Summary:

- Transocean’s revenue and backlog are growing, and debt is under control, but it’s too early to be bullish on the company.

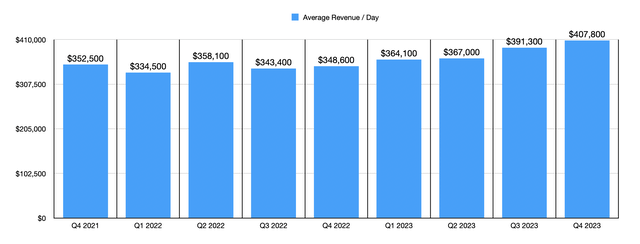

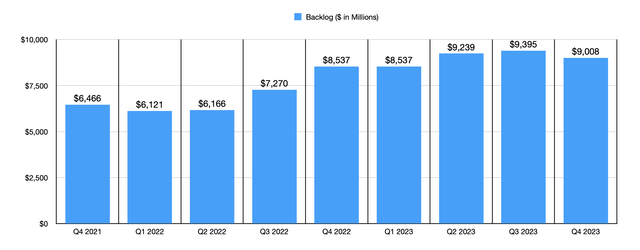

- The average daily revenue per rig has been increasing, and the backlog has seen meaningful improvements.

- Cash flows have taken a hit, and the utilization rate of the fleet is not inspiring confidence.

MarkusBeck

When it comes to the offshore drilling industry, one of the companies that investors absolutely must know about is Transocean (NYSE:RIG). With a sizable fleet at its disposal, the firm is a very large player in this industry. But unfortunately, that alone does not make it an attractive investment. Late last year, in the middle of November to be precise, I ended up writing an article on the firm that took a rather neutral stance. At the time, the overall trend for backlog and revenue for the company had been positive. But its bottom line was painful because of increased expenses. This, combined with house shares were priced, led me to rate the company a ‘hold’ to reflect my view that the stock should perform more or less along the lines of the broader market for the foreseeable future.

Since then, I have been proven wrong. Admittedly, from the middle of November through today is a rather short window of time. But since the publication of that article, shares are down 14.1% at a time when the S&P 500 is up 13.5%. You might think that I would be tempted to throw in the towel and become bearish. Or, since I am a contrarian, you might think that I’m ready to upgrade the stock because of how much cheaper it has gotten. But neither of those is true. Today, revenue is still growing and backlog is following suit for the most part. Debt seems to be more or less under control as well. But when you consider all of the dynamics at play, it’s too early to become bullish about the business. Until we see more evidence of a sustained recovery in this industry, I would argue that the ‘hold’ rating that I assigned the stock previously should remain in place.

The good and the bad

In many respects, the picture for shareholders of Transocean continues to improve. As an example, let’s first start looking at average daily revenue per rig that the company has in operation. While the firm does operate on contracts, many of them being long term in nature, an improvement in the space in terms of demand for drilling rigs should still cause average daily revenue to increase over time. In the chart above, you can see that this has been the case for the past several quarters now. For the nine different quarters that I looked at, the low point was the first quarter of 2022 where the company reported average daily revenue of $334,500. In every quarter since then, with the exception of one, this number has increased. By the final quarter of 2023, average daily revenue expanded to $407,800. That’s an increase of 17% compared to what it was one year earlier.

So far, this is a great development. Another, to a lesser extent, involves backlog. For those not familiar, backlog is the total value of all contracted work planned for the future. After bottoming out at $6.12 billion in the first quarter of 2022, backlog saw some meaningful improvements until peaking at just under $9.40 billion in the third quarter of last year. We have seen a decline since then to $9.01 billion. But that’s still 47.2% higher than the low point over the last nine quarters and it is 5.5% greater than what it was at the end of 2022.

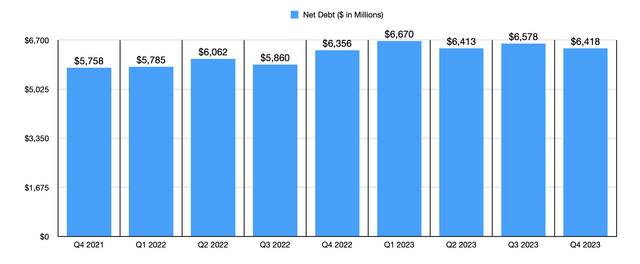

Another positive for shareholders to be appreciative of is debt. Any asset intensive space like this is bound to have a good deal of leverage involved. But after rising from $5.76 billion in the final quarter of 2021 to $6.67 billion at the end of the first quarter of 2023, net debt for the business pretty much stabilized. In fact, by the end of last year, it fell slightly to $6.42 billion. For context, if we use data from 2023, this implies a net leverage ratio of 8.70. This is still higher than I would like it to be. But the fact that the picture is not worsening and has even improved is something to be celebrated.

