Summary:

- PayPal’s stock price has dropped significantly since its peak in 2021, but this does not reflect its future potential and first-mover advantage.

- PayPal’s competitive advantage lies in its extensive value chain and ability to seamlessly integrate new innovations.

- The appointment of Alex Chriss as CEO, the potential for lower interest rates, and the acquisition of Paidy position PayPal for growth and increased revenue.

Editor’s note: Seeking Alpha is proud to welcome MS Research as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Editor’s note: Seeking Alpha is proud to welcome MS Research as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Justin Sullivan

Thesis

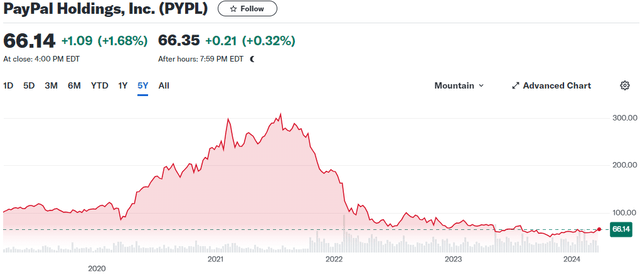

PayPal Holdings, Inc. (NASDAQ:PYPL) is a platform that enables payments for consumers and merchants through digital and mobile channels worldwide. The graph below shows PayPal’s stock price peaked in 2021, at $308.53 and plunged 80% since then. As of March 20, 2024, PayPal Holdings is priced at $65.05 per share with a market cap of $69.72 billion. The company’s low stock performance does not reflect the future of PayPal or its first-mover advantage which solidifies its hard-to-replicate business model. It also does not reflect the inherent growth within the transaction and payment processing services sub-industry. Therefore, investors are left wondering what is next as Alex Chriss replaced Dan Schulman as CEO on September 27, 2023. As Chriss takes the helm, I believe he will accelerate growth, prove margins have bottomed, and enter a possible lower interest rate environment with rigor.

Company Overview

PayPal Holdings’ goal is “to enable consumers and merchants to manage and move its money anywhere in the world, anytime, on any platform, and through any device.” The company enables this value proposition through digital and mobile payments that consumers and merchants can utilize around the world.

PayPal developed a core software product that enables a two-sided network where consumers and merchants have PayPal accounts. Its primary source of revenue is derived from the fees from completing payment transactions and it makes up 90%+ of its net revenues. The other 10% of net revenue is sourced through fees from subscriptions, interest on PayPal loans and credit, and interest on account balances.

PayPal’s value proposition for consumers reduces the difficulty of payments and money transfers between friends and family. The only fees initiated are fees for foreign currency exchange.

PayPal’s value proposition for merchants provides an end-to-end payment solution that provides security, authorization, and settlement. PayPal’s easy-to-use platform, a fast onboarding process with no recurring fees for standard service, allows merchants to accept payments through various outlets such as PayPal, Visa (VISA), Mastercard (MA), Apple Pay (AAPL), etc. This service is PayPal’s bread and butter as merchants experience higher conversion rates, contrary to abandoned carts, as consumers respond well to the PayPal experience.

