Summary:

- Starbucks is a highly profitable specialty coffee chain with a strong global presence and a differentiated brand image.

- The company has a wide economic moat due to its pricing power and sticky relationship with customers.

- Despite challenges in the macroeconomic environment, Starbucks continues to generate solid earnings and has a positive outlook for future growth.

- Shares may be up to 38% undervalued given a base-case growth scenario implying 15% YoY EPS growth.

- Buy rating issued.

JohnFScott

Investment Thesis

Starbucks (NASDAQ:SBUX) is a massively profitable specialty coffee chain with a truly global presence. The firm has positioned their coffee shops at the upper-end of the market and has differentiated themselves as the go-to premium choice for consumers.

Even despite the macroeconomic slowdown, Starbucks continues to generate solid earnings data with top-line growth being complemented by solid margin expansion.

Current valuations suggest share are up to 38% undervalued given a base-case scenario. However, while the stock is currently trading at a much cheaper valuation compared to a running 5Y average, significant amounts of growth are still baked-in to the current price.

Nevertheless, I rate Starbucks stock a “Buy” at present time and see a real GARP opportunity in the firm’s shares.

Business Profile

Starbucks Investor Relations

Starbucks is perhaps the most iconic coffee and specialty beverage chain in existence today. With over 38,000 stores across more than 80 countries, Starbucks as a brand has successfully globalized a reputation for providing an up-market coffee experience.

A focus on delivering a premium experience for customers has differentiated the brand from competitors in what is traditionally a highly competitive market.

This up-market theme has been applied to all customer-facing operations ranging from the physical store designs to the coffee beans and all auxiliary products and merchandise.

The rate at which Starbucks has spread their business across the globe is a testament to the relationship the company has managed to curate with its customers.

Starbucks’ Economic Moat

While the restaurant industry is traditionally one of the most competitive and low-margin sectors in existence, I believe Starbucks has managed to develop a wide economic moat thanks to the curation of a superb brand image which provides the firm with real pricing power.

The coffee shop market environment is massively saturated. Traditional local establishments have been challenged over the last 30 years by an onslaught of big-name chain alternatives entering the industry.

Despite large competitors potentially enjoying slightly more lucrative economies of scale compared to smaller rivals, the real issue for players within the market is the lack of switching costs and the ultimately homogenous product of coffee and sweet treats on offer to consumers.

In lieu of these industry characteristics, Starbucks has managed to differentiate themselves from the competition in one critical area: brand image.

By positioning their coffee chains at the upper-end of the market, Starbucks has managed to justify their higher prices by convincing consumers that their products are also of higher quality.

I believe this creates a lucrative offering to potential customers with the chain harboring a luxury appeal similar to that held by the likes of Apple (AAPL) in the consumer electronics industry.

This massive brand appeal generates real pricing power for Starbucks which allows the firm to charge a significant premium for their coffee and treats. Indeed, a 2022 study by CNET found that a Starbucks medium drip coffee cost on average $2.25, over 19% ($0.36) more than at Dunkin’.

Starbucks Menu Update Press Release

Furthermore, I believe Starbucks has also managed to differentiate their menu from those offered by competitors thanks to their focus on specialized drinks and customization. These items further increase both Starbucks’ ability to draw-in customers from rival stores while simultaneously allowing the company to charge an even larger premium for these special beverages.

Considering that even when selling an undifferentiated product such as a drip coffee Starbucks is able to charge a 19% premium over Dunkin’, it should come as no surprise that I view such a powerful pricing power very positively for the firm.

It is ultimately this pricing power that allows Starbucks to generate excess returns on their invested capital and thus achieve superior earnings compared to rivals.

Of course, it goes without saying that the massive brand appeal which the firm has successfully spread across the globe is responsible for this pricing power and ultimately why I believe Starbucks holds a wide and robust economic moat.

Fiscal Analysis

Starbucks is a uniquely profitable company when it comes to the coffee shop sector. With rolling 5Y (FY23-FY19) ROA, ROE and ROICs of 12.20%, 62.00% and 31.44%, Starbucks is quite simply a very profitable and lucrative enterprise.

I particularly like the firm’s 5Y average ROIC of 31.44% given their current weighted average cost of capital (WACC) is just 8.06%. Such a significant margin between the firm’s cost of capital and return on said capital illustrates how critical their ability to charge a premium price for their products really is.

