Summary:

- Denison Mines Corp. is a Canadian company focused on uranium exploration and exploitation, with three principal assets.

- The company’s main value driver is its Phoenix project, which, if successful, could more than justify its current market cap.

- Recent global dynamics, including geopolitical tensions and supply disruptions, have led to an increase in uranium prices, benefiting companies like Denison Mines Corp.

- Despite potential high returns, DNN’s investment appeal is subject to U308 price fluctuations and regulatory challenges.

- Overall, I consider DNN a “buy”, specially for investors with a favorable long-term view on U308.

RHJ

Denison Mines Corp. (NYSE:DNN) is a primarily Canadian company focused on the exploration and exploitation of uranium. DNN has three principal assets: the McClean Lake mine, the Wheeler River Project, and the Midwest Uranium Project. The McClean Lake mine is one of the largest uranium mining facilities of the highest-grade uranium. The world stage is set for the surging investor’s confidence in the companies producing this crucial geopolitical mineral critical for energy production and military applications. As such, DNN’s main value driver is its Pheonix project, which, if developed successfully, should be more than enough to justify DNN’s current market cap. However, this ties its value directly to U308’s price, a layer of risk entirely outside management’s control. Thus, DNN is a “Buy” for investors aware of the commodity-related risks embedded here.

A U308 Bet: Business Overview

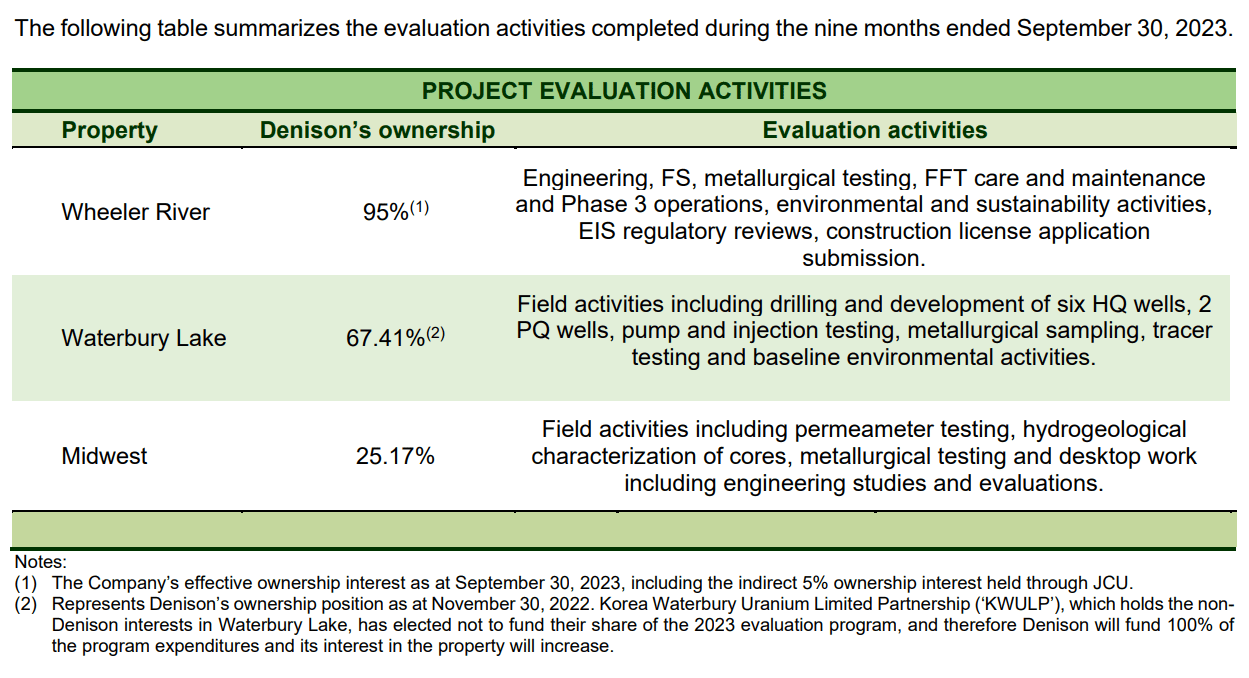

