Summary:

- Let’s assess the significance of the recent news from China for Microsoft and the stock’s medium-term growth potential.

- I believe Microsoft’s well-developed ecosystem and strong presence in the market contribute to the growth of Azure and its advantage over competitors.

- I see a multitude of opportunities for the Company’s business development in the coming years, thanks to smart investments in AI and cloud infrastructure. And China’s impact seems too little.

- According to my relative valuation model, MSFT’s annualized return for the next 4 years is 7.6%, which is quite good, but does not offer a significant advantage compared to other stocks.

- Microsoft stock turned out to be overvalued by ~9.5% based on the fundamental assumptions incorporated into my DCF model. I’d consider buying the stock at prices 10-15% or even 20% below current levels. MSFT is a “Hold”.

Lintao Zhang/Getty Images News

Introduction

Before I go into the topic in the title of this article, I would like to note that this is not my first article about Microsoft Corporation (NASDAQ:MSFT). I was bullish on MSFT until July 2023, but then switched to ‘neutral’. I consider MSFT to be one of the leading AI companies with a very strong position in its core markets, but the stock’s valuation has kept me on the sidelines since the middle of last year. However, the rich valuation did not prevent the stock from continuing its enchanting rally in 2024. Today I’ll try to assess why this happened, to what extent my views on the valuation of the company have changed, and will also share my opinion on why I think the recent news about China’s attempts to abandon Windows is a very insignificant event for MSFT from a fundamental perspective.

Microsoft’s Recent Financials And Corporate Developments

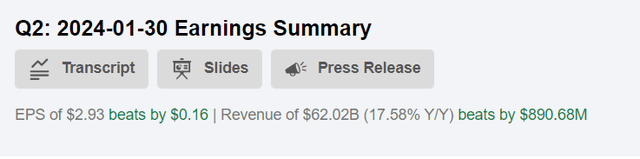

On January 30, 2024, Microsoft reported results for fiscal 2Q FY2024 (ended December 31, 2023), beating both EPS and revenue consensus estimates. The revenue reached $62 billion, demonstrating a significant YoY growth rate of 18%, while the EPS hit $2.93 (up 26% YoY).

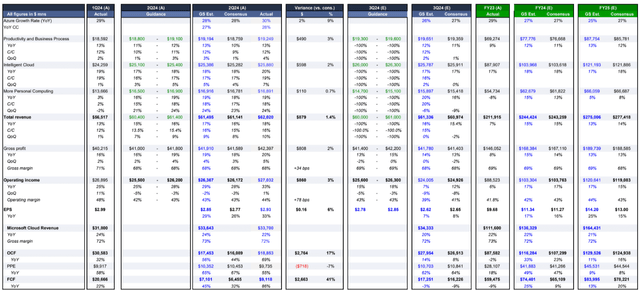

According to the latest 10-Q, the company reports based on 3 business segments: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. Goldman Sachs’ January analytical report (proprietary source), which specifically looks at the results of Q2 FY2024, allows us to understand from which of these segments came the main growth that allowed MSFT to beat consensus.

Goldman Sachs’ MSFT January analytical report (proprietary source)

As one may see, the Productivity and Business Processes segment’s revenue exceeded expectations by 3%, showing a QoQ growth rate of 4% instead of the 1% expected. The growth was driven by strong Office 365 Commercial and LinkedIn results. Dynamics 365 showed solid growth, although weaker signals in the net new business affected bookings growth.

The Intelligent Cloud segment also notably outperformed expectations, growing by 20% in USD (19% in constant currency), largely driven by increased adoption of AI services, contributing to a 28% growth in Azure revenue. It’s important to note at this point Satya Nadella’s comments that Azure has once again increased its share of the global cloud market – apparently Microsoft has some qualitative advantages over other competitors that enable the company to actively close the existing gap with Amazon’s (AMZN) AWS.

In the More Personal Computing segment, revenue increased by 19% YoY, driven by robust Windows OEM revenue and stronger-than-expected growth from Activision. By the way, Activision contributed significantly to revenue growth but was dilutive to EPS by ~5 cents (i.e. excluding this impact, the EPS would grow by 35.5% compared to the previous quarter).

So the main reason for Microsoft’s consensus beat was the strength of Azure, as I see it. In my opinion, Microsoft’s main advantage in terms of Azure’s future development lies in the company’s well-developed ecosystem, which is very convenient to use. According to Statista, Windows’ global market share (data for desktop PCs) has been declining for years but is still over 70%. I’d venture to say that almost all businesses in America are built on Microsoft-developed applications (Excel, Word, PowerPoint, etc.), which gives the company some advantage in marketing Azure. When a potential customer (a company that needs cloud solutions) is thinking about which service to choose, I think the price will play less of an important role here than awareness of the synchronization of different services within an ecosystem that no one but Microsoft has offered so far.

