Summary:

- PayPal’s share price has declined approximately 80% from its peak due to slowing growth and increased competition.

- The stock’s valuation does not offer a compelling entry point, but an entry point around the low $50s would present a more appealing risk-reward ratio.

- Selling slightly in-the-money call options could yield a low to mid-double-digit annualized return if the stock price remains stable or appreciates.

Morsa Images

Summary

During the COVID-19 pandemic, PayPal Holdings Inc. (NASDAQ:PYPL) experienced a significant rally, with its share price nearly tripling. However, the company has since witnessed a decline of approximately 80% from its peak, primarily due to slowing growth and increased competitive pressures. Presently, the stock’s valuation does not seem to offer a compelling entry point based on conservative estimates, though it is not deemed excessively overvalued. An entry point around the low $50s would present a more appealing risk-reward ratio. Although we maintain a neutral stance on PayPal’s shares, we recognize the arguments favoring investment. A strategy to consider might be the sale of slightly in-the-money call options, which could yield a low to mid-double-digit annualized return if the stock price remains stable or appreciates, offering a potentially attractive effective basis.

Company Overview

PayPal operates a two-sided network with a diversified product offering that enables digital payments and simplifies commerce experiences on behalf of merchants and consumers worldwide.

It operates through a portfolio of brands/products, including PayPal, PayPal Credit, Braintree, Venmo, Xoom, PayPal Zettle, Hyperwallet, and Paidy. It has two detailed reporting segments:

- Transaction Revenues: Fees charged to merchants and consumers on a transaction basis: Take rate (3.49% + $0.49 per transaction), currency conversion, transfer of funds to bank account, purchase or sale of cryptocurrencies, contractual

- Other Value-Added Services (“OVAS”): Partnerships, referral fees, subscription fees, gateway fees, other services, interest and fees earned on loans receivable and assets underlying customer balances

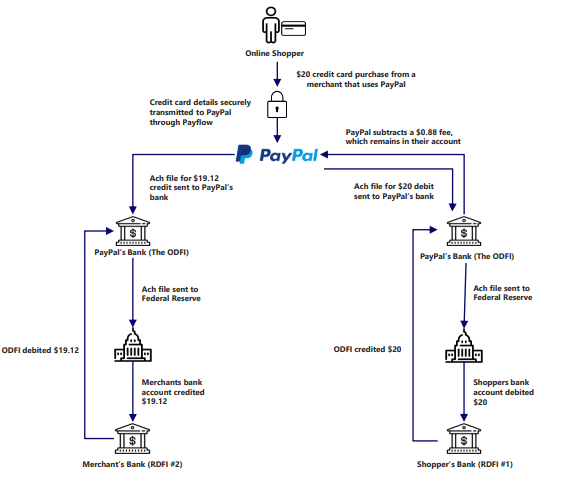

Illustrative Transaction (Empyrean)

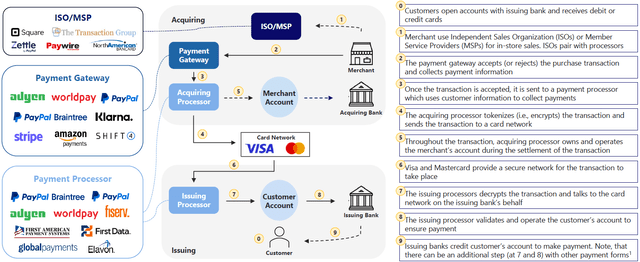

The payment system value chain involves several components required for merchants and customers to conduct commerce, online or in person. Although complex, the various parts of the value chain work together to create a seamless experience for the customer, all completed within seconds.

Payments Value Chain (Empyrean)

PayPal saw tremendous success with the outbreak of COVID-19, as e-commerce sales surged; however, recent macro challenges and increasing competition have caused a slowdown in active accounts, resulting in poor share price performance.

PYPL 5Yr Share Price History (CapIQ)

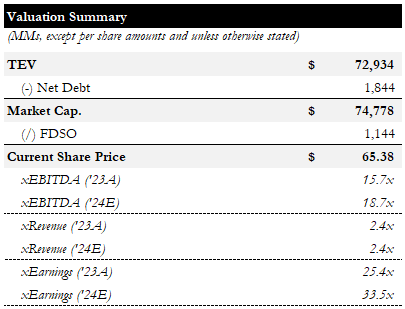

Valuation

Since reaching its nadir in the low-$50s, the shares have rallied nearly ~30% to the mid-$60s. The current price implies an EV/EBITDA of ~16x.