Denison Mines Corp. (DNN) is a Canadian mining company dedicated to exploring, developing, and producing uranium in the Athabasca Basin. The Athabasca Basin is located in northern Saskatchewan, Canada, a region recognized for presenting the highest-grade uranium and the world’s largest mines for this mineral. DNN’s principal assets are the McClean Lake mine, the Wheeler River Project, and the Midwest Uranium Project. The company is evaluating its Wheeler River, Waterbury Lake, and Midwest properties.

Source: DNN’s 2023 Q3 presentation.

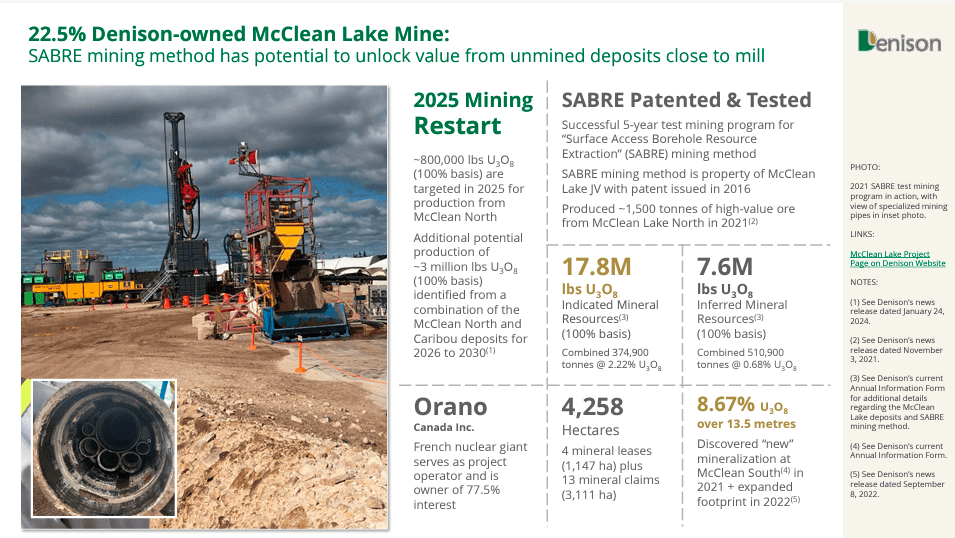

Additionally, DNN owns 22.5% of the McClean Lake Mine in the eastern part of the Athabasca Basin. DNN shares the ownership of the McClean Lake joint venture operated by Orano Canada Inc. The mill on this site is one of the world’s largest uranium processing installations to treat high-grade, not dissolved, uranium solution. This is likely DNN’s main source of stable repeat revenues as it’s linked to the deal DNN signed in 2017 with Ecora, though most of it is just being recognized as deferred revenues from a previous upfront payment. DNN has $35.26 million left in deferred revenues related to this deal to be recognized.

Furthermore, DNN owns 95% of the Wheeler River project. On the other hand, this is DNN’s main value driver in the future, and likely the bet investors are making if they invest in the shares today. This project contains two assets: 1) Phoenix deposit of U308 uranium concentrate, described as a low-cost in situ recovery [ISR] operation that involves dissolving the uranium from the surrounding rock using a solution injected into the ground and pumping the liquefied uranium back into the surface for treatment. 2) The Gryphon site is a low-cost production mine that uses conventional underground ore extraction that is later processed at a mill.

