Summary:

- The Home Depot yesterday announced it will acquire SRS Distribution in a $18.3 billion transaction – $15 billion more than what the business fetched only six years ago.

- In this update, I share my views on the acquisition of SRS from an operational and financial perspective.

- I also discuss the impact on The Home Depot’s balance sheet, especially considering the ongoing and partly debt-funded share repurchases.

- I take a fresh look at the valuation of HD stock and share whether I have locked in gains after a 30% surge in just over four months.

OceanFishing/iStock via Getty Images

Introduction

Shares of The Home Depot, Inc. (NYSE:HD) – the world’s largest home improvement retailer by net sales – have been on a spectacular bull run since bottoming in October 2023. I cover the company more or less regularly here on Seeking Alpha, most recently in November when I wrote my first bullish note on HD stock.

HD stock has gained more than 30% in just over four months (Figure 1), outperforming the AI-hype-driven S&P 500 by a whopping 14%. But don’t get me wrong – even though I upgraded HD stock to “buy” in November, I was in no way expecting such a performance. I always remain humble, so the sharp rise in the share price makes me a little uneasy.

Figure 1: Screenshot from the Nov. 10 article on HD stock (Seeking Alpha)

In the meantime, HD’s management announced results for fiscal 2023 and the annual report (10-K) was published. Yesterday, it was announced that Home Depot intends to acquire specialty distributor SRS Distribution in a transaction valued at $18.25 billion, further strengthening the leading home improvement company’s addressable market in the professional customer space.

For these reasons, I think it’s a good time to sit back, digest the facts and reassess. In this update, I share my views on the acquisition of SRS Distribution from an operational and financial perspective. I also discuss the impact on The Home Depot’s balance sheet, especially considering the ongoing and partly debt-funded share repurchases. Finally, I take a fresh look at the valuation of HD stock using a multi-faceted approach and explore the question of whether the stock is still a hold or whether it is already time to lock in profits.

SRS Distribution: A Good, Not To Say Logical Fit – But An Expensive One

One of the main reasons I like The Home Depot is its strong commitment to professional customers – who now probably account for more than 50% of the home improvement giant’s sales. This growing segment dampens cash flow and earnings volatility, largely due to strong customer stickiness (loyalty and time-saving programs, trusted value proposition). Conversely, the professional segment is less susceptible to the cyclical demand for discretionary items, which were in high demand from DIY customers during the pandemic but are now showing weaker demand given high inflation and somewhat more cautious customers.

In addition, the buying characteristics of professional customers and the exclusive benefits HD offers them lead, in my view, to comparatively higher profitability (economies of scale) as well as up-selling opportunities. Its main competitor, Lowe’s Companies, Inc. (LOW) – which I also cover here on Seeking Alpha – is pursuing the same strategy, but is at an earlier stage in this regard.

In this sense, the planned acquisition of SRS Distribution is a clear sign of The Home Depot’s commitment to remain the leader in the professional segment. While Lowe’s is also a major player in the U.S. home improvement market, I think HD has an edge due to its better scale, larger size and better credit rating (A2 vs. Baa1), which allows it to grow more easily through acquisitions. I will discuss the impact of the SRS Distribution acquisition on Home Depot’s balance sheet in the following section.

According to HD management, the acquisition will increase the total addressable market by $50 billion or 5% in relative terms (slide 8, SRS acquisition presentation). More importantly, the acquisition will enhance and strengthen HD’s offering, particularly in the roofing segment, SRS’s core competency. Landscaping and swimming pool verticals are newer segments in which SRS gained a foothold in 2019 and 2021 respectively (slide 5, SRS acquisition presentation).

As for the impact on HD’s P&L statement, I wouldn’t say SRS will have much of an immediate impact. Considering that HD, with an enterprise value (EV) of currently $425 billion, is planning to acquire SRS in a $18.25 billion, this is already evident from this ratio. SRS revenue in 2023 was approximately $10 billion, so the acquisition will increase HD’s top-line by 6.5% (based on HD’s average net sales from 2021 to 2023). The impact on EBITDA is significantly lower at only around 4.3% due to the comparatively low operating margin of SRS. This in turn means that the elimination of redundancies is expected to result in a modest margin expansion in the SRS segment. However, it should be borne in mind that SRS apparently only uses a single ERP system, which it will probably retain even after the consolidation.

Hence, and because SRS will continue to operate largely independently, I would not expect too much from the consolidation in terms of profitability. I think it is actually reasonable to expect a small negative impact on HD’s operating margin before synergies are realized, but likely no more than 30 basis points.