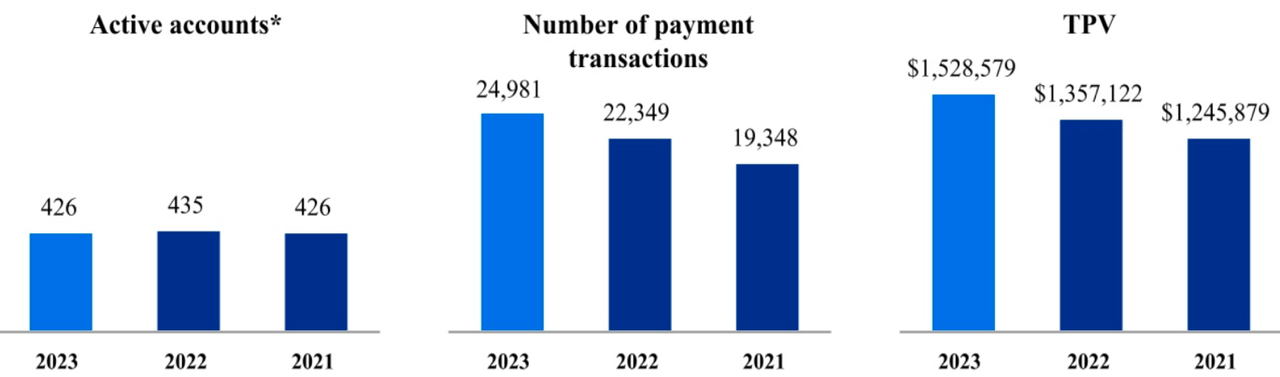

Therefore, PayPal aims to solidify this product offering by growing its market share through consistently growing its active users. PayPal is also pursuing partnerships and has already partnered with companies like Uber (UBER) and Meta Platforms (META). As of year-end 2023, PayPal facilitated global commerce by providing end-to-end payment solutions for roughly 426 million active customers. The 426 million active users spanned over 200 markets. The total addressable market includes close to all retail shopping channels, peer-to-peer and remittances, cross-border payments, domestic non-cash payments, and digital consumer financial services. However, PayPal will not be able to target all these markets and is consistently focusing on peer-to-peer and merchant transactions.

Competitive Advantage

PayPal is the first mover in the industry and was founded in 1998. Throughout PayPal’s history, it evolved from an online checkout channel to providing financial services such as digital wallets, money transfers, loans, fraud management, and credit card security. This was accomplished through in-house development, with extensive build time, and acquisitions. Its business activities evolved over decades and became synergies that seamlessly integrated into one another. I view the synergistic value chain as PayPal’s core competitive advantage. I believe this because a competitor will not easily be able to build all the competencies PayPal has.

The difficulty of replicating the business activities within a value chain is not only theorized through Michael Porter, a Harvard professor, but is exemplified through JPMorgan’s (JPM) attempt at penetrating the end-to-end payment solution industry. The Chase Pay app, a product of JPMorgan, was launched in 2016. It was a new digital wallet payment provider and initiated payments for consumers through a smartphone app. However, the Chase Pay app was completely discontinued in 2021. This is despite JP Morgan’s extensive knowledge, dominance, and capital investments within the financial services sector. JPMorgan challenged PayPal and its competitors and failed to compete. JPMorgan’s failure solidifies the understanding that end-to-end payment solutions have high barriers to entry while also suggesting low customer churn.

Low customer churn is a result of the conveniences PayPal offers its customers. I believe PayPal’s first mover advantage, extensive synergistic value chain, and ability to innovate on customer demands differentiates PayPal from its competitors. For example, due to customer’s demands, PayPal integrated cryptocurrencies into its digital wallets. This is attributed to higher active users and revenue growth. Furthermore, as customer demands evolved, PayPal integrated buy now, pay later services. PayPal’s capability to seamlessly integrate new innovations without disrupting or cannibalizing its business activities is a differentiating factor that will allow it to continue to strengthen its product offerings. I view this as attributable to its first-mover advantage.

Therefore, as the markets continue to evolve, I believe PayPal’s specialization in end-to-end payment solutions will continue to foster a competitive position in the digital payments industry. I view this to be the reason PayPal has the second-highest market capitalization, fourth-highest return on equity, and third-lowest long-term debt-to-capitalization ratio against its peer groups like Affirm (AFRM), Block (SQ), Euronet Worldwide (EEFT), and Fidelity National Information Services (NYSE: FIS).

Catalyst

Alex Chriss replaced Dan Schulman as PayPal CEO

Chriss had unanimous support from PayPal’s board, Dan Schulman, and the CEO search committee after extensive evaluation of key metrics that are critical in fostering PayPal’s success. Chriss is a highly seasoned professional who brings leadership and experience immersed in technology and product development. Previously, he served as Executive Vice President and General Manager of Intuit’s Small Business and Self-Employed Group.

Chriss is an exciting hire for PayPal because he has shown success in growing Intuit’s revenue at a CAGR of 23% over the last five years and led INTU’s $12 billion acquisition of Mailchimp. He enabled Intuit to deliver QuickBooks and Mailchimp to millions of users around the world. This led Intuit to become a market leader in end-to-end customer growth engines and platforms for small and mid-market companies and entrepreneurs.

It is evident Chriss is a leader within the small business and self-employed sector. His expertise can be translated to further develop PayPal’s competitive advantage. I believe Chriss is well positioned because his experiences convey a deep understanding of PayPal’s value proposition tailored towards customers, corporate development, technology, and product development.

