Summary:

- PayPal’s stock has underperformed in recent years, but the company continues to generate significant cash flow, and shares are trading at a discount.

- Despite a decline in active accounts, PYPL’s revenue for the final quarter of 2023 increased by 8.7% compared to the previous year.

- The company’s net income, operating cash flow, and EBITDA have all increased year over year, and its stock is trading at low multiples compared to similar firms.

Justin Sullivan

In my opinion, one of the best and most interesting companies on the market today is payment processing giant PayPal (NASDAQ:PYPL). Due to some growth-related issues, the company has had a rather difficult time from a share return perspective in recent years. Over the past 12 months, the stock is down 12.3%. And over the past five years, it has plunged by 36.6%. In spite of this, the company continues to generate significant amounts of cash flow and shares are trading at a significant discount compared to most similar enterprises. The firm does have some problems that need to be sorted out. But with a massive base of users, combined with significant amounts of share buybacks aimed at picking up units on the cheap, it’s difficult to not be bullish on this firm.

Still A Quality Play Despite Some Issues

The last article that I wrote about PayPal came out in late December of last year. In that article, I talked about how the revenue of the company had been rising, but I also recognized the bottom line results were disappointing and that the number of active accounts for the company had fallen for the third quarter in a row. Despite these problems, I felt as though further upside for shareholders was warranted. That led me to rate the business a ‘buy’. Unfortunately, the stock has since underperformed the broader market. Why all the S&P 500 is up 8.2%, shares of the payment processing behemoth are up only 3.7%.

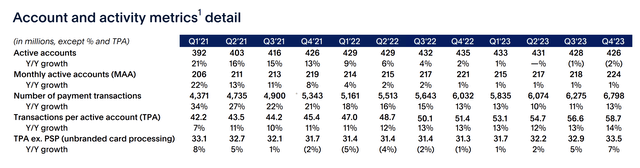

This is interesting because, fundamentally speaking, things have finally started looking up for PayPal. To see what I mean, we need only look at data covering the final quarter of the 2023 fiscal year. Driven by PayPal-branded checkout, its Braintree business, and higher interest income because of high interest rates, revenue for the firm came in at $8.03 billion. That’s 8.7% above the $7.38 billion generated only one year earlier. This is not to say that the company didn’t face some problems that impacted its top line negatively. The number of active accounts has declined for the fourth consecutive quarter, hitting 426 million. That’s down by 2.1% from the 435 million that the company had in the final quarter of 2022. And it’s down from the 428 million that it reported at the end of the third quarter of last year. If we restrict the picture only to monthly active accounts, the company hit an all-time high of 224 million. That was up from the 221 million reported one year earlier and stacked up nicely against the 218 million reported for the third quarter of 2023.

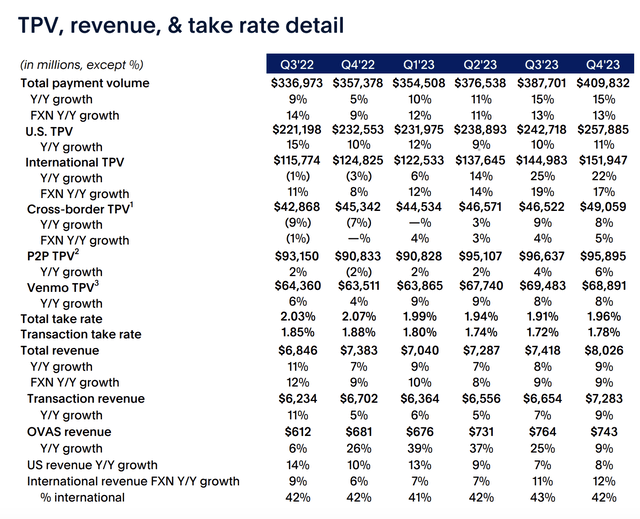

There are, of course, many other factors baked into the revenue Three years provided by management. While total active accounts fell, the number of payment transactions hit a new all-time high for the company of 6.80 billion. That’s well above the 6.28 billion that the company reported only one quarter earlier and it is up 12.7% from the 6.03 billion reported at the end of 2022. Transactions per active account managed to hit a high of 58.7. To put this in perspective, in the final quarter of 2022, that number was only 51.4. So while the number of active accounts has declined, those utilizing the company’s services continued to rely more heavily on it. This also had an impact on TPV or total payment volume. In the final quarter of the year, this hit $409.8 billion. That represents an increase of 14.7% compared to the $357.4 billion reported one year earlier.