In my opinion, this primarily explains the growth of Azure users in recent times. As the CEO noted during the earnings call, MSFT has 53,000 Azure AI customers, and over 1/3 of them came over the past year (FYI, Azure was launched in 2010). So once the use of AI in business processes has become a pressing need, regardless of the industry in which the potential customer’s company is represented, it is easier and clearer for that potential customer to trust Microsoft, knowing that there should be fewer problems with synchronizing different applications.

We now know that Microsoft’s strategic partnership with OpenAI, fueled by a $1 billion investment back in 2019, aimed to integrate AI technologies like ChatGPT across its product portfolio. I particularly like how MSFT’s Copilot has developed so far. According to the initial projections by Morgan Stanley (proprietary source), Microsoft 365 Copilot could offer a revenue potential of $10 billion by FY2025, assuming a 100% increase in average revenue per user (ARPU) for Office 365 and a 20% penetration rate among the installed base.

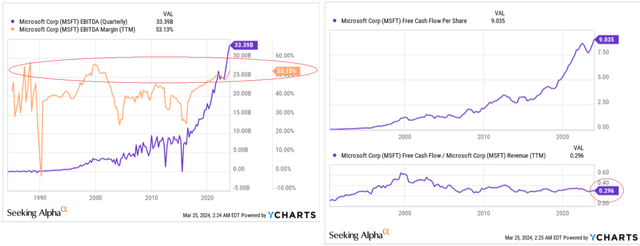

I see a multitude of opportunities for Microsoft’s business development in the coming years, thanks to smart investments in AI and cloud infrastructure. At the same time, the company’s financial position today is breaking all records: the EBITDA margin has reached its highest level ever and the FCF margin is close to 30%, which in my opinion is a lot for a company with a market capitalization of almost $3.2 trillion.

But perhaps the latest news from China could cloud the overall picture for Microsoft? Let’s figure it out.

China Seeks To Cut Usage Of Microsoft’s Windows

On March 24, 2024, the Seeking Alpha News Team reported that China wants to ban the use of Intel and AMD chips in government computers. At the same time, Chinese authorities are looking for ways to cut the usage of MSFT’s operating system (and foreign-made database software) to minimize their dependence on Western technologies.

MSFT stock did not react to this news and I believe that market participants have drawn the right conclusions.

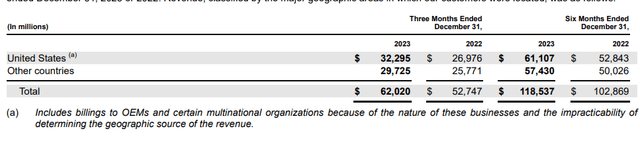

According to Argus Research (proprietary source), Microsoft generated more than 50% of revenue outside the U.S. According to the latest 10-Q report, the non-US revenue share was 48.4% in the last six months, but the report doesn’t indicate what share China holds exactly:

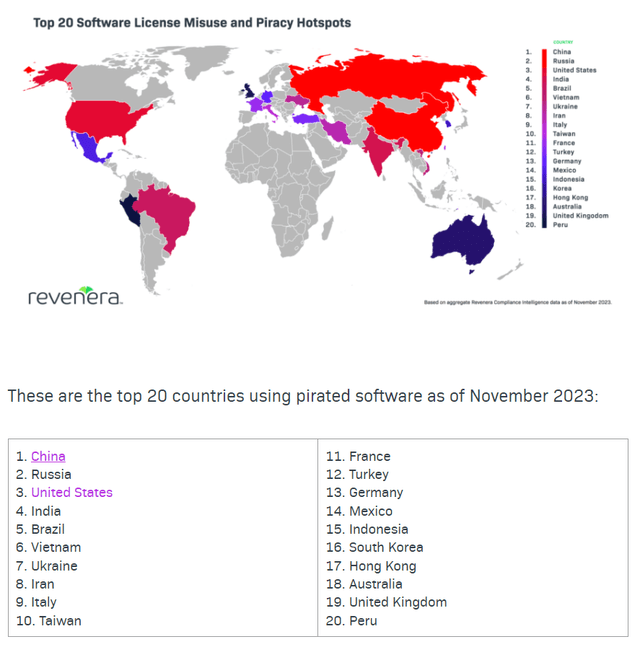

However, according to Investing.com, China represented less than 2% of Microsoft’s revenue in FY2022. So the question arises: How has such a large and global company like MSFT managed without China all this time? For comparison, Apple (AAPL) made 20% of its sales in this region last year. I can only guess, but one of the indirect indicators is the huge number of pirated software subscriptions – China has been the ultimate leader in this regard for more than a year.

