Summary:

- Meta Platforms has officially made new all-time highs.

- The stock is up several hundreds of percentage points from the lows, but investors should focus on the fundamentals.

- META is arguably the greatest beneficiary of artificial intelligence.

- I reiterate my strong buy rating as this has a clear path to more upside.

Bloomberg/Bloomberg via Getty Images

Meta Platforms (NASDAQ:META) has come full circle. In late 2022, the market had lost confidence in the stock, as it doubted that the company could move past iOS data privacy changes, competition from TikTok, and post-pandemic macro pressures. The company addressed the first two issues with cold-blooded execution, as it has been able to utilize artificial intelligence to increase the relevance of its content feeds. Then the tough comparables experienced in 2022 became easier comparables in 2023, setting the stage for a dramatic acceleration in top-line growth. META may be up strongly over the past twelve months (and that is understating it), but the stock remains more than reasonably valued before accounting for strong near-term projected revenue growth and a continued commitment to profitability. Though the company appears to also remain committed to investing in the metaverse, the stunning profit margins at the Family of Apps have Wall Street looking the other way, for now. I reiterate my strong buy rating as investors should focus more on the strong fundamental picture and less on the hyperbolic stock price action.

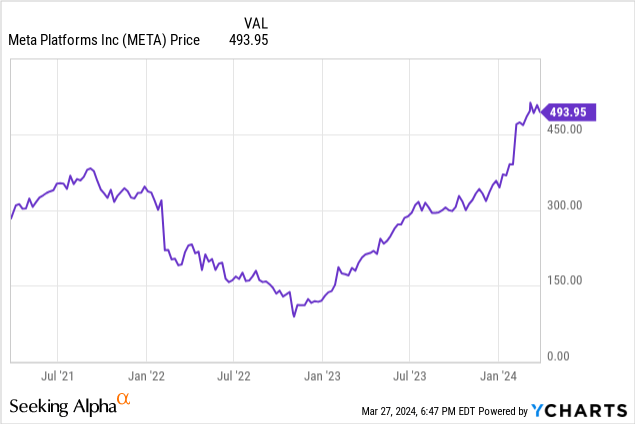

META Stock Price

It may be difficult to believe, but META has not only fully recovered its 2022 losses but is now trading near all-time highs.

I last covered META in January where I named it a top pick for 2024. The stock wasn’t the cheapest mega-cap name at the time but had the strongest fundamental setup. That remains today, and I see more upside ahead.