So the biggest benefit – besides a more holistic experience for its professional customers, which should further improve retention and bolster growth – are cross-selling and upselling opportunities, as well as significantly improved distribution capabilities. SRS has more than 760 branches across 47 states, which is a very significant addition to the 2,015 stores HD operates in the U.S. (p. 24, fiscal 2023 10-K).

All in all, I think it is fair to conclude that SRS is a good, not to say logical, fit for The Home Depot, which will certainly help to further strengthen the company’s already leading position in the professional segment. Of course, the acquisition is still subject to regulatory approvals, but it is reasonable to expect that the deal is finalized by the end of 2024 or early 2025.

Finally, in terms of valuation, it is fair to say that HD was definitely not bargain hunting with an implied EBITDA multiple of 16-17 and a sales multiple of 1.8. It is also interesting to note that the private equity firm Leonard Green & Partners (LGP) bought SRS Distribution from Berkshire Partners LLC in 2018 for an implied enterprise value of over $3 billion. So it is clear that HD is acquiring SRS today at a much higher multiple – if we assume, for example, that SRS had sales of $6.5 billion in 2018 and growth of 9% p.a. (= $10 billion sales in 2023), the sales multiple of the LGP transaction would have been around 0.5 – or slightly more than a quarter of the pending deal’s valuation. And even if we assume – which is hardly realistic – that SRS grew by 15% annually over the last six years, the implied sales multiple would still be only 0.6 ($5.0 billion implied sales in 2018).

How Is Home Depot’s Balance Sheet Impacted By The Acquisition And Ongoing Massive Share Repurchases?

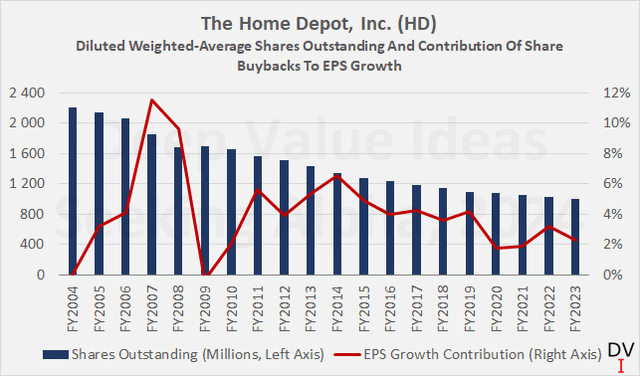

The Home Depot is known for buying back significant amounts of its own stock year after year, and sometimes the company is accused of “financial engineering”. Granted, buying back shares and reducing the number of shares outstanding in the process has a beneficial effect on earnings per share growth. But this is actually a good thing, in my view, as long as the shares are of course bought back at an appropriate valuation and the company’s organic growth remains intact.

Figure 2 shows the evolution of HD’s diluted weighted-average shares outstanding over the last 20 years and the contribution of buybacks to EPS growth in percentage points. Over this period, HD has repurchased nearly 55% of its diluted shares outstanding in 2004, increasing earnings per share by 121%. In other words, without buybacks, fiscal 2023 earnings would be less than half of what they actually were. Buybacks were very pronounced before the Great Recession and have slowed to a 2-3% contribution to EPS growth in recent years. Given HD’s very strong – mostly double-digit – EPS growth during this period, I find the “financial engineering” hypothesis difficult to support.

Figure 2: The Home Depot, Inc. (HD): Diluted weighted-average shares outstanding and contribution of share buybacks to EPS growth over the last 20 years (own work, based on company filings)

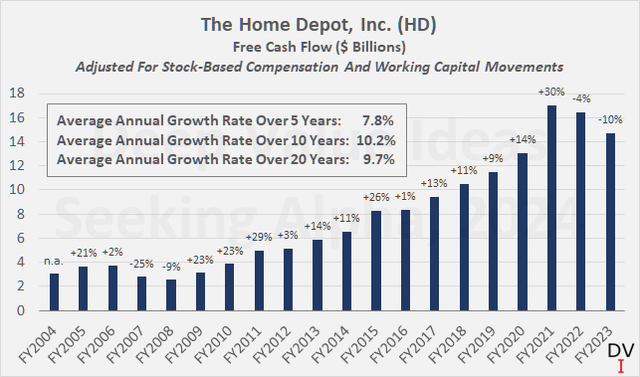

However, considering that HD generates between $14 and $16 billion in free cash flow annually (after adjusting for stock-based compensation and working capital movements, Figure 3) and pays out about half of that to its shareholders in the form of dividends, it’s easy to see that at least some of those buybacks were funded by debt. But what sounds like a bad thing can make perfect sense from a financial perspective as long as the debt is cheap – which has definitely been the case for many years. A large company with tremendous scale and predictable cash flow like The Home Depot is perfectly capable of borrowing temporarily to buy back stock, but of course that can’t go on forever.