These superb returns are complemented by 5Y rolling (FY23-FY19) gross, operating and net margins of 26%, 13% and 11% respectively which given the industry in which they operate are absolutely wonderful especially considering the detrimental impact COVID-19 had on their operating efficiency in 2020.

One cannot forget that these superb returns and margins have been achieved all the while Starbucks has continued to open around 900 new stores per year.

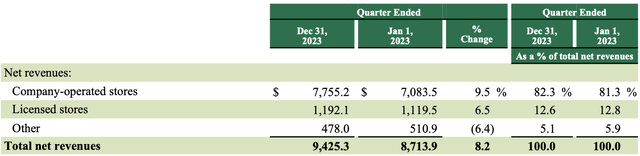

On January 30, 2024 Starbucks reported their Q1 FY24 results which overall were quite positive in my opinion.

Global store sales increased 5% YoY thanks to a mix of solid pricing power leading to a 4% increase in average “ticket” (which can be considered as ‘per customer’) values and a modest 2% increase in total transaction volumes.

The firm’s international segment saw particularly robust transactional volume growth at 11% YoY while Starbucks’ North American market segment saw slightly more muted transactional volume growth at 5% YoY.

Consolidated net revenues were up 8% YoY in Q1 thanks to the solid sales growth achieved by the firm.

China has become one of Starbucks’ most lucrative markets with over 13% of all 590 new stores opened in Q1 located in the republic.

While the firm reports revenues from the Chinese market within its “international” classification, I expect around 20% of total revenues come from the nation given that the firm operates almost 7000 stores in the region.

The U.S. and Chinese markets combined account for 61% of the firm’s global portfolio which illustrates just how much influence these two segments have on Starbucks’ total earnings.

While this solid revenue growth is quite impressive given the convoluted macroeconomic environment in both the U.S. and China, I am even more impressed by the firm’s ability to manage their expenses.

Total operating expenses in Q1 increased just 5.3% YoY as the firm pursued cost savings initiatives aimed at reducing expenses related to the operation of stores and distribution channels.

GAAP operating margins expanded accordingly in Q1 by a whopping 140bp to 15.8%, up from just 14.4% in Q1 FY22.

I view this tangible margin expansion as an illustration of the both the benefits significant pricing power can provide a firm especially during market downturns and the benefits of operational streamlining.

SBUX FY24 Q1 Earnings Summary Leaflet

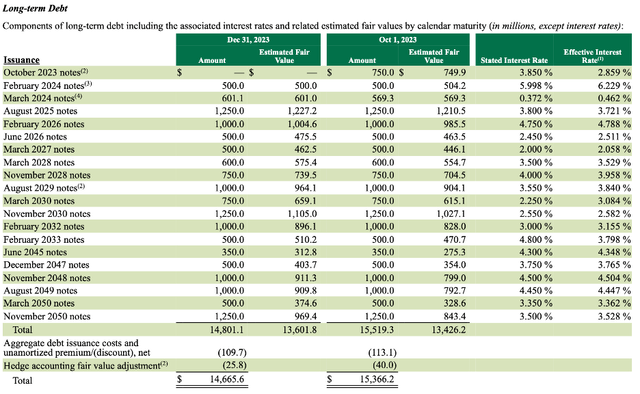

Such great margin expansion and earnings power adds credibility to Starbucks’ “Triple Shot” reinvention strategy which is designed to enhance the company by addressing the three key pillars of brand reputation, digital capabilities and global expansion.

These initiatives represent what I believe is an effective attempt to reinvigorate the brand amidst an increasingly competitive market landscape.

An increasingly omni-channel approach to digital communication and interaction with customers could allow Starbucks to capture a younger generation of customer many of whom are increasingly in search of remote ordering solutions.

Underpinning their entire reinvention strategy is the promise to unlock $3B in savings by FY27 which should allow for significant earnings growth, margin expansion and shareholder value generation.

