Summary:

- Coca-Cola has demonstrated strong growth in revenue and profit in Q4 2023 and throughout the year.

- The company expects further revenue growth of 6% to 7% in 2024.

- Coca-Cola remains dedicated to enhancing shareholder value through dividends and share repurchases.

Rattankun Thongbun/iStock via Getty Images

Coca-Cola (NYSE:KO), an internationally renowned beverage, has been a staple since its establishment in 1886. Known for its distinctive flavor derived from a proprietary blend of ingredients, Coca-Cola has become synonymous with joy and conviviality. Recognizable by its iconic red branding and unique bottle design, Coca-Cola has cultivated a global presence, offering a diverse range of beverages to cater to varied preferences. From its inception, Coca-Cola has upheld a tradition of innovation and excellence, consistently delivering refreshing experiences to consumers worldwide. As a symbol of shared moments and cherished memories, Coca-Cola continues to resonate with individuals across cultures and generations.

We have started coverage of the Coca-Cola company in May 2023, with an initial bullish view, which we have maintained until now. Our key arguments for the “buy” rating have been:

- Industry leading profitability

- Strong track record of safe and sustainable dividends

- Extraordinary brand recognition

Since our writing, KO’s stock price has remained relatively flat, gaining only 2.5%, while the broader market has gained as much as 22%.

In this article, we will examine whether the current underperformance is expected to persist or if there are signs of potential improvement ahead for the stock. Our focus will center on several key aspects, including the firm’s recent earnings report from February. We’ll closely analyze the global demand for KO’s products and track the trends in profitability over time. Additionally, we’ll evaluate the company’s current valuation by comparing a set of traditional price multiples across both the consumer staples sector and KO’s specific peer group.

Earnings results

Sales

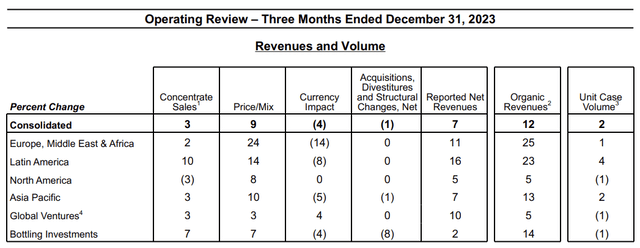

During the quarter, the company’s total revenues increased by 7% to $10.8 billion, with organic revenues growing by 12%. This growth was primarily due to a 9% increase in pricing and product mix, along with a 3% increase in concentrate sales. The quarter’s results were slightly boosted by having one extra day. For the entire year, total revenues rose by 6% to $45.8 billion, with organic revenues increasing by 12%. This growth was driven by a 10% rise in pricing and product mix, along with a 2% increase in concentrate sales. Throughout both the quarter and the year, all operating segments demonstrated strong performance in organic revenue growth.

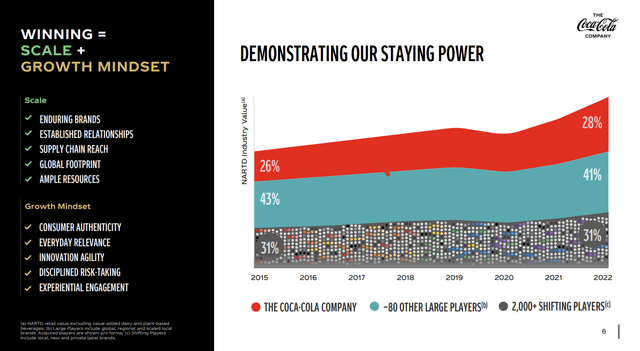

Also important to note that over the past years, KO has managed to further increase its market share, which reaches about 28% now.

