Summary:

- Netflix’s strategy to reduce password sharing through AI presents an intriguing investment opportunity.

- The implementation of transfer profile programs and tighter regulations has fueled Netflix’s recent success, with a record increase in subscribers and revenue.

- The use of AI technology to crack down on password sharing has been successful, and Netflix has found new avenues for growth, including an ad-supported plan.

Michael M. Santiago/Getty Images News

Investment Thesis

I believe Netflix, Inc.’s (NASDAQ:NFLX) strategy to reduce password sharing, through their adoption of AI, presents the streaming giant as an intriguing investment opportunity (even though this password crackdown has been widely known).

With the introduction of transfer profile programs and tighter regulations, users have been forced to either add an extra member to their profile for an additional fee or kick people off. These tight regulations helped fuel Netflix’s recent success. This success was shown shortly after they implemented these programs, as they gained a record 13.1 million subscribers in Q4 2023 alone.

So far, the results of these methods have shown to be successful. Net income grew to $938 million in Q4 2023, up from a whopping $55 million the year before. Revenue also jumped, up 12.5% to $8.8 billion. Adding to these revenue increases was the introduction of their ad-supported plan, which appeals to their more price-sensitive consumers. This plan allows Netflix to provide, in essence, a subsidized plan to users who were previously using someone else’s password.

Given the strong jump in revenue and net income that resulted from the password crackdown, I think the company has found a new avenue for growth and I think there is more room to run. It is evident that Netflix is able to consistently grow their subscriber base and revenue stream. I think the stock is a strong buy.

Background

In 2023, Netflix began their password crackdown through trials of their transfer profile program which allowed extra users to set up a new profile, while still keeping all of their account data such as watch history. These trials were first implemented in Latin American markets, and then expanded to the following areas in early 2023: Canada, New Zealand, Portugal, and Spain. In May 2023, Netflix implemented a rule in the US that if users wanted to add another member to their current Netflix account they would have to pay an additional $7.99 a month or remove the person.

