Summary:

- Plug Power Inc. has seen the value of its shares fall by some 95% since its peak in February of 2021.

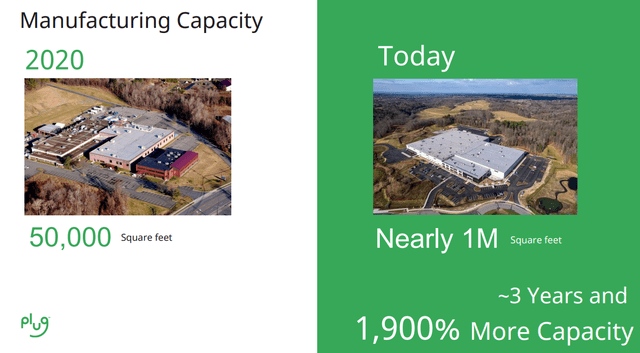

- The company has seen a huge increase in its production capacity in recent years, but profitability is a long way off.

- Management has faith their vision will eventually be realized, and insiders have held onto their shares despite significant business challenges.

- Leadership has plans to radically reduce cash burn in FY2024 and improve margins.

- What’s ahead for Plug Power and its beleaguered shareholders in 2024? An analysis follows below.

Vanit Janthra

It is amazing to me how much a frenzy there was around the alt-energy space. It was similar in some ways to the enthusiasm around the AI revolution. Except, the AI arms makers like Nvidia Corporation (NVDA), Super Micro Computer, Inc. (SMCI) and Advanced Micro Devices, Inc. (AMD) are immensely profitable. Something that has become quite hard to do in the alt-energy space.

Easy money from the Federal Reserve triggered a massive IPO/SPAC wave in 2020/2021. Scores of alt-energy/EV firms debuted on the market over this time. Many, like Fisker Inc. (OTC:FSRN) and ChargePoint Holdings, Inc. (CHPT), are circling the drain.

Even mighty Tesla, Inc. (TSLA) has seen its shares be more than cut in half since their highs late in 2021 at the peak of the alt-energy/EV frenzy. As I noted in a recent article, Tesla still faces some tough slogging ahead.

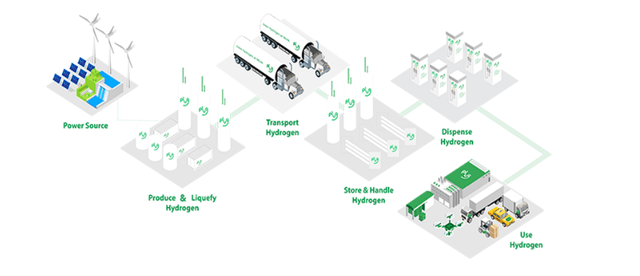

Which brings up to Plug Power Inc. (NASDAQ:PLUG), whose shareholders have been taken to the woodshed since the equity peaked at just over $65.00 a share at the start of February of 2021. Things have gotten so bad for this developer of hydrogen and fuel cell product solutions that the company recently had to address a going concern issue. The company has now deployed nearly 70,000 fuel cell systems and over 250 fueling stations so far in its history.

So, will Plug Power turn things around, or will it eventually face the same fate as Fisker? An analysis follows below.

Let’s start with one positive about the company. Insiders seem to be keeping the faith, judging by the fact only just over $230,000 worth of shares have been sold by company insiders since July of 2021 despite the huge drop in the stock.

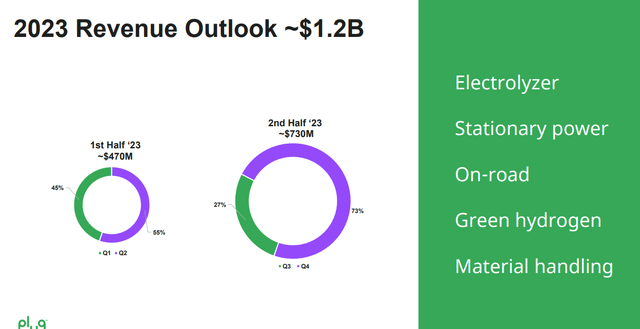

The company posted full year results for FY2023 on March 1st. First, the good news. Revenues rose 27% on a year-over-year basis to $891 million. This was in line with the consensus analyst firm forecast, but short of management’s projections made in October of 2023.

October 2023 Company Presentation

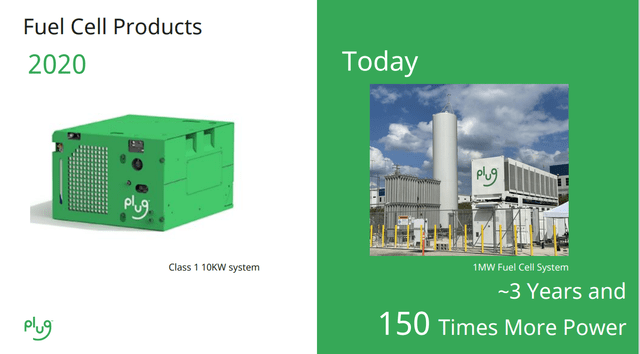

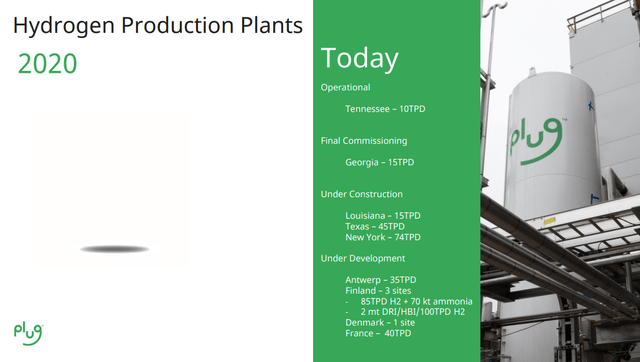

Other positives during the year included the commissioning of Plug’s Georgia hydrogen plant, which is now the largest PEM electrolyzer system in the nation. The company also deployed its first large-scale megawatt (MW) level stationary product. These both greatly enhanced the company’s hydrogen production capabilities.

