Summary:

- Meta Platforms is a leading social media company that owns Facebook, Instagram, WhatsApp, Messenger, etc.

- Meta has invested $9.4 billion into the Metaverse in the trailing 9 months, but these bets may not be as crazy as they seem.

- The company has not monetized WhatsApp yet, a platform with over 2 billion monthly active users.

- Its stock is deeply undervalued intrinsically, according to my discounted cash flow model.

Thinkhubstudio

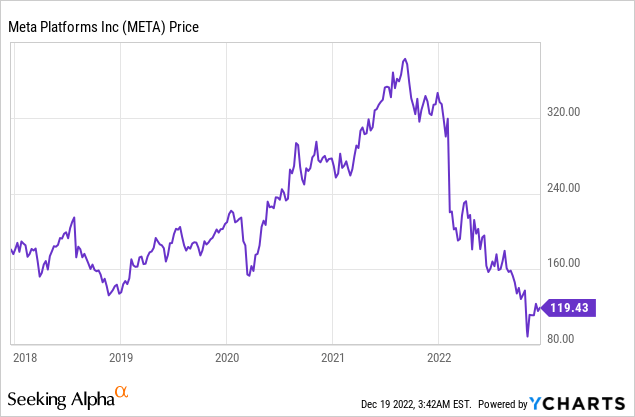

Meta Platforms (NASDAQ:META), formerly known as Facebook, is a leading social media giant which owns Facebook, Instagram, WhatsApp etc. The company is currently facing a series of headwinds such as slowing user growth, increasing competition (TikTok), and a tepid market for advertising. This has resulted in Meta’s stock price getting butchered and it is now down 68% from its all-time highs in August 2021. To put things into perspective, Meta trades at a similar price to 2016, yet its revenue has ballooned by over four times from $27.6 billion to $118 billion over that period. I believe it is “ridiculous” for the stock to trade at such a low multiple. In this post, I’m going to break down the reasons why, its valuation, and Metaverse investments. Let’s dive in.

The Reality of the Metaverse

Meta Platforms has been criticized by many investors for its plans to “waste”, billions of dollars on the “Metaverse”, an unproven VR/AR concept. However, this is a misperception, to say the least. In a recent interview at the New York Times Event, in December 2022, Zuckerberg clarifies the concerns. In the short term, he plans to operate the company with “discipline and rigor” while still focusing the majority of his time on the core “Family of Apps” such as Facebook, Instagram, etc. Zuckerberg states that “80%” of Meta’s investments go toward its core social media apps. Therefore, the perception that Zuckerberg is “betting the company” on the Metaverse is actually false. The remaining 20% of Meta’s investment goes towards “Reality Labs”, which also includes the world’s most popular VR brand Oculus. Therefore, this also debunks the myth that all of the VR investments are “unproven”.

Oculus VR headset facial expressions (Meta Connect)

We can also reason that the Metaverse is really just a more immersive social media platform and therefore not really “unrelated” as many investors and analysts on Wall Street think. Web 1, was traditional search engines and blog posts, Web 2 was the social media revolution and now Web 3 is the next step, a more immersive platform. Zuckerberg points out that we spend most of our time “looking at screens” anyway, so it might as well be more immersive and with a real “feeling of presence”, I personally can’t argue with this logic. In addition, there could be many strategic benefits from moving away from the smartphone form factor, as Apple (AAPL) is effectively the gatekeeper. Apple has ~55% of the U.S. smartphone market and collects 30% of all in-app revenues, which is substantial. Later in this post, I will discuss the R&D investments for the Metaverse and why it is not as bad as many think.

Zuckerberg Photo Realistic Avatar (created by author, Meta Connect day.)