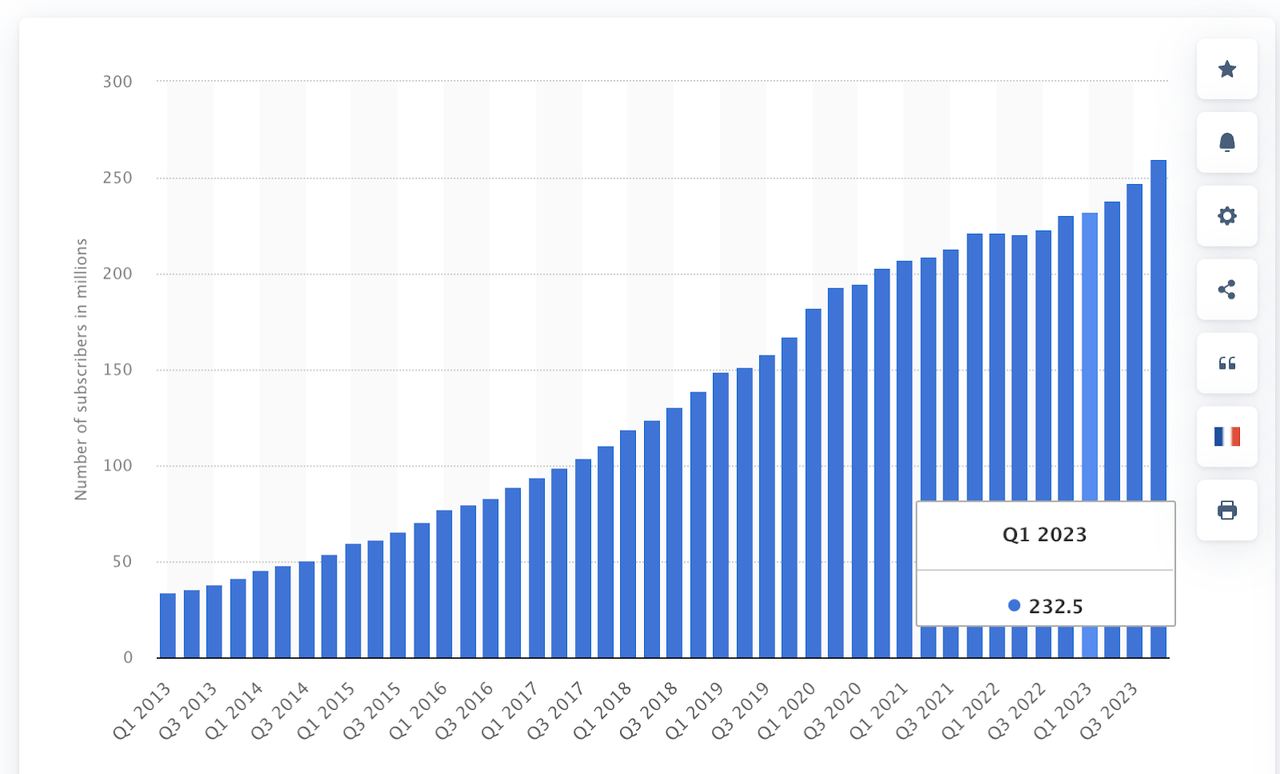

By introducing these stricter controls and alternative subscription options, Netflix added 5.9 million new subscribers in the second quarter of 2023 alone. In the past Netflix has estimated that over 100 million potential subscribers worldwide have access to Netflix through password sharing. Considering these numbers, a large portion of users still participate in password sharing, meaning that as Netflix implements stronger guidelines, they will be able to transition these password sharers into subscribers. As shown in the Statista graph below, subscriber growth clearly reaccelerated after the password sharing ban began in Q2 (Q1 data highlighted to show the starting base case). The company now has over 260 million subscribers globally.

Netflix Subscriber Count Quarterly (Statista)

On top of additional revenue streams from cracking down on password sharing, Netflix has begun to acknowledge the variety of preferences possessed by their users (especially the ones that got their content for free before by sharing a password). By introducing a more affordable ad-supported plan, they greatly increased their appeal to their more budget-conscious consumers. This new ad-supported plan (implemented before the password sharing ban began but has since become a go-to beginner subscription) has attracted over 23 million subscribers so far. The cost of this plan is $6.99/month in the US.

How AI is helping Netflix Crackdown

To pull off the password crackdown, Netflix has implemented a sophisticated AI-driven approach to address the issue of password sharing. One example of this technology in the industry is Synamedia’s Credentials Sharing and Fraud Insight. The white paper provided gives a great insight into how streaming giants (like Netflix) are able to keep password sharing at bay.

In essence, this system detects and distinguishes between casual and fraudulent sharing by analyzing user behavior, IP addresses, and device IDs. This system ensures that users connect to Wi-Fi at their primary location and watch content at least once every 31 days to validate their account usage. For users on vacation, Netflix allows for a temporary verification code, active for seven days, to access their accounts from different locations.

Q4 Recap

Diving deeper, the numbers in Netflix’s Q4 2023 earnings call demonstrated their increased performance. As I mentioned before, Netflix reported an addition of 13.1 million subscribers in their fourth quarter, causing an 11% jump in stock price the day after. When looking at engaged global active users, the company reported at CES that this user group has grown to 23 million, a significant increase from where they sat in November of 2023 at 15 million. For 2024, Netflix is expecting FX-neutral revenue growth to hit a double-digit percent increase year over year (Q4 Earnings Call).

Zooming out to the whole year, 2023 saw a total increase of almost 30 million subscribers, significantly higher than 2022, which witnessed an increase of only 8.9 million subscribers. As I showed in the graph before from Statista, much of this jump occurred after the password crackdown began.

As of right now, the basic subscription for Netflix costs users $11.99 a month, which increased by $2 from $9.99 in November of 2023. During the Q4 earnings call, co-CEO Greg Peters mentioned that increases in subscription costs have been put on hold due to the implementation of the paid sharing program.

Even with this price hike pause, quarterly year-over-year revenue is still growing at a healthy rate of about 12.5%, reaching 8.83 billion in Q4. This can likely accelerate once they resume the subscription price increases.

While analysts had concerns on the call about the amount of money Netflix is spending in order to keep current subscribers happy (currently it is $17 billion annually and the recent acquisition of WWE rights could impact this spending plan) management was quick to quell these concerns. Management noted on the call that WWE streaming rights fit within the $17 billion budget.