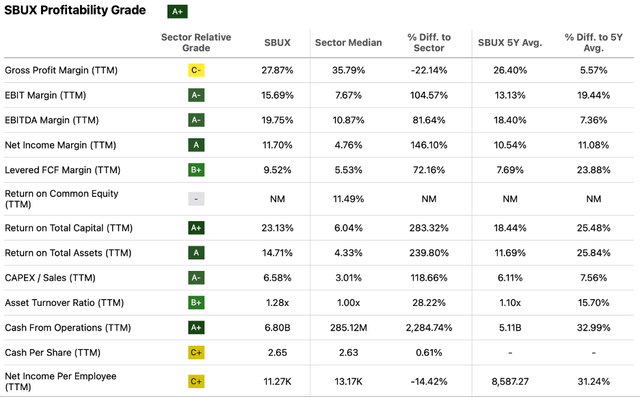

Seeking Alpha | SBUX | Profitability

Seeking Alpha’s quant assigns Starbucks an “A+” profitability rating which I believe perfectly summarizes the firm’s relative and absolute earnings power over both 2023 and the past five years.

Analysis of Starbucks’ balance sheets reveals what I believe to be the result of a mostly sound asset allocation strategy. The firm has $6.57B in total current assets with total current liabilities amounting to $9.4B.

This leaves the firm with a quick ratio of 0.48x and a current ratio of 0.70x. While these ratios may initially appear alarming given the massive imbalance between current assets and liabilities, it is important to consider that Starbucks generated over $3.49B in unlevered FCF in 2023.

Such massive cash flows are excellent to see and provide the firm with significant wiggle room when it comes to financial planning and the financing of their ambitious growth objectives.

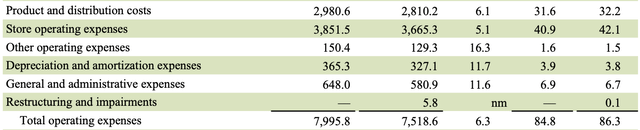

However, this is not to say that the firm has taken excessive risk when it comes to their overall debt burden. At present time, Starbucks has approximately $13.6B in long-term debt with a majority of maturities only occurring post 2029.

I like this conservative and responsible approach to business by Starbucks and view their debt burden as being very well managed.

Indeed, Moody’s credit ratings for Starbucks support my thesis with the firm being awarded a “Baa1” rating for their unsecured domestic papers along with a commercial paper rating of “P-2”. Moody’s classifies these “Baa1” ratings as being of “medium investment grade” while P-2 short-term ratings are considered of medium “Prime” quality.

Finally, it is worth discussing Starbucks’ approach to shareholder returns. Starbucks repurchased $1.27B worth of common stock in Q1 which falls in line with the board authorizing a $40B repurchase plan back in May of 2022.

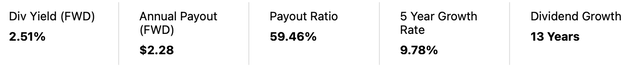

The firm also declared a dividend of $0.57 per share of common stock which extends their dividend growth streak to 13 years.

Seeking Alpha | SBUX | Dividend

Seeking Alpha’s dividend tab on SBUX stock informs us that the firm has a 5Y dividend growth rate of 9.78% which is very healthy along with a FWD expected yield of 2.51%.

Considering the payout ratio of 59.46%, I believe the current dividend is sustainable so long as the firm continues to generate solid top- and bottom-line expansion thanks to the realization of both growth and cost-savings objectives laid out in their reinvention strategy.

Overall, I really like Starbucks as an enterprise. The firm’s economic moat continues to support the firm’s pricing power while a strong brand reputation continues to generate sales volume growth even amidst a difficult macro landscape.

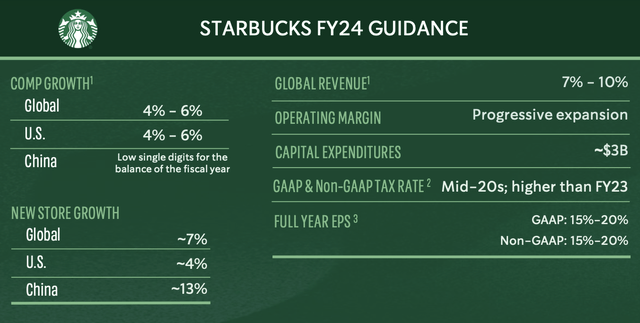

SBUX FY24 Q1 Earnings Summary Leaflet

Management expects the company to generate between 7-10% YoY revenue growth in FY24 along with a progressive expansion of operating margins thanks to continued cost-savings successes. Full-year GAAP EPS estimates suggest between 15%-20% growth.

