Summary:

- NIO’s bottom-line continues to suffer due to the ongoing price war within the EV industry.

- NIO’s business model is unsustainable at the current cash burn rate and the company will likely be prompted to dilute its shareholders even more to get the additional liquidity.

- NIO is unlikely to be a great long-term play, but its shares might rebound in the short-term.

Sundry Photography/iStock Editorial via Getty Images

NIO (NYSE:NIO) continues to be in a tough spot as its business continues to suffer from the ongoing price war within the EV industry while its cash burn rate is not significantly improving. Even though the recent liquidity injection from third parties will ensure that the business won’t go under, it’s likely a matter of time until another injection is needed in order to properly compete with more advanced peers.

As such, the company is likely to suffer financially in the long run as there are no major growth catalysts that could improve its bottom-line performance. At the same time, NIO’s stock has already greatly depreciated in recent months, found a technical support level, and could rebound in the short term thanks to the better macro environment. That’s the main reason why I’m currently changing the rating from SELL to HOLD. However, NIO is unlikely to be a great long-term play even if you buy its shares at the current price.

From Bad to Worse

Back in December, I wrote an article on NIO with a SELL rating. In that article, I noted that the company’s bottom-line performance is likely to continue to suffer as a result of the ongoing price war within the EV industry that has led to the compression of NIO’s already weak margins. Since that time, the shares have depreciated by nearly 50% and the situation hasn’t improved significantly for the company.

Even though NIO managed to increase its revenues by 6.5% Y/Y to $2.41 billion in Q4, its non-GAAP EPADS of -$0.39 was below the estimates by $0.07. On top of that, its deliveries decreased by 9.7% Q/Q to 50,045 vehicles.

At the same time, NIO’s business model is non-sustainable at the current cash burn rate. In my previous article on the company, I noted how NIO received several rounds of liquidity injections from third parties to ensure that its business remains solvent. While its cash reserves increased from $3.8 billion in Q2 to $5.3 billion in Q3 and to $7 billion in Q4, the share count has also increased by over 6% in the last year due to the constant share offering to raise additional funds.

NIO will likely continue to dilute its existing shareholders to raise new funds since the business is expected to remain unprofitable for a long time. In Q4 alone, NIO’s operating loss was close to $1 billion, while in Q3 and Q2 its operating loss was $663 million and $837 million, respectively.

The issues that NIO is facing have nothing to do with its cars and more to do with the overall state of the EV industry which is currently in the middle of a price war. All of NIO’s major competitors such as BYD (OTCPK:BYDDF), Tesla (TSLA), XPeng (XPEV), and others, have been decreasing prices for their vehicles and launching cheap versions of their cars to compete for the consumers. At the same time, Tesla has recently curtailed the EV production in China. This is likely due to the fact that the sales have been slowing down in the region as China’s economy is currently in the deflation territory and there’s an indication that it will continue to face various structural issues in the future.

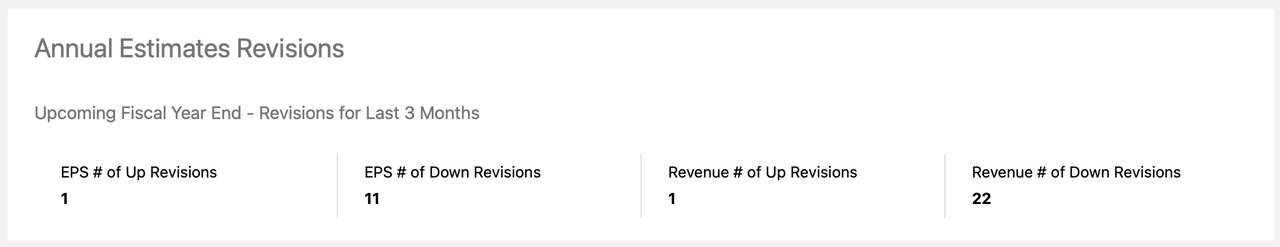

Considering all of this, NIO will likely remain uninvestable in the following months. NIO’s Q1 outlook already came below the consensus, the company has received dozens of downward revisions in recent months, and its business is expected to remain unprofitable in the next few years at the very least.

NIO’s Earnings Revisions (Seeking Alpha)

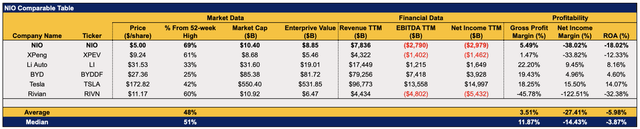

What’s more is that NIO has one of the lowest gross and net margins among its competitors, and it’s hard to see how it will be able to improve its performance and avoid another round of liquidity injection given the current state of the EV industry.

NIO’s Comparable Table (Data: Seeking Alpha, The Table Was Made By The Author)

Geopolitical Risks To Consider

Another issue that NIO faces is the unstable geopolitical environment. To diversify its business and stop relying on the volatile Chinese EV market, NIO has been actively looking for other markets to create new sources of revenue. While the company has been trying to penetrate the European market for a while, its efforts there so far have been futile.

In Q4, NIO sold only 742 vehicles in Europe, while in Q1 it has sold only 308 vehicles there so far. Without having a manufacturing facility on the old continent, NIO won’t have a major price advantage against the local competitors and will constantly be exposed to various shipping risks that will have the ability to disrupt its operations in Europe.

What’s worse is that there’s a high chance that the European Commission will launch a trade war against China later this year after it finishes its anti-subsidy investigation against the influx of Chinese EVs into the European market. Without waiting for the results of the investigation, Beijing has already escalated the trade tensions that could worsen Sino-European relations even more and make it harder for NIO to properly penetrate the European market in the future.

In addition to all of that, the worsening of the Sino-American relations could prevent NIO from entering the American market and disrupt its operations in China at the same time. On the one hand, the rising trade tensions and the potential implementation of harsher tariffs on Chinese goods will make it nearly impossible for NIO to decrease its reliance on the Chinese market. On the other hand, the latest American restrictions on the exports of chips to China could undermine NIO’s self-driving efforts and make its cars less attractive in comparison to other peers.

What’s Next?

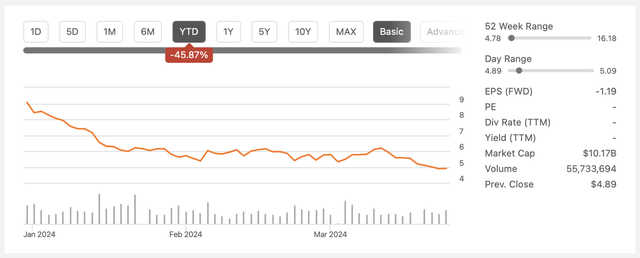

The only thing that NIO has going for it is the fact that it can nevertheless grow its top-line performance even if it’s doing so at a lower rate. Considering that the company’s stock is trading close to a technical support level of around $5 per share and the business itself is likely to ramp up production of vehicles in the following months – its shares could appreciate in the short to near term. That’s why I’m changing my rating to HOLD after issuing a successful SELL call a few months ago.

NIO’s Stock Performance (Seeking Alpha)

However, the ongoing price war is likely to keep the margins suppressed and prevent a significant improvement in the cash burn rate. Add to this all of the macro and geopolitical challenges and it would be safe to assume that NIO is unlikely to be a great long-term play even if you buy its shares at the current price. That’s why the change of rating is done purely from the technical analysis perspective, as there are no fundamental reasons to believe that NIO should be considered an attractive and safe investment at this time.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.