Summary:

- Meta Platforms has experienced significant growth and is now one of the most valuable companies in the world.

- The company’s recent earnings results indicate successful mitigation of disruptions caused by Apple in the past.

- Meta has multiple growth opportunities, including the potential ban of TikTok in the US and the continuous monetization of Reels, WhatsApp and Messenger.

Alex Wong/Getty Images News

Meta Platforms (NASDAQ:META) seems to be unstoppable. After struggling to stop the exodus of users in early 2022, Meta’s CEO Mark Zuckerberg managed to execute a proper comeback in the recent year and make his company one of the most valuable businesses in the world. In recent months, Meta’s business was able to grow at an aggressive double-digit rate, its shares have recently reached new all-time highs, and the outlook is extremely positive. Add to all of this the fact that the latest earnings results indicate that Meta was able to mitigate Apple-related (AAPL) disruptions and it becomes obvious that the company’s growth story is far from over.

Meta Platforms Is Unstoppable

Back in 2022, I established a sizable long position in Meta believing that the monetization of short-form video content along with the implementation of ads within the company’s messaging platforms would be able to create additional shareholder value. That’s exactly what happened during that time as shares have more than doubled in a short period of time. After making a significant return on my investment, I sold my shares in Meta back in May of 2023 and redistributed the profits mostly into Palantir (PLTR) and later into Nvidia (NVDA) as the AI-related rally was far from being over.

While I made great returns on those other investments in the last year, Meta’s shares have managed to greatly appreciate as well in recent quarters thanks to the explosive growth of the company’s business. Since the publication of my latest article on the company with a HOLD rating in October, Meta’s stock made a ~65% return and there’s an indication that it could appreciate even more in the future thanks to the various new growth opportunities that have recently appeared. As such, even though I’ve missed a major rally in recent months by focusing on other investments, I believe that Meta’s stock has additional room for growth and decided to give it a BUY rating.

One of the biggest changes that occurred in Meta in recent quarters was the ability to finally mitigate the downside caused by Apple-related losses (AAPL) in the past. In part, this was achieved by spending a significant amount of cash on R&D to improve its algorithms and build its own large language model to join the generative AI race. As a result of this, the latest earnings report that was released last month showed that Meta’s revenues in Q4 increased by a stunning 24.7% Y/Y to $40.11 billion and were above the estimates by $940 million. At the same time, Meta continues to attract new users to its platforms, and at the end of Q4, it had 3.98 billion monthly active people, up 6% Y/Y.

Going forward, Meta could continue to generate impressive returns thanks to the improvement of the overall economy. There’s an indication that as a result of a better macro environment, advertising spending is expected to grow by 4.6% to $752.8 billion in 2024, which will greatly benefit Meta in the coming months.

At the same time, Meta’s entrance into the generative AI field with the launch of its large language models and the addition of new features to its AI assistant makes it possible for the company to improve its algorithms and attract new developers over time. Add to all of that the potential ban of TikTok in the United States, the impressive growth of Reels, and the continuous monetization of WhatsApp and Messenger make it possible for the company to deliver a stellar performance in 2024 and beyond.

Considering the amount of growth opportunities that Meta has going for it, it’s safe to assume that the company will be able to meet the street expectations and grow its revenues and earnings at a double-digit rate in the following years.

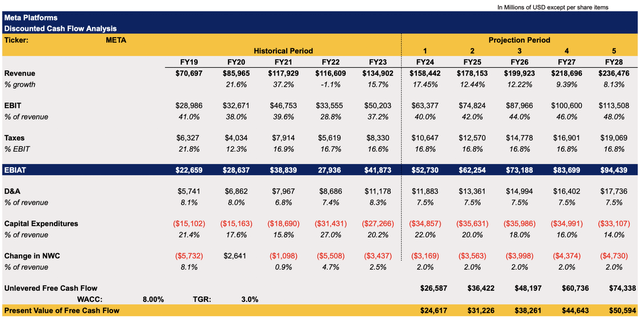

To figure out whether Meta’s stock itself is an attractive investment at the current price, I decided to create a DCF model that can be seen below. The revenue and earnings assumptions in the model are mostly in line with the street expectations. The assumptions for all the other metrics correlate closely with Meta’s historical performance. The WACC in the model is 8%, while the terminal growth rate is 3%.

Meta Platforms DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

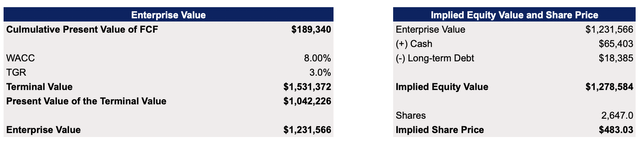

The model shows that Meta’s enterprise value is $1.23 trillion, while its fair value is $483.03 per share, which is close to the current market price at the time of this writing.

Meta Platforms DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

However, while it looks like Meta appears to be fairly valued, there’s a possibility that if it manages to capitalize on most of the growth catalysts described above, then it will be able to exceed expectations and surprise the whole market again. In such a scenario, the upward revision of assumptions would follow and result in a higher fair value for the company.

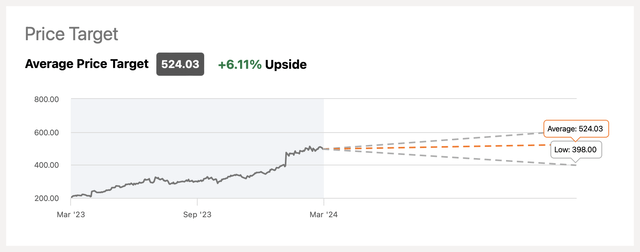

Given that Meta currently trades at a forward P/E of only ~25x, which is below the market’s P/E of ~28x, and recently has attracted the attention of dividend investors after announcing that it will pay dividends for the first time in its history, it’s safe to assume that the upside is still there. The consensus on the street is that Meta is worth over $500 per share, and considering the amount of growth catalysts the company has – there’s a high chance that the business will be able to exceed estimates in the coming quarters. That’s why I decided to give Meta’s stock a rating of BUY since the assumptions in my model could be too conservative given the latest developments.

Meta Platforms Consensus Price Target (Seeking Alpha)

Major Risks To Consider

Unfortunately, Meta’s metaverse project continues to be a failure to this day. The latest earnings report showed that the Reality Labs division that’s responsible for all the metaverse initiatives generated $1.89 billion in revenues and $16.1 billion in net loss in 2023. There’s still no clarity on how to properly monetize Reality Labs, which might mean that it will remain a major money pit in the foreseeable future.

At the same time, there’s also a risk that economic growth will slow down and negatively affect advertising spending which could result in Meta’s underperformance. Even though the Federal Reserve recently improved the economic outlook for the year, the deflation in China could create a domino effect on the global economy and negatively affect economic activity across the globe.

In addition to all of that, the changing regulatory landscape could also hurt Meta’s ability to generate impressive returns and exceed expectations. Earlier this month, the European Commission launched an investigation against Meta to figure out whether it violates the recently enacted Digital Markets Act. While the investigation will take time and Meta could always drag the process for years if the European Commission initially accuses the company of any wrongdoing, it could nevertheless result in the loss of earnings and value over time.

The Bottom Line

Even though the macro and regulatory issues will continue to haunt Meta for years to come, while its metaverse project will likely remain a major money pit, the company has more than enough growth catalysts that are likely to outweigh most of the downside in the upcoming quarters. Add to all of this the fact that the company managed to mitigate the Apple-related disruptions and is now able to ensure the sustained growth of its advertising business on its own, and it becomes obvious that Meta’s growth story is far from over.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, PLTR, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.