Financial Analysis

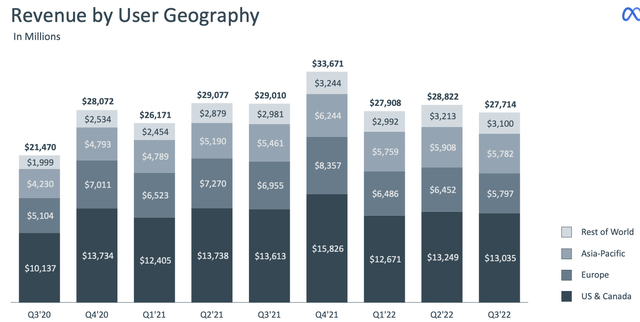

Meta generated tepid financial results for the third quarter of 2022. Revenue was $27.7 billion, which actually declined by 4% year over year. This may seem terrible at first glance, but this metric still surpassed analyst estimates by $313.8 million. A strong dollar caused unfavorable FX headwinds, thus on an FX-neutral basis, revenue actually increased by 2% year over year, which is an extra $1.79 billion added to the top line. Also if we take a step back, Meta has just come off a huge revenue boost as its revenue increased by 35% year over year, between Q3 2020 and Q3 2021. In addition, its Reels platform, which is competing with TikTok, offers low advertising rates as it is still being optimized. This trend is expected with any new platform and YouTube with its “Shorts” format has also reported a similar trend. Ironically, the more people that consume “Reels” versus other post types, the less revenue the company will make, at least in the short term. By region, U.S. revenue looks to have been the hardest hit, declining by 4.15% year over year. While Asia-Pacific revenue actually increased by 5.9% year over year.

Revenue by Geography (Q3 2022 report)

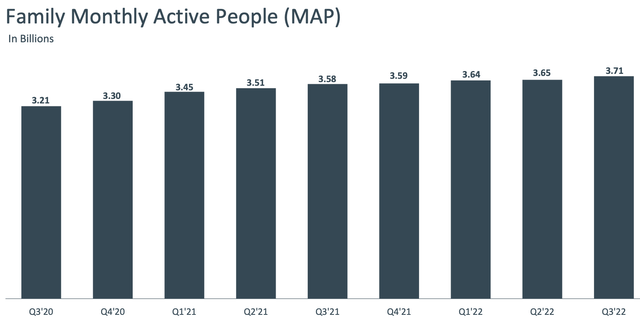

A positive for Meta is the lockdown of 2020 caused an acceleration in the adoption of digital technology. I personally have found myself to be using social media apps more in 2020 and still use these applications more than pre-pandemic levels. Of course, I am just a sample size of one person, but feel free to comment below on your own social media usage trends below. Meta’s own data confirms my personal trend, with 3.71 billion Monthly Active People [MAP] using its platforms in Q3 2022. This is an increase of 3.6% year over year and 15% higher than in Q3 2020. This is a positive sign as it shows the real issue isn’t users, but a tepid advertising market and the monetization of Reels.

Family of Apps Monthly Active People (Q3 2022 report)

WhatsApp is the Secret Weapon

A key point to mention is Meta has not monetized WhatsApp yet, a chat platform with over 2 billion monthly active users. Zuckerberg confirmed in the aforementioned interview, this was his next short-term plan to bring in extra revenue. I have a few ideas for how Meta could monetize this; for example, the company could introduce a premium service, purchased on a monthly subscription. Even if this only cost $2/month, and 25% of people signed up that would equal an extra $1 billion. Alternatively, the company could run advertisements or do both. However, Meta must be cautious with this, as WhatsApp doesn’t have the strong network effects Facebook/Instagram has, thus it is has a low barrier entry to the competition. For example, Telegram is a popular messaging app that many people use for groups and also to send large files, this app is free and could easily replace WhatsApp if Meta forces people to pay.