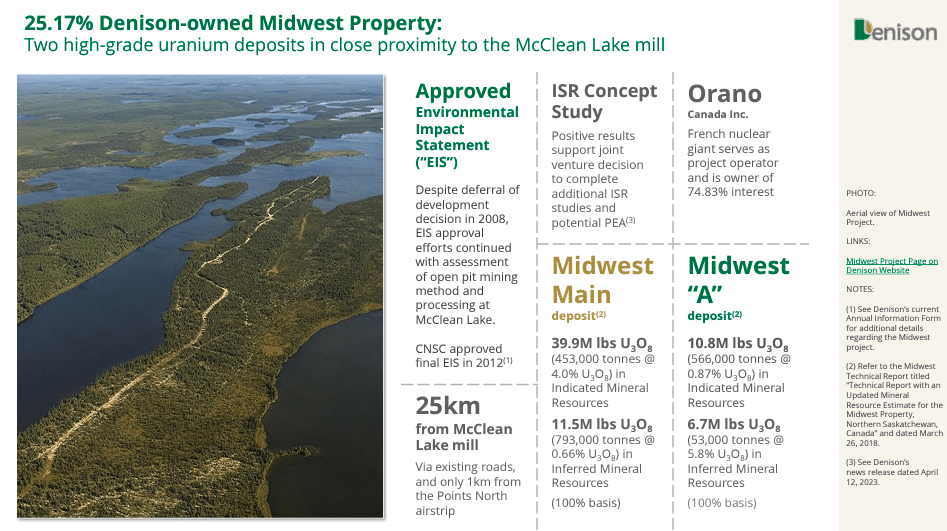

The Midwest Uranium Project is also found in the Athabasca Basin and is a joint venture with multiple partners. DNN owns 25.17% of this property, and Orano Canada Inc. owns 74.83%. This site has two high-grade uranium deposits, MidWest Main and MidWest A. They are close to the McClean Lake mill, which has the infrastructure to process ore from these mines. The extraction technique that is discussed for these sites is ISR.

Source: Investor Update – February 2024.

Also, DNN used to oversee the care and maintenance of sites no longer operating in the Elliot Lake area, managing decommissioned mines, which involves site rehabilitation and environmental monitoring to avoid potential contamination. The extraction and use of uranium are strictly regulated because of its radioactive properties and effects on the environment and human health. However, as of September 2023, the company has ceased this part of its business, signaling a strategic pivot toward focusing on its Phoenix project.

Global Dynamics Spark a Surge in Uranium

Recently, world events have increased the need for energy sources, and Uranium is an alternative to standard fossil fuels. Thus, uranium-producing companies have enjoyed secular tailwinds as a result. This is mostly a macroeconomic event related to the Russian invasion of Ukraine, which has pressured energy needs across Europe and raised the need for additional energy sources.

Starting on January 9, 2024, Uranium stocks rose after the US Department of Energy called for proposals to create a domestic supply of high assay low enriched uranium [HALEU] to counteract that currently HALEU is mainly sourced from Russia, and its price has doubled since the Russian invasion of Ukraine. The next day, on January 10, analysts anticipated a continuous rise in the price of uranium due to supply issues provoked by the possible US banning of Russian uranium and the unstable Niger political situation. Niger is one of the top producers of uranium in the world. Furthermore, on January 12, Kazatomprom, the world’s largest uranium producer, announced a reduced output for the next two years due to a shortage of sulfuric acid for uranium extraction.

The interesting part of this is that DNN appears to be trying to capitalize on these events because, on January 24, DNN and Orano Canada announced their joint venture (22.5% DNN, 77.5% Orano) would restart uranium mining at the McClean Lake JV in Saskatchewan. This mine was closed in 2008 due to declining prices. The mining activities would start in 2025. During 2024, the joint venture activities will focus on preparations such as installing pilot holes. Recently, on February 1, Kazatomprom announced even more reductions. It would produce only 80% of its uranium output instead of the anticipated 90%. This decrease was due to the difficulty of acquiring sulfuric acid and construction delays. So, DNN is riding high on macroeconomic tailwinds favorable for Uranium prices and its specific mining operations.

