Summary:

- Merck’s FDA approval of Winrevair for PAH treatment follows its $11 billion acquisition of Acceleron Pharma.

- Winrevair, targeting the TGF-beta pathway, promises to improve exercise capacity and reduce clinical worsening in PAH patients.

- With peak revenue projections of $2 to $3 billion, Winrevair is poised to become Merck’s seventh blockbuster drug.

- Recommendation: Hold Merck shares, considering potential revenue from Winrevair against risks like patent cliffs and competitive pressures.

Morsa Images/DigitalVision via Getty Images

Merck’s High-Pressure Win: Winrevair Breathes New Life into PAH Treatment

Back in 2021, Merck (NYSE:MRK) acquired Acceleron Pharma for $11 billion. The deal centered around Acceleron’s pulmonary arterial hypertension [PAH] asset, sotatercept (Winrevair). PAH is a progressive disease characterized by high blood pressure within the arteries of the lungs, often leading to heart failure and a reduced life expectancy. Winrevair utilizes a novel therapeutic approach for PAH in that it acts on the transforming growth factor-beta (TGF-beta) pathway, reversing vascular remodeling in the lungs. On Tuesday, the FDA approved Winrevair “for the treatment of adults with pulmonary arterial hypertension (PAH, WHO Group 1) to increase exercise capacity, improve WHO functional class and reduce the risk of clinical worsening events.” Merck’s stock traded up 4.6% in after-hours trading—a $14 billion rise in market capitalization. So, clearly, investors have high expectations for Winrevair, and I believe they are right in doing so.

Current treatments for PAH include prostacyclin pathway agonists (e.g., Uptravi, treprostinil), nitric oxide-guanosine monophosphate enhancers (e.g., sildenafil), and endothelin receptor antagonists (e.g., ambrisentan). PAH patients are divided into groups (e.g., Group 1, estimated to affect 44.5% of PAH patients, refers to cases that are not attributed to other causes like heart disease, lung disease, or blood clots) and functional classes (e.g., no limitation of activity, slight limitation, marked limitation, and severe limitation). PAH is rare and estimated to impact “15 to 50 persons per million within the United States and Europe.” Assuming a lower end of that range (25 persons per million), this gives us an estimate of 25,000 US and European patients. Nearly 12,500 of them have Group 1 PAH. PAH is also deadly. The survival rate after 5 years has been estimated to be just 54%. Subsequently, drugs approved for PAH can demand higher prices.

Johnson & Johnson’s (JNJ) Uptravi, approved in late 2015, which is typically the third drug added to regimens (PAH often requires two or three medications), procured $1.58 billion in global revenue in 2023. Given Winrevair’s unique disease-modifying mechanism of action, as well as the severity and chronic nature of PAH, it is reasonable to estimate that it will generate at least $2 to $3 billion in peak annual revenue. This is significant for Merck, as Winrevair is expected to become their seventh or eighth blockbuster drug, following others like Keytruda ($6.6 billion in Q4 2023 revenue), Gardasil ($1.871 billion), Januvia ($787 million, down 13% year on year), Proquad/Varivax ($545 million), Bridion ($429 million), and Lynparza ($315 million).

Looking at the bigger picture, Merck’s fourth-quarter sales totaled $14.63 billion, a 6% increase from the previous year. 2023 sales totaled $60.115 billion. Net income was much lower in 2023 ($337 million compared to $14.5 billion) as Merck more than doubled its research and development investments ($13.548 billion to $30.531 billion).

Financial Health

According to their annual filing (10-K), Merck had $6.841 billion in cash and cash equivalents as of December 31. Current assets totaled $32.168 billion, while current liabilities equaled $25.694 billion. Merck’s current ratio is ~1.28. So, they have a reasonable cushion to cover short-term liabilities. Merck’s long-term debt totals $33.683 billion, which is an increase from $28.745 in the previous year.

After adjusting for acquisition charges (e.g., Prometheus Biosciences), which are considered investing activities, and non-cash expenses, Merck’s net cash provided by operating activities of continuing operations totaled $13 billion.

Merck is clearly investing for the future, much thanks to Keytruda’s massive cash infusions. It’s been noted that Keytruda’s key patents expire in 2028, which could open the floodgates for generic biologics and threaten 1/3 of Merck’s revenues. As expected, Merck will fight tooth and nail to extend Keytruda’s life. For example, they are developing a subcutaneous version of Keytruda.

For now, Merck appears financially healthy, with the ability to meet their debt obligations.

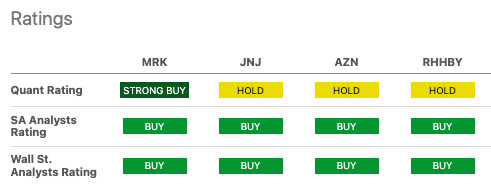

Peer Comparison

Seeking Alpha

Merck’s ($317 billion market capitalization) stock is significantly outperforming its peers, with a price return of 22% within the past year. Johnson & Johnson (JNJ) ($375 billion) and AstraZeneca (AZN) ($204 billion), to contrast, have returned 2% and -1%, respectively, during the same period. MRK, JNJ, AZN have dividend yields of 2.45%, 3.06%, and 2.97%, respectively. So, they attract income-focused investors. All three are valued reasonably, with P/E ratios of 14.6 for MRK and JNJ and 16.4 for AZN. Forward revenue growth estimates pin MRK at 4.66%, JNJ at -1.44%, and AZN at 7.7%. For some context, both AZN and JNJ fight COVID comps, but AZN has managed to overcome this due to robust oncology growth (up 23% year over year). Of the three, Merck appears to have the most leverage (96% debt-to-equity ratio, 32.4 debt/free cash flow). Therefore, it is the riskiest of the three and, subsequently, demands higher expected returns.

My Analysis and Recommendation

Winrevair is a welcome addition to PAH sufferers and Merck’s bottom line. In it, Merck is very likely to have another blockbuster drug. This is crucial given the uncertainty beyond 2028 for Merck’s lead asset, Keytruda. Merck’s $11 billion acquisition of Acceleron, in hindsight, appears like a solid move considering Winrevair, a biologic, figures to procure as much as $30 billion of revenue during its 12 years of market exclusivity. While this will soften the blow of Keytruda’s assumed decline later this decade, Merck will have to win on other investments as well to continue to outperform its peers. For now, Merck remains a solid Hold in most investors’ portfolios, as it is reasonably priced and has reasonable growth prospects in the next few years, and investors may benefit from adding shares on price dips. Idiosyncratic risks for Merck include PAH competitive risks, patent cliffs (e.g., Keytruda), and financial risks (e.g., relatively higher reliance on debt). As always, investors can mitigate idiosyncratic risks by deploying a diversified and robust portfolio.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article aims to offer informational content and is not meant to be a comprehensive analysis of the company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions expressed herein about clinical, regulatory, and market outcomes are those of the author and are rooted in probabilities rather than certainties. While efforts are made to ensure the accuracy of the information, there might be inadvertent errors. Therefore, readers are encouraged to independently verify the information. Investing in biotech comes with inherent volatility, risk, and speculation. Before making any investment decisions, readers should undertake their own research and evaluate their financial position. The author disclaims any liability for financial losses stemming from the use or reliance on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.