I believe this guidance is very positive especially given the potential for a recession to hit the U.S. economy in 2024. While the election year may help spur investor and consumer confidence for the short-term, a medium-term slowdown could derail the firm’s ambitious growth prospects and place pressure on total sales.

Valuation

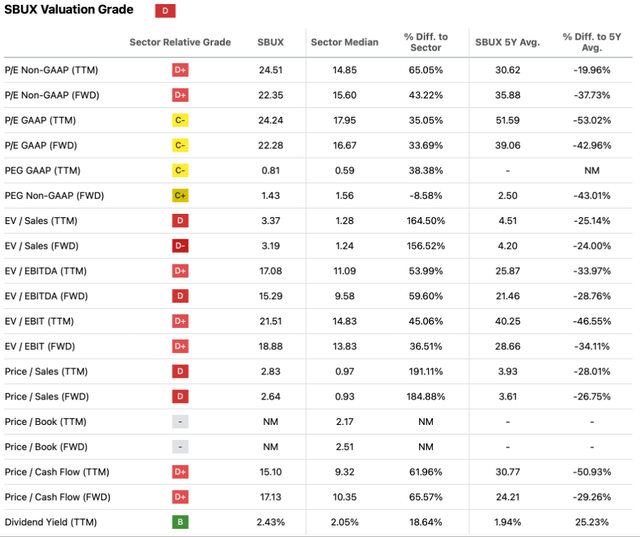

Seeking Alpha | SBUX | Valuation

Seeking Alpha’s Quant calculates a “D” valuation rating for SBUX stock. I am largely inclined to disagree with this evaluation and believe it is excessively pessimistic at present time.

The current P/E GAAP TTM ratio of 24.51x is 20% lower than SBUX’s 5Y average which illustrates just how differently investors currently appear to be pricing Starbucks’ growth potential.

Indeed, the P/S TTM ratio is also down 28% from the 5Y average to just 2.83x as markets seem to have downgraded the growth prospects at Starbucks’, potentially due to the increasingly bearish macroeconomic environment and the threat of a recession limiting expansion.

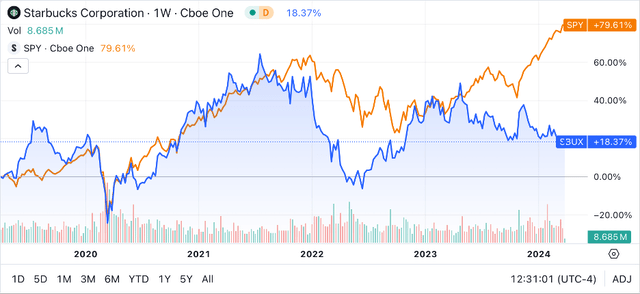

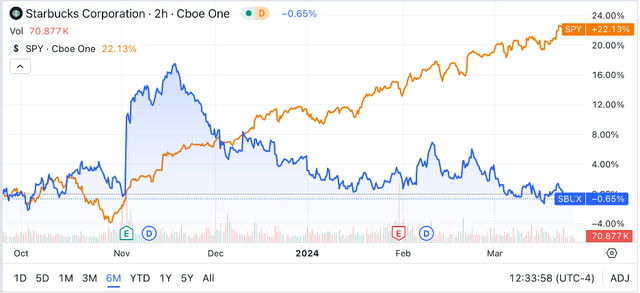

Seeking Alpha | SBUX | 5Y Advanced Chart

SBUX stock has underperformed the greater U.S. market (as represented by the popular S&P500 tracking SPY (SPY) index fund) by over 60% over the last five years. This lackluster performance has come as a result of Starbucks struggling to meet growth expectations along with a post-COVID decrease in demand.

Seeking Alpha | SBUX | 6M Advanced Chart

The last six-months have delivered more of the same for SBUX shareholders as the rally that has gripped the U.S. markets failed to extend to Starbucks stock.

While these returns have been quite poor, I must admit that I believe the market is currently mispricing Starbucks shares as a result of excessive market pessimism surrounding the firm’s ability to return to growth.

