Summary:

- MCD continues to deliver sustainable top/ bottom line growth, thanks to the intensified digital approaches and franchised business model.

- With the management already guiding increased global locations and expanded profit margins in FY2024, we may see the management lap up the tougher YoY comparisons.

- Its growth and dividend investment thesis remain robust, aided by the healthy balance sheet and current fair valuation.

- With MCD continuing to generate alpha for long-term shareholders, we believe that the stock is one that is highly suitable for income and growth oriented investors. Add at every dip, while DRIP-ing.

tbradford/iStock Unreleased via Getty Images

We previously covered McDonald’s Corporation (NYSE:MCD) in June 2022, discussing its inflation-proof and recession-proof prospects during the potential bear market after the hyper-pandemic boom.

While we had believed its offerings and stock to be highly resilient, the stock had also been overly prudently rated as a Hold then, with us missing out on the impressive rally of over +19% since then.

In this article, we shall discuss why we are re-rating the MCD stock as a Buy, with the management continuing to deliver excellent top-line growth aided by the multiple strategic initiatives and expanded profit margins as the franchised model takes off.

Combined with the long-term growth target, prospective dual pronged returns through capital appreciation/ dividends, and the stock’s excellent bullish support, MCD offers a compelling investment thesis at every dip.

The MCD Investment Thesis Remains Marvelously Golden With Long-Term Tailwinds

For now, MCD has reported a bottom line beat in the FQ4’23 earnings call in February 05, 2023, with revenues of $6.4B (-4.3% QoQ/ +8.1% YoY) and adj EPS of $2.95 (-7.5% QoQ/ +13.8% YoY), with FY2023 numbers of $25.49B (+10% YoY) and $11.94 (+18.2% YoY), respectively.

Despite the supposed top-line miss, the company reported excellent YoY comparable sales growth of +9% globally, attributed to strategic price increases, intensified marketing campaigns, and improved digital/ delivery/ drive through experiences.

With digital sales already representing over 40% of its system-wide sales in the top six market at nearly $9B by FQ3’23, it is unsurprising that the management has doubled down on these investments, with the aim to “drive long-term growth while improving its business efficiencies.“

MCD’s accelerating profitability is impressive as well, with much of the tailwinds attributed to the growing franchised restaurants at 39.68K in FY2023 (+626 units QoQ/ +1.51K YoY/ +3.62K from FY2019 levels of 36.05K).

This is because the fees from the franchised model offer an expanded operating profits of $12.96B (+10.2% YoY/ +37.1% from FY2019 levels of $9.45B) and operating margins of 83.9% (+0.6 points YoY/ +2.8 from FY2019 levels of 81.1%) in FY2023.

With the franchised model clearly being MCD’s top and bottom line driver, it is unsurprising that the company reports impressive overall operating margins of 45.6% in FY2023 (+5.2 points YoY/ +2.6 from FY2019 levels of 43%).

At the same time, the management also aimed to deliver profitable growth ahead, with over 1.6K in projected net restaurant additions globally in FY2024 (compared to 1.54K in FY2023) and a total of 50K restaurants by 2027 (compared to 41.82K in FY2023), implying a CAGR of +4.5%.

As a result of the company’s comprehensive growth strategy through digital approaches, growing franchised locations, and aggressive global expansions over the next few years, we concur with the MCD management in that FY2024 may bring forth expanded operating margins in “the mid-to-high 40% range,” despite the decelerating sales growth guidance of +3.5% YoY at the midpoint.

The management’s transition from high single-digit pricing actions in FY2023 to low single-digit pricing actions in FY2024 as inflation cools further underscores why the franchise model has been so successful in boosting its bottom line thus far, despite the tougher YoY comparison.

The excellent profitability has directly contributed to MCD’s improving debt-to-EBITDA-ratio of 2.72x by FQ4’23, down from the 2.94x reported in FQ4’22 and 3.22x in FQ4’19, with 89.9% (inline YoY) of its debts also at fixed interest rates, partially insulating the giant from the elevated interest rate environment.

The management has prioritized shareholder returns as well, with 9M shares/ 1.2% of its float retired over the past twelve months and 32.7M/ 4.2% since FY2019, putting much of the cash flow to great use other than capital investments and dividend payouts.

In the long-term, we expect MCD to consistently deliver profitable growth through these strategies, allowing it to focus on robust shareholder returns as well.

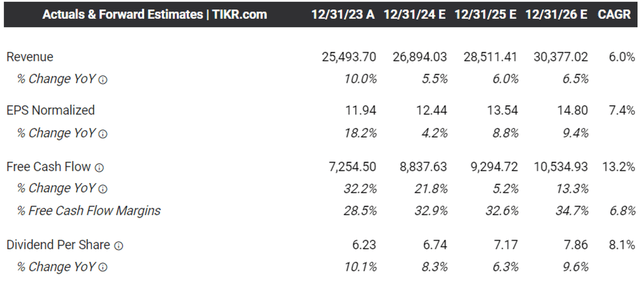

The Consensus Forward Estimates

The same has been estimated by the consensus, with MCD expected to generate an excellent top/ bottom line growth at a CAGR of +6%/ +7.4% through FY2026.