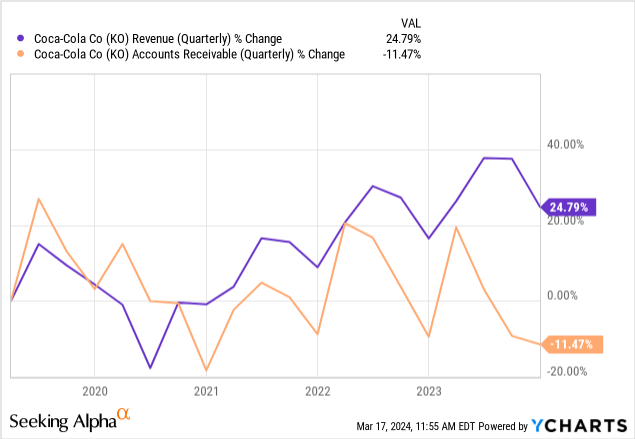

Before we draw any conclusions, let us look at how sales growth compares with accounts receivable growth. If accounts receivable grow at a significantly faster rate than revenue, it may be an indication that the firm is manipulating revenue by selling more on credit or changing revenue recognition policies. For KO, however, this is not the case. Over the past 5 years, the firm’s revenue growth on average has outpaced its accounts receivable growth, which is another good sign.

We believe that this is a clear indication that the demand for KO’s products has remained strong and robust both in Q4 2023 and in the entire past year. Looking forward to 2024, we can also be quite optimistic as management had a relatively upbeat tone about the outlook. KO expects a further 6% to 7% revenue growth for 2024. Currency is expected to create negative impacts this year again, however at a much smaller magnitude than in the prior year, roughly 2% to 3%.

Operating income and EPS

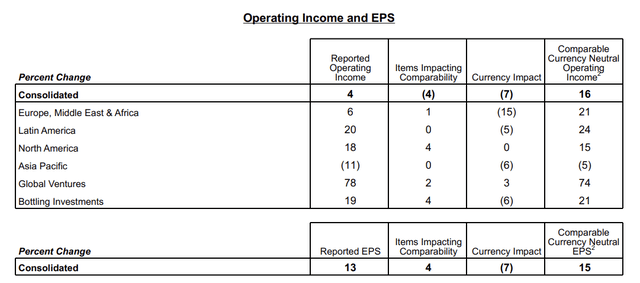

Operating income increased by 10% during the quarter and by 4% for the entire year. When adjusted for currency fluctuations, operating income, which is a measure of how much money a company makes from its regular business activities, rose by 20% for the quarter and by 16% for the full year. When looking at these figures from a profitability stand point, the picture also looks quite attractive. In the quarter, the operating margin was 21.0%, up from 20.5% the previous year. When adjusted for comparability and currency differences, the comparable operating margin (non-GAAP) was 23.1%, compared to 22.7% in the prior year. For the full year, the operating margin was 24.7%, down from 25.4% the previous year, while the comparable operating margin (non-GAAP) was 29.1%, up from 28.7% in the prior year. Both quarterly and annual comparable operating margin expansions were primarily driven by strong revenue growth.

Note that except Asia Pacific, all segments have contributed positively to the overall growth.

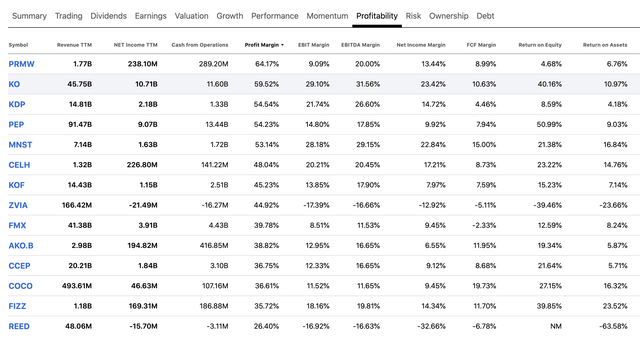

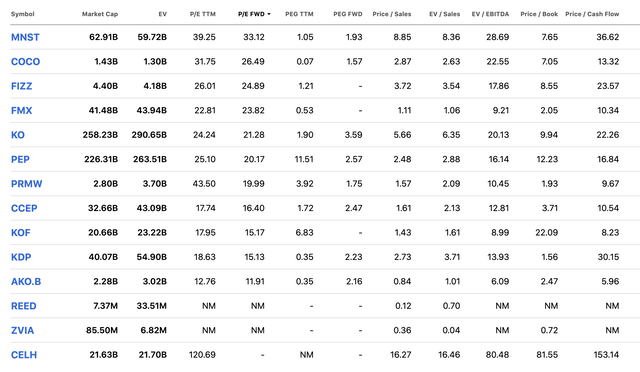

The following table also puts the firm’s profitability metrics into perspective within the industry. Just like pointed out in our previous article, we once again highlight that KO remains one of the leaders in the industry, in terms of profitability.

