Summary:

- AMD is a top player in the AI industry, with potential for significant growth in the AI-related server segment and gaming CPU/GPU market.

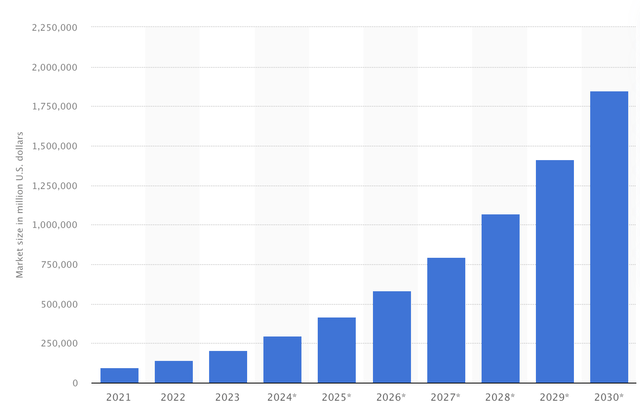

- The AI market is expected to grow significantly, reaching over a trillion dollars in sales by 2030, and AMD could have a considerable portion of the pie.

- The Chinese government’s announcement to ban AMD and Intel chips in the CCP systems will likely have a minimal effect on AMD while having a more significant impact on Intel.

- Despite competition risks and potential cyclical downturns, AMD’s stock remains a top pick for the next decade due to its long-term potential in AI.

da-kuk

Advanced Micro Devices (NASDAQ:AMD) – “AMD AI” remains synonymous with the top “picks and shovels” company powering the lucrative AI industry from the ground up. In fact, AMD is second only to Nvidia (NVDA) due to the essential duopoly the two mega chip makers have in the burgeoning GPU and other advanced processor space. Intel (INTC) is also gaining some share in this highly advanced processor market but remains behind AMD and Nvidia in many respects, especially in the high-end server accelerator space.

AI applications need massive computing power to function correctly, and AMD provides the necessary hardware to run the enormous industry. AMD’s MI3000s are among the best accelerators powering the massive AI server market, and there is an excellent opportunity to expand sales and profitability considerably as we advance. There’s even discussion about AMD competing at the very high end of the market with Nvidia’s top-line accelerator products and other advanced AI-related chips.

The recent China ban on Intel and AMD chips may be exaggerated. It primarily concerns CCP central government agencies, which should have a limited effect on AMD. All eyes are on AMD’s growth in the AI-related server segment and potential increased demand in the AI-related gaming CPU/GPU and other advanced processor space.

The AI Market Should Become Huge

It seems we may be underestimating the magnitude of the AI market and AMD’s potential in the space. AI is already becoming a formidable industry, and it may only be in the beginning phase. The market could increase several-fold over the next few years.

Massive AI Market Potential

AI market size potential (statista.com )

While we should see around $300 billion in AI-related sales this year, the total could be about $1.85 trillion by 2030. Moreover, the market should continue expanding beyond then and has the potential to reach epic proportions like the internet and other revolutionary industries. Also, we are still in the early stages of the AI gold rush, and we should see several years of excellent growth ahead, especially for high-quality companies like AMD. AMD’s CEO said that the AI chip market alone could be worth around $400 billion by 2027, and AMD could have a considerable portion of the market share.

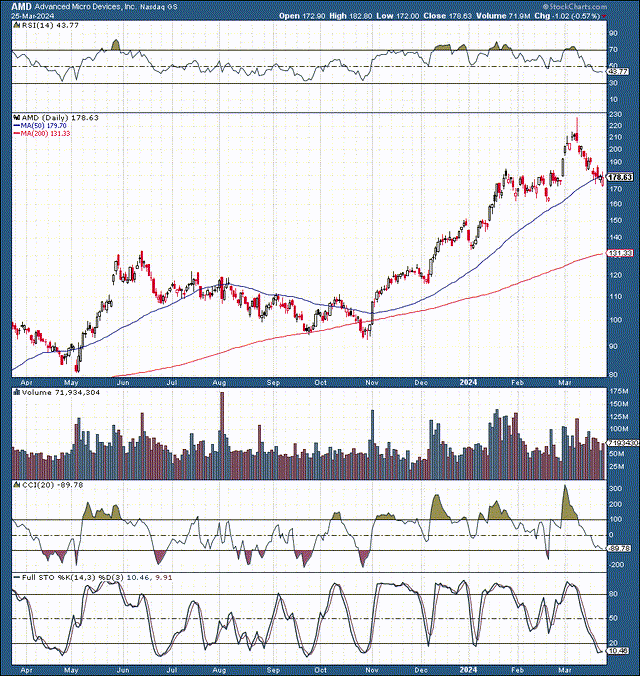

AMD: Technically, Buy The Dip

In addition to solid fundamental, psychological, and positive sentiment factors, AMD is also bullish from a technical perspective. AMD is one of the most promising companies from a long-term perspective, and this is likely an excellent opportunity to get into AMD’s stock.

