Summary:

- Starbucks’ financial history shows consistent revenue growth but fluctuating free cash flow due to operating expenses and capex.

- Though wonderful, valuation analysis suggests that SBUX stock is priced for a premium.

- The potential for automation and cost reduction through robots could significantly improve Starbucks’ free cash flow in the future.

sarawuth702/iStock via Getty Images

From 2019 to 2020, I worked as a barista at Starbucks (NASDAQ:SBUX). Since then, I’ve remained a semi-frequent customer at my store (although I get the cheapest drinks possible now). It was an instructive time, where I got to see a lot of the good and the bad about this business and was one of the first companies I reviewed after learning investment analysis.

I haven’t written about it up to this point, but I figured it was time to do so. As usual, this is going to be a long-term thesis, and I’ll lay out when I think SBUX becomes an attractive buy again.

Financial History

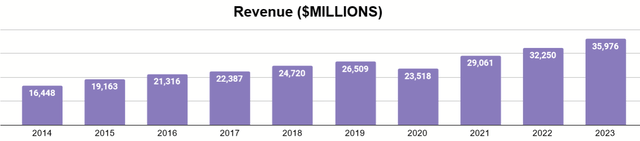

First, let’s just look at the numbers we have so far. Over the past decade, revenues grew from $16.4 billion to about $36B.

Author’s display of 10K data

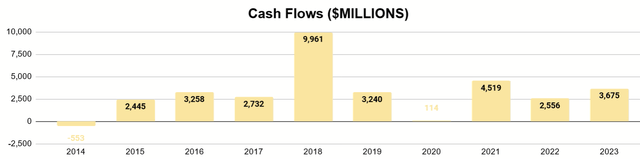

That’s a CAGR of 9% over the period. Free cash flow, meanwhile, has had a less obvious trend.

Author’s display of 10K data

With capex exceeding operating cash flows in 2014, there was one negative year. 2018 also stands out like a sore thumb. This spike was due to an upfront payment for a licensing deal with Nestlé that resulted in “unearned revenues” for the year. Overall, despite the heightened revenues, free cash flow looks to be in the same range in the last half of the decade that it was in the first. What’s going on there?

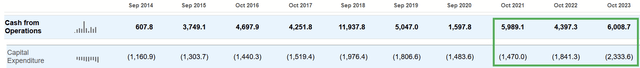

Well, operating expenses have been growing at a similar CAGR as revenues. Operating cash flows are actually higher too. The issue is that, recently, so is capex.

Seeking Alpha

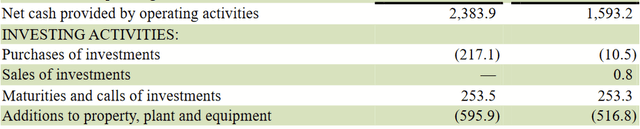

Q1 2024 results suggest that this level of capex may persist.

Q4 2023 Form 10Q

Q1’s capex is at a similar level as last year’s, but there is a reassuring sign that OCF is also higher (it’s worth noting Starbucks reports its Q1 sales are typically their highest).

Valuation

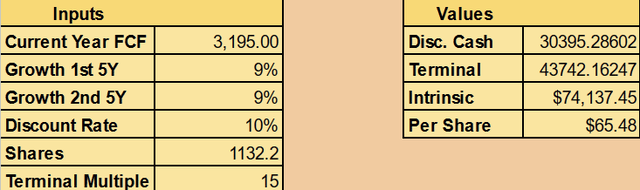

With all that laid out, I’ll go ahead and do my valuation. With a Discounted Cash Flow Model, I’ll use the following assumptions:

- $3.2B as baseline FCF

- 9% growth over the decade

- Terminal Multiple of 15

$3.2B is the average, annual FCF for the decade. 9% growth assumes the prior decade’s growth will persist (there’s room for plenty more Starbucks stores across the world, and 9% is sustainable). A multiple of 15 seems high, but I do think this is one of those companies where the market will usually be willing to overpay (the most recent analyst before me said this himself).

Author’s calculation

With a current price around $90, that suggests SBUX is not attractively priced for a 10% discount rate/similar return to a broad market index. (Current price works better with a 6% rate.)

Challenges

Now I’m going to talk a bit about what challenges Starbucks’ attractiveness and then after I’ll discuss what I think the happy ending is most likely to be.

Size

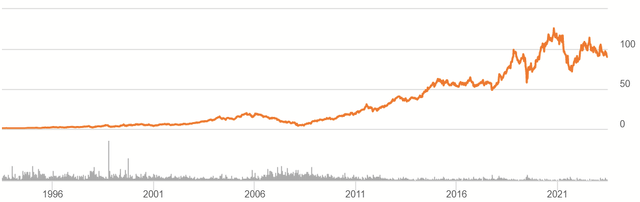

Starbucks is already the little store in Seattle that did it. It’s a megacap in coffee retail.