Furthermore, management noted that these new rights help bring a greater value proposition to Netflix subscribers by getting into the “sports storytelling” side of content. This continues to fit well with their “general licensing deals and with economics that [they’re] super happy with globally” (Q4 Earnings Call).

Size of the Opportunity

I mentioned before that it’s estimated that 100 million people globally share a Netflix password with someone. In May of 2023, Netflix alerted their consumers that they would start cracking down on password sharing, resulting in nearly 100,000 new users signing up daily on May 26th and 27th. Over the next 60-day period, on average 73k users joined every day, a 102% increase from the previous 60-day period. Of course not everyone was supportive of this policy, leading some users to cancel their subscriptions. Luckily for Netflix, since the announcement in May of 2023, their ratio of sign-ups to cancellations increased by +25.6% compared to the prior 60-day period.

Like I mentioned before, Netflix in 2022 introduced a cheaper version of their subscription, one with advertisements. One notable aspect of this growth is that a majority of these users were not downgrading from a normal plan. A report conducted by Samba TV concluded that 21% of millennials with a subscription to Netflix signed up for the advertisement version, and 68% of this group subscribed post-release of the cheaper-ad included version.

In all, Netflix has added 28 million subscribers since the end of Q1 2023. While not all of these signups are from people who shared passwords before, if the estimate of 100 million Netflix password sharing users is true, this means the company could still capture up to an additional 72 million new paying subscribers.

Valuation & Why I Don’t Think This Is Priced In

Despite seeing record new subscribers in Q4 and revenue growth of 6.67% last year that beat the sector median of 2.34% revenue growth by 184.34%, and forward revenue growth of 10.83% that beats the sector median forward estimates of 2.76% by a margin of 291.93% the company’s PEG ratio comes in at 1.22, below the sector median of 1.40.

While the company has been able to see accelerating growth due to their password crackdown, the PEG ratio implied from the company’s current valuation suggests analysts and investors are not expecting the company to have stronger than industry growth prospects forward (I think this is false).

Keep in mind that a higher PEG ratio typically means that investors are pricing in higher growth. The opposite is true here, even though median forward estimates for revenue growth are higher than sector median revenue growth.

If the company can see its forward PEG ratio converge on the sector median (which on its own may be a low benchmark because, again, Netflix has well above sector median growth) we could see the stock appreciate another 14.75%. This is on top of the 25.59% growth we have seen so far this year. In essence, I believe there is more room to run.

Risks

Netflix’s crackdown on password sharing may lead some of their current consumers to seek alternatives, such as switching to other streaming services instead of purchasing a new Netflix account. Despite an initial spike in sign-ups following the announcement of the crackdown-with nearly 100,000 daily sign-ups reported immediately after -the long-term implications on subscriber loyalty and growth remain uncertain. For example, many of these new users (23% according to one source given to Reuters) have since opted for a cheaper ad-supported subscription model now that the password crackdown has started. Given users’ acceptance of ad-based streaming services, this does raise some concerns that Tubi, which is claimed to be the “free Netflix”, as they offer a free ad-supported model could be real competition.

Tubi’s library holds over 50,000 titles, which is much larger than Netflix’s offering of 10,000. Considering Tubi’s larger content base and their option for free, ad-supported access, they will be a challenging competitor for Netflix to outperform.

While there are concerns about users switching platforms, I think this is unlikely to cause major issues considering Netflix’s collection of over 1,500 originals; titles unavailable elsewhere and titles that users love. High-profile original content like “Squid Games,” which streamed for 1.65 billion hours by 111 million accounts, is an example of one of these originals, and shows how powerful and captivating Netflix’s content is.

Bottom Line

Netflix addressing password sharing raised many concerns on whether they would lose their customer base, but since implementation, it has shown to be very successful, and a trend I think that can still continue. With the use of artificial intelligence, Netflix is able to get better and better at regulating account sharing. On top of this, Netflix has broadened their revenue streams with the introduction of an ad-supported subscription tier to help ease previously password sharing users into their own, paid accounts. Despite potential risks stemming from consumers switching to competitors, Netflix has still produced promising results. Given their favorable PEG ratio and what I believe is further room to grow, the company establishes itself as a solid investment opportunity, demonstrating a promising outlook for 2024 and beyond. I think the stock is a strong buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the Managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.