Figure 3: The Home Depot, Inc. (HD): Free cash flow over the last 20 years, after adjusting for stock-based compensation and smoothing working capital movements with a three-year rolling average (own work, based on company filings)

In this context, I think it is worth noting that HD management has vowed to pause share buybacks until the SRS acquisition – which will add $12.5 billion of debt (excluding operating leases) – is digested. This announcement was one of the reasons behind the recent affirmation of HD’s A2 senior unsecured rating by Moody’s.

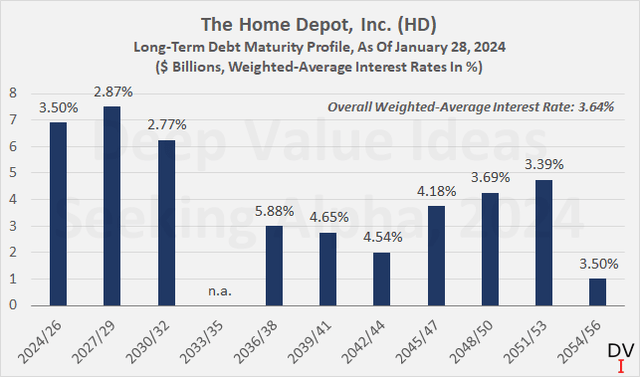

A look at the maturity profile of Home Depot’s debt (Figure 4) – which of course does not yet include the impact of the SRS acquisition – is quite reassuring, despite the massive and partially debt-funded share buybacks. HD currently pays a very favorable weighted-average interest rate of 3.64% on its long-term debt, and maturities – while somewhat right-skewed – appear very manageable. With a free cash flow after dividends of about $25 billion over three years, it’s easy to see that HD could theoretically pay down debt as it matures off the balance sheet. There is $14.4 billion of debt coming due over the next six years, and assuming management wants to pay down SRS debt over that period as well, HD would need to set aside about $27 billion of free cash flow to pay down debt. If the economic environment proves reasonably stable over this period, this is a very realistic expectation and HD could even continue increase its dividend further and resume share buybacks after three to four years.

Figure 4: The Home Depot, Inc. (HD): Long-term debt maturity profile and weighted-average interest rates, as of fiscal 2023 year-end (own work, based on company filings)

Of course, it is not practical for HD to repay all the debt that will come due in the next few years – especially if interest rates fall again. However, I find it very reassuring that HD’s debt – even after the acquisition of SRS Distribution – remains manageable, even if the economic environment weakens somewhat going forward.

At Almost $400 – Is It Time To Sell HD Stock?

Before concluding this update, I would like to briefly discuss the valuation of HD stock. After all, a return of more than 30% in just over four months just doesn’t seem realistically sustainable – perhaps HD stock has simply gotten ahead of itself? When I published my last article, HD shares were trading just under $300, and I thought this was a reasonably good price with a long-term mindset, but definitely no steal.

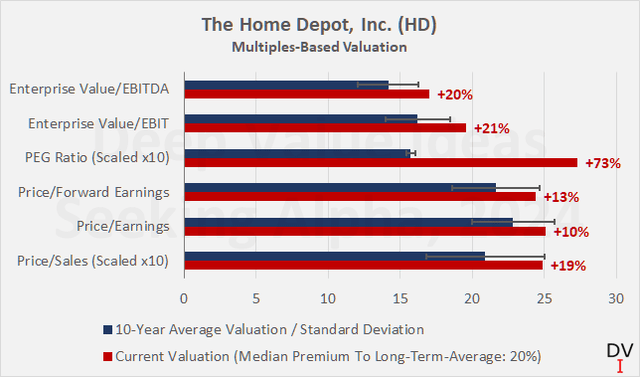

At nearly $400, of course, things look very different. Figure 5 illustrates various valuation multiples and compares them to their ten-year average. Considering that HD stock has benefited massively from the low interest rate environment and the real estate boom, I would argue that the ten-year average valuation is not necessarily a conservative comparison. Yet despite this already fairly optimistic backdrop, HD stock is currently trading at about a 20% premium, depending on which valuation metric you look at. In particular with HD’s already large market share in the U.S. in mind, the high price-to-earnings-growth (PEG) ratio in particular makes me a bit uneasy.