SBUX Price History (Seeking Alpha)

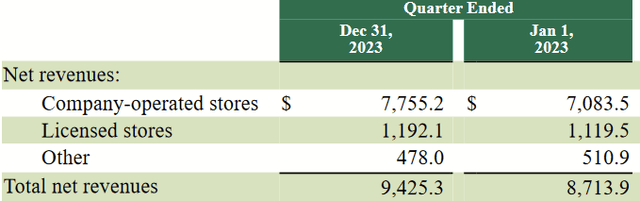

Folks hoping for similar returns as this have another thing coming. In 2023, the company reported over 38.5K stores (owned and licensed) globally.

Q4 2024 Form 10Q

With stores being the source of nearly all their revenues, this where the growth would have to be. Capital intensive as stores are, huge growth of FCF in the double digits for an extended period of time and for a company already large seems unlikely to me. Starbucks could create new revenue sources, leveraging its brand and talents in some creative way, but that leaves a lot to individual imagination, and I can’t use it for a thesis.

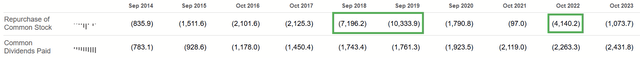

Buybacks

Throughout the decade, Starbucks has usually paid around half of its FCF as a dividend to shareholders, while buybacks depend a lot more on how much extra FCF there is that year.

Seeking Alpha

For example, the 2018 spike from the Nestlé deal was pretty much all spent on buybacks. When COVID hit, buybacks declined sharply in 2020 and 2021.

Seeking Alpha

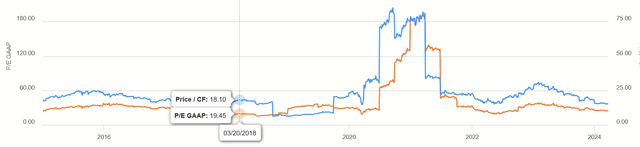

If we look at the history of P/E or P/CF multiples, they usually trade in the upper teens and into the twenties. These aren’t exactly buybacks at discounts to enhance long-term shareholder value, and at some of the higher levels that can detract from the projections in my own valuation.

The Big Improvement: Robots

The main thing that I foresee reasonably giving Starbucks a boost in FCF like that in its heyday isn’t its strong brand that people both love and love to hate. It isn’t a pandemic of coffee addictions. It’s primarily a question of cost reduction through automation. I’ll focus on some of the company’s data to explain this.

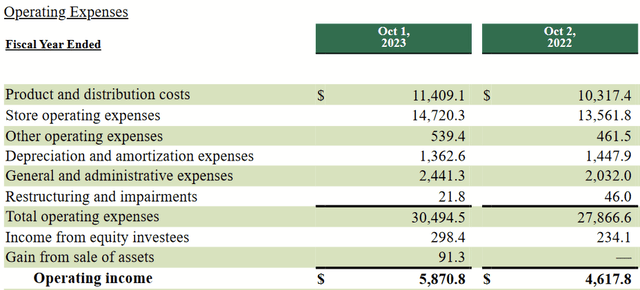

Operating Expenses (2023 Form 10K)

When we look at expenses, we can see that store operating expenses are item #1, followed by production and distribution. What’s under the hood of store opex?

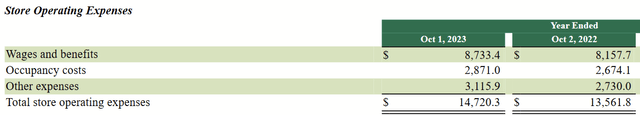

2023 Form 10K

Here, the big expense is employees. That’s $8.7B in cost. Operating cash flows for the past decade, meanwhile, never exceeded $7B. The question then is how much automation takes off and how soon. I also want to remind folks that product and distribution costs are over $11B. When Starbucks’s hand-crafted beverages are made incorrectly, they need to be remade, and shareholders have to eat the cost of wasted product. This is a very common, something that even seasoned and talented baristas will do.

Of course, it’s hard to get seasoned and talented baristas because most people don’t want to stay at Starbucks forever. I got out when I could. So did my boss. There is a constant cycle of training and the same mistakes being made by new hands.

While many customers and baristas will say that nothing can beat a “hand-crafted” beverage, the reality is that customers want their drinks made quickly and correctly the first time. With a complex menu that is always changing and easy to mess up in a rush (again, speaking from experience here), Starbucks has every reason to replace the barista with a machine that can make a drink just as well because it will waste less product getting it right, reduce wait times, and eliminate a payrolls costs. With quite a few billion in cash on the table here, there’s no reason to think this won’t happen once the opportunity comes.

Yes, espresso machines and other devices have had gradual improvements that automate certain aspects of drink-making, and this has been reflected in financial results over time, but it’s an entirely different ballgame when baristas begin to disappear from the floor.

That is the moment that SBUX signals undervaluation and growth at a reasonable price.

Conclusion

While Starbucks is many investors’ idea of a wonderful company, buying it at a premium where foreseeable growth is modest at best seems unwise. The main thing to multiply free cash flow isn’t going to be more stores but substantial cost elimination for payroll and production once machines can make the drinks themselves. People like to romanticize baristas and coffee shops (even I do), but the bottom line is the bottom line.

Until I begin to see that materialize or get a better discount for the current company, I’m gonna wait before I have a stake SBUX again.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.