Source: Investor Update – February 2024.

Therefore, this series of events has led to an increment in the stock prices of uranium producers. These occurrences are a combination of geopolitical tensions following the Russian invasion of Ukraine, the anticipation of regulatory actions such as the possible US banning of Russian uranium, potential supply disruptions due to the coup in Niger, and supply reductions like the Kazatomprom’s output reduction. In simple terms, the current macro environment benefits companies like DNN.

A Speculative Buy: Valuation Analysis

However, from an investment perspective, DNN is relatively straightforward. Its main value driver going forward will be its Phoenix project. After all, most of its repeat revenues come from the toll milling agreement, of which only $35.26 million is left in deferred revenues. Other than that, DNN has ceased providing closed mine services, which brought in $6.58 million in revenues for the first nine months of 2023. Also, DNN used to have mineral sale revenues, but as of September 2023, this was zero. Therefore, it’s fair to say that DNN is a bet on its Phoenix project.

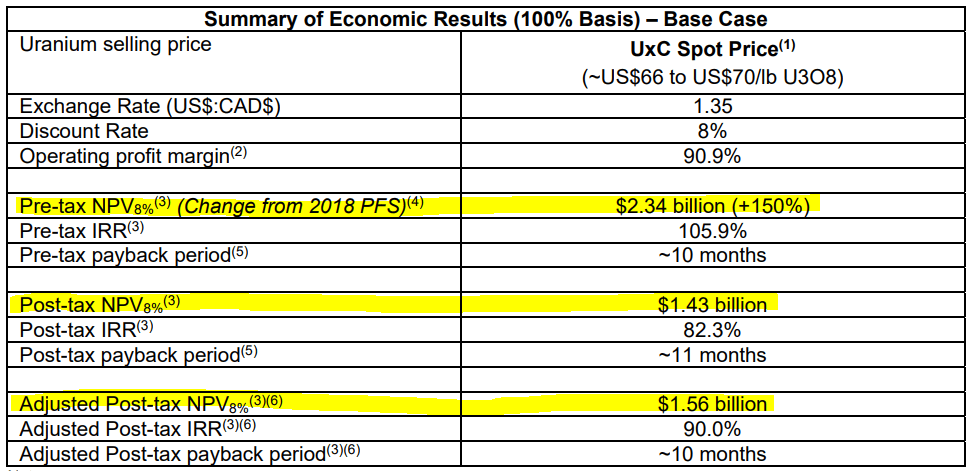

Source: DNN’s 2023 Q3 presentation.