AMD: 1-Year Chart

AMD (stockcharts.com )

AMD’s pullback has been a gift, and it is precisely where I was calling to buy in after the recent peak ($170-$180 level). AMD just climbed too high too quickly recently, but the recent selloff has nothing to do with the fundamentals that should continue powering AMD much higher in the intermediate and long term. There is an excellent support base of around $150-$160, and there is a minimal probability that the stock can go below there.

The Nvidia Moment Is Likely Near

Moreover, AMD has not had its “Nvidia moment” like SMCI and several other stocks have had. Once AMD’s AI demand translates to the bottom line, AMD should guide much higher revenues and EPS. Increasing demand and revenues for its server accelerator processors and other advanced GPU/CPU hardware should enable AMD’s Nvidia moment to occur. This dynamic should allow AMD’s stock to move much higher, and we’re around an excellent buy-in spot right now.

Several Hundred Million May Not Make A Difference

Several hundred million fewer dollars in Chinese government sales may not significantly affect AMD’s bottom line. Moreover, AMD can compensate for the lost revenue in other segments, such as gaming, CPU/GPU, server, AI, and other sales. In my view, this really is a non-issue for AMD, and the Chinese government could return to using AMD’s products in the future if it so chooses.

On the other hand, Intel’s revenues could get hit much harder due to the CCP ban (about $1-$1.5B). Unfortunately for Intel, it is the bigger loser in this deal. In addition, Intel doesn’t have AMD-like AI and other growth potential that could offset China’s CCP-related sales decline.

Keeping My Eyes on The Prize

AMD faces competition risks from Nvidia, Intel, and other heavyweights in the chip industry. Moreover, we should keep our eyes on the prize with AMD and consider the long-term image. The prize is a massive segment of the AI market, where AMD has a market-leading position. AMD is a dominant force in AI-enhanced CPUs, GPUs, server accelerator processors, and other leading hardware, experiencing massive demand in this AI gold rush age.

Therefore, I am disregarding the short-term noise and focusing on AMD’s long-term potential. AMD is relatively cheap and can increase revenues and EPS considerably in future years. Moreover, I expect AMD to achieve much higher sales and EPS than many analysts expect. This dynamic should lead to positive earnings revisions, higher valuation multiples, and likely a much higher stock price as we advance.

Here’s where AMD’s stock could be in future years:

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $28 | $38 | $45 | $52 | $60 | $70 | $80 |

| Revenue growth | 21% | 37% | 20% | 18% | 16% | 15% | 14% |

| EPS | $4.60 | $7.50 | $9 | $11 | $13 | $15.2 | $17.8 |

| EPS growth | 72% | 63% | 20% | 22% | 18% | 17% | 17% |

| Forward P/E | 30 | 31 | 32 | 33 | 32 | 31 | 30 |

| Stock price | $225 | $280 | $352 | $429 | $486 | $552 | $615 |

Source: The Financial Prophet

I’ve adjusted my figures slightly from my previous AMD projections and expanded the multiple slightly to peak around 33 in 2027. Despite minor upward adjustments, my AMD projections remain relatively modest compared to some of the more bullish estimates and AMD’s long-term potential in AI. Due to the improving intermediate and long-term outlook, AMD’s stock remains one of my top picks for the next decade.

- I recently raised my AMD 2024 year-end price target to $225-$275.

Risks to AMD

AMD faces competition risks from Nvidia, Intel, and other heavyweights in the chip industry. Moreover, some of AMD’s businesses are highly cyclical and could suffer due to a slowing economy and high-interest rates. Nonetheless, it is beneficial that the Fed is tilting toward a more accessible monetary policy, which should benefit AMD’s business in multiple respects. AMD also risks possible margin compression due to inflation and other factors. The potential rewards outweigh the risks in AMD’s case. Still, investors should carefully examine the risks before investing in AMD shares.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!