Summary:

- BOX appears to have seen a turnaround in revenue growth, with calculated billings and remaining performance obligations showing acceleration.

- The rollout of Box AI and a focus on channel partnerships are expected to drive further growth acceleration.

- The growth targets set by management are achievable within the next 5 years.

your_photo

Summary

Following my coverage of Box, Inc. (NYSE:BOX) in October 2023, for which I recommended a hold rating as the upside potential was not attractive, this post is to provide an update on my thoughts on the business and stock. Performance wise, the stock was pretty much flattish since my update, but has surged since the 4Q24 results. Post the 4Q24 performance, I have turned bullish on the stock as leading growth operating metrics point to a turn around in growth pace, and two key developments in the business further support the notion of growth acceleration in the coming years. This gives me confidence that BOX will be able to achieve its growth targets within the next 5 years.

Investment thesis

Recent 4Q24 performance (5 March 2024) came in line with consensus expectations, where revenue grew 4% y/y on a constant currency [CC] basis; pro forma [PF] gross margin of ~78% came in modestly ahead of consensus; and the combination of these two led to a PF operating margin of 26.7%, which was 100bps ahead of consensus. Cash flow metrics were also a highlight, as adjusted free cash flow came in at $82 million (31% margin).

My key takeaway from the recent performance is that BOX might be turning the corner in revenue growth as certain operating metrics are pointing to growth acceleration in FY25. For instance, calculated billings grew 10% y/y CC, marking an acceleration vs. the 2% decline saw in 3Q24. Although this was partially helped by easy comps in 4Q24 and some renewal benefits, it is still safely ahead of the implied guidance of 5.5%–8% y/y CC growth set out by management. Even if we assume 200 bps of benefit, it is still at the high end of the guide, which points to very positive demand ahead (i.e., growth is still ahead of revenue growth). Additionally, remaining performance obligations [RPO] growth also accelerated by 100bps on a CC basis to 9% vs. 3Q24, which speaks very well of the underlying demand health.

Layering on top of the positive turn in operation metrics, two other developments in the business also support the narrative of growth acceleration ahead. Firstly, it is the rollout of Box AI and the upcoming advancement, which I expect to accelerate adoption for Enterprise Plus. So far, Box AI has shown its impact in driving increased adoption for Enterprise Plus, which is evident in the quarter as suites attached to 81% of over $100K deals, up from 79% last quarter and 72% a year ago. As BOX integrates new AI models, expands its AI capabilities for enterprise customization, and uses Box Hubs to enable multi-document analysis, it should naturally accelerate adoption. Additionally, management is targeting FedRAMP compliance, enhanced integration with external security vendors, and better security and governance offerings related to Box AI, all of which I believe are important attributes that large enterprises will pay attention to given the growing importance of cybersecurity.

We also announced that Box AI is generally available to customers on Enterprise Plus plans starting today. Since rolling out Box AI in beta to Enterprise Plus customers in November, we have seen a number of existing customers upgrade to Enterprise Plus to gain access to Box AI. 4Q24 earnings results call

Secondly, in FY25, BOX is strengthening its partnerships with system integrators [SI] and independent software vendors [ISV] to facilitate the development of industry-specific solutions and drive new logo acquisitions. Given that BOX current sales strategy is a direct sales approach, the change to a channel partner strategy should greatly widen the number of prospects and the speed of closing deals. With a renewed focus on SIs and ISV partners, I expect BOX to see an acceleration in new logo growth.

Hence, all in all, I think there is a pretty good chance for BOX to meet long-term targets, which management reiterates as revenue growth of 10-15% over the next 3–5 years.

Valuation

The upside potential is now a lot more attractive than in my last update. In my previous model, I did not have confidence in the long-term grow aspect of the business, hence, I only forecasted FY25 figures which gave me a price target of $25.5.

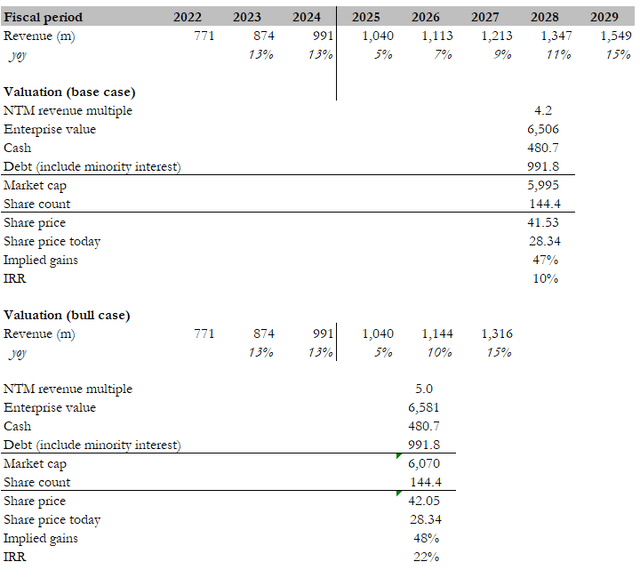

In my current model, because of the updates seen in the latest results, my target price for BOX is ~$41 in FY28 in the base case (9% IRR) and $42 in FY26 in the bull case (22% IRR). In my base case, I assumed BOX would reach the top end of its growth target within 5 years (FY28), scaling up linearly from the 5% FY25 growth guide. To be specific, I expect revenue to grow 5/7/9/11/15% in FY25/26/27/28/29. Taking a more conservative stance on multiples in this scenario, I assumed no change in multiples (ie BOX to trade at 4.2x forward revenue). The reason for assuming no change in multiple in the base case is that BOX is merely returning to its historical mid-teens growth profile, and when it was generating this type of growth previously, the stock traded at 4.2x forward revenue. In my bull case, I modeled growth to hit the 15% target within 3 years and assumed a higher multiple of 5x (a recent high) because this suggests very strong momentum in the business, and there is a good chance it might cross the mid-teens growth threshold, potentially accelerating to high-teens growth rates. While both scenarios have a similar price target, because of the investment duration, the IRR is very different.

Risk

Revenue might not improve as linearly as I expected in the base case because any transition in go-to-market strategies typically involves some form of disruption (key risk I note from the latest quarterly result). It might take longer than expected for SI and ISV to become familiar with BOX’s products before they can form the right sales pitch and gather the right set of customers, which might lead to slower than expected new logo growth in the near term. Any signs of growth slowdown or slower-than-expected growth acceleration could spark a negative narrative about BOX’s growth story.

Conclusion

In conclusion, I am upgrading BOX to a buy rating due to positive growth outlook. Recent performance suggests a turnaround in revenue growth, supported by accelerating calculated billings and RPO. Additionally, the rollout of Box AI and a focus on channel partnerships position BOX for further growth acceleration. Hence, I believe the growth targets set out by management is achievable within the next 5 years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.