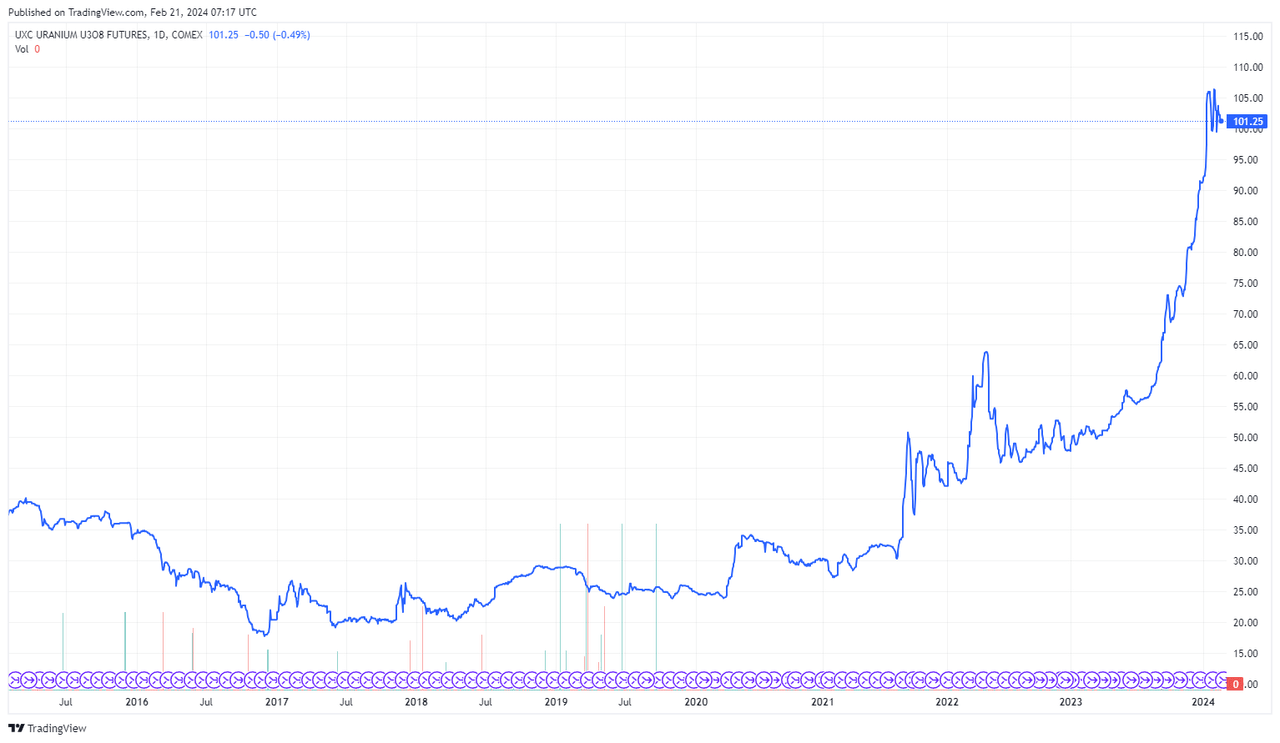

If you look at the figure above, you’ll see DNN’s valuation in NPV terms of its Phoenix project. The pre-tax NPV estimate is $2.34 billion, whereas the post-tax projections range from $1.43 billion to $1.56 billion. Naturally, DNN assumed a price of $66-$70 per pound of U308, which appears conservative compared to today’s prices. After all, if we look at U308 futures, these trade today at roughly $100 or higher, depending on the settlement date. Moreover, the implied NPV value doesn’t increase linearly with the price of U308 because operational leverage is inherent in mining projects. So, these marginal U308 price increases on the model above can significantly add to the NPV estimates.

U308 Futures prices. (Source: TradingView.)