So China doesn’t really bring any tangible benefits to MSFT, and therefore I don’t think a ban from the CCP will be a strong headwind for the company.

So far, all my musings have been about the good things associated with MSFT’s prospects. But I share my opinion on the company’s potential rapid growth in cloud and AI regardless of the stock’s valuation today, and that’s not entirely correct. Therefore, there is no way to avoid a valuation update.

Microsoft Stock Valuation Update

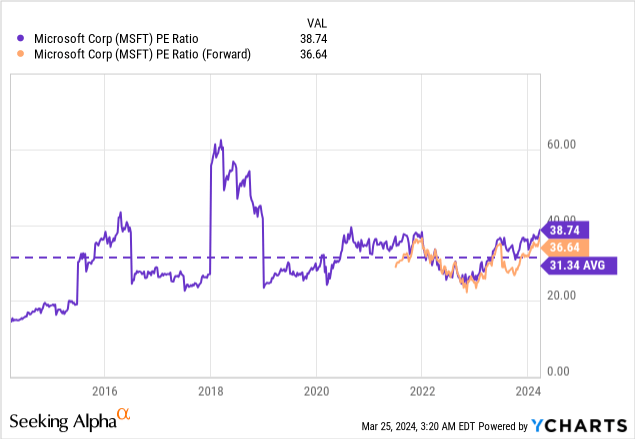

Over the past six months, Microsoft’s stock has risen about 35%, and during that time, Seeking Alpha’s Quant system’s Valuation grade has lit up with a bright red “F” signal without anything changing. In other words, the aforementioned financial improvements – record EBITDA, faster revenue and earnings growth, etc. – haven’t caused MSFT to “grow out” of its lofty valuation. All because buyers have been exceptionally strong and defended the existing valuation premium.

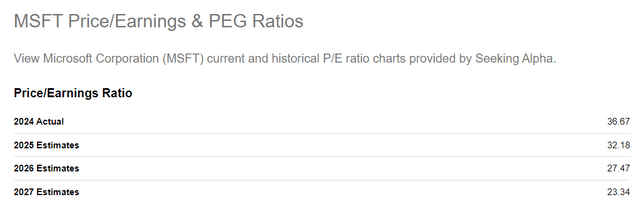

However, market expectations suggest that Microsoft’s EPS will grow at a CAGR of almost 12% so that the P/E ratio for FY2027 will be 36% lower in 4 years compared to the forecast for FY2024:

Looking at historical norms, I don’t think 23.3x will be reached in FY2027: MSFT has risen many times over the last 10 years, and the average P/E ratio over that period is now ~31.3x – a level at which we can expect MSFT to eventually reach as the hype around AI begins to die down at some point.

Assuming such a “valuation multiple mean reversion” (to 31.3x by the end of FY2027) and an FY2027 EPS consensus of $18.37, the stock price has the opportunity to rise to $575 by the end of the fourth forecast year. This means the annualized return is around 7.6%, which is quite good, but does not offer a significant advantage compared to the same bond market as an alternative investment market today.

Now, I propose to validate that upside by using the discounted cash flow model (DCF).

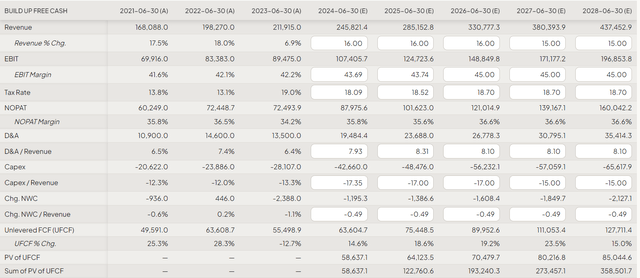

As you recall, the market consensus is that Microsoft’s revenue will grow at a CAGR of ~12% over the next 4 years. I, on the other hand, expect a CAGR of 15% for the next 5 years and thus give a slightly more optimistic forecast (i.e. I have an out-of-consensus view on MSFT’s prospects here).

I also expect the company’s EBIT margin to gradually increase and reach 45% by FY2026 and remain in this range until FY2028. The current effective tax rate of ~18% will remain relatively stable, as will the D&A to sales ratio.

I estimate that CAPEX as a percentage of sales will reach 17% in FY2025 and FY2026 and decrease to 15% in the last two forecast years. The change in net working capital (NWC) as a percentage of sales is left unchanged (the average level of the last 3 years).