Profitability and Expenses

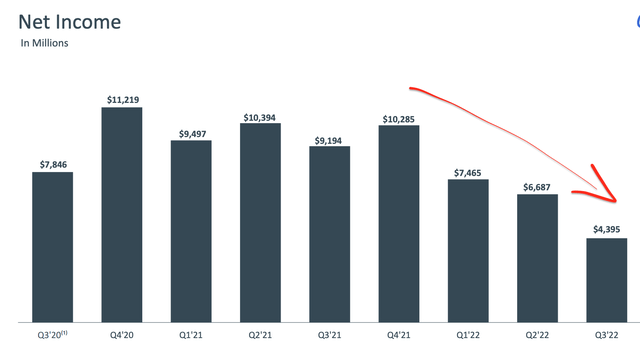

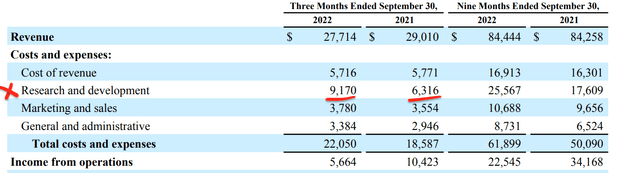

Meta reported a $4.395 billion in net income which declined by an eye-watering 57% year over year. This was driven by a 19% increase in costs and expenses, which rose to $22.05 billion in Q3 2022. This was eye-watering but did include a one-off impairment loss of $413 million related to office space, as the company streamlines its operations. In addition, we have the tepid advertising market, Reels monetization issues, and of course heavy investments. The lower earnings have got analysts worried, but Zuckerberg did clarify that many of these investments were planned in 2020 when the outlook was strong.

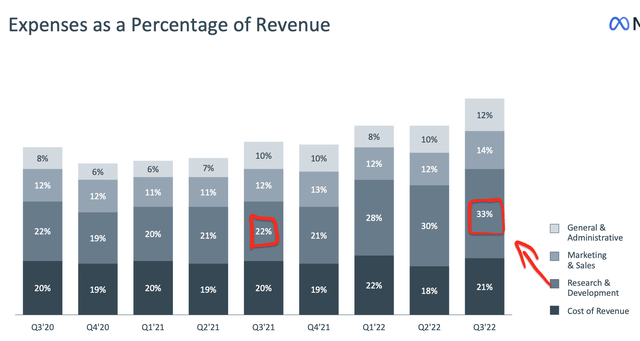

Breaking down the expenses in more detail, Meta’s Research & Development [R&D] expenses have risen as a portion of revenue from 22% in Q3 21 to 33% in Q3 2022.

Expenses as a portion of Revenue (Q3 2022 report)

Analyzing R&D expenses by numbers, Meta reported $9.17 billion in Q3 2022, which has increased by 45% year over year. I believe as revenue growth declined, these R&D expenses became more obvious (in a negative way).

Meta Expenses (Q3 2022 report)

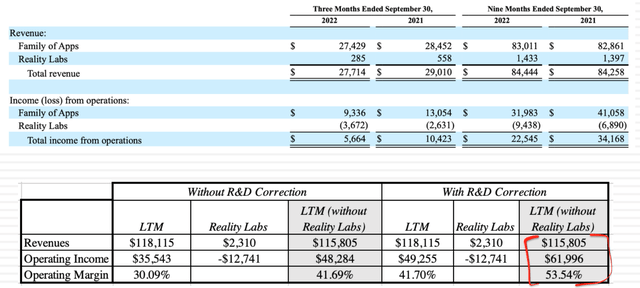

If we dive deeper into these investments, Meta reported $12.7 billion in Reality Labs “operating expenses” in the last twelve months. However, as these are actually “capital expenses” which are expected to have a future payoff, we can “capitalize” these expenses. Therefore, Meta’s operating income actually jumps to $61.996 billion at a 53.54% operating margin. This is outstanding given the average operating margin for the software industry is approximately 23%.

Meta Reality Labs Capitalized (Aswath Damodaran )

Credit: I would like to give credit to the fantastic Professor Aswath Damodaran for his accounting analysis and thinking.

Meta also has a robust balance sheet with approximately $41.78 billion in cash, cash equivalents, and marketable securities. In addition, the company has $9.92 billion in long-term debt and Meta bought back $6.55 billion in stock in Q3 2022.

