Summary:

- Fisker Inc. is facing potential bankruptcy and is currently uninvestable due to high risks.

- The company has paused production for six weeks to manage inventory levels and secure additional financing.

- Fisker’s stock represents excessive risks, and its survival as an EV company is uncertain.

Victor Golmer

Fisker Inc. (NYSE:FSR) is in a very precarious situation and it might even slide into bankruptcy which I think makes the stock uninvestable at the present time.

Though the electric-vehicle manufacturer just announced a $150 million financing commitment from an investor, Fisker also announced that it was pausing production for six weeks in an attempt to manage inventory levels.

The EV company has enough cash to survive until the end of the year, but Fisker’s stock represents exceptionally high risks that I think are too great for the average investor.

My stock classification for Fisker, taking into account the just announced financing commitment, is Sell.

Fisker Is In A Bad Place

Fisker rolled out its first electric-vehicle, the Fisker Ocean SUV, in 2023 and has since seen a substantial increase in production and sales. Besides the Fisker Ocean SUV, the electric-vehicle company laid out an ambitious production plan that would see the market introduction of other non-SUV electric-vehicles in the coming years as well.

With that said, the California-based company had to scale back its production target for the fourth time in December 2023 to 10,000 electric-vehicles amid waning demand in the EV industry. The revised 10,000 production target ultimately proved to be achievable as Fisker produced 10,193 Fisker Oceans in 2023.

However, only 4,929 electric-vehicles were delivered. By delivering only 48% of its Fisker Ocean 2023 production, the company created an inventory problem that is now affecting the company’s run-rate production.

Fisker had to lower its production forecast four times last year as the company’s production didn’t scale as fast as anticipated. Or better said: Demand for the company’s flagship electric-vehicle was not as great as forecast which in turn caused a confidence crisis among investors. Nonetheless, Fisker profited from an upswing in sales in 2023 as the company began ramping deliveries.

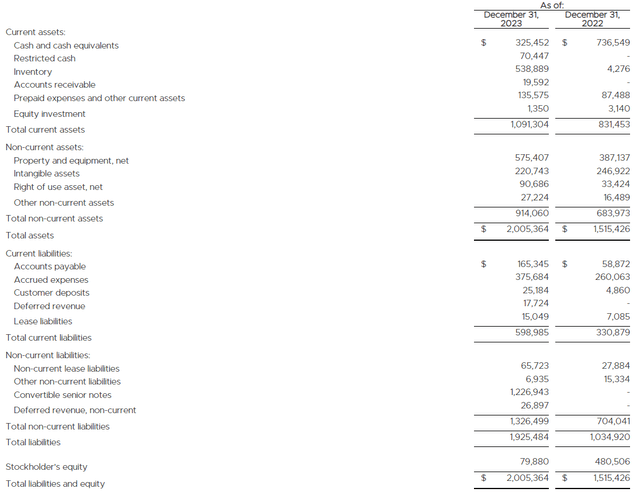

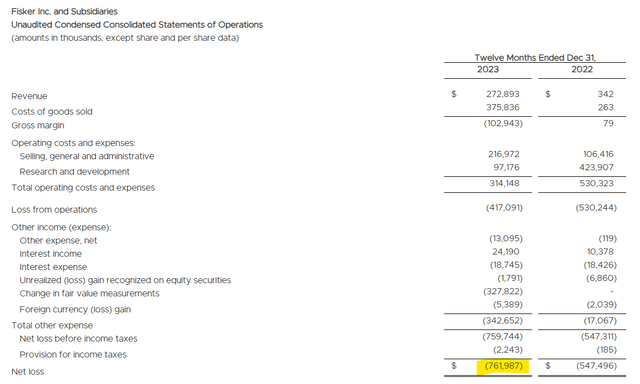

Fisker produced $272.9 million in sales in 2023, up from a mere $342K in the prior year. Notwithstanding, the electric-vehicle company did not come close to achieving any profitability and Fisker reported a net loss for 2023 amounting to $762.0 million.

Unaudited Condensed Consolidated Statements Of Operations (Fisker)

Fisker announced last week on its website that it secured a financing commitment from an investor in the amount of $150 million which will be paid out in four tranches.

In addition, the electric-vehicle company paused its Fisker Ocean production in order to work through its inventory issues and arrange a new financing deal.

Fisker has about 4,700 electric vehicles in inventory right now which is, according to the company, valued at $200 million. In a dramatic change of events, just a few days before that, Fisker announced the hiring of restructuring advisers.

The $150 million financing commitment provides crucial support for Fisker’s balance sheet which, as of December 31, 2023, showed $325.5 million in cash. This balance dwindled to just $120.9 million as of March 15, 2024, according to a regulatory filing, which puts the company’s survival at serious risk.

Bankruptcy Is On The Table

With a bankruptcy very much on the table, Fisker’s stock carries excessive risk and is probably not more than a gamble for the most risk-seeking investors.

With $121 million in cash + $150 million in financing commitments, Fisker has approximately $0.50 per share in cash. I don’t think, frankly, that a reliable intrinsic value at this point can be derived for Fisker given the gigantic uncertainty embedded here, but if I had to make an educated guess, I would probably refer to the $0.50 per share in estimated cash value.

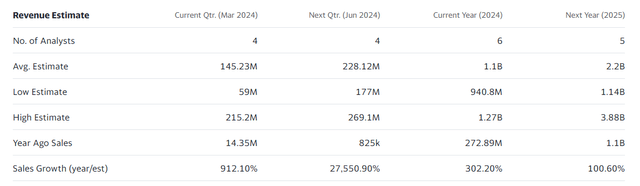

The market models $1.1 billion in sales this year and $2.2 billion in sales in 2025 which still seems very optimistic considering that Fisker effectively revealed that it has to stop production in order to sell through its inventory.

These sales estimates are likely to see significant corrections now that Fisker paused its production and I have serious concerns that the electric-vehicle company may not be able to realize its sales potential at all as the company’s bankruptcy odds have substantially increased in the last couple of days.

Revenue Estimate (Yahoo Finance)

Why Fisker May Surprise To The Upside

In the unlikely event that Fisker could attract an equity investment from an OEM manufacturer, the electric-vehicle company’s stock could get a shot in the arm and Fisker might get a second lease on life.

I think the odds of this are very low, however, and even an equity investment wouldn’t solve the problem of Fisker dealing with a demand issue for its electric-vehicles.

An equity deal might change the equation in favor of Fisker a little bit and give the company room to breathe, but I don’t see what unique technology Fisker owns that a larger auto company would want to acquire here.

My Conclusion

Fisker’s stock at this point in time is uninvestable as the risks are excessive and even an equity investment might only prolong the company’s suffering for a little while.

The fact that the electric-vehicle manufacturer is pausing production for six weeks in order to get rid of excess inventory strongly suggests that management misjudged the demand situation which is resulting in a number of inconvenient downstream effects such as the need to raise additional capital.

I think that the risk/reward relationship is very unfavorable here and there is a good chance that Fisker won’t even exist anymore as an EV company by the end of the year.

With a bankruptcy quite possibly on the horizon in the near-term, I think that investors better stay away from here and don’t consider the stock at the very least until an equity commitment of an OEM manufacturer has been secured.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.