META Stock Key Metrics

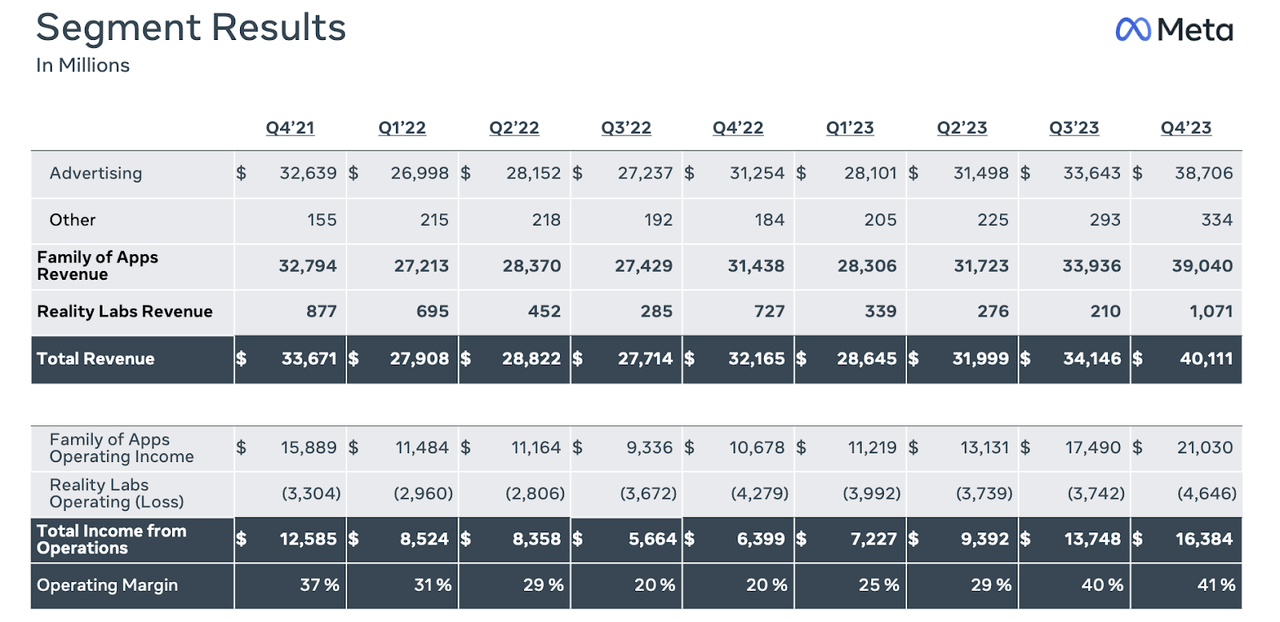

In its most recent quarter, META generated 24.7% YoY revenue growth to $40.111 billion, surpassing guidance for revenue of between $36.5 billion and $40 billion. The strong growth rates mark a macro recovery in the advertising market as well as the company lapping easy comparable. META delivered another quarter with at least 40% operating margins with the Family of Apps generating a 54.3% operating margin (not a typo). The company continues to burn cash in Reality Labs, but when the company is generating a 41% operating margin on a consolidated basis, Wall Street may be willing to overlook it.

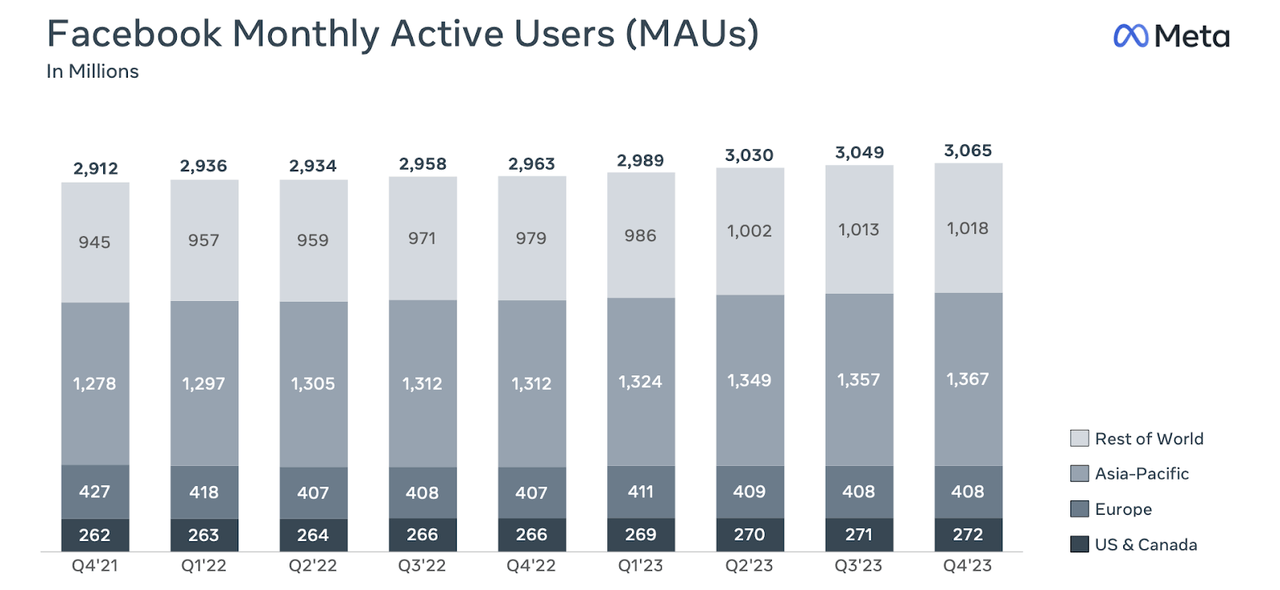

It wasn’t just the financial numbers that looked good. META also delivered yet another quarter of monthly active user growth on Facebook. This is important because it may indicate that the company is fending off TikTok risks (at least for now).