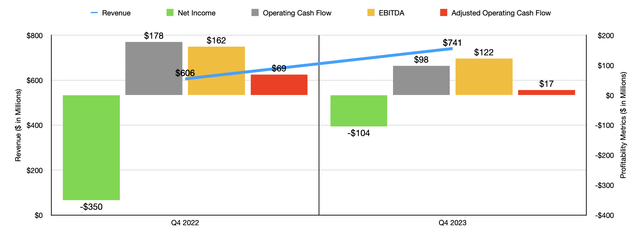

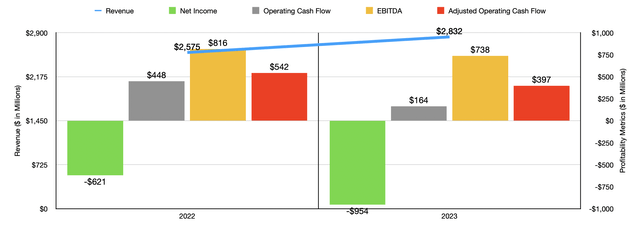

Unfortunately, there are some negatives associated with the company. And these prevent it from being a solid investment prospect. First and foremost is that, while revenue has fallen, cash flows have taken a hit. In the chart above, you can see what I mean for the final quarter of 2023 relative to the same time of 2022. And in the chart below, you can see the same data but for 2023 in its entirety compared to 2022. Focusing on the latest quarter, revenue of $741 million dwarfed the $606 million generated one year earlier. Management attributed this rise to a couple of factors, including an increase in average daily revenue per rig, which is something that I mentioned already, as well as higher fleet revenue efficiency.

It’s great to see that profits improved in the final quarter of the year, even though, for the year as a whole, they worsened considerably. But when you look at cash flow data, you see a lot of pain. For the final quarter of the year, operating cash flow was only $98 million. That’s down from the $178 million generated one year earlier. Management chalked a lot of this up to higher operating and maintenance costs that were driven by rigs returning to work after undergoing contract preparation, as well as an increase in server maintenance costs across the fleet. The firm has faced some other issues. For the year as a whole, for instance, it booked a $169 million loss associated with the disposal of certain assets. This was on top of $57 million associated with asset impairments, $31 million involving loss on retirement of debt, $27 million from the conversion of debt to equity, etc… while the bottom line for the final quarter of the year showed an improvement from negative $350 million to negative $104 million, all three of the cash flow metrics reported by the company showed a worsening of results.

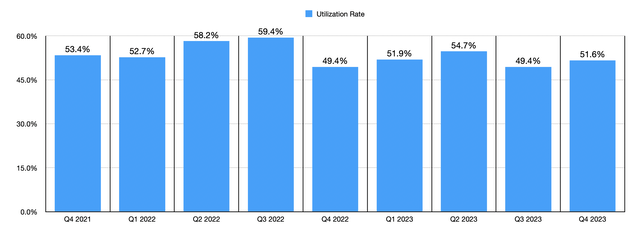

Another negative, at least in my book, involves the utilization rate of the firm’s fleet. You would expect, if we were seeing a broad-based recovery in the industry, for the utilization rate to gradually improve. But that hasn’t exactly been the case. Over the last nine quarters, this metric has ranged between a low of 49.4% and a high of 59.4%, with no clear trend in terms of direction. At the end of the final quarter of 2023, it stood at 51.6%. That is not exactly confidence inspiring.

