Summary:

- Centene is a leading healthcare enterprise specializing in managed care services.

- Healthcare stocks are currently undervalued compared to other sectors, presenting a buying opportunity.

- Valuation suggests the company’s shares are considerably undervalued.

SOPA Images/LightRocket via Getty Images

Investment Thesis

With increasing economic uncertainty and an inverted yield curve, the attractiveness of defensive low-beta stocks such as Centene (NYSE:CNC) has only grown. After a prolonged period of sideways trend, an upward trend is hence likely to follow.

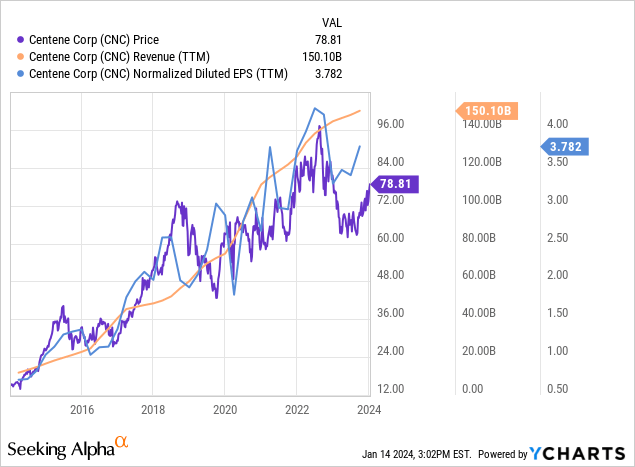

YCharts

Corporate profile

Centene Corporation is a leading healthcare enterprise based in the United States, specializing in managed care services. Founded in 1984, the company has grown into a Fortune 500 organization and a key player in the healthcare industry. Centene focuses on providing high-quality, accessible healthcare solutions to individuals and families, particularly those covered by government-sponsored programs such as Medicaid, Medicare, and the Health Insurance Marketplace. Centene’s corporate mission centers around improving the health and well-being of its members, emphasizing preventive care and innovative healthcare solutions.

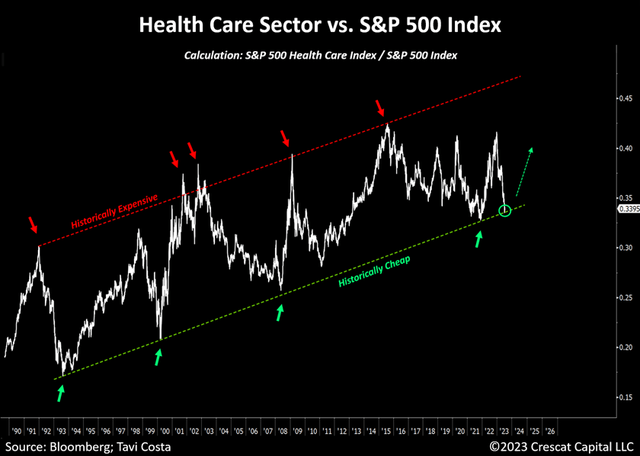

Relative healthcare sector undervaluation

In the broader market context, healthcare stocks now seem inexpensive compared to other sectors. Over the last 30 years, the healthcare sector has been in an upward channel, with peaks and bottoms in certain years. And 2024 appears to be the year when healthcare stocks are historically cheap relative to the S&P 500. Moreover, some sub-indices within the healthcare sector are trading at even more depressed levels. For example, the Nasdaq Biotechnology index, which includes larger and established businesses, currently has a price-to-sales multiple of approximately 5.5 times, down from nearly 13 times at the last peak in 2015. Sentiment and cyclicality can be seen as factors behind this undervaluation, as investors have favored predominantly tech stocks in recent years and there have not been many new developments driving the healthcare sector to the forefront. One can notice that healthcare got pricier, especially during post-correction, recessionary environments, which have not occurred frequently in the recent past.

Crescat Capital

Key insights from the latest quarterly earnings call

Reading through the latest quarterly earnings call transcript, the management sounded very optimistic about the business’s performance in the recent period and improved outlook for the whole year:

We are pleased with the performance of the company in the first three quarters of the year and are increasing our outlook to at least $6.60 of adjusted EPS for 2023. As Sarah mentioned, this puts us at greater than 14% adjusted EPS growth in 2023 after posting 12% in 2022, two pretty good years. – Drew Asher – Chief Financial Officer

The CEO of the company also talked about operational improvements stemming from workflow automation and new technology introductions:

For the initial installations of our new telephony system, we are now layering on additional features that are driving month-over-month improvement in cell service. And over the last few months within our now centralized utilization management teams, we have been focused on reducing provider abrasion by expanding the use of our proprietary tool CATA, which automates the approval of authorizations for clinically appropriate procedures using AI technology we developed in collaboration with Apixio. – Sarah M. London – Chief Executive Officer