Chriss, as CEO, will enable PayPal to continue to innovate alongside a seasoned technology and product development expert. As mentioned previously, PayPal only focuses on peer-to-peer and consumer retail purchases, which is a sub-section of the approximate total addressable market of $110 trillion, which PayPal highlighted during its 2021 Investor Day. Therefore, I view Chriss as an exciting hire because it enables PayPal to take advantage of innovations within the broader industry while also competitively expanding existing and new product offerings.

Higher for Longer Interest Rates or Soft Landing

2022 and 2023 were high interest rate environments with the FED enacting monetary tightening policies. There were interest rate hikes spanning from March 2022 to July 2023. The high-interest rates and inflationary pressures had negative impacts on PayPal, as most of PayPal’s revenue depends on consumer’s discretionary purchase activity. PayPal will feel the pain when consumers cut back on spending. This explains PayPal’s much slower growth rates of 8.2% in 2022 and 8.1% in 2023.

Unfortunately, the start of 2024 interrupted the trend of declining inflation with stronger-than-expected economic and labor market data and inflation readings. However, the FED is not suggesting more interest rate hikes. its guidance reveals a higher for longer interest rate environment or interest rate cuts in the latter half of 2024. In either scenario, PayPal is still poised to experience revenue growth. An average YoY growth of 8.15% throughout 2022 and 2023 still represents a 22% increase in payment transactions since 2022.

I believe PayPal’s revenue growth will be hindered in a higher longer interest rate environment, but it will not be stifled. Furthermore, a macroeconomic environment with rate cuts will further bolster its revenue growth and allow PayPal to begin returning to average historical YoY revenue growth rates.

Acquisition of Paidy for $2.7 Billion

Paidy is a Japanese buy now, pay later firm that offers payment services for both consumers and merchants. Like PayPal’s existing product portfolio, Paidy enables safe purchases for consumers and provides merchants with key performance indicators, higher conversion rates, order values, and repeat purchases. As a result, Paidy will seamlessly solidify PayPal’s data intelligence and Asian strategic expansion. It’s a strategic play that advances PayPal’s non-credit card deferred payment infrastructure, which will bolster new cash flows by offering alternatives to credit cards.

Within the broader industry, the buy now, pay later market is expected to reach $3.9 trillion by 2030 with a CAGR of 45.7%. I see a vast opportunity for growth as only 30% of transactions in Japan are non-cash based and Japan possesses the third largest e-commerce market globally. Furthermore, the desire for flexible payments can be accelerated through growing e-commerce, a reflation environment, and the inclusion of Millennials and Gen-Z in the economy. Therefore, I believe it makes sense for PayPal to acquire Paidy to build a competitive advantage against Square, Mastercard, and Visa.

