Summary:

- Energy Transfer is facing disputes and legal battles with Williams Companies. Management needs to avoid this type of situation in the future.

- The ongoing litigation is causing a cash drain for Energy Transfer and could lead to costly outcomes. Even with the current “win”, this is a very risky strategy.

- Accruals for contingent obligations are increasing, indicating potential future expenses for the company.

- Any company that “hits a lot of singles and doubles” could hit a home run. In the legal area, investors do not want this type of home run.

- Management still has a lot of cleaning up to do. The company needs to get away from going to court as much as it does.

onurdongel

I have long maintained that companies that tend to hit “home runs” are the companies that hit a lot of singles and doubles. Energy Transfer (NYSE:ET) just keeps those legal single and doubles coming. This time around, Energy Transfer appears to be prevailing. But it is not something that you want to keep doing because sooner or later there could be a costly mistake that shareholders pay for. It is the homerun you want to avoid as management.

With the Mariner Project in Pennsylvania, management had to deal with all kinds of fines, work stoppages, and other costly related events to get that pipeline done. This was covered previously. Frankly, frequent trips to regulators and courts for these kinds of issues is an expense that shareholders can do without.

Williams Companies

Now comes the dispute with Williams Companies (WMB). According to the CEO of Williams, the company will be rerouting a pipeline around a disputed area where Energy Transfer has an easement. Therefore, Energy Transfer management “wins” this particular dispute. Management noted that no court has found that Energy Transfer acted in bad faith. However, the fact that the article and others noted that the company had gone to court over similar issues with other pipeline companies in the industry means that this stance is on thin ground even if it is “correct”.

For all the years that I worked in the industry there was one common mantra and that was to stay out of court in the first place. While the company’s stance is legally correct, the piling up of legal bills yet again for another dispute tells shareholders that a course correction is in order. All those other companies that are taking Energy Transfer to court may be wrong for now. But it likely will not be too long before there is a loss that could be potentially costly.

The strategy of going to court, appearing in front of regulators, and the work stoppages that are related to some of these cases cost money that could be going to shareholders. More importantly, the continuing disputes may mean that management will add to the list of items under the litigation note in the annual report. Really that needs to be cleaned up so that there is only “routine” things that are not significant and do not need to be noted in the annual report.

Dakota Access Pipeline (DAPL)

The Army Corps of Engineers may not release the results of the latest court ordered study until around election day according to the latest rumors. The easement was previously voided by a court so the company is in the position of operating a pipeline without an easement while going through the application process (again) for that easement (or permit).

This dispute is likely to remain relatively quiet until that study is released along with a recommendation. However, opponents of this appear ready to head back to court. If the Army Corps releases an opinion unfavorable to the company, then it would appear that the company is ready to head back to court as well. In short, this dispute appears to be a cash drain (even if small compared to the size of the company) for years to come with a risk of a costly unfavorable outcome.

Phillips 66 Partners had this to say about the dispute (before they were folded back into Phillips 66):

“However, the appellate court acknowledged the precise consequences of the vacated easement remain uncertain. Since the pipeline is now an encroachment, the USACE could seek a shutdown of the pipeline during the preparation of the EIS. Alternatively, the trial court could again issue an injunction that the pipeline be shut down, assuming it makes all findings necessary for injunctive relief. A status hearing is scheduled for April 9, 2021, at which time the parties will discuss the appellate court’s decision and how the USACE plans to proceed given the vacating of the easement. If the pipeline is required to cease operations pending the preparation of the EIS, and should Dakota Access and ETCO not have sufficient funds to pay ongoing expenses, we also could be required to support our share of the ongoing expenses, including scheduled interest payments on the notes of approximately $25 million annually, in addition to the potential obligations under the CECU.”

Source: Phillips 66 Partners 10-K Filed February 2021.

During the follow-up conference call, management mentioned they thought that this litigation would continue for years to come. All of this was done back in 2021 in a previous article. But it still looks good now. There is plenty in that quote that is now old. But the last part about needing to potentially pay expenses applies to an unfavorable outcome. The pipeline still has the possibility of ceasing operations even though “clearly” the pipeline is still operating. So that first sentence still carries some weight because there is a likelihood that no one in the future wants an operating pipeline without an easement. Some uncertainty is now gone, but plenty of uncertainty remains even though this is no longer 2021. The discussion here of potential liability from a partner viewpoint is still one of the best around despite the fact that the quote is old.

The latest lull in court activity has made many think that the DAPL dispute is over with. But really, everyone is waiting for an Army Corps opinion. Then the side with the unfavorable outcome will likely resume the litigation yet again.