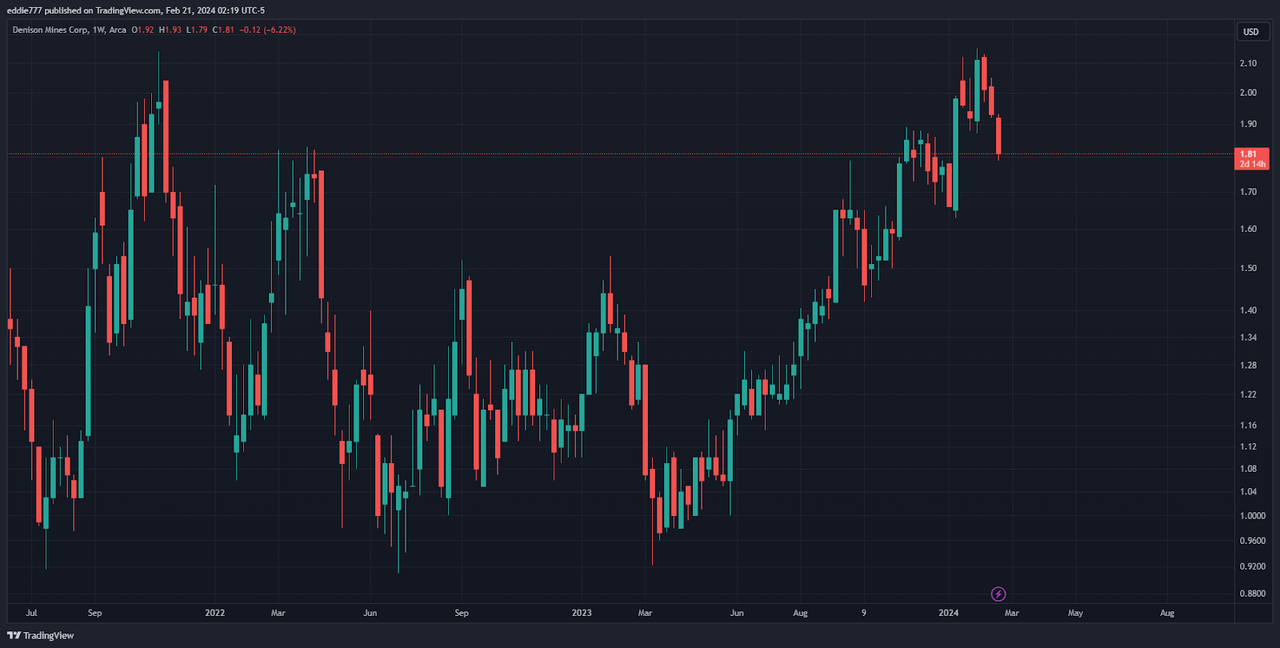

All of this suggests that DNN’s main project alone (Phoenix) should be enough to justify its current market capitalization of just $1.70 billion. Furthermore, if you have a particularly bullish view on the Uranium price from now on, DNN could be a high-beta play, which could be DNN’s main investment selling point. You see, it’s cheaper to buy DNN for an effectively leveraged bet on the price of U308 than it is to leverage on it via future or debt and pay interests or fees. So, as a whole, I think there’s an embedded discount given in the share price at these levels because U308 prices are significantly higher than the inputs for the NPV estimates. That alone justifies an investment in DNN, in my view. But if the ongoing Uranium bull market continues, DNN could be a fantastic investment vehicle to ride that, given negligible debt and embedded optionality due to its Phoenix project. Hence, I rate DNN a “buy” at these levels.

Investment Thesis Risks

Naturally, the main risk to this investment thesis is the price of U308 itself. If this commodity declines in price significantly, then the NPV of DNN’s Phoenix project would plunge even faster, which would be reflected in the share price rather quickly. Beyond that, there are also regulatory risks because uranium is a highly regulated commodity, given that it’s also potentially harmful to the environment if mishandled.

Additionally, it’s worth mentioning that DNN’s cash burn for the latest quarter was about $6.4 million. I estimated this figure by adding its quarterly CFOs and CAPEX. If we annualize these numbers, DNN’s implied yearly cash burn is roughly $25.6 million, which, compared to its current cash reserves of $61.6 million, suggests a cash runway of 2.4 years. This is not terrible, given that the Phoenix project should quickly bring in cash flows once fully operational. Yet, for now, it’s worth considering that if unforeseen circumstances delay that, DNN could be forced to tap into additional liquidity from debt or equity. Yet, overall, I think these risks seem relatively unlikely, and even if they occur, DNN appears to be well-positioned to handle them.

Source: TradingView.

Conclusion

I think DNN is a well-run mining and development operation that exposes investors to a leveraged bet on the price of U308. For the most part, I believe that this is a reasonable bet, and in fact, DNN’s Phoenix project alone should be enough to justify a “buy” rating. I don’t give it a “strong-buy” rating because DNN is undoubtedly dependent on U308 prices and regulatory risks beyond management’s control. This layer of uncertainty can quickly erode shareholder value if it turns unfavorable. Moreover, U308 has increased significantly in price, and past returns do not indicate future returns. If anything, we could see a mean reversal in such prices, and DNN would quickly reflect that in its stock price. Yet, as a whole, I think DNN does offer a compelling investment position and could be a great way to express a leveraged bullish view on Uranium in the future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.