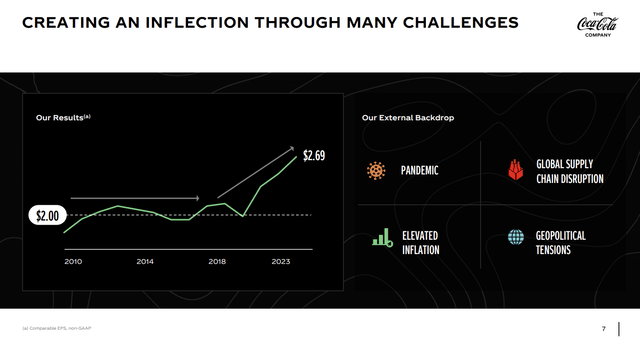

These results are even more impressive, when we take into account all the hurdles that KO and many other companies had to overcome in the past decade.

Looking forward, the expectations in terms of bottom line results also appear attractive. The company anticipates achieving a comparable earnings per share growth of 8% to 10% when adjusted for currency fluctuations, and a growth of 4% to 5% without such adjustments, compared to the $2.69 EPS reported in 2023. This anticipated growth in comparable EPS (non-GAAP) is expected to be impacted by a 4% to 5% negative effect from currency fluctuations, based on current exchange rates and accounting for hedged positions, as well as an additional approximately 2% negative effect from acquisitions, divestitures, and structural changes.

All in all, in our opinion, KO has delivered very strong results for the past quarter and year, exhibiting substantial growth, while giving an upbeat guidance about further growth expectations. This makes the firm’s stock an interesting investment candidate for us for 2024.

Capital allocation

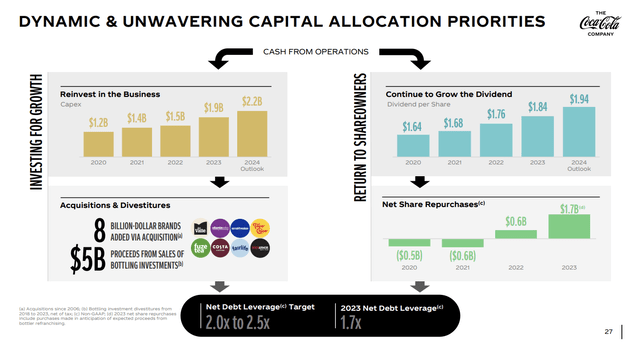

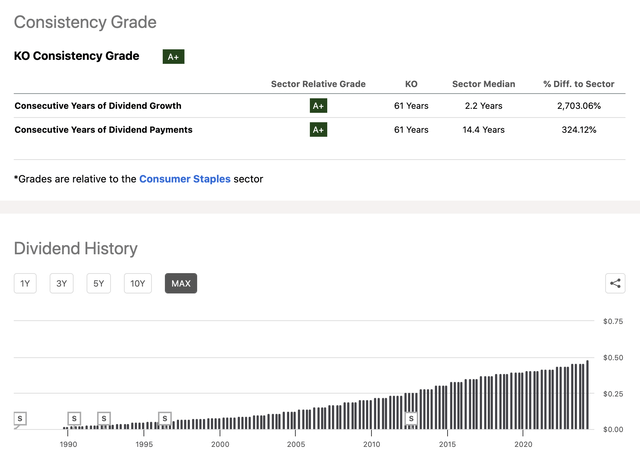

In our previous article, we have highlighted that KO has been a reliable dividend player for decades. This reliability hasn’t seemed to stop. The firm has recently increased its quarterly dividend to $0.485, representing a 5.4% growth. With this increase, the company has been increasing its dividends for each year over the past 61 years.

