Summary:

- Centene beat Q3 earnings expectations, with revenue reaching $38.04 billion and membership growth expanding to over 3.6 million members.

- The company has consistently performed well, generating $150 billion in annual sales and trading at a discount to peers.

- The company continues to hold a steady market share and compounds steadily, which could lead to more upside in the future.

Wipada Wipawin

Centene Corporation (NYSE:CNC) fits the archetype of a seemingly boring value stock, often overlooked in favor of larger healthcare providers like UnitedHealth (UNH). Operating in the healthcare sector, Centene specializes in managed care services, offering health insurance plans to government-sponsored programs such as Medicaid, Medicare, and the Health Insurance Marketplace. Its mature business model may lack the flashy allure of high-growth industries, but it has demonstrated resilience and steady growth.

Despite residing in the shadows of industry giants, Centene has quietly delivered consistent performance, as evidenced by its latest earnings report. After all, the healthcare giant is on track to generate $150 billion in annual sales, while trading at a discount to peers.

Earnings Snapshot

Centene beat Q3 earnings on the top and bottom line, with Non-GAAP EPS at $2.00, surpassing expectations by $0.46. The company’s revenue reached $38.04 billion, exceeding estimates by $1.91 billion, marking a 6.0% year-over-year increase. Centene also raised its 2023 full-year adjusted diluted EPS guidance by $0.15 to a minimum of $6.60, compared to the consensus estimate of $6.50.

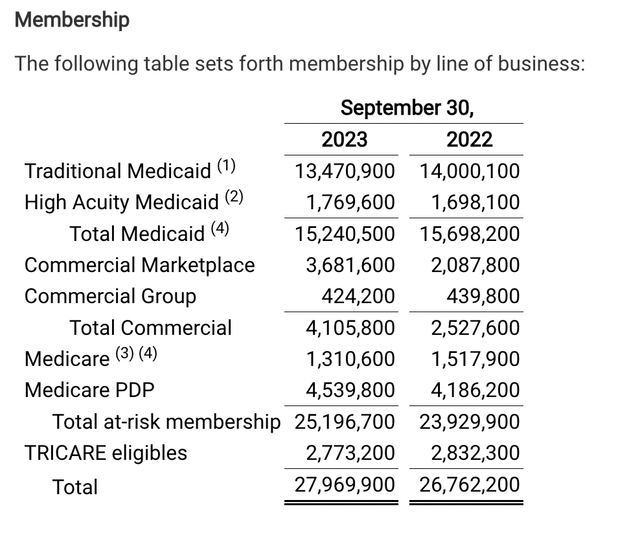

Centene

In terms of membership growth, Centene’s Marketplace has expanded to over 3.6 million members as of September 30, 2023, a significant rise from the 2.1 million members reported a year earlier. Overall, total memberships grew by roughly 1.2 million from last year, representing 4.5% growth. The company remains committed to effective cash flow management, evident in its execution of $773 million in share repurchases during Q3 2023 and year-to-date repurchases totaling $1.6 billion.

Solid Valuation

Over the past few decades, Centene has recorded consistent revenue and earnings growth although the sources of this growth have partially been linked to aggressive acquisitions. While these acquisitions have boosted revenue and market share growth, they incur complexity in forecasting future growth. As mentioned in the latest earnings call, Centene has initiated the repurchase of its outstanding shares, a move that may suggest the company is entering a maturation phase. It could also signal that management believes shares are currently attractively valued at just 10 times P/E and part of its strategy to return capital to shareholders.

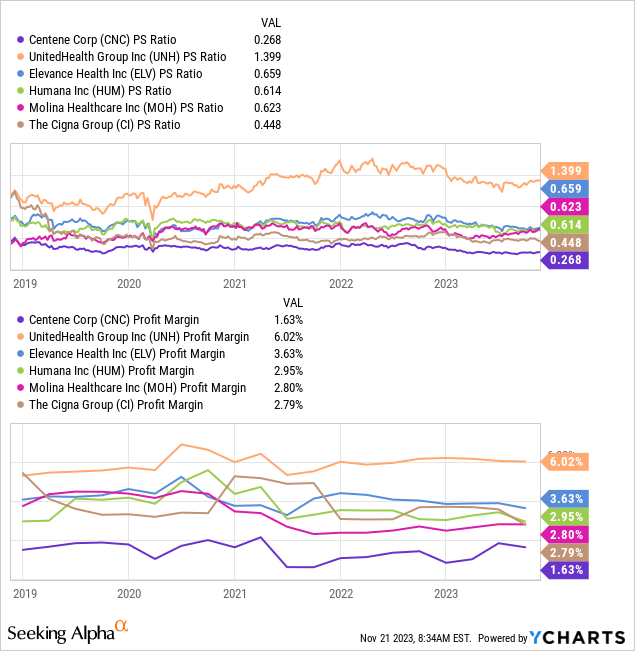

As Centene’s revenue continued to climb over the past few years and its share price traded sideways, its valuation deflated. Part of this is probably because the market expects lower growth going forward at $150 billion in annual sales, growing revenues at a CAGR of 5%. This compares to its past growth of well above 10% annually over the past two decades. However, Centene also beat revenue estimates by $1.9 billion last quarter or 5%, demonstrating that the market may be underestimating Centene’s revenue and market share growth going forward. After all, part of its low valuation is tied to its loss of market share in the Medicaid and Medicare market segments. As a result, the business announced earlier this year, that it would lay off 3% of its workforce.

Despite the negative sentiment compared to market leader UnitedHealth, I believe Centene’s valuation is too low compared to competitors, despite holding the lowest profit margins, as demonstrated above. Most healthcare names such as Cigna (CI), Humana (HUM), and Molina Healthcare (MOH) trade at around 0.5-0.6 times Price to Sales (P/S) and hold profit margins of around 2-4%. The small divergence comes from the relatively low pricing power of healthcare providers, as well as government regulations. While Centene deserves a lower valuation due to its smaller profit margins, I believe Centene can reach a 2% profit margin, considering its relatively attractive gross margin profile of 12%.

Takeaways

Centene, though not the most thrilling business, maintains a robust market position, commanding a significant share of the healthcare market. The recent substantial beat in its financials suggests that future growth prospects might be underestimated, and the prevailing negative sentiment stemming from its Medicaid loss could be overly pessimistic. The lack of engagement on SeekingAlpha posts indicates that the stock appears overlooked, a sentiment that is mirrored in its relatively low valuation. Despite its unassuming nature, Centene has the potential to be a steady compounder, with the prospect of upside in the future.

Nevertheless, there are risks to the thesis. Centene, like other healthcare providers heavily rely on government-sponsored healthcare programs, making it susceptible to changes in policies or funding. The recent Medicaid contract loss highlights its vulnerability to significant contract changes. Finally, regulatory uncertainties in the healthcare industry could impact operations and compliance costs.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CNC, ELV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

All predictions and projections are solely median estimates by financial analysts and are due for uncertainty. All graphs, charts, etc. may not be up to date and only represent the latest available data. I do not guarantee the accuracy of any of my mentioned price targets, and thus, they should not be used as investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.