Figure 5: The Home Depot, Inc. (HD): Multiples-based valuation of HD stock and comparison to ten-year average multiples (own work)

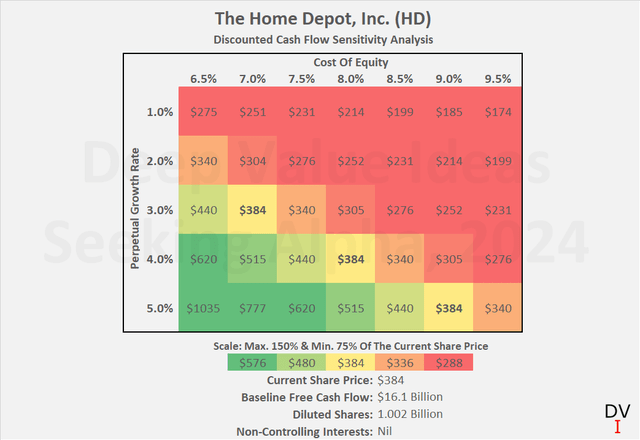

Approaching the valuation from a cash flow perspective, I performed a discounted cash flow (DCF) sensitivity analysis. The results are shown in Figure 6 and should be interpreted as follows. An investor who buys HD stock today and is content with a cost of equity of 8% expects the company to grow its free cash flow by 4.0% annually in perpetuity. This doesn’t seem overly unrealistic, but given HD’s already very large size and the notorious sensitivity of DCF models with respective to the terminal value, a word of caution is nonetheless warranted. Now, one could argue that an 8% cost of equity is too low an expected return, given that the long-term risk-free rate (as measured by 30-year Treasuries) is currently 4.3%. Personally, I think 8% is acceptable in this case as I find it hard to imagine HD losing its leading status, which should allow it to maintain healthy earnings and therefore dividend growth.

Figure 6: The Home Depot, Inc. (HD): Discounted cash flow sensitivity analysis (own work)

Conclusion

The Home Depot – the world’s largest home improvement retailer – yesterday announced the acquisition of SRS Distribution, a leader in roofing, landscaping, and pool verticals. In my view, the acquisition is an excellent addition that will further strengthen HD’s leading position with professional customers – one of the reasons why I am a very confident long-term shareholder of HD.

The decision to allow SRS Distribution to continue to operate largely independently is puzzling at first glance, but indicates that the company has a good standing and is highly trusted by its customers. However, retaining the brand while establishing cross-advertising and integration of the offerings into each other’s loyalty and discount programs should result in significant growth. In terms of profitability, SRS Distribution is – unsurprisingly – significantly weaker than The Home Depot. HD’s margins are therefore likely to decline slightly, at least in the near term, but I think some synergies can be realized despite the fact that SRS will continue to operate largely independently. Given that The Home Depot’s sales will only increase by around 6.5% after the consolidation of SRS, I would not overstate the impact on margins, which I estimate to be around 30 basis points in the short term.

The implied valuation of the transaction on the high side in my opinion, especially bearing in mind that SRS Distribution changed hands only six years ago at an implied sales multiple of probably well below 0.6x. However, it’s obviously impossible to quantify the impact on HD’s growth at this point, so I’ll give management the benefit of the doubt, and I think it would be an exaggeration to interpret the sharp valuation multiple expansion as a sign of desperation to grow at any cost.

With HD currently trading at an enterprise value of $425 billion, SRS is obviously a rather small fish to swallow. However, it seems worth noting that SRS has about $5.5 billion in debt (market value) on its balance sheet, and including the consideration to be paid, HD’s debt will increase by about $12.7 billion. That’s certainly sizable, especially given how aggressively HD has been buying back shares over the past few years. However, I think HD’s debt remains very manageable even after the acquisition is completed (which is expected to be in late 2024 or early 2025).

The home improvement giant generates between $14 and $16 billion in free cash flow each year and returns around half of this to shareholders in the form of dividends. Buybacks are paused until the SRS takeover has been digested. This is a positive sign, which was also noted by the rating agency Moody’s in its latest affirmation of the A2 senior unsecured rating. Assuming that the economic environment does not deteriorate significantly, HD should be able to reduce leverage by around $7 billion per year. In my view, the company can continue to increase its dividend despite currently prioritizing deleveraging, and I expect it to resume share buybacks in a few years.

In terms of valuation, the market-beating return of more than 30% in just over four months suggests that HD stock has gotten ahead of itself. To a certain extent, I think this is true, and the multiples-based valuation based, the comparison with ten-year average valuation multiples, and the DCF sensitivity analysis confirm this. However, we never know what the future holds and I don’t think the valuation of HD stock is high enough to justify selling the position now. Of course, tax considerations also played a role in my decision-making process, but I obviously no longer consider the stock a buy at this level and hence downgrade it to “hold”.

Thank you very much for reading my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well. As always, please consider this article only as a first step in your due diligence.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HD, LOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.