Dividend history (Seeking Alpha)

Further, in 2023, the company issued $0.5 billion worth of shares when employees exercised their stock options, and bought back $2.3 billion worth of shares. This means that after subtracting the shares bought back from those issued, the net share repurchases (non-GAAP) totaled $1.7 billion. The company still has around $6 billion left in its authorization for further share repurchases.

For these reasons, we believe that KO’s stock could be an attractive choice for investors looking for dividends and dividend growth.

Valuation

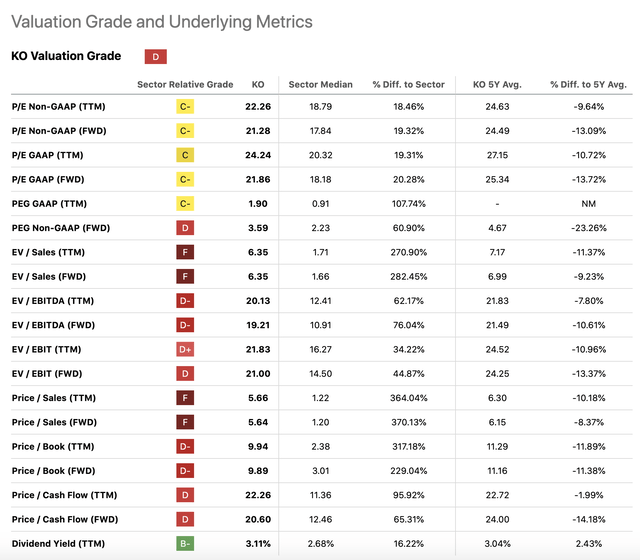

To assess whether it could be an attractive opportunity to buy KO’s stock at the current price level, we are going to examine a set of traditional price multiples. The following table summarizes these multiples, and compares KO’s figures with those of the consumer staples sector median and with the firm’s own 5Y historic averages.

It is clear from the table that KO is selling at a meaningful premium compared to the sector median across all metrics, on the other hand however, compared to its historic valuation KO’s stock appears to be trading at a discount. Now, the comparison using the entire consumer staples sector may be too broad, as it contains a large amount of firms, which may have a substantially different business from that of KO, for this reason, we are going to narrow down the peer group now to a handful of firms – KO’s closest peers and competitors. The following table shows the comparison of the valuation metrics across the Soft Drinks & Non-alcoholic Beverages industry. While KO is on the higher end of the valuation range in the industry, it does not appear to be unreasonably expensive, especially considering the firm’s growth prospects and current financial performance.

Risks

Before we conclude our writing, we must point out some of the key risks. KO faces several risks to its business, which may not appear significant or material now, based on the strong financial performance, but they need to be kept in mind for investors and potential investors. These risks include shifts in consumer preferences towards healthier beverages, potentially impacting sales of traditional sugary drinks. Economic downturns or instability in key markets could also affect consumer spending and demand – we have seen enough examples of this in the past few years. Moreover, regulatory changes or taxes aimed at reducing sugar consumption pose a threat to Coca-Cola’s product portfolio. Additionally, supply chain disruptions, such as those caused by natural disasters or geopolitical tensions, may impact production, distribution and demand. Coca-Cola must navigate these risks adeptly to sustain its market position and profitability in the coming years

Conclusion

In the fourth quarter of 2023 and throughout the year, KO demonstrated robust growth in both revenue and profit. Based on the guidance for 2024, this strong financial performance is expected to continue throughout 2024, despite the expected currency headwinds. The company remains dedicated to enhancing shareholder value through dividends and share repurchases. While KO may not be the most inexpensive option in its industry, its global brand recognition and loyal customer base contribute to its strong market position. Considering these factors, we believe the current valuation is reasonable, and shareholders can anticipate promising prospects ahead. Therefore, we maintain our buy recommendation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.