Summary:

- Netflix has a deep moat with a massive $260Mn subscriber base, which is its biggest asset.

- The saturation in the streaming market has allowed it to become the de-facto gatekeeper to our homes.

- Netflix has great and increasing operating margins, which throws out gobs of cash, creates even more content and perpetuates the virtuous cycle.

- The improving operating margins make it a very attractive earnings story in addition to the market leadership in subscribers.

- There are further growth catalysts from gaming and advertising, which should propel it to even greater heights.

Rutmer Visser/iStock via Getty Images

I’ve owned Netflix, Inc. (NASDAQ:NFLX) for a long time, mainly focusing on subscriber and revenue growth. However, the most recent quarter was a great one, where Netflix hit it out of the park with 13Mn subscriber growth and ended the year with 21% operating margins, convincing me that Netflix has become more of an earnings story, and I should buy more and recommend it on earnings strength as well, instead of just global subscriber additions.

I scrambled to buy it post earnings in January, and I still believe there are a lot of gains left in the stock — this is a new blockbuster and features a Goliath Netflix, the King of the Jungle, ready to expand its domain.

Let’s look at the main reasons to invest in Netflix.

Netflix has become the gatekeeper amidst weaker competitors

The moat

For a long time, the common refrain was that the US streaming market was over-penetrated, with 99% of households having at least one service and with 260Mn worldwide and 80.1 Mn US and Canada subscribers, how many more homes could Netflix could get into? And while I worried about it, it struck me that perhaps the over-penetration is the real moat and that because Netflix was already in every home it was the de-facto gatekeeper, and it wasn’t going to let you in without getting compensated. This theme was accentuated further in Q4-2023 with lesser players such as Warner Bros. Discovery, Inc. (WBD) adding only 1.8Mn net new subscribers, Paramount Global (PARA) adding 4.1Mn and NBC’s Peacock only 3Mn, their total of 8Mn subscriber additions was way below Netflix’s 13Mn new additions. Disney actually lost 1.3Mn subscribers due to price hikes in Q4-23.

If you can’t beat ’em, join ’em

The show “Suits'” success in its re-run at Netflix is the best example of how it’s becoming easier and cheaper for competitors to get more money out of its libraries, to reach viewers through Netflix, instead of building a distribution channel and acquiring viewers for exclusive viewing of its content. The economics works better with licensing, instead of going head-to-head with Netflix. If you can’t beat ’em, join ’em. Here are more examples of how its competitors have kept Netflix going with shows like Comcast’s “The Super Mario Bros Movie” and Warner Brothers’ “Breaking Bad”, and “Young Sheldon”, or movies like “Dune” and “The Batman”. Add Paramount’s Yellowstone and The Walt Disney Company (DIS) owned shows, like “Lost” and “Grey’s Anatomy.”

Further, because of Netflix’s massive reach of 260Mn subscribers, $17Bn programming spend, and its excellent cash flow generation of $7.2Bn, which feeds the same spend, many competitors have to scramble to consolidate to make the most of their legacy content. Paramount with Warner Brothers for example, or Disney completely taking over Hulu. But even if they do so it’s still beset with the scattershot approach of explaining to the subscriber what they can access from which plan. Besides, all the legacy players have other priorities, other businesses and loads of debt, which don’t allow them to focus on pure content creation.

On paper, a consolidation shows a large number of subscribers with a large number of titles, but they’re struggling to add more subscribers to a saturated market. I believe that ship has sailed, and besides Netflix, Amazon.com, Inc. (AMZN) and Disney, I believe other streamers will be also rans stretching the household budget. It would make sense for them to focus on content instead of distribution, which is their historic strength – especially for the likes of HBO and Max in my opinion.

The virtuous cycle and network effect – a barrier to entry

The virtuous circle

One of the key competitive advantages that Netflix enjoys is the scale of its large member base of $260Mn subscribers, which works in leveraging content creation so that it can be used for more than one audience with similar demographics across different countries and languages – the kind that would be almost impossible for the likes of the studios and linear programmers to catch up with. This adds a ton of leverage to operating margins – content is amortized on an annual basis, and it’s not a cost of sales each time someone watches a show produced by Netflix, Since Netflix spends more on content than other streaming peers it has more popular hits, drawing even more subscribers – thus creating the virtuous cycle.

Except for Amazon Prime, Disney, and YouTube, this kind of audience scale is out of reach for the others, and a barrier to entry for aspiring competitors a) Who can’t spare the cash b) And are hamstrung by other objectives or c) lack the focus to customize or scale programming

Scale

Netflix’s CFO at an investors conference, spoke about content creation suggesting that both the top-down and bottom-up approach worked if it achieved scale, for a top-down approach they would identify market gaps for content and for a bottoms-up approach if genre popularity was the reason they would see if the same genre could be used in other markets as well.