Financials

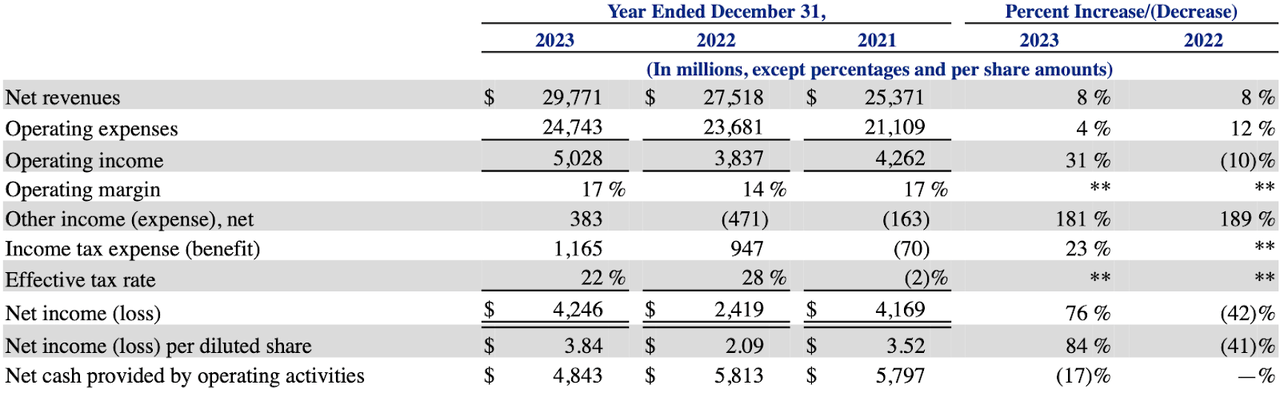

As shown in the table below. PayPal’s net revenues increased by $2.3 billion, or 8%, compared to 2022. This revenue growth was primarily driven by a total payment volume of 13%. Operating expenses increased $1.1 billion, or 4%, compared to 2022 due primarily to transaction expense increases, partially offset by reductions in sales and marketing expenses, restructuring and other, and technology and development expenses. Operating income increased $1.2 billion, or 31%, in 2023 compared to 2022. PayPal’s operating margin was 17% and 14% in 2023 and 2022 respectively. This positively reflects PayPal’s operating efficiencies.

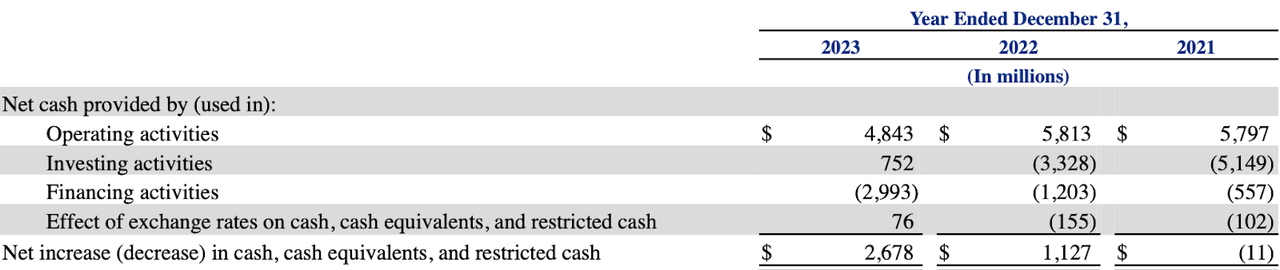

The net cash provided by operating activities of $4.8 billion in 2023, as shown in table below, was primarily due to operating income of $5 billion and adjustments for non-cash expenses.

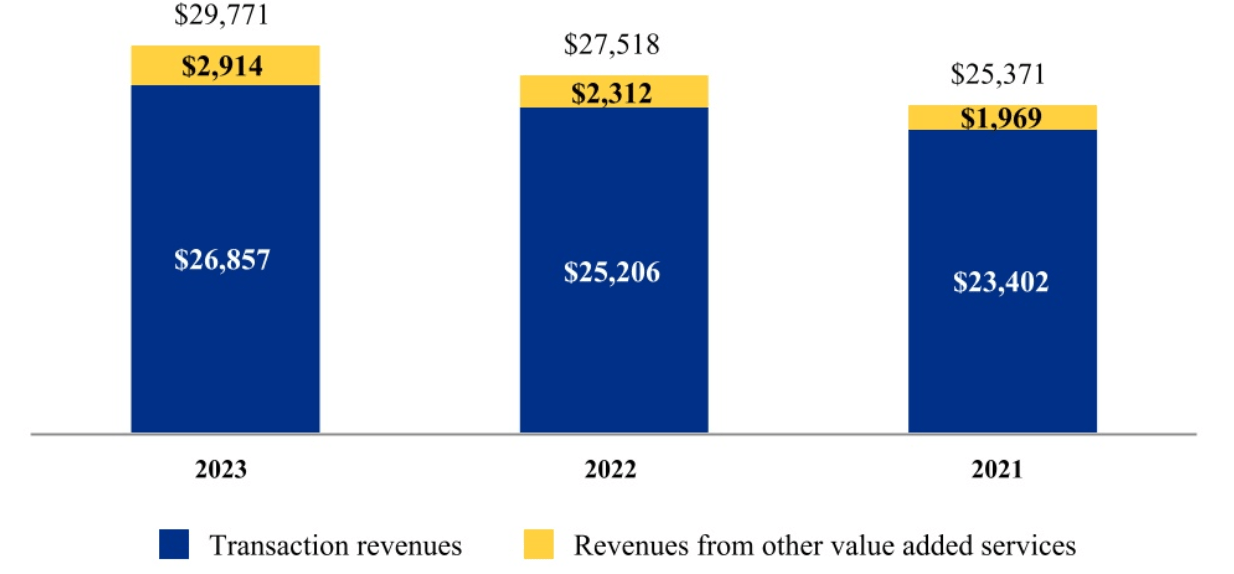

Most of PayPal’s revenue is attributed to understanding three performance metrics, which are the total value of payments, number of payment transactions, and active accounts. The graph below represents the respective key metrics for the years ended December 2023, 2022, and 2021.

