Summary:

- Texas Instruments focuses on industrial and automotive applications and has a robust and well-integrated manufacturing footprint.

- Nvidia dominates the AI chip market but relies on TSMC for chip fabrication.

- Texas Instruments has faced a cyclical decline in growth due to exposure to industrial and automotive segments, while AI chips drive Nvidia’s surge.

- TXN investors must be steadfast in holding on to their positions as they ride out the near-term cyclical weakness.

- I explain why TXN offers a more robust buying opportunity than Nvidia at the current levels.

patpitchaya

AI Hype Missed Texas Instruments

Texas Instruments (NASDAQ:TXN) is a well-established semiconductor company focusing on trailing-edge process applications. Accordingly, Texas Instruments’s primary focus is increasingly on the 300mm wafers, underpinning its robust profitability expansion in recent years. Texas Instruments has also enhanced its manufacturing footprint, capitalizing on the strategic focus on domestic production. Nvidia (NVDA) is the semiconductor value chain’s most critical AI chips designer. It doesn’t own its manufacturing facilities and relies primarily on Taiwan Semiconductor Manufacturing Company (TSM) to fabricate its chips. It has dominated the AI hype, driving significant near-term revenue accretion and significant revisions in its earnings potential. I discussed Nvidia’s earnings surge in a recent article, which has stunned even my most optimistic predictions. While credit must be given to Nvidia for proving its doubters wrong, serious questions must still be asked whether FOMO over Nvidia’s AI surge has reached a new level.

Observant semiconductor investors should be keenly aware of these significant differences in the valuation drivers between Nvidia and Texas Instruments, even though both companies are leaders in their own right. However, Nvidia’s recent surge is mainly predicated on the euphoria underpinned by the retooling of data centers, with AI chips taking center stage. In contrast, Texas Instruments has faced a growth normalization phase as it suffers a decline due to its substantial exposure to the industrial and automotive segments.

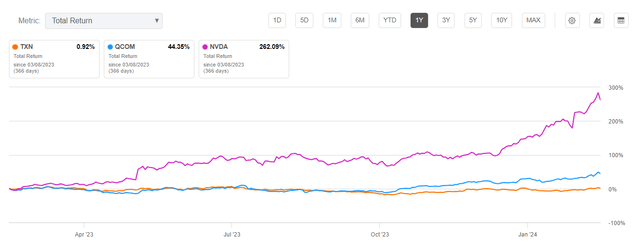

TXN Vs. Peers 1Y total return CAGR % (Seeking Alpha)

As a result, I believe investors have not been surprised by the relative outperformance of NVDA against TXN over the past year. Accordingly, TXN notched a 1Y total return of less than 1%. Compared to NVDA’s incredible 262% surge, TXN’s underperformance has been hugely disappointing. Even consumer-focused Qualcomm (QCOM) has seen its stock perform admirably over the past year, delivering a 1Y total return of almost 45%.

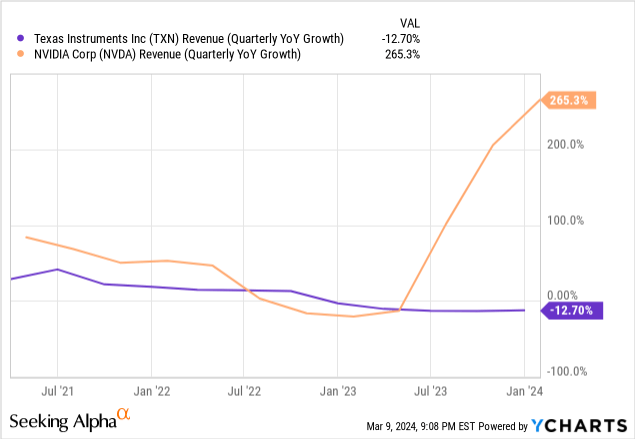

While the market has turned cold over TXN over the past year, it still notched a 5Y total return of 13.6%, hardly a disaster. Despite that, it’s clear that the market has priced in Nvidia’s incredible surge in its data center revenue, leading to a 265.3% revenue growth in the most recently reported quarter. In contrast, Texas Instruments saw a 12.7% decline in topline growth as it suffered the effects of its weaker industrial and automotive segments.