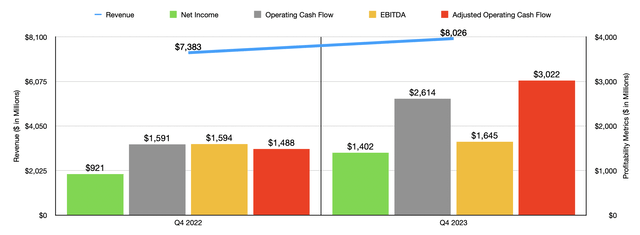

The overall rise in revenue, combined with the reasons for the increase, led to significantly higher profits and cash flows year over year. Net income of $1.40 billion in the final quarter dwarfed the $921 million reported for the final quarter of 2022. Operating cash flow surged from $1.59 billion to $2.61 billion. And if we adjust for changes in working capital, we get a more than doubling in the metric from $1.49 billion to $3.02 billion. The only metric that saw only a modest increase was EBITDA. But it still managed to climb by 3.2% from $1.59 billion to $1.65 billion.

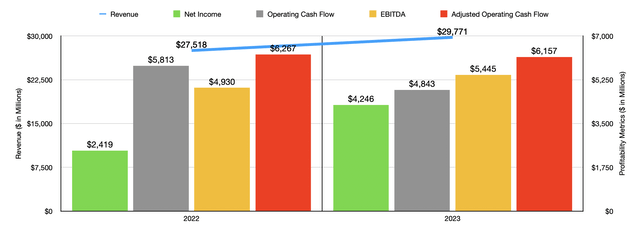

As you can see in the chart above, financial results for 2023 as a whole were rather mixed. Revenue rose nicely thanks to the aforementioned factors, with particular strength coming from PayPal’s unbranded card processing activities with a 30% increase in activity on a foreign currency-neutral basis. Net profits and EBITDA also increased nicely year over year. The only weak spot was when it involved operating cash flow and adjusted operating cash flow. Both of these fell, the former rather substantially while the latter fell only modestly.

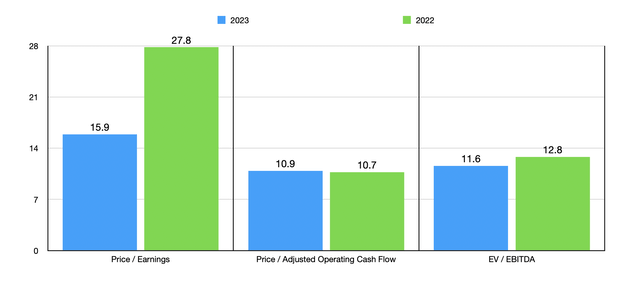

If we use the data provided by management for 2023, we can see just how cheap shares are. As the chart above illustrates, the stock is trading at rather low multiples, both on an absolute basis and relative to what we get when using data from 2022. It is worth mentioning that management did provide earnings guidance for 2024. However, the adjusted earnings estimate factors in things like stock-based compensation that should not be included in adjusted earnings. And the GAAP earnings of $3.60 per share, down from the $3.84 per share reported for 2023, also include some one-time items that resulted in 2023 results being artificially inflated. This does not give us enough to work with in terms of projecting cash flows for the company. In the table below, I compared the company to five similar firms. What I found interesting is that, even with the inflated earnings for last year, shares are still trading substantially lower than what you get when comparing the company to other players. Even if earnings were to fall back to what they were in 2022, PayPal would still be the second cheapest of the group. Using the EV to EBITDA approach, PayPal was also the cheapest of the group, while when it came to the price to operating cash flow multiple, only one of the five companies was cheaper than it.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| PayPal Holdings | 15.9 | 10.9 | 11.6 |