Which is also useful to understand because when their fastest growing APAC market, which added 19% more subscribers YoY to 45Mn, struggles with pricing, it is the sheer scale that allows them to get decent operating margins by lower entry-level pricing to get subscriptions. The ARM (Average Revenue Per Month) actually fell in the APAC region from $7.69 to $7.31, losing about 4% in constant currency. This is a big competitive advantage.

The pure-play

Netflix took advantage of not having legacy assets that were losing value in dusty studio shelves, nor was it burdened with expensive sports contracts or a subscriber base that was dependent on retaining sports rights. Instead, they pioneered how a society consumed video entertainment at home, a pure play that allowed it to put its full effort behind its core streaming offering, astonishingly using cash judiciously. And now having built this virtuous cycle it is perhaps the only player in the industry that can do it at scale and increase margins. I don’t believe any legacy or linear competitor can come even close to it. The closest competitor Amazon’s base is about 200Mn subscribers – they are still 23% behind and Disney is a distant third at 150Mn. This virtuous cycle should earn excess economic returns for the foreseeable future.

Barriers to entry

Because customer budgets are finite and limited, I don’t believe there will be more room than the current average of 2.9 subscriptions and a cost of $46 per month, and Netflix, Amazon with its Prime bundle and Disney with its legacy assets, worldwide cultural icons, and affiliates like Hotstar in India seem to have taken it.

Threats from existing content have not made a dent abroad and except for Disney’s assets, which are bolstered by the name recognition of some of its theme characters, it’s unlikely that legacy content will make inroads in international markets, at least it would be very difficult at scale. It takes a continuing stream of cash for a provider to have the best odds of having attractive/fresh with crossover and international appeal content at any given time, and after seeing the lack of margins I don’t see it happening. Netflix overcame its cash burn – not just for content creation but also for platform and marketing expenses, now having overcome it has become a huge moat.

The Suits rerun is one of the best examples of the virtuous circle. I suspect if you ask viewers who made Suits, 2 to 1 they would say Netflix instead of the USA network. Suits became a bigger bit in 2023 in its rerun avatar at Netflix after being aired a decade earlier on the USA network. Another example is the massive success enjoyed by “The Office” on Netflix when it went from “Popular” to “Phenomenon.”

Then there are the sports documentaries like the Formula1 series that’s finding a second life on Netflix because of its large user base. The chances of Netflix having an extended dry run look very low.

Netflix is using the same strategy for streaming WWE Raw from 2025. This is a smart move and so much better than making the mistake of overpaying for and offering expensive live sports programming – while WWE has a smaller, niche base, it has intense loyalty and stickiness, and it’s at an affordable price. In the earnings interview, Netflix Co-CEO Ted Sarandos clarified, that they should not look at this as a signal to any other change, or a change to their sports strategy, categorizing WWE as “sports entertainment” rather than traditional sports.

Weaknesses and threats

Competition

For the better part of their existence, Netflix faced threats from studios, networks, and broadcast businesses with all the content in the world, and yet after all the mergers, consolidations, and the largest libraries they are still growing subscribers slower than Netflix, nor producing relevant content to audiences in Asia and Europe or Latin America. While these are genuine threats and not going to fold up and go away, they floundered because they never had a pure play strategy like Netflix.

The remaining streaming threats are exclusivity from the likes of HBO, which can charge for quality programming, and it has an array of exclusive content, which can slow growth and force Netflix to contain pricing.

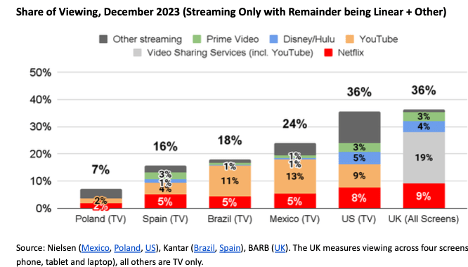

I believe that besides traditional threats, the real competition is for eyeballs and there’s a very large market of total viewers of which Netflix has very small percentages and has to fight for eyeballs with the likes of YouTube. Even in its largest market, the US, Netflix has 8% to YouTube’s 9% as seen below and in Brazil, it’s 5% to 11%. YouTube’s parent Alphabet Inc. (GOOG) (GOOGL) has a lot more resources and is not shy about spending them. Besides, there is competition from Social Media giants like Instagram and TikTok, who also have deep pockets.

Netflix share of viewing (Netflix)

Churn and cancellations

Based on a Wall Street Journal article, customer churn rose to 6.3% in November 2023, from 5.1% a year earlier, though Netflix has the lowest churn rate among the major streamers. Additionally, in the past two years, 25% percent of US subscribers cancelled at least 3 subscriptions, an increase from 15% in the pandemic era. This confirms that US households are penetrated and if the churn is higher among its smaller competitors, it will help Netflix more than hurting it.

Key Risks

Valuation Risk

Netflix has jumped from $492 pre-January earnings to $600, a gain of 22% in less than two months, and more than double its 52 weeks of $285. While I strongly believe in its future, there is a possibility of the stock going sideways for a while.