Financial analysis

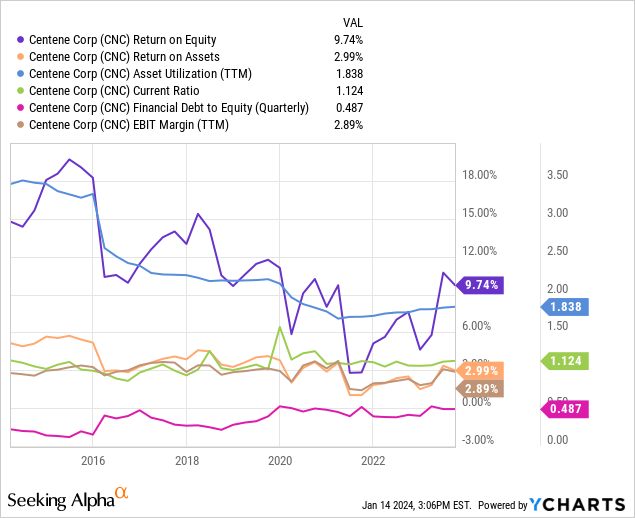

From the financial statements perspective, Centene maintains a sustainable level of debt, which positively contributes to profitability (ROE of ~10%). The company also has sufficient liquidity levels, with a current ratio just above 1.

YCharts

Valuation

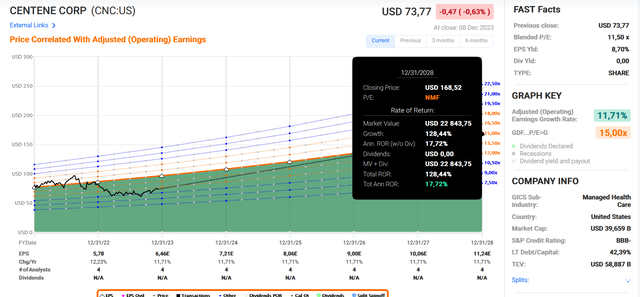

Through the lenses of F.A.S.T. Graphs forecasting calculator, the company’s growth outlook appears bullish. Should the company’s shares trade at price-earnings multiple of 15x in five years from now and Centene’s operating earnings expand at an annualized growth rate of around 12 percent, the shares’ fair price implies as much as 17 percent annualized upside potential.

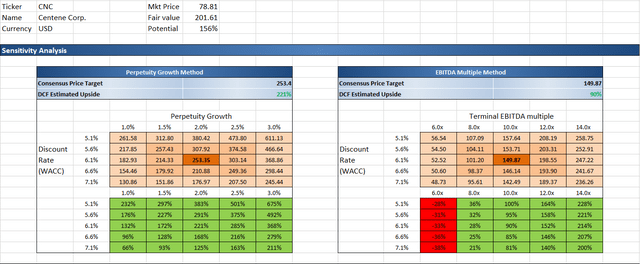

DCF analysis

Plugging in Centene’s financial statement figures into my DCF template, the company’s shares show to be considerably undervalued. Under the perpetuity growth method with a terminal growth rate of 2 percent, 24 percent annual revenue growth over the next five years and stable operating income margin of 2.9 percent assumption, the model’s estimate of the intrinsic value of the stock comes at 253 USD. Under the EBITDA multiple approach of a discounted cash flow model, the intrinsic value per share of the company stands roughly at 150 USD if we assume that the appropriate exit EV/EBITDA multiple in five years’ time is around 10x.

Key risks

Investing in Centene shares, like any other investment, comes with its set of risks that potential investors should carefully consider. One key risk is the company’s sensitivity to changes in healthcare policy and regulations. Centene operates in the managed care sector, and any alterations to government healthcare programs or policies can significantly impact its revenue and profitability. Additionally, the healthcare industry is subject to rapid and unpredictable changes, including advancements in medical technology, drug pricing fluctuations, and demographic shifts. Centene’s business model heavily relies on government-sponsored healthcare programs, making it vulnerable to political and budgetary decisions that may affect its contracts and reimbursement rates. Furthermore, competition within the healthcare sector is intense, and any failure to adapt to evolving market dynamics or effectively manage costs could pose challenges for Centene’s financial performance. Lastly, for the company’s shareholders, there is also a risk of equity dilution, which has already occurred several times in the past.

The bottom line

To sum up, Centene is an outstanding healthcare company with very attractive valuations and long-term prospects. With imminent economic uncertainty, it is wise to stay cautious and aware of possible risks for equity portfolios. High-beta stocks may currently not be the best choice, as lower entry points might emerge after economic risks clear out.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Please note that this article has an informative purpose, expresses its author's opinion, and does not constitute investment recommendation or advice. The author does not know individual investor's circumstances, portfolio constraints, etc. Readers are expected to do their own analysis prior to making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.