| Automatic Data Processing (ADP) | 28.2 | 25.4 | 18.3 |

| Fiserv (FI) | 30.4 | 18.2 | 13.7 |

| Fidelity National Information Services (FIS) | 44.4 | 9.5 | 13.8 |

| Global Payments (GPN) | 34.5 | 15.2 | 13.7 |

| Paychex (PAYX) | 26.8 | 22.0 | 18.1 |

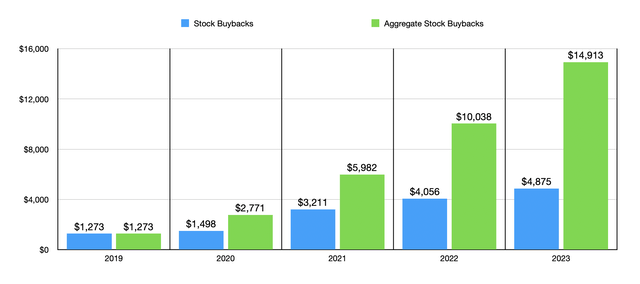

It’s imperative for me to point out that there are other reasons why I like PayPal even though it is facing some issues when it comes to active accounts. For starters, while I generally am not a fan of share buybacks, I do support them when shares of a company are trading on the cheap. In the chart below, you can see the company’s history of net stock buybacks over the last five fiscal years. Each year has been progressively larger in terms of the firm’s commitment. And in that five-year window, the company has bought back a total of $14.9 billion worth of shares. For a company with a market capitalization at this moment of $67.4 billion, that’s quite impressive.

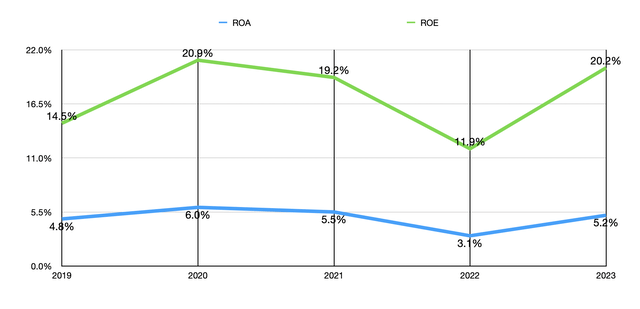

Another reason why I believe investors should be bullish is because of the quality of its assets. In the chart below, you can see both the return on assets and the return on equity for PayPal over the past five years. Admittedly, return on assets are not terribly impressive. If we were comparing it to a bank, these would be home run numbers. But for large financial institutions as a whole, these are just decent. What’s really impressive is the return on equity. For three of the past five years, the return on equity of the company has been right up around 20%. This is the sweet spot that many value investors tend to like. It means that the company can create a tremendous amount of value, on a net basis, for its shareholders, even without achieving growth.

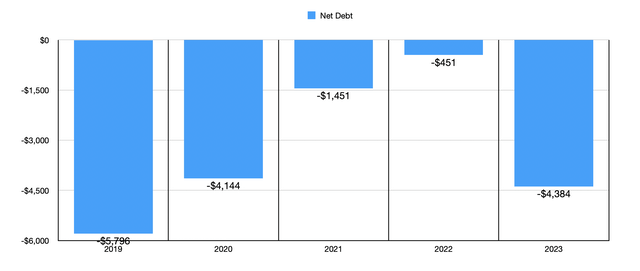

Even in spite of these large buybacks, the company has maintained a consistent net cash position in recent years. Back in 2019, it was nearly $5.80 billion. Every year since then, that number declined. By 2022, the net cash position of the business was only $451 million. But then, in 2023, it shot back up to $4.38 billion. That’s in spite of $4.88 billion worth of share buybacks. When you have a company trading very close to the single digits from a multiple perspective and that company has a sizable net cash position and a high return on equity, it’s difficult to not be bullish.

Takeaway

As things stand, I believe that shares of PayPal are significantly undervalued. The fourth quarter of the 2023 fiscal year really showed the cash flow generation capabilities of the enterprise. Shares are trading at a steep discount compared to most similar firms and management is buying back tremendous amounts of stock. The return on equity of the business is impressive and, while it does have an active accounts issue, those using its services continue to rely ever more heavily on it. Due to these reasons, I believe that upgrading the stock to a ‘strong buy’ makes sense at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is in cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!