Summary:

- I continue to strongly believe that investing in META stock is a generational buying opportunity.

- In this article, I discuss 3 key arguments why the world’s leading social media conglomerate may have found a bottom.

- The arguments are: 1) focus on cost discipline, 2) progress with AI and Reels, and 3) monetization of WhatsApp & Messenger.

- Meta’s valuation is too attractive to ignore – trading at a FWD x11 P/E and having no debt. I reiterate a ‘Strong Buy’ rating.

Derick Hudson

Thesis

I have voiced a bullish opinion on Meta Platforms (NASDAQ:META) at $165, $127, and $97 per share, with only the last recommendation being in the money – apologies. However, I continue to strongly believe that investing in META stock is a generational buying opportunity, and in this article, I discuss 3 key arguments why the world’s leading social media conglomerate may have found a bottom: 1) focus on cost discipline, 2) progress with AI and Reels, and 3) monetization of WhatsApp & Messenger.

For reference, Meta stock is down approximately 66% YTD, versus a loss of only 21% for the S&P 500 (SPY).

1) Focus On Cost Discipline

One key argument why Meta stock has shed more than $600 billion of market capitalization is anchored on the markets’ perception that Zuckerberg has failed to build a culture that values profitability. While this might have been true – and perhaps still is to some extent – investors should consider that Zuckerberg has now clearly started to push for more cost discipline.

In early November, Zuckerberg has shared a memo where he announced that the social media giant could lay off as many as 13,000 employees, which would be approximately 13% of Meta’s headcount. Assuming that the affected workforce (skewed towards HR and other support functions) received an average annual salary between $115,000 and $135,000, the lay-offs could translate into annual cost-savings of $1.25 billion – $1.37 billion. Moreover, Meta has also announced that the company will aim to reduce its real estate footprint and other operating costs, which could likely add between $625 million – 1,050 million of additional savings.

Although it is hard to estimate how the cost savings will translate into higher equity valuations, I have previously calculated that Meta’s cumulative cost savings announced YTD may add as much as $30 billion of economic value.

In sum, I believe it is reasonable to assume that Meta’s savings ambitions will likely reduce operating expenses by approximately $1.5 – $2 billion annually. Assuming a P/E multiple of x15, this could strengthen Meta’s market capitalization by $22.5 to $30 billion.

2) Progress with AI and Reels

Despite the more disciplined approach towards costs, Meta remains committed investing in R&D. In fact, for the trailing twelve months Meta expensed a cumulative $32.4 billion of research and development costs. While it is true that a large part of this amount is attributable to Reality Labs, an equally large part is invested in Meta’s core social media app business – building an AI-supported discovery engine, as well as new products such as Reels.

In the Q&A sessions with analysts following Q3 reporting, Zuckerberg commented:

Our AI discovery engine is playing an increasingly important role across our products — especially as advances enable us to recommend more interesting content from across our networks in feeds that used to be primarily driven just by the people and accounts you follow.

Moreover, Zuckerberg has commented especially positive on the company’s progress with Reels:

There are now more than 140 billion Reels plays across Facebook and Instagram each day. That’s a 50% increase from six months ago. Reels is incremental to time spent on our apps. The trends look good here, and we believe that we’re gaining time spent share on competitors like TikTok.

Although Reels do not yet monetize at a similar rate as the social media network’s other products such as Stories and News Feed …

Reels doesn’t monetize at the rate of feed or stories yet. That means as Reels grows, we’re displacing revenue from higher-monetizing surfaces. I think this is clearly the right thing to do so that Reels can grow with the demand we’re seeing, but closing this gap is also a high priority.

… I strongly believe that Meta’s continued progress with AI recommendation and Reels will improve investor sentiment and Meta’s long-term potential – as these initiatives will help Meta to compete more effectively against entertainment platforms such as TikTok and Googles YouTube.

3) Monetization of WhatsApp & Messenger

While Meta’s ambitions with Reality Labs and Reels will likely not be monetized for a good while, the social media giant is finally pushing to monetize its super popular messaging platforms – WhatsApp and Messenger. Investors should consider that as of late September, WhatsApp had approximately 2 billion users, which Meta has only started to monetize.

… messaging is another major monetization opportunity. Billions of people and millions of businesses use WhatsApp and Messenger every day, and we’re confident we can connect them in ways that create valuable experiences.

With Q3 2022 reporting, Meta disclosed that the monetization of messaging currently stands at a $9 billion annual run rate, which implies an annual revenue of less than $5 dollar per user.

We started with Click-to-Messaging ads, which let businesses run ads on Facebook and Instagram that start a thread on Messenger, WhatsApp or Instagram Direct so they can communicate with customers directly. This is one of our fastest growing ads products, with a $9 billion annual run rate. This revenue is mostly on Click-to-Messenger today since we started there first, but Click-to-WhatsApp just passed a $1.5 billion run rate, growing more than 80% year-over-year.

… We think we can build a substantial sized business around paid messaging.

Personally, I think that given WhatsApp’s engagement and popularity, there should be an opportunity to generate at least $20 of annual revenue per user. If this estimate proves to be true, the monetization of Meta’s messaging network could add approximately 20-30% of incremental revenues to Meta’s current topline.

For reference, Facebook’s annual revenue per user in the US and Canada is approximately $200.

Risks/ Headwinds

As I see it, there has been no major risk updated since I have last covered META stock – only that perhaps the risks have been discounted more. Thus I would like to highlight what I have written in a previous article:

First, a worsening macro-environment including challenges coming from high inflation and rising interest rates could negatively impact the ad-budget of Meta’s customer base. If challenges turn out to be more severe and/or last longer than expected, the company’s financial outlook should be adjusted accordingly.

Second, investors should monitor competitive forces in the industry. Although I highlighted the difference between TikTok and Meta from a value-proposition perspective, I also highlighted that the company is competing for advertising spending. Thus, if competition increases more than what is modelled by analysts, profitability margins and EPS estimates for Meta web must be adjusted accordingly.

Third, much of Meta’s current share price volatility is currently driven by investor sentiment towards risk and growth assets. Thus, investors should expect price volatility even though Meta’s business outlook remains unchanged. In addition, inflation and rising-real yields could add significant headwinds to Meta’s stock price, as the higher discount rates affect the net-present value of long-dated cash-flows.

Valuation Simply Too Attractive To Ignore

With 1) focus on cost discipline, 2) progress with AI and Reels, and 3) monetization of WhatsApp & Messenger supporting both sentiment and fundamentals, Meta’s valuation is too attractive to ignore – trading at a FWD x11 P/E and having no debt.

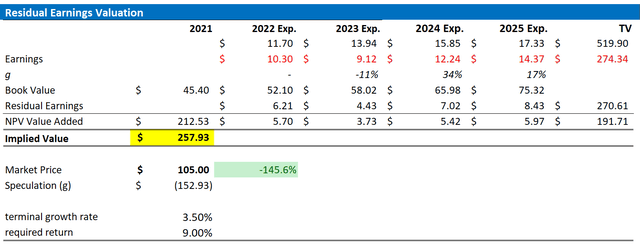

Personally, I estimate that Meta stock should be valued at somewhere around $257.93. I base my argument on a residual earnings model anchored on analyst EPS consensus estimates, a 9% cost of equity and a 3.5% terminal growth rate.

I reiterate a ‘Strong Buy’ rating.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advise.