October 2023 Company Presentation

Now for the challenges. Plug Power lost $2.30 a share in FY2023, which was 67 cents a share worse than the consensus. The company lost $1.25 a share in FY2022 in comparison. The company took a $325 million non-cash charge in the fourth quarter to write down the value of certain assets. As noted in a Seeking Alpha article earlier this month, these write downs came as a result of auditor concerns.

Balance Sheet Concerns:

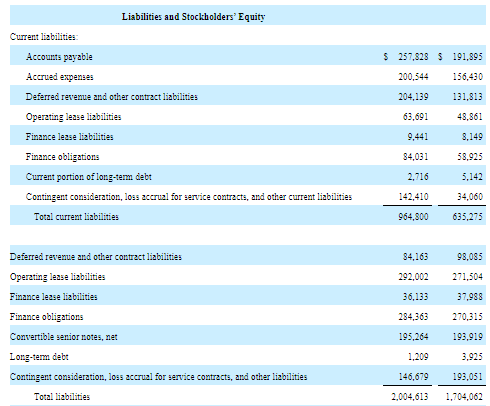

The company had negative free cash flow of $1.8 billion in FY2023, including just over $425 million in Q4. According to the company’s 2023 10-K, Plug Power had $135 million of cash and just over $215 million of restricted cash as of December 31st. It also listed its current liabilities as follows:

2023 PLUG 10-K

The company had net interest expense of just under $56 million in FY2023 compared to just over $37 million in FY2022.

Management is targeting some $75 million in operational savings (largely by consolidating facilities and streamlining processes) and is focused on reducing cash burn by 70% in FY2024. They will lower CapEx and should greatly benefit from new hydrogen facilities in Georgia and Tennessee which will lower hydrogen costs and greatly improve margins. CapEx was approximately $650 million in FY2023, and management’s initial plan is to bring that down to $250 million in FY2024. Inventory grew by $400 million in FY2023, and leadership is planning a $200 million to $300 million reduction this year. Plug Power has also largely ended sales leasebacks, which will improve working capital but will also result in slower sales growth in FY2024.

The company plugged its short-term balance sheet and going concern worries by entering into a $1 billion At the Market [ATM] facility with B. Riley Financial in the third quarter, which was expanded in February. As of late February, the company had raised just over $300 million through this facility. To put in perspective as far as dilution, PLUG’s current market cap is approximately $2.2 billion. Plug Power is also expecting conditional approval of $1.6 billion project financing facility via the Department of Energy in the near future.

The Analyst Community Take:

Since the company posted its FY2023 results early this month, nine analyst firms including Jefferies and Piper Sandler have reissued/assigned Hold/Sell ratings on the stock. Price targets proffered range from $2.50 to $4.00 a share. Craig-Hallum, HSBC ($8.50 price target), H.C. Wainwright ($18.00 price target), and Roth MKM ($9.00 price target) have maintained Buy ratings on the shares.

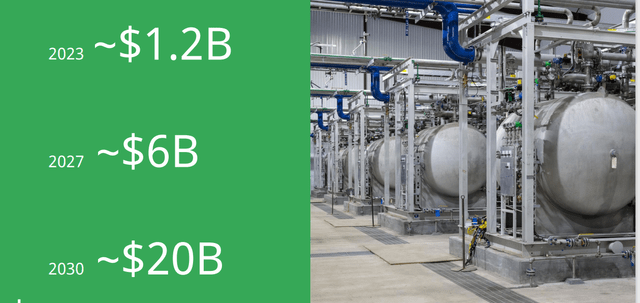

The current analyst firm consensus is that Plug Power will cut losses to a buck a share in FY2024 on $1.01 billion in revenues. They also project an over 50% sales surge in FY2025 and losses to fall to 55 cents a share. There is a large divergence in sales estimates (from just under $900 million to $2.7 billion) in that latter figure, it should be noted.

Build It And They Will Come:

October 2023 Company Presentation

Plug Power has massively increased its production capacity in recent years and will continue to do so. Management is slowing investment in follow-on hydrogen facilities in Texas and New York compared to their projections last October.

October 2023 Company Presentation October 2023 Company Presentation

Management believes that this will usher in a huge era of revenue growth. They certainly have put their money where their mouth is as far as holding onto their equity and not selling at much higher prices. That said, leadership has not been able to hit shorter-term revenue goals and is diluting current shareholders significantly with the consistent use of their ATM facility. Therefore, an investment in Plug Power Inc. is a true leap of faith, and not one I am willing to make at this time.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author’s note: This is your chance to try us out – without any strings attached. Activate your two-week free trial period now and see if The Insiders Forum is right for you.