Valuation Summary (Empyrean)

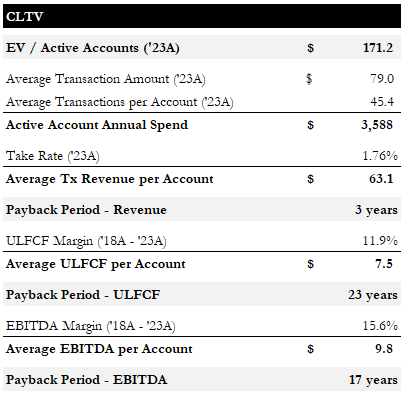

While we have a DCF model for PayPal, we rely heavily on it due to our numerous questions about growth and discount rates, pricing power, and appropriate discount rates. Instead, we prefer to consider EV/Active Account vs likely customer lifetime values (“CLTV”). The market is currently ascribing a value of ~$171k to each active account as of Dec-23. Based on the Dec-23 average transactions per account and average transactions per account, each customer generates ~$3,600 of payment volumes. Using the latest take-rate, we calculate ~$63 of transaction revenue per account and ~$7.5 of ULFCF or ~$10 of EBITDA based on recent average margins. This implies payback periods of ~23 and ~17 years for ULFCF and EBITDA, respectively.

CLTV (Empyrean)

While this analysis assumes no growth in the user base, we feel comfortable with this as a conservative assumption given the recent weakness (n.b., ~2% decline in active accounts YoY from ’22 to ’23). We present the EV / Active Account / [Revenue, ULFCF, EBITDA] as payback periods, though they can also be thought of as multiples. With the company having grown EBITDA and ULFCF at a ~14% and ~19% CAGR from ’18 to ’23, we view these multiples as moderately high.

Given the backdrop of increasing competition (discussed further below) and pricing pressure, we do not see a significant price dislocation or margin of safety. However, we do not see the shares as significantly overvalued.

Risks

1) Intensifying Competition in Payments

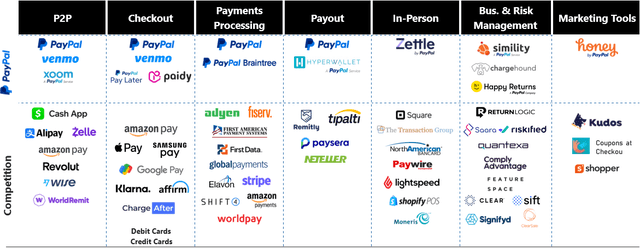

There are more digital wallets today than ever, and PayPal is not immune from competition despite being the largest provider. Intensifying industry competition can lead to pricing pressure or loss of market share.

Competitive Landscape (Empyrean)

Potential Mitigant: Despite facing competition for both branded checkout and processing, PayPal’s immense scale and double-sided network effects will serve as a resilient economic moat against competitors.

2) Elevated Customer Churn Decreasing Revenue Base

PayPal’s net new active customer growth slowdown over the last two years has worried investors. Given the elevated churn rate for PayPal’s customers, this may lead to future negative earnings revisions from management.

Potential Mitigant: The recent issues of elevated churn are related to the cohorts of customers PayPal onboarded during the pandemic rather than being a structural issue of the business. After these users are churned off, PayPal should be able to return to its typical pace of user growth, especially with new product introductions and enhancements.

3) Loss of Exclusivity with Major Merchants

After PayPal’s loss of exclusivity with eBay, the company has continued to face degrees of market pessimism regarding its ability to maintain agreements with certain large online marketplaces.

Potential Mitigant: PayPal’s loss of exclusivity to eBay is not a future risk for the business’s customer base at all, given that PayPal’s average take rate is double its take rate for eBay customers. PayPal’s agreements with eBay at the individual merchant level have contributed to the decline in PayPal’s take rate over time, and this agreement change will only stabilize its take rate

4) Global eCommerce Growth Outlook is Limited

The pull-forward in eCommerce demand due to COVID enabled PayPal to benefit from an uplift in customer capture, but weaker long-term eCommerce trends could serve as a significant headwind for the business.

Potential Mitigant: Although PayPal’s slowdown of total transaction volume growth can be attributed to the deceleration of eCommerce penetration globally, PayPal’s core segment does not lag industry growth. Other headwinds, such as renewed lockdowns in China, have also contributed to a decrease in cross-border transaction volumes but will eventually recover

Conclusion

Following a monster rally through COIVD, which saw the share price nearly triple, PayPal has crashed ~80% as growth has slowed and competitive pressures mounted. The current price does not appear to provide a highly attractive entry point under conservative assumptions, though we do not see it as significantly overvalued. We would be more comfortable with shares in the low- $ 50s. Though we are not interested in the shares, we understand the bull case. One way we could feel comfortable playing PayPal today would be to sell slightly ITM call options, providing a low/mid-double-digit annualized return if shares remain flat or rally, at a potentially attractive effective basis.

t

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.