Readers must also note that the estimates have been moderately raised from the previous numbers of +2.9%/ +5.2%, with it likely to further sustain the stock’s excellent returns ahead.

MCD’s Near-Term Risks Are Likely Temporal

For now, MCD has reported near-term headwinds in France and China, mostly attributed to the uncertain macroeconomic outlook. With both being two of their largest and most profitable markets, the recent correction is somewhat warranted indeed, given the potential impact on its comparable sales.

However, readers must also note that MCD has often been able to develop specialized menus to fit the taste buds and culture of local communities, with the management already installing new leadership teams in the affected markets to address the underlying issues.

As a result of the management’s determination to turn things around, we believe that the market softness is likely to be temporal, with things to improve over the next few quarters.

It goes without saying that MCD needs to consistently generate improved profit margins, to counter the rising long-term debts of $37.21B (+3.3% YoY/ +9% from FY2019 levels) and growing interest expenses of $1.36B (+13.3% YoY/ +21.4% YoY), with any temporal slowdown likely to impact its dividend investment thesis.

Readers may want to focus on these risks moving forward, since the Fed expects a normalized macroeconomy only by Q4’26, triggering moderate uncertainties in the mean time.

So, Is MCD Stock A Buy, Sell, or Hold?

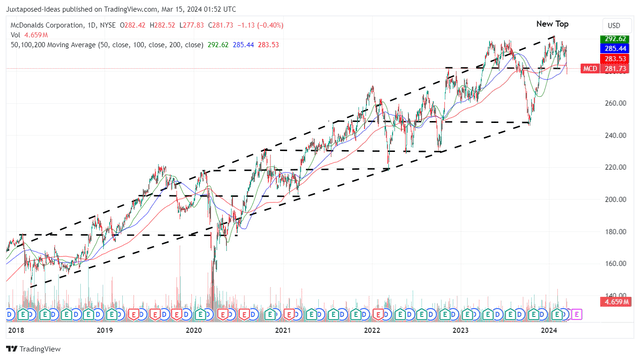

MCD 5Y Stock Price

For now, MCD has charted new heights while recording an impressive recovery from the October 2023 bottom. Based on the stock’s upward momentum over the past few decades, it is apparent that bullish support has been excellent thus far, despite the recent correction from the sluggish international sales.

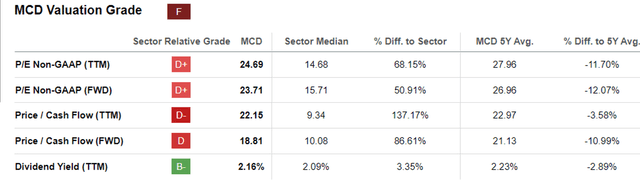

MCD Valuations

At the same time, we believe that MCD’s FWD P/E valuations of 23.71x and FWD Price/ Cash Flow of 18.81x do not appear to be expensive, since these are somewhat inline compared to its 1Y mean of 24.36x/ 24.60x and from our previous article the mean was at 25.02x/ 23.2x, though relatively higher than the 3Y pre-pandemic mean of 22.81x/ 20.90x, respectively.

This is attributed to its profitable growth trend with a historical top-line expansion at a CAGR of +0.5% between FY2016 and FY2023, and accelerating bottom-line growth at a CAGR of +11.1%.

This is on top of the increased Free Cash Flow generation at a CAGR of +8% and expanding FCF margins from 17.2% in FY2016 to 28.5% in FY2023, with things likely to further improve as MCD grows.

As a result of its consistent valuation over the past few years, we believe that MCD is trading near our fair value estimate of $283, based on the FY2023 adj EPS of $11.94 and the FWD P/E valuations of 23.71x.

Based on the FY2026 adj EPS estimates of $14.80, there seems to be an excellent upside potential of +19% to our long-term price target of $350.90 as well.

This is on top of MCD’s expanded forward dividend yield of 2.36% and exemplary 5Y dividend per share growth at +8.01%, compared to the sector median of 2.13% and +6.40%, respectively.

As a result of the prospective dual pronged returns, we are rating MCD as a Buy. Bottom fishing investors may consider adding after a moderate retracement to its previous support levels of between $260s and $280s.

With MCD continuing to generate alpha for long-term shareholders, attributed to the intensified digital approaches/ expanded franchised locations, we believe that the stock is one that is highly suitable for income and growth oriented investors alike.

Add at every dip, while DRIP-ing on a quarterly basis.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.