As was mentioned before, the Army Corps of Engineers came up with five possibilities. Everything from completely favorable to the company to digging up the pipeline and moving it is on the table at the current time. There has been no indication at this time as to which way the ruling will go.

Illinois

Not attracting as much attention was a move in Illinois to void an expansion permit. That means this partnership is operating the DAPL pipeline with two revoked permits or easements. Even though this revocation is not attracting the attention of the other hard-fought case, it still needs to be resolved.

Accruals

In the meantime, the latest 10-K saw accruals piling up and one payment to Williams was already made.

“As of September 30, 2023, and December 31, 2022, accruals of approximately $947 million and $200 million “

Source: Energy Transfer Third Quarter 2023, 10-Q

Another source for shareholder concern is that the accruals are continuing. The latest 10-K shows a small increase from the previous year. But any increase considering the Williams payment is an issue until the threats of big payments decreases considerably. Given another round of disputes with Williams, it is only a matter of time before another likely accrual happens. Most companies avoid court. This company seems to embrace trips to court. The following note is likely to be around for annual reports for years to come showing money slowly heading to other pockets because management is unlikely to “win them all”.

“As of December 31, 2023 and 2022, accruals of approximately $285 million and $200 million, respectively, were reflected on our consolidated balance sheets related to contingent obligations that met both the probable and reasonably estimable criteria. In addition, we may recognize additional contingent losses in the future related to (i) contingent matters for which a loss is currently considered reasonably possible but not probable and/or (ii) losses in excess of amounts that have already been accrued for such contingent matters. In some of these cases, we are not able to estimate possible losses or a range of possible losses in excess of amounts accrued. For such matters where additional contingent losses can be reasonably estimated, the range of additional losses is estimated to be up to approximately $200 million”

Source: Energy Transfer 10-K Fiscal Year 2023 Filed February 16, 2023.

Again, any company that hits a lot of “singles and doubles” has an enhanced chance of hitting a homerun. This is not an area where you want any hits at all (let alone a homerun).

There is a fair number of items listed in the annual 10-K report that may or may not prove to be significant to the company prospects. Until all of those items are cleaned up, these common units are not going very far. In fact, the common units are probably a good trading vehicle only for those that know what they are doing until the risk of an unfavorable decision abates.

The key here is that money that could be returned to common unit holders is going to expenses that definitely do not benefit unit holders and may in fact lead to more expenses in the future.

Operations

Fourth quarter operations really are in decent shape. The objective needs to be to clean up all of this other stuff. More importantly, the company needs to stop all these trips to court.

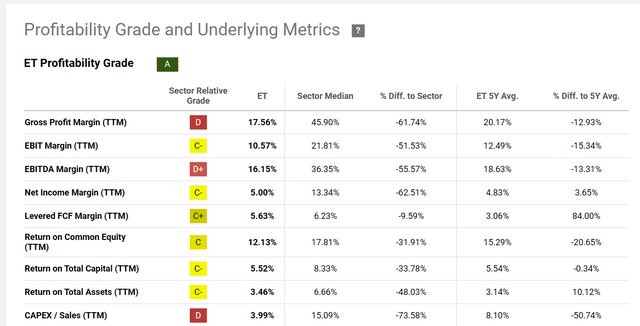

Energy Transfer Key Profitability Measures (Seeking Alpha Website March 24, 2024)

The cash drain is showing up as subpar grades on profitability. That return on capital, in particular is the lowest among the midstream companies that I follow. The return on equity is possibly average. These measurements shown above indicate trouble with management practices.

An investment should be considered when the indicators above largely flash above average even in the “bad times”. Since Energy Transfer is a large company, this could take some time before those measurements get to where they should be.

Conclusion

For investors that know what they are doing and when to walk away (hopefully with a profit), the common partnership units can be a trading vehicle. But this is not a long-term buy and hold idea for the average investor because this idea needs constant monitoring in case it is time to go. This is really an idea for advanced investors. This is definitely a higher risk issue even if you “get away” with the idea. Some of these do work out long term, but not enough of them to make this a positive recommendation. It is just too risky.

The stock, despite what has happened, has in the past has had some good times. Hence the trader recommendation. But I follow a lot of companies that do not have the issues here. Yet those issues do at least as well as this one. Therefore, this one for me is an avoid right now until the big issues get resolved.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Long Player believes oil and gas is a boom-bust, cyclical industry. It takes patience, and it certainly helps to have experience. He has been focusing on this industry for years. He is a retired CPA, and holds an MBA and MA. He leads the investing group Oil & Gas Value Research. He looks for under-followed oil companies and out-of-favor midstream companies that offer compelling opportunities. The group includes an active chat room in which Oil & Gas investors discuss recent information and share ideas. Learn more.