Advanced Valuation

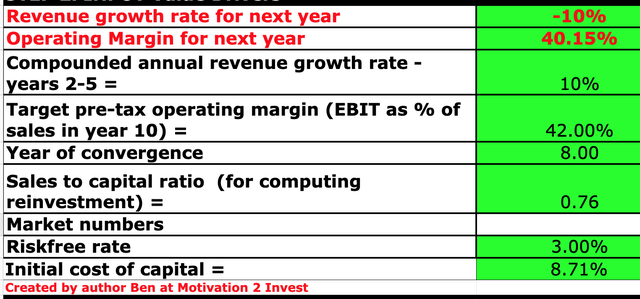

To value Meta, I have plugged its financial details into my discounted cash flow valuation model. I have forecasted its revenue will decline by 10% next year which is extremely pessimistic and based upon a recession and a further fall in advertising spending. However, in years 2 to 5, I have forecasted a small recovery with revenue increasing by 10% per year.

Meta stock valuation 1 (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation, I have capitalized the company’s R&D expenses, as discussed prior which has lifted net income to 40.15%. I could easily execute the Reality Labs’ capitalization of its $12.7 billion in expenses, which would further increase the operating margin to 53.54%. However, to be conservative, I will just capitalize its R&D expenses.

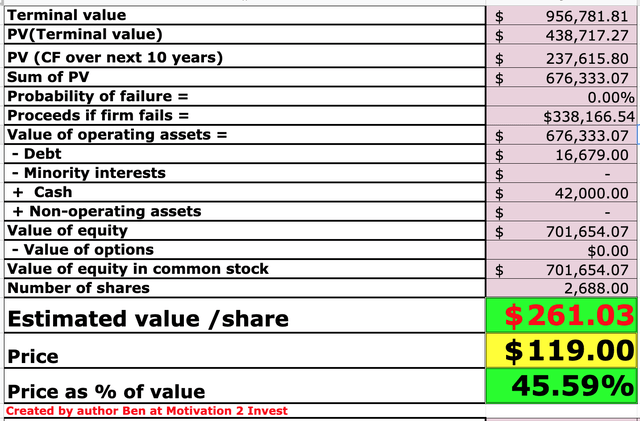

Metaverse stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $261 per share, the stock is trading at ~$119 per share at the time of writing and thus is ~54% undervalued.

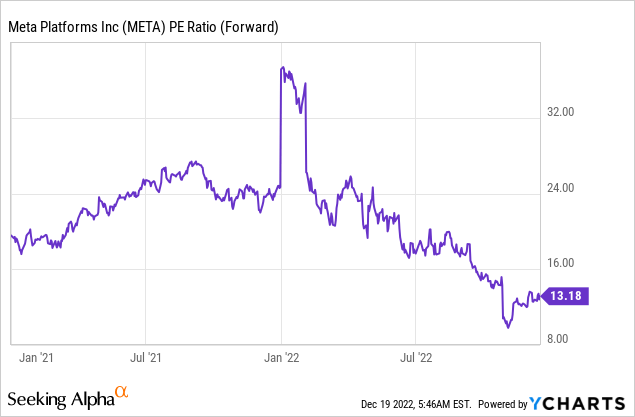

As an extra data point, Meta trades at a P/E ratio = 13, which is 45% cheaper than its 5-year average.

Risks

Competition

Meta Platforms still leads the social media landscape, but it is not as dominant as in previous years. TikTok is expected to reach 1.8 billion monthly active users by the end of 2022, which is fast approaching Instagram’s 2 billion monthly active users. Then we also have Artificial Intelligence such as ChatGPT by OpenAI, which could disrupt the landscape. In addition, Elon Musk has recently announced plans to introduce better video on Twitter, which could then compete with Instagram and TikTok.

Recession/Lower Advertising Spend

As mentioned prior, many analysts have forecasted a recession and we are going through a downturn in the advertising market. A positive is the advertising market has historically been cyclical and thus a rebound in the future is likely.

Final Thoughts

Meta Platforms is currently facing a series of headwinds, but the company is still in a strong leadership position with a plethora of addictive products. As the advertising market recovers so should Meta’s revenue and the monetization of WhatsApp could also give the platform a huge boost. The stock is undervalued intrinsically at the time of writing and relative to historic multiples and thus could be a great long-term investment.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.