As shown in the graph above, PayPal’s revenue growth is primarily driven by PayPal’s transaction revenues, as it grew $1.7 billion in 2023, or 7%, in comparison to 2022.

Beyond PayPal’s competencies in its core business, I believe that its financial position reflects its ability to compete effectively. I view its strong balance sheet and cash flow generation to be another competitive advantage. At the end of December 2023, PayPal had a net cash position of $14.06 billion and free cash flow generation of $2.7 billion. Therefore, I believe its financial position is attributed to its market dominance. PayPal’s revenue will continue to grow against its peer group because PayPal can expand its total addressable market through organic reinvestments or acquisitions. This is exemplified through its $2.7 billion dollar, mostly cash, acquisition of Paidy.

Valuation

Revenue Growth Rate Projections

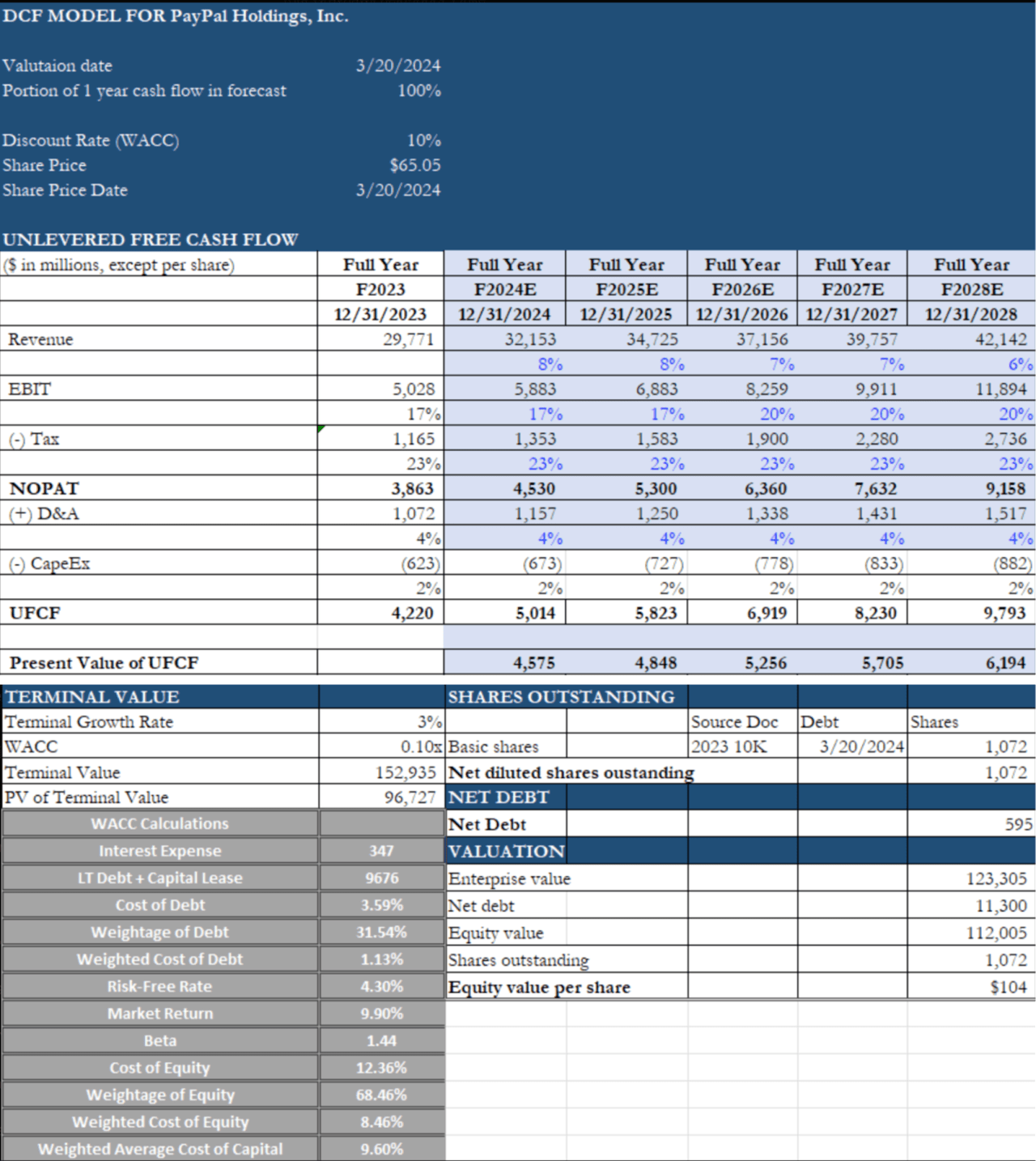

In my DCF model, I estimated a base case revenue growth rate of 8% as an average of 8.15% revenue growth was achieved, by PayPal, in monetary tightening macroeconomic conditions throughout 2022 and 2023. I believe with the catalysts mentioned above and the financial positioning of PayPal, they can maintain this base case revenue growth rate. Furthermore, I assumed a 17% EBIT margin as I view its 15% margin in 2022 to be its bottom, especially due to the fact that PayPal has boasted much higher margins in the past.

Terminal Value Projections

I then took a terminal growth rate of 3% which is on par with historical GDP growth rates. Because PayPal profits off of transactional revenue, its long-term growth rate, in my opinion, will be heavily correlated to GDP growth.

Weighted Average Cost of Capital (WACC)

To calculate WACC, I first divided interest expenses from long-term debt and capital leases; I then multiplied by the weightage of debt to find a 1.13% Weighted Cost of Debt. I exercised a similar process to solve for the Cost of Equity, where the 30-year treasury bond is the risk-free rate, the SPY historical average return is the market return, and I used PayPal’s beta of 1.44. After multiplying by the Weightage of Equity, I arrived at an 8.46% Weighted Cost of Equity. Lastly, I added both the weighted cost of debt and the weighted cost of equity to get a WACC of 9.60%.

Intrinsic Value

I finally summed the 5 years of projected cash flows and present terminal value to find the enterprise value and subtracted it from net debt. After dividing by total shares outstanding, I was led to a target price of $104 per share, representing a 60% potential upside.