FinChat, MSFT’s model, the author’s inputs

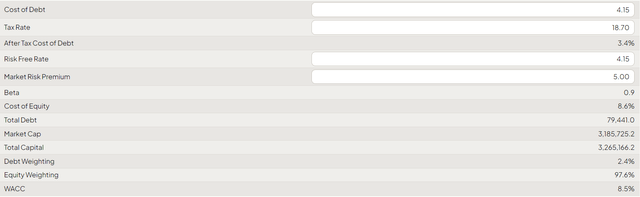

I assume that Microsoft, as the largest company in the world, has a cost of debt of 4.15%, which means that there is no spread between government bonds (so the risk-free interest rate is estimated at 4.15%). In addition, the market risk premium (MRP) stands at 5%. Consequently, the company’s weighted average cost of capital (OTC:WACC) equals 8.5%.

FinChat, MSFT’s model, the author’s inputs

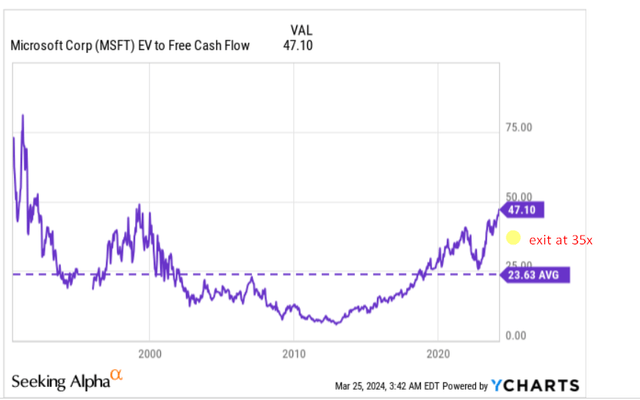

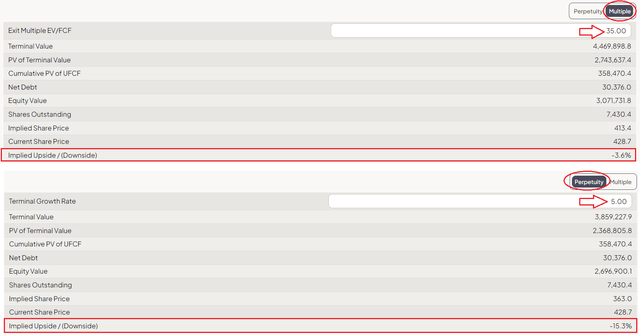

Microsoft’s current EV/FCF ratio is ~47x, almost double the multi-year average. I expect the exit multiple to be 35x, which is still above average, but lower than the current figure.

To check the consistency of my terminal value calculation, I use Gordon’s growth model, assuming a “perpetual growth rate” of the company’s FCF of 5%. So what do I have as an output of the model?

Microsoft stock turned out to be overvalued by ~9.5% based on the fundamental assumptions incorporated into my DCF model:

FinChat, MSFT’s model, the author’s inputs

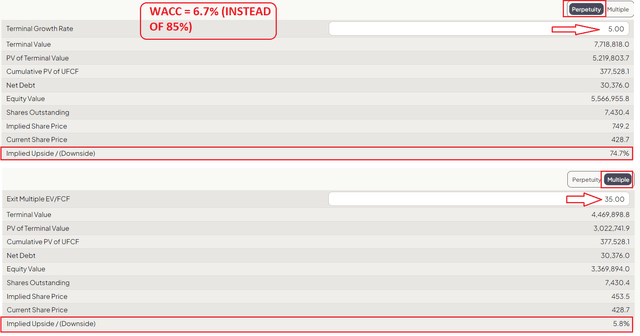

However, it’s important to note that my model is highly sensitive to changes in the discount rate – WACC. If we hypothetically assume that the market risk premium decreases from 5% to, say, 3%, Microsoft would be undervalued by an average of 40.2% relative to its current market cap, suggesting significant growth potential ahead.

FinChat, MSFT’s model, the author’s inputs

I think the above scenario presents one of the most bullish views. In the base scenario, I still believe that Microsoft is currently slightly overvalued.

The Bottom Line

To sum up, I’m impressed by Microsoft’s ability to sustain its growth despite its size (measured by market cap and sales volume). The company continues to expand its user base and explore new avenues of monetization, such as AI, cloud technology, and gaming. While the risk of potential trouble in China seems meaningless to me today, the main concern for investors should be the current valuation of the stock.

While buying Microsoft today can offer solid long-term returns, the current growth potential appears somewhat limited according to my calculations, even on optimistic assumptions. Therefore, I’d consider buying the stock at prices 10-15% or even 20% below current levels to provide some margin of safety.

However, it’s uncertain if and when such a correction will occur. So for those who already hold Microsoft stock, I recommend holding on to it but not increasing the overall allocation. Given the company’s strong fundamentals and growth prospects, selling doesn’t seem logical.

I reiterate my previous “Hold” rating.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!