Summary:

- Snap has experienced a slowdown in user growth as well as advertiser interest, leading to a 30% decrease in share value.

- The company faces risks of competition from newer platforms and struggles to compete with Facebook and Instagram’s appeal.

- Snap’s investments in machine learning have resulted in high server costs, impacting gross margins and profitability.

- I’d recommend waiting for Snap to fall below $10 before buying in.

Scott Olson/Getty Images News

Amid a broad rally in tech stocks this year, one major social media company has been a notable holdout: Snap Inc. (NYSE:SNAP), the maker of the eponymous disappearing-messaging app. The Evan Spiegel-founded company has reported a slew of problems over the past several quarters, including slowing user growth, declining advertiser interest, and sharply rising infrastructure costs.

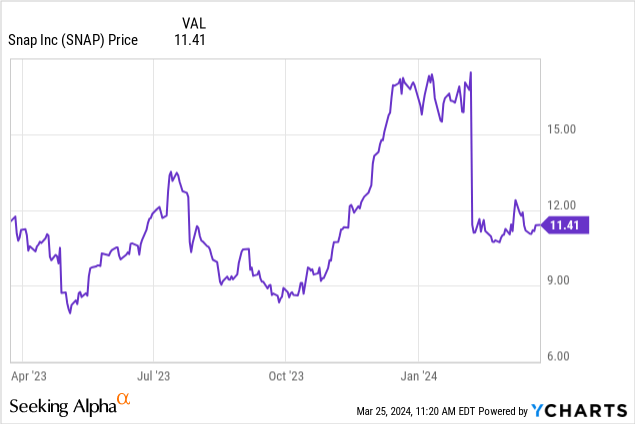

Year to date, shares of Snap have lost nearly 30% of its value, despite a 20%+ gain in most other tech names:

Not time to dive in just yet

I last wrote a bearish note on Snap in December, when the stock was trading closer to $17 per share. Since then, the company has reported dismal Q4 results that sent the stock careening. I do think there is salvage value in Snap, but we’re not quite there yet. I remain solidly bearish on this stock, at least at current levels.

Here’s a reminder as to the core risks that I’m seeing in this company:

- Slowing DAU growth, particularly in the U.S. Snap’s user base continues to grow at an anemic pace, and most of this growth is driven outside of the U.S. where advertising dollars are much softer. In the U.S., meanwhile, the user base has all but flattened.

- Social media is fad-driven. More to the point above, Snap is always at risk of a newer and more in-the-moment platform (like TikTok) taking over eyeball share and stealing users away, perhaps permanently. Snap doesn’t have the same messaging/connecting-with-old-friends appeal that Facebook and Instagram do, putting it at risk of obsolescence.

- Skyrocketing infrastructure costs. As we’ll discuss in more detail in the next section, Snap’s investments in machine learning have dramatically increased its server costs, which have taken a hit to gross margins and overall profitability.

The good news, at least: with this year’s sharp contraction in share prices, Snap is no longer that expensive; in fact, it’s approaching value territory. At current share prices near $11, Snap trades at a market cap of $18.83 billion. And after we net off the $3.54 billion of cash and $3.75 billion of convertible debt on Snap’s most recent balance sheet, the company’s resulting enterprise value is $19.04 billion.

Meanwhile, for the current fiscal year, Wall Street analysts are calling for the company to generate $5.24 billion in revenue, representing 14% y/y growth. Note that this is quite an aggressive forecast, considering Snap exited Q4 of 2023 at a 5% y/y growth rate. It essentially banks on consistent DAU growth to deliver steady impressions, while also counting on Snap’s investments in advertiser improvements to drive a recovery in advertiser demand.

Nevertheless, if we take these estimates at face value, Snap trades at 3.6x EV/FY24 revenue. I’m not a buyer here just yet, but I could be convinced off the sidelines if Snap went down to 3x revenue, implying a price target of $9.50 and ~17% downside from current levels. It’s also roughly where Snap traded as recently as mid last year, before rallying (for no good reason) at the tail end of 2023.

All in all, Snap remains a watch-and-wait story. For now, more risks than opportunities remain, especially at its ~$11 levels. Steer clear here and invest elsewhere for now.

Q4 download

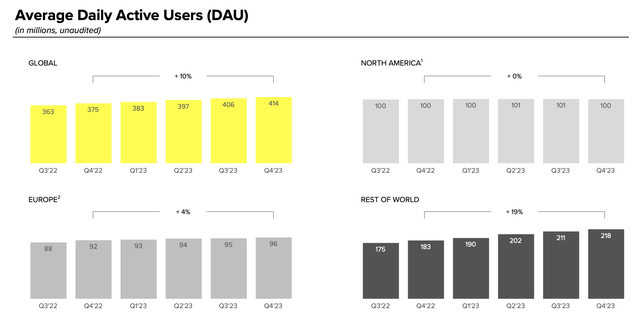

Let’s now go through Snap’s latest quarterly results in greater detail. The DAU (daily average user) trends are shown in the chart below:

Snap DAUs (Snap Q4 earnings deck)

Total DAUs grew 10% y/y and added 8 million sequential new users in the fourth quarter; and yet almost all of this growth was in the “Rest of World” segment, which grew 19% y/y. Y/Y trends in North America, meanwhile, were flat, while the company actually lost users sequentially versus Q3. It’s worth noting as well that the company is guiding to only 420 million DAUs in Q1, which implies only 6 million net new adds (versus 8 million in the prior Q1, and 8 million in Q4).