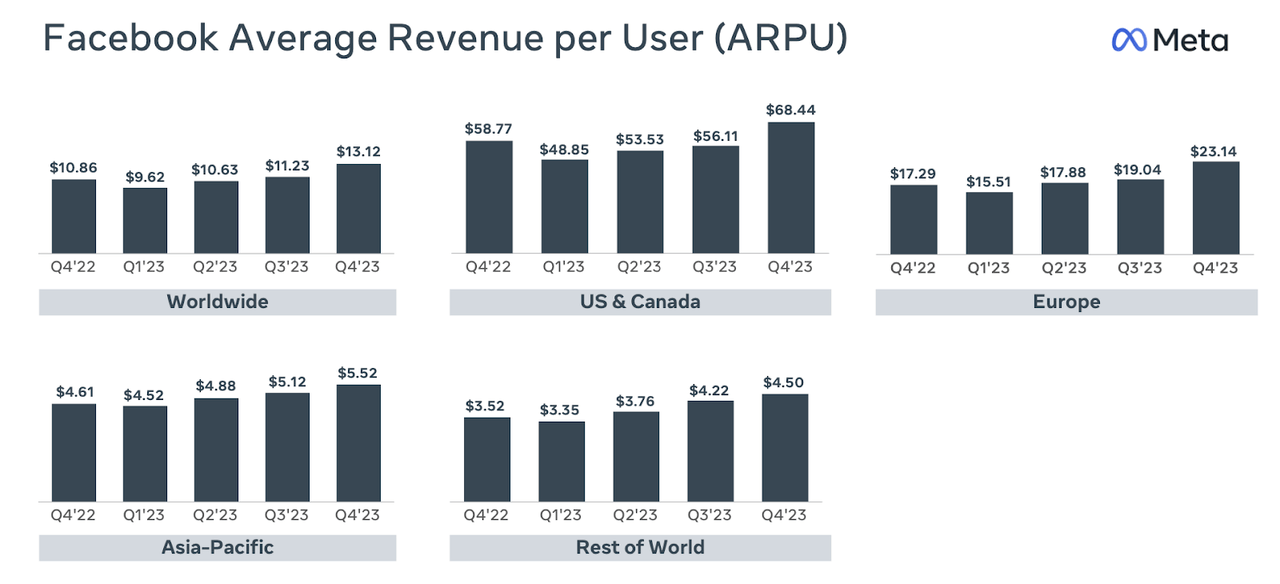

Despite the tough macro environment, META was able to dramatically grow Facebook’s average revenue per user. Given that Facebook is arguably the company’s weakest platform from a relevance perspective, the fact that it is still turning in these strong growth numbers says a lot about the company’s staying power.

META ended the quarter with $65.4 billion of cash versus $18.4 billion of debt. The company repurchased $6.32 billion of stock in the quarter. While META has been more or less maintaining the same net cash position over the past several quarters, the fact that management has been choosing to issue debt instead of using cash may be a foreshadowing of the company’s ability to eventually take on net leverage over the long term. The company announced a $50 billion increase in its stock repurchase program but that is arguably not so important given the company’s current earnings power and market cap. Instead, I was impressed by management’s decision to initiate a regular quarterly dividend. While the $0.50 per share quarterly payout may not amount to much in terms of dividend yield, starting a dividend growth history might be a worthy long-term investment, as the company will eventually need to see a shifting investor base from growth towards dividend growth.

Management guided for the next quarter to see revenue between $34.5 billion and $37 billion, representing 20.6% and 29.4% YoY growth. It is important to tame our bullishness here – we must remember that this is not meant to be interpreted as a sustainable long-term growth rate. As mentioned earlier, the company is benefiting from tough comparables becoming easy comparables, and growth rates should moderate at some point over the coming quarters.

On the conference call, management noted that Threads has more people using it than the initial launch peak, which may mean that it is “on track to be a major success.” Management gave some commentary about their artificial intelligence ambitions, as seen in the following segment:

Everyone who uses our services will have a world-class AI assistant to help get things done, every creator will have an AI that their community can engage with, every business will have an AI that their customers can interact with to buy goods and get support, and every developer will have a state-of-the-art open-source model to build with.

META has already used artificial intelligence to generate relevant content in the content feed. Back in 2022, Wall Street was worried that the company was falling behind TikTok and would have trouble generating relevant advertisements due to an iOS data privacy change. However, META has shown that artificial intelligence was the cure to these problems – as a user of many of their apps I can anecdotally relate to the reality that a large portion of feed content now comes from people that I do not follow.