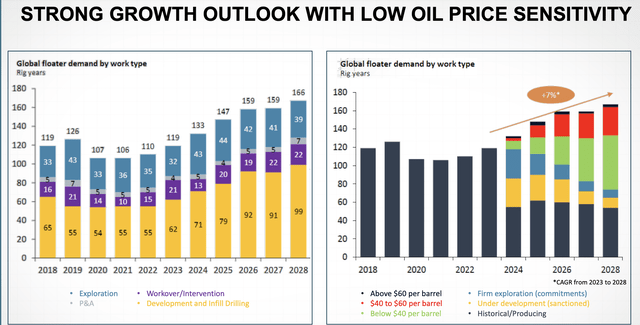

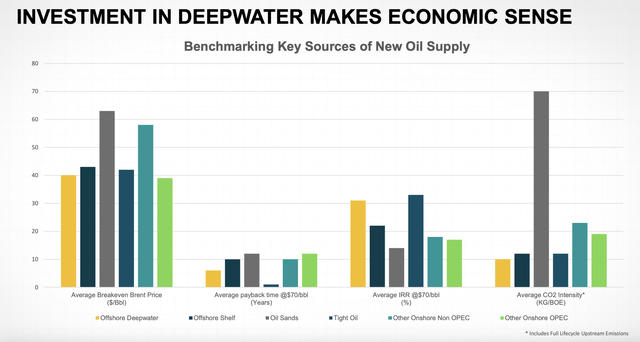

This is not to say that the picture won’t change. In fact, management is forecasting global floater demand to increase over the next few years. It’s expected to rise from a row of 106 rig years in 2021 to 119 this year. And by 2028, it’s expected to rise further to 166 rig years. What’s really positive for investors, if this does come true, is that much of this will involve projects where the break even for oil is below $40 per barrel, with some of it then being between $40 and $60 per barrel. This is fascinating because offshore projects have often been associated with high costs, often exceeding those involving fracking.

Management has also pointed out that there seems to be an increase in contract duration and lead times. This is bullish because it shows that customers are trying to lock in long-term prices and that they are planning for bigger-picture projects that require decisions to be made earlier rather than later. I would consider both of these to be positives for a company like Transocean. Those who are bearish about the space, in general, will point out that US non-conventional oil, as well as OPEC+ production, both of which can see significant swings in output in a short window of time in response to changing market conditions, make offshore less appealing. After all, offshore projects are often long-term investments that require significant amounts of spending in order to get up and running. But that’s not true of the activities pushed by non-conventional oil and by OPEC+.

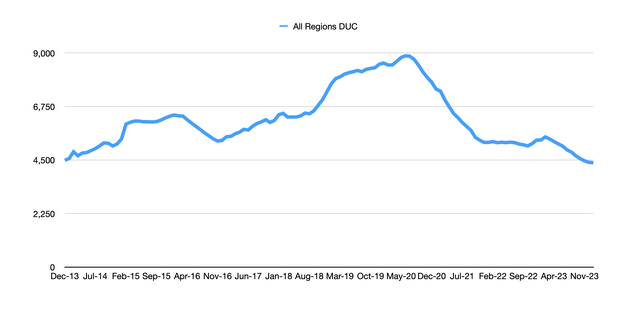

In truth, I don’t have an answer when it comes to OPEC+. Anybody in the oil space should only make investments knowing that the group can and will alter output in order to do what’s best for it in the long run. The risk is just a cost of doing business in this space. But when it comes to non-conventional oil, we do have some insight. As I touched on in a prior article, the number of DUC wells in the US has plummeted over the past few years. The increase in oil production that we have seen has been the result of oil and gas companies using wells that were already drilled but that were not yet completed. But with DUC wells now shrinking considerably, at some point you would expect it to become more costly to extract crude. That could bode well for a player in the offshore space given the breakeven costs detailed by management. So in a sense, this could be a rather important leading indicator for the business.

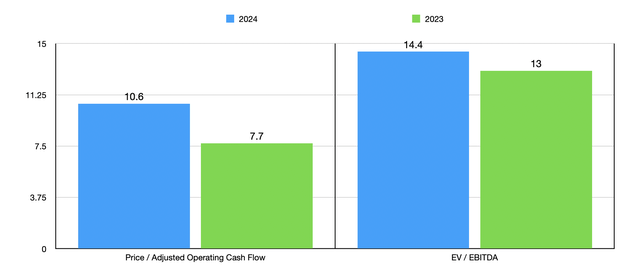

The last topic I would like to touch on involves the overall cost of shares at this time. In the chart below, you can see how shares are priced using data from both 2022 and 2023. Clearly, shares are more expensive on a forward basis because financial results did worsen from 2022 to 2023. This is one of the reasons why I’m not terribly optimistic in the near term. The stock does look a bit pricey, especially for a firm in an industry that experiences tremendous volatility. Until we see signs that cash flows will rebound enough to change this, it’s difficult to become terribly optimistic.

Takeaway

As things stand, the picture for Transocean is definitely mixed. There are positive and negative attributes about the company and the industry in which it operates. On the whole, I feel like this leaves me rather neutral on the business at this time. If we think about a longer-term picture such as the window of two to five years from now, I would say that things will start to look up. But with how the stock is priced at the moment and the cash flows that would be needed in order to become bullish on the firm, I cannot justify an upgrade at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!