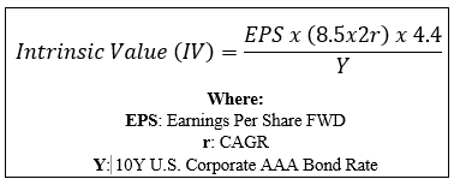

The Value Corner

To gain an objective quantitative perspective of the value present in Starbucks stock, we can use The Value Corner’s Intrinsic Valuation Calculation.

By inputting the current share price of $90.69, a 2024 estimated EPS of $4.06 (in line with the bottom-end of management guidance), a realistic “r” value of 0.16 (16%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 5.03%, I derive a base-case IV of $143.80 per share. This represents a substantial 37% undervaluation in shares.

Using a bear-case CAGR value for r of 0.06 (6%) to reflect a scenario where a recession results in muted top-line growth and limited operational improvements generates an IV of just $72.80. This suggests a significant 25% overvaluation in shares and illustrates just how reliant current valuations are on Starbucks achieving significant double-digit growth in the coming years.

In the short term (3-12 months), I find it hard to forecast a direction for SBUX stock. While positive earnings in Q2 may reinvigorate investor confidence in the stock, any recessionary macro indicators may place further downward pressure on shares.

In the long-term (2-10 years), I believe Starbucks will continue to enjoy the competitive advantages arising from their wide economic moat. A robust global presence and continued brand strength should allow the firm to expand their operations even further and enter into new markets which could present significant growth opportunities to the company.

Starbucks Risk Profile

Starbucks is exposed to two primary risks: a cyclical market environment and the threat of a degraded brand image.

The restaurant industry as a whole is highly cyclical with earnings and growth being largely dependent on the overarching macroeconomic conditions. During recessionary periods, consumers will become more conservative with their pocketbooks as a result of decreased real incomes.

This reduces their willingness and ability to spend cash on non-essentials such as eating out or getting a coffee.

While Starbucks’ superb branding and extensive relationship with consumers may make their business model slightly less cyclical than more undifferentiated competitors, I still see the company facing declining sales and muted growth in a recessionary macroeconomic scenario.

I also believe that the coffee chain is not immune to a degradation in their image reducing their pricing power and resulting in a weakened economic moat. The potential for branding mishaps or simply a change in consumer tastes and preferences could decrease the demand and appeal of Starbucks products which would in turn result in decreased pricing power for the firm.

From an ESG perspective, Starbucks faces some real risks arising from recent high-profile clashes with their workforce.

Starbucks has become entwined in accusations that the firm allegedly violated labor laws and has an anti-union agenda. While the firm denies all claims of labor violations and maintains that they accept unionization, Starbucks has previously come under pressure from allegations of worker mistreatment and poor working conditions.

These societal concerns have potential to do real damage to the Starbucks image. Since its founding the firm has conveyed a responsible corporate image which I believe forms a key element of the firm’s entire brand image.

While Starbucks has always been an advocate for responsible consumerism and has allowed customers to utilize their own personal reusable cups and mugs at stores since 1985, the chain undeniably has work to do when it comes to dealing with unionization and labor relations matters.

Considering these business and ESG concerns, I rate Starbucks as having a medium risk profile and due to the issues with labor relations, and do not recommend the firm as a candidate for a more ESG conscious investor.

Of course, opinions may vary and I implore you to conduct your own business risk, ESG, and sustainability research before investing in SBUX if these matters are of concern to you.

Summary

Starbucks is a superb enterprise which has managed to carve-out a robust economic moat in what is otherwise a hugely competitive and low-margin industry.

The most recent Q1 earnings highlight the progress the firm has made in their reinvention strategy with significant cost savings and solid topline growth being achieved despite a tricky macro landscape.

Current valuations suggest shares are trading in real deep-value territory should their growth match both management and analyst forecasts.

However, it is important to note how reliant even the current valuation is on at least 10% YoY EPS growth with a bear-case 6% scenario implying an overvaluation in shares.

Considering these factors, I rate Starbucks as a “Buy”, and see the company’s shares as potentially being a lucrative GARP opportunity at the present time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and do not solicit any content or security. The opinions expressed in my articles are purely my own. My opinions may change at any time and without notice. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.