Constant need to create content

Netflix’s strengths lie in generating content, and while it has done so admirably, it cannot survive or thrive unless it constantly creates the right content and even though it has a lower rate of churn than its competitors it is a very fine needle to thread, especially without overpaying. Since the majority of subscriber growth is abroad in the APAC region, Netflix faces significant challenges in countries like India, where there is a thriving film and television industry in several languages catering to targeted audiences. Disney/Hotstar is the clear leader with over 40Mn subscribers, and Amazon Prime has 20Mn compared to Netflix’s 6.5Mn. More importantly Netflix, lags in creating local content with only 12% of its titles in domestic languages, compared to 60% for Prime Video.

Pricing

Pricing has been sluggish in its growth markets in the APAC region, with a 4% drop YoY in ARM (Average Revenue Per Month) to $7.31, so while Netflix added 19% more subscribers it came at a cost and given the competition from local programming, I don’t believe this should improve in a hurry. Further, ARM in the APAC region at $7.31 is less than 50% of UCAN (US and Canada) ARM of $16.64.

Decrease in tailwinds from enforcing sharing rules

In the past year, Netflix forced customers to pay up for sharing passwords, and it did show up in higher revenues in 2023, which likely not going to continue going forward.

Valuation and investment case

Emphasis on profitability

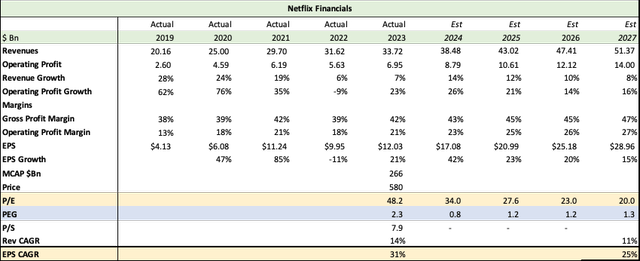

Netflix Financials (Netflix, Seeking Alpha, Wall Street Journal, Fountainhead)

A huge factor in my investment thesis is the improvement in margins, superior operating profit and cash generation, which allows them to perpetuate the virtuous cycle of content creation and increasing the subscriber base. From the table above, as revenues grew from the high 24% and 19% in the pandemic years to single digits of 6% and 7% in 2022 and 2023, operating profits grew much faster at 76% and 35% respectively during the pandemic, decelerating 9% in 2022 before re-surging by 23% in 2023. All throughout, margins stayed strong, ending 2023 with 21%. Netflix manages its cost of content extremely well, gross profit didn’t drop below 39% and closed 2024 at 42%. Content amortization over larger revenue brought in by more subscribers will always result in better margins and Netflix has pretty much mastered that. I compared their margins with some of their competitors from an article by Seeking Alpha contributor Juxtaposed Ideas, which lists the contrasting margins below, which pale in comparison to Netflix’s operating margin of 21%.

The list includes The Walt Disney Company (DIS) with negative D2C operating margins of -12.5% in FY2023 (+6.5 points YoY), Comcast Corporation (CMCSA) with negative D2C gross margins of -186.9% through FQ3’23 (-72.7 points YoY), Warner Bros. Discovery, Inc. (WBD) at D2C adj EBITDA of 2% through FQ3’23 (+30.5 points YoY), and Paramount Global (PARA) at D2C adj OIBDA margins of -24.1% through FQ3’23 (+11.3 points YoY).

Going forward, this gets even better, as Netflix has guided to 24% operating margins in 2024 and incremental increases each year. With that, we see EPS more than doubling from $12.03 in 2023 to $28.96 in 2027, that’s a CAGR of 25%! Netflix is an earnings story! Who knew?

Revenue growth will not exceed a CAGR of 11% in my estimates for several reasons:

- The US market is mostly penetrated with an average of 2.9 subscriptions and $46 spend per household.

- There is a fair amount of churn of 6.3%.

- The highest subscriber growth is abroad but at much lower ARM’s (Average Revenue Per Month)

- International subscription rates also run into currency headwinds and competition from cheaper local providers

- Most of the tailwinds from cracking down on sharing will cease this year.

The stock is currently priced at 34x 2024 earnings with a PEG ratio of just 0.8. This steadily drops to a P/E of 20 in 2027, which is low. I believe they should get a P/E multiple of at least 35 with an earnings CAGR of 25% (which is a PEG of less than 2) for these reasons…

- The gatekeeper moat of 260Mn subscribers, which creates and perpetuates the virtuous cycle, and the barriers to entry.

- Their scale, which gets the best operating margins in the industry.

- Market leadership by far.

- International reach and growth, which besides Disney and Amazon is difficult for other competitors to emulate.

- Further growth catalysts of advertising and gaming, which have just begun. Advertising subscriptions grew 70% in the last two quarters and should continue to grow.

- Ample growth is left in the entire entertainment sector of which they have less than 5%.

I believe that Netflix has at least 50% appreciation left at 25x 2026 earnings of $25 = $880 or 51% higher than the current price of $590.

I think they have just begun, and I’m all in for this ride.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.