasible given catalysts like the acquisition of Crestwood Equity Partners.

- Valuation metrics, including Graham’s approach, still suggest that ET is undervalued compared to its market price.

- At the same time, an ~8% dividend provides nonnegligible downside protection in the case of a market downturn.

olm26250/iStock via Getty Images

ET is a still a buy

My last article on Energy Transfer LP (NYSE:ET), published in Oct 2023, argued for a strong buy thesis. The argument was largely built on the potential for oil price recovery, considering catalysts like the persisting inflation and the Israel-Gaza conflict.

Energy Transfer stock prices have indeed rallied strongly after that, by almost 13% (see the next chart below). The stock price now sits near a 52-week high, and also close to the highest level in more than 4 years. Combined with the stock’s generous dividends, the total return is more than 18%. However, the issue of a correct bull thesis is that it eventually defeats itself as the stock price rises, valuation expands, and risks heighten.

Although in the case of ET, the goal of this article is to explain why the stock is an enticing investment opportunity combining a reasonable valuation, growth potential, and current income. In particular, the valuation could be still even discounted according to Graham’s metrics (more on this later).

Growth potential and catalysts

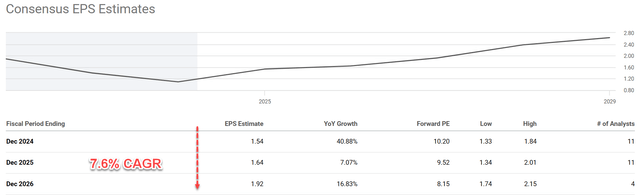

Valuation ultimately should be normalized by growth rates. So, before we further discuss price and valuation projections, let me first analyze its growth potential. The below chart shows consensus estimates for ET’s future EPS. As seen, according to these estimates, ET’s EPS is projected to grow at a compound annual growth rate (“CAGR”) of 7.6% in the next years, from $1.54 in 2024 to $1.92 in 2026.

I see good odds for such growth rates to materialize in the next few years. As detailed in my earlier articles, ET enjoys a robust ROCE (return on capital employed) and stable reinvestment rate in the long term, the two key ingredients for organic growth. Besides such long-term organic growth, there are also several other catalysts that can boost earnings substantially in the next few years. And the top catalyst on my list is the acquisition of Crestwood Equity Partners (“CEQP”). ET recently completed this all-equity purchase for ~$7.1 billion, a sizable addition to its assets.

To contextualize things, ET’s current market cap is about $52B. I view this acquisition as a strategic long-term play that will pay dividends – pun intended – in the years or even decades to come. More specifically, I expect ET to start realizing cost synergies from Crestwood as soon as 2005, which adds strong support for the expected full-year earnings of around $1.54 per unit. Other tailwinds in the next 1~2 years include the LNG sales and purchase agreement with Shell NA LNG.

Graham’s valuation metrics

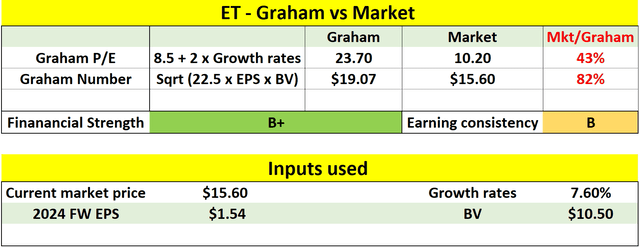

If you agree with the above consensus projections too, then we can move on to assess its valuation multiples. Since we are dealing with a mature business like ET, I will assess its valuation following Graham’s approach designed for “defensive stocks,” which really is equivalent to mature businesses. The following approach is a summary of the key points from his book: The Intelligent Investor. Details are provided in my earlier article, and a summary is provided here:

As a value investor to the core, Graham also recommended a series of methods for investors to gauge the price they should pay. Two of these methods involve the so-called Graham P/E and the Graham number. The Graham P/E is calculated as 8.5 plus twice the expected annual growth rate. And the Graham number is calculated as the square root of 22.5 x EPS x the book value. Graham

Following this approach, the table below shows the Graham P/E and the Graham number for ET based on my calculations. To calculate the Graham P/E, I used the growth rate implied by the consensus estimates quoted above (i.e., 7.6% CAGR). With a CAGR of 7.6%, ET’s Graham P/E turned out to be 23.7x (8.5+2×7.6). In contrast, its market P/E is about 10.2x only even after the recent price rallies, a large discount compared to the Graham P/E.

For the Graham number, I used the FY1 ESP of $1.54 from consensus estimates and an FWD BV of $10.5 per unit (taken from Value Line). With these parameters as inputs, the Graham number worked out to be $19.07, again above the market price by a sizable margin.

Author based on Seeking Alpha data

Other risks and final thoughts

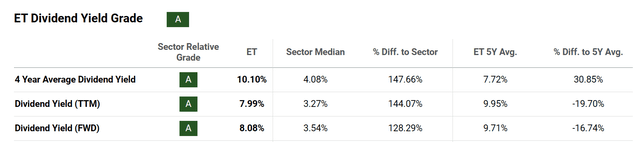

Before closing, there are a few other risks worth mentioning. The generous and consistent dividends are another large upside risk to my thesis. As seen in the chart below, ET currently yields more than 8% on an FWD basis, not only very high in absolute terms but also much higher than the sector’s median of 3.54% (and the sector is well known for its dividends to start with). The high dividend yield could be especially important for investors who need a steady stream of current income and could serve as an effective hedge in the case of a major market downturn.

There are some downside risks to consider too. As mentioned earlier, while I consider ET’s recent Crestwood acquisition to be a strategic long-term play, there is some near-term risk associated with it. Two risks are at the top of my mind.

First, the company already operated with a considerable amount of debt before the acquisition (which is normal in the pipeline sector). The acquisition added further debt to the balance sheet (see the chart below). Combined with the prevailing elevated borrowing rates, this might limit its capital allocation flexibility and slow its reinvestment rates in the near term.

Second, the pricing environment in the energy market presents some challenges to ET too, especially for liquefied natural gas (“LNG”), a major segment for ET. To make things even more challenging, the Biden administration recently put a pause on U.S. LNG export approvals.

All told, my overall conclusion is that the positives currently surrounding Energy Transfer LP still outweigh the negatives. The challenges mentioned above are all temporary in my view. As such, my thesis is that ET still presents a BUY opportunity despite the large price advancements since my last write-up. To reiterate, the key positives in my mind are the strong EPS growth potential and catalysts, reasonable or even discounted valuation ratio compared to Graham’s metrics, and finally, a very generous dividend that provides nonnegligible downside protection.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.