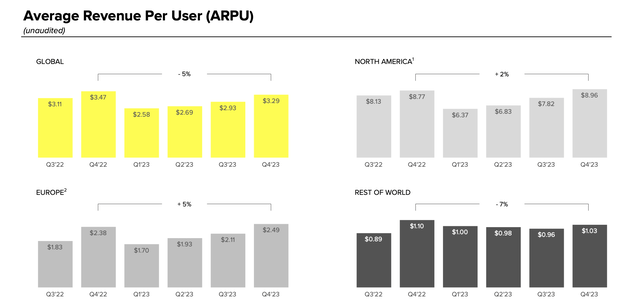

Snap faces a similar problem as many other social companies, ranging from small like Pinterest (PINS) to large like Meta (META) – the social media user base in the U.S. is just too saturated. Meanwhile, this is a risk because North America ARPU (average revenue per user) at ~$9 is roughly 9x a Rest of World user and ~3-4x a European user:

Snap ARPUs (Snap Q4 earnings deck)

Snap’s ARPU fell -5% y/y to $3.29, driven both by an unfavorable user mix shift to Rest of World, as well as a drop in Rest of World advertiser rates. Snap’s overall revenue of $1.36 billion also grew only 5% y/y and missed Wall Street’s expectations of $1.38 billion (+7% y/y) by a two-point margin, driving weakened sentiment in the stock.

The company is hyper-focused on improving the advertiser experience in order to drive better results. Writing in the Q4 shareholder letter, CEO Evan Spiegel noted as follows:

First, we are continuing to evolve our ML models to improve ROAS for our advertising partners. For example, we implemented ML ranking and optimization improvements for App, Web, and Dynamic Product Ads (DPA) optimization goals in Q4. In addition, ongoing momentum with our 7-0 Pixel Purchase optimization model led to a more than 90% increase in purchase-related conversions year- over-year. We are encouraged to see these improvements driving results for advertisers. For example, James Allen, a rapidly growing online retailer specializing in diamond and bridal jewelry, ran a successful campaign on Snapchat leveraging Snap Ads and our performance-oriented 7-0 optimization feature. The campaign exceeded the brand’s expectations, delivering an 18% reduction in CPA and improving their ROI by 67%, demonstrating efficiency and a strong return on investment. In addition, PMG, a leading independent advertising agency, tested 7-0 across six leading retailers and, when compared to baseline performance, 7-0 optimization led to more than 85% higher ROAS and 25% lower cost per site visit, on average.”

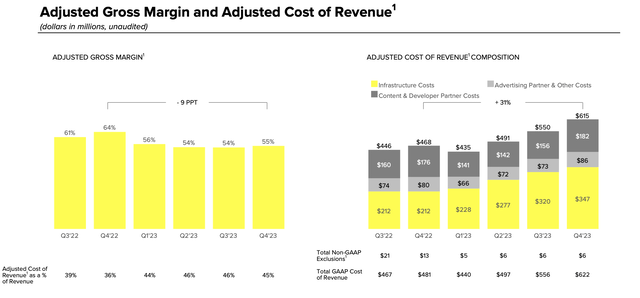

Conversely, these investments in ML to drive better advertiser performance have driven skyrocketing infrastructure costs: which, as shown in the chart below, grew 64% y/y to $347 million, or 26% of revenue:

Snap costs (Snap Q4 earnings deck)

Total cost as a percentage of revenue, meanwhile, rose 9% to 45%, driven by this sharp increase in infrastructure costs.

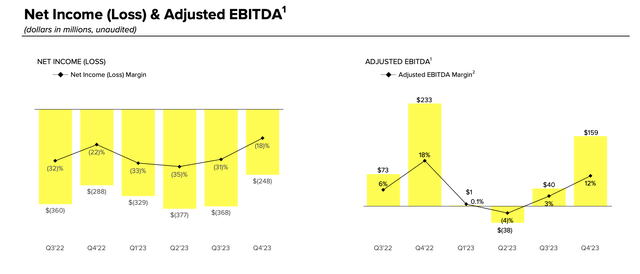

As a result, as shown in the chart below, Snap saw a -29% y/y contraction in adjusted EBITDA to $159 million, or 12% of revenue – a six-point hit to adjusted EBITDA margins.

Snap adjusted EBITDA (Snap Q4 earnings deck)

Key takeaways

With poor user growth, weaker advertising results, and decaying profitability, there’s a strong reason for Snap’s ~30% fall this year. In my view, it’s best to wait for Snap to fall below $10 before considering buying in.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.