META has also been utilizing generative AI to help make the advertisement creation process easier for customers – while META might not get as much attention for generative AI due to not being one of the cloud titans, it is arguably one of the biggest beneficiaries due to the deep applicability of generative AI in its platforms.

Management noted that the Reality Labs ambition ties in with artificial intelligence, as it may enable people to engage with AI without having to use their phones. Even as a bullish investor, I am still more in the “show me” camp on the metaverse.

Management emphasized that their “year of efficiency” is meant to shape their long term mindset. Management noted that while they intend to grow headcount, it is expected to be “minimal” compared to their historical trends. CEO Zuckerberg appears to have won it all: Wall Street loves his company’s intense focus on profitability and is willing to overlook its growing investments in the metaverse.

Is META Stock A Buy, Sell, or Hold?

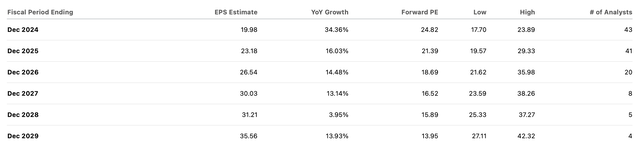

Even amidst the stock’s furious non-stop rally, the stock is still trading reasonably at under 25x earnings.

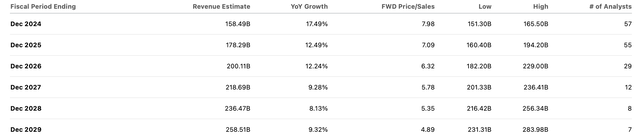

Consensus estimates call for a strong year of top-line growth, with growth decelerating to the low double-digits thereafter.

Reality Labs losses make up 33% of consolidated net income. If we value Reality Labs at $0, then the Family of Apps businesses are being valued at approximately 18x earnings. I still see the stock eventually earning an earnings multiple of 25x to 30x the Family of Apps businesses – that might lead the stock to trade at well over $600 per share. I justify that price target based on the long term secular growth, high barriers to entry, and strong balance sheet position. I note that I am assigning no value from any upside potential from a “ban” of TikTok in the country. Though I note that if TikTok were to actually be banned (in my view an unlikely scenario) then META would be a prime beneficiary from both a financial growth as well as valuation multiple perspective. But again – I wouldn’t hold my breath. Further, given the kind of market we have today, I find it more likely that ByteDance would sell its interests to a US company than exit operations in the country altogether.

What are the key risks? Apple (AAPL) has finally begun shipping out its Vision Pro headsets. It is possible that by validating the market, AAPL may be giving META the catalyst needed to jumpstart its own ecosystem. It is also possible (if not likely) that AAPL will be able to dominate the market in similar fashion as it has done for products within its ecosystem. This result is unlikely to lead to satisfactory results for META shareholders. While the optimist in me would like to believe that CEO Zuckerberg and his team might see such a development and just decide to give up metaverse ambitions (to a warm welcome from Wall Street), I find such a result unlikely. Given that the company has already spent so much on their Reality Labs unit, the more human response would be to continue pouring money into this segment – perhaps at an even more aggressive pace – in order to compete against AAPL. At the current moment, it isn’t exactly clear how much profits the metaverse may bring for META, so such uncapped investment may come to the detriment of shareholders.

It is also possible that TikTok continues to take market share, especially among younger generations. At the end of the day, technology alone has not made META a winner. Don’t get me wrong, their investment in technological innovation has been impressive, but they became the dominant market leader today in large part due to network effects. But if TikTok is able to appeal to younger generations in the same way that Facebook did over a decade ago, then Facebook might go the way of MySpace. META was able to avoid competitive threats in the past through its acquisition of Instagram, but between the anti-competitive scrutiny and Chinese influence, it is highly unlikely that META will be able to use the same playbook on TikTok.

Focus on the fundamentals over the stock price action. META stock continues to trade at compelling valuations, even if many may find it irresistible to take some profits. I reiterate my strong buy rating as the stock looks to be on a straight-line path to 30x earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- And much more

Subscribe to Best of Breed Growth Stocks Today!