These segments aren’t expected to deliver the type of surge driven by new growth areas such as Nvidia’s AI chips. Despite that, it has delivered a relatively stable and predictable growth cadence over the past ten years. Texas Instruments management highlighted that the “company’s revenue from industrial and automotive segments grew at a 10% CAGR between 2013 and 2023.” As a result, Texas Instruments’s strategic focus on these two segments has also helped the company “achieve significant revenue growth and market share in these sectors.”

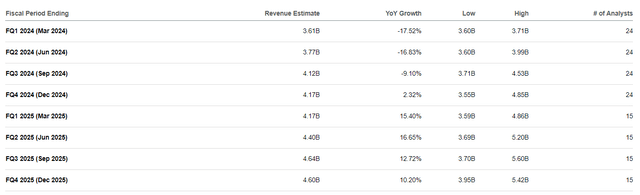

TXN’s quarterly revenue growth estimates (Seeking Alpha)

As seen above, Texas Instruments’s revenue growth is anticipated to recover through FY25 while bottoming out in the second half of 2024. The company continues to invest in its long-term vision, placing its confidence in secular growth opportunities in industrials, EVs, and energy storage. More robust opportunities in the IoT segment are also anticipated to accrue to Texas Instruments as these segments stage their cyclical recovery.

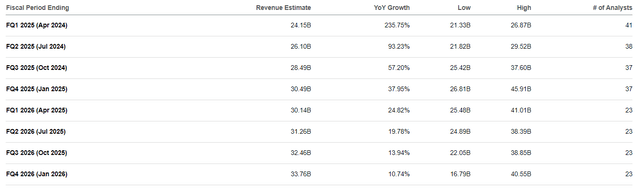

Nvidia quarterly revenue growth estimates (Seeking Alpha)

While Nvidia is still projected to post incredible revenue growth in the next quarter, can we expect the Jensen Huang-led company to keep delivering such massive beats over the next two years? Even the highly bullish Wall Street analysts (rated by Wall Street as a Strong Buy) don’t expect the growth cadence to continue through the quarter ending January 2026 (Nvidia’s fiscal fourth quarter). Accordingly, Nvidia’s growth momentum is expected to decelerate markedly. While Nvidia is expected to remain the King of AI chips, competitive headwinds over the highly lucrative segment are expected to catch up. Furthermore, supply chain dynamics are also expected to improve. Near-term monetization should also be anticipated to slow down as companies assess the ROI from their earlier investments in generative AI.

In contrast, Texas Instruments is a steady compounder, driven by its highly profitable business model. While it’s investing in CapEx over the next three years to internalize its manufacturing processes, it is expected to drive free cash flow margin accretion as it re-shores manufacturing to the US. Despite that, Texas Instruments remains exposed to geopolitical headwinds due to its 20% revenue exposure to China.

Nvidia has managed to mitigate its revenue exposure challenges in China, as the surge in generative AI came at the right moment. However, China is a massive market for industrial and automotive chips. Hence, it’s paramount for Texas Instruments to maintain its leadership in China. Despite that, China’s headwinds would likely continue to concern investors as Beijing looks to untether itself from America’s technology leadership. While China faces significant challenges in manufacturing advanced chips, it’s arguable that it might have less intense challenges in the trailing nodes. Given China’s massive scale, I believe Texas Instruments seems more exposed to China’s headwinds than Nvidia. As a result, the market will likely be more cautious about ascribing a much higher valuation multiple to TXN in the near term.