Risks

Macroeconomic risk

PayPal’s business model relies on consumer discretionary spending. Consumer spending must remain resilient for increased revenue growth YoY. However, I see there is a risk present because the FED may not achieve a soft landing as proposed. In the future, there may be lower job growth, a weaker economy, and decreased consumer spending. PayPal’s business model is linked to these macroeconomic conditions.

Business risk

I believe PayPal’s strategy offers merits as being agnostic to funding sources used by consumers. However, this implies PayPal must rely on third-party rails such as the Visa and Mastercard networks, banks, and payment processors. I view this advantage to have shortcomings as PayPal must incur transaction processing expenses from its end-to-end payment solution. Therefore, PayPal’s margins decreased due to third-party associations increasing expenses.

Industry risk

PayPal has been a leader in the digital payments sector for over two decades. However, the sector has become highly competitive, and the changing landscape is bringing in new competitors. I believe it is hard to tell who will win this war on market share, as Apple Pay has quickly become a major player in the payment space. Apple’s advantage is that it owns an extensive mobile operating system while having abundant financial resources to innovate. On the merchant side, PayPal’s revenue increased by 30% in 2023 YoY, but Shopify has begun to offer turnkey solutions for merchants. Therefore, I believe there can be arguments made that PayPal may not win this war.

Takeaway

Secure and authorized end-to-end payment solutions are in high demand as digital and online payments continue to increase. PayPal has solidified its brand in this sector and customers reported higher conversion rates due to PayPal’s trusted trademark. However, to remain competitive, PayPal must continue to innovate and target the $110 trillion TAM through various product offerings. I believe PayPal can achieve this because they have shown success in integrating innovative products through organic investment or acquisitions. PayPal’s acquisition of Paidy is one prime example. Therefore, I see PayPal’s financial position, new CEO Alex Chriss, and synergistic value chain to be reasons why PayPal is currently undervalued against its peer group. I rate PayPal as a Buy with a 60% upside potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.