Summary:

- Walmart continues to report strong operating numbers, with total revenue growing 5.7% in 2024.

- The company’s competitive position and operating model allow it to capture traffic and gain market share.

- Walmart’s expansion in margins and technological advancements contribute to its growth and improved productivity.

Alexander Farnsworth

Summary

Following my coverage of Walmart (NYSE:WMT), for which I recommended a buy rating as I believed the business was going to become stronger for longer given the prevailing macroeconomic backdrop (trade-down movement) and WMT increasing penetration in private labels, this post is to provide an update on my thoughts on the business and stock. I reiterate my buy rating for WMT, as execution has been on point in capturing share and technological investments. I believe WMT can continue to scale larger, which would give it more scale to drive gross and EBIT margin expansion. As WMT continues to deliver against its guidance, valuation should remain trading at a premium.

Investment thesis

WMT continues to report very strong operating numbers in the 4Q24 quarter, where total revenue grew 5.7% to $173.4 billion, driven by Walmart US comp sales growth of 4% and Sam’s comp sales growth of 3.1%. What was notable here is that Walmart US comp sales growth was driven by traffic (4.3% contribution), which really speaks of WMT’s competitive position in the industry and how its operating model well positions it to capture traffic in a tough macro backdrop. The strength was especially seen in key categories like grocery (mid-single-digit percentage growth contribution) and health/wellness (mid-teen percentage growth contribution). What these numbers also indicate is that WMT continues to gain share (reinforcing my stronger for longer view as WMT continues to scale up). What was also notable was the expansion in margins, where gross margin expanded by ~39 bps to 23.3% and EBIT margin expanded by 28 bps to 4.2%. Note that EBIT margin expansion was driven by all segments: Walmart saw 43 bps expansion, Sam’s saw 43 bps expansion, and International saw 31 bps expansion. All of these led to an EPS beat vs. consensus, for which WMT reported $1.80 EPS vs. the consensus estimate of $1.65.

Looking ahead, my view is that WMT is going to continue becoming stronger and bigger. Although there is the narrative that moderation in inflation will hurt WMT as prices come down and consumers revert back to their normal purchase routine (no more trade down), I don’t see this as much of an issue because: (1) this is at worst going to be a 1-year issue (e.g., FY25 resets to a lower base and FY26 will be a clean year); (2) growth through pricing was never WMT’s main strategy anyway. What matters is whether WMT can hold on to its share gains over the past 12 to 24 months, which gives it more scale to benefit from gross and operating margin expansion. Moreover, because WMT is now $76 billion larger (revenue size) compared to 24 months ago, I believe it is in an even better position to negate the deflation impact on unit prices via cost deflation. This was well communicated via the FY25 guidance, where management expects gross margin to expand as it expects to see further pricing efficiencies. Looking at how WMT executed in 4Q24 on the gross margin front, where it strategically managed price gaps by pulling back on ineffective discounts, driving increased vendor support given volume headwinds, and stronger inventory management initiatives, which led to a gross margin expansion of ~39 bps, I am positive that WMT can achieve FY25 gross margin expansion.

On operating margin expansion, aside from the benefit of gross margin expansion, the advancement that WMT has made on the technological front is also very promising, which I believe has clearly contributed to both top-line growth and improved productivity. In the recent MS TMT conference, management specifically noted that WMT is benefiting from its connected retail platform, automation, and data usage, and importantly, the right-sizing of legacy technology has been completed. If my understanding is accurate, it means two things: (1) WMT is going to see more profound benefits as the transition years are over, and (2) there will be fewer investments required as the major upgrades are done, which means the cost structure is lower. I am especially looking forward to the productivity gains from the non-customer-facing technology rollout, such as automation at distribution centers, that I expect will unlock meaningful savings as WMT scales larger. Unlike the past, where WMT had low automation capabilities, larger scales mean the need for more labor. Moving forward, with automation, WMT should be able to better scale margins.

Valuation

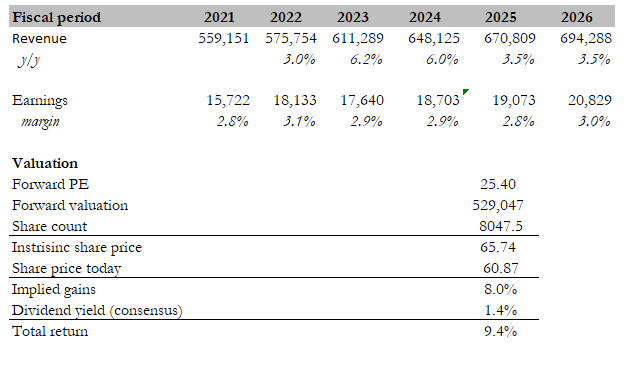

Own calculation

My target price for WMT based on my model is $65.74, which implies a share price gain of 8%. If we include the consensus estimated dividend yield of 1.4%, this brings the 1-year expected total return to ~9.4%. Please note that my model has rolled forward by 1 year, forecasting up to FY26 as FY24 has ended. I expect FY25 to be a “transition” year for WMT as the impacts of inflation moderation settle, which should drive top line growth back to historical levels of low-single-digit percentage growth. I also expect FY25 earnings to be near the high end of management’s FY25 guidance, as I expect WMT’s larger scale to cushion out any major impacts of inflation moderating. That said, I think it is fair to assume that margins will see minor moderation as WMT continues to invest in technology. As WMT moves past FY25, FY26 should be a clean year, where I expect growth to continue at 3.5% (with potential upside if inflation stays sticky for longer than expected) and earnings margin to improve as WMT reaps the benefit from its technological investments. I also revised my valuation expectations upwards from 23x to the current 25.4x forward earnings as I believed the market would continue to attach a premium multiple (relative to historical average) as WMT has shown that it is a major beneficiary of the current macro environment.

Risk

If the moderation in inflation is faster than expected, so much so that consumers have become confident in spending at more premium places (i.e., trading up), WMT could see further growth slowdown in FY25 that might impact investors’ sentiment given that it will impact FY26 estimates. As I noted above, I modeled WMT to continue trading at a premium multiple in the near term. If growth slows down because of losing consumer traffic, valuation could see rapid mean reversion, thereby impacting returns.

Conclusion

In conclusion, my rating for Walmart is buy as the business continues to deliver very positive performance. In the recent quarter, WMT saw solid revenue and earnings growth, driven by effective pricing strategies and market share gains. Both gross and EBIT margins also expanded, and I expect it to continue expanding due to its larger scale and investments in automation and data analytics. While inflation moderation might pose a slight challenge in the short term, my view is that it is not a big problem given WMT’s larger scale that has better position it to negotiate on cost of goods.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.