Summary:

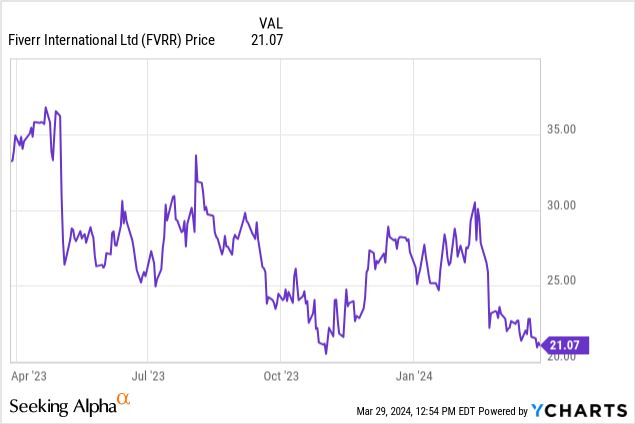

- Fiverr’s stock has dropped 20% this year due to slower growth rates and increasing risks from AI.

- The company’s active buyer base is shrinking, and AI tools are reducing the need for “simple services” on the platform.

- Fiverr faces competition from other freelance marketplaces and may struggle to compete in the long run.

- The only draw to this company is value, as it trades at a <8x forward adjusted EBITDA multiple. This isn't enough to compensate for long-term existential risks, however.

borchee/E+ via Getty Images

So far in 2024, the market has proven to be a “winner take all” game. Though the S&P 500 is sitting at all time highs, that growth has been driven by AI stocks – while many less prominent companies have conversely seen dramatic declines in share price.

Fiverr (NYSE:FVRR) is in the losers’ bucket here. The freelance marketplace company has shed ~20% of its share value this year, driven by slower growth rates and increasing risks vis-a-vis AI:

I last downgraded Fiverr to a neutral rating in December, when the stock was trading in the high $20s. Since then, Fiverr has dropped a fresh ~20% while also releasing Q4 results that didn’t solve any of its core problems. Active buyers continued to decline (which the company defended by arguing that it’s simply moving upmarket), while AI risks remain ever prevalent.

The only positive I see in Fiverr is a cheap valuation. At current share prices near $21, Fiverr trades at a market cap of $815.4 million. After we net off the $745.7 million of cash and $455.3 million of debt on the company’s most recent balance sheet, Fiverr has a minuscule enterprise value of $525.0 million.

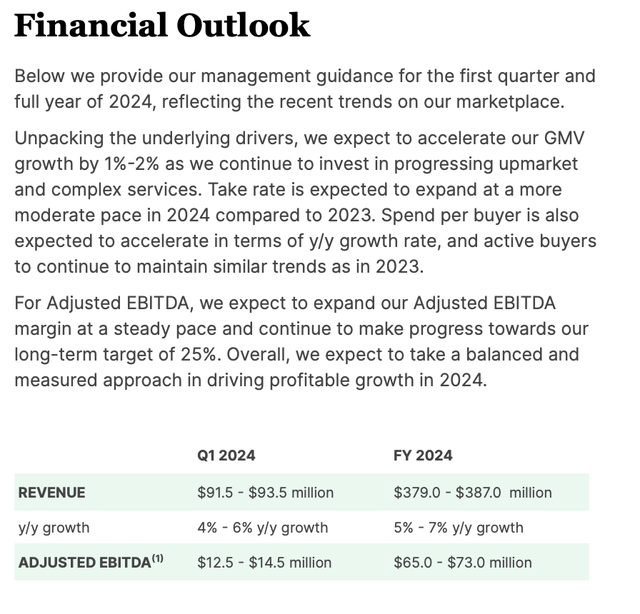

Fiverr outlook (Fiverr Q4 shareholder letter)

Meanwhile, as shown in the chart above, Fiverr has guided to measly 5-7% y/y growth in revenue this year, alongside $65-$73 million of adjusted EBITDA, representing an ~18% adjusted EBITDA margin at the midpoint. This puts Fiverr’s valuation multiples at:

- 7.8x EV/FY24 adjusted EBITDA

- 1.4x EV/FY24 revenue

Fiverr is cheap… but it’s also cheap for a reason. Here are the red flags that I’m most concerned about:

- Active buyer base is shrinking. No matter how Fiverr tries to spin it, it’s mostly an SMB platform and not a meaningful enterprise business (as evidenced by an average spend per buyer below $300 – no enterprise deals in projects that small). This buyer base, meanwhile, is shrinking.

- AI risks. While Fiverr also tries to emphasize the fact that it’s embedding AI across its platform, there can be no doubt that AI’s increasing ease of use is a threat to many core Fiverr functions. For example – there is much less need to pay a logo designer on Fiverr now when free AI tools can craft a professional-looking logo in seconds.

- Competition. Fiverr is far from the only game in town when it comes to freelance marketplaces, with competition from companies like Upwork, Toptal, Freelancer, and Taskrabbit.

All in all, I’m not convinced that Fiverr’s low valuation is a good enough compensation for the myriad operational risks that the company faces. I’d argue that the AI threat is an existential one: though the company is citing ~30% growth in “complex services,” in the long run I doubt that companies will turn to freelance marketplaces like Fiverr to source AI talent. The risk of cannibalization from AI to Fiverr’s core “simpler” services, meanwhile, is much greater.

Continue to keep an eye on this stock as it falls, but don’t rush to buy in.

Q4 download

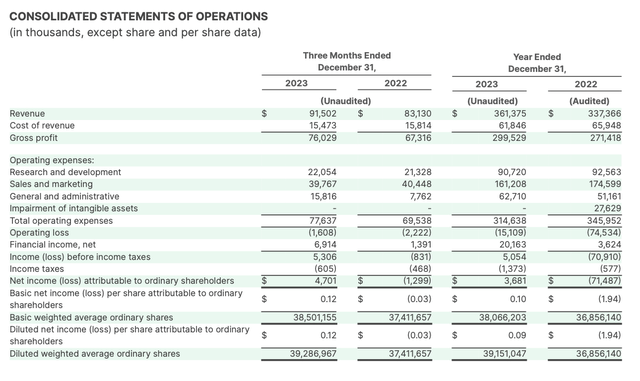

Let’s now go through Fiverr’s latest quarterly results in greater detail. The Q4 earnings summary is shown below:

Fiverr Q4 results (Fiverr Q4 shareholder letter)

Fiverr’s revenue grew 10% y/y to $91.5 million, missing Wall Street’s expectations of $92.6 million (+11% y/y) while also decelerating two points versus Q3’s revenue growth rate of 12% y/y.