TXN’s Relative Discount Against NVDA Has Closed Markedly

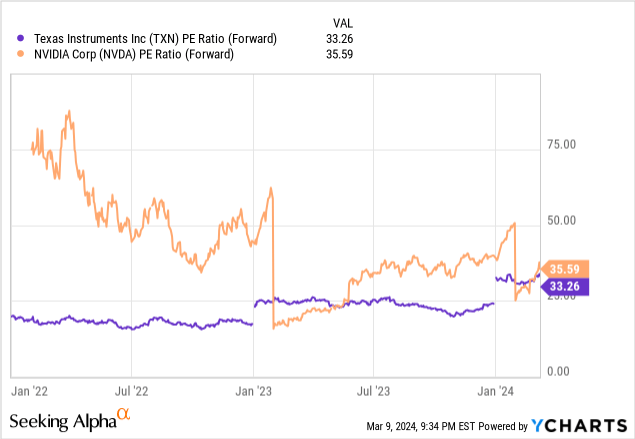

With a forward P/E that’s pretty close, NVDA doesn’t seem to command such a steep valuation premium against TXN compared to the levels seen over the past two years. I assessed that’s likely attributed to the significant earnings growth revisions linked to Nvidia, as analysts realized their forecasts could have been too cautious.

At the same time, Texas Instruments is undergoing a growth normalization phase. As a result, investors could be reticent in reallocating too aggressively to TXN currently, considering NVDA’s impeccable execution prowess. Texas Instruments needs to improve its execution over the next two quarters and potentially outperform analysts’ estimates markedly to drive a more robust valuation re-rating potential.

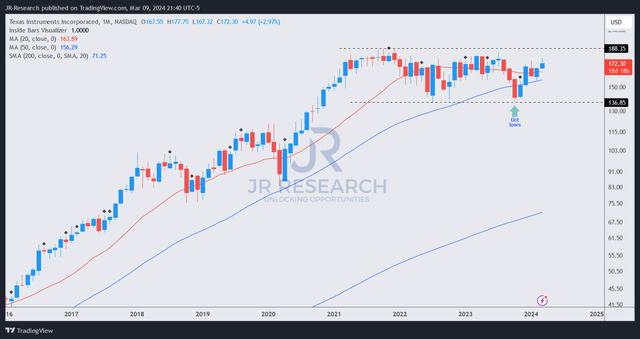

TXN price chart (long-term, monthly, adjusted for dividends) (TradingView)

As seen above, TXN has a robust support zone at the $135 level over the past two years. That level has also proved its worth during the October 2023 pullback, attracting dip buyers to return. I assessed its relatively attractive forward dividend yield of 3.1% (10Y average of 2.7%) should proffer solid valuation support to TXN’s buying momentum.

However, caution is assessed at the $190 level, as selling resistance has stymied TXN’s upward bias since 2021. Despite that, I evaluated that TXN’s long-term uptrend has remained undefeated. As a result, I have confidence Texas Instruments’s anticipated bottom in its topline growth in the second half of 2024 should bolster TXN’s buying sentiments. Therefore, I assessed that TXN remains well-poised to resume its uptrend continuation thesis, subsequently breaking above the $190 level.

Is TXN Stock A Buy, Sell, Or Hold?

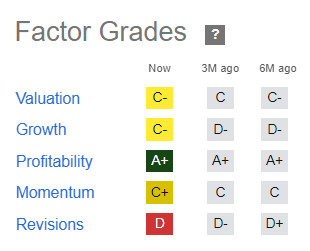

TXN Quant Grades (Seeking Alpha Quant)

TXN isn’t your “sexy” AI chips leader partaking in the hottest trend dominating the semiconductor landscape right now. The company focuses on long-term positioning as it continues to execute its “six-year investment plan.” Texas Instruments expressed its confidence that the anticipated market recovery should “yield attractive results as the market rebounds.”

With a best-in-class “A+” profitability grade, I believe Texas Instruments is a fundamentally strong company. TXN’s long-term uptrend bias has also corroborated my confidence. Robust buying sentiments at TXN’s $135 level have strengthened my confidence that we have likely seen the bottom as investors look forward to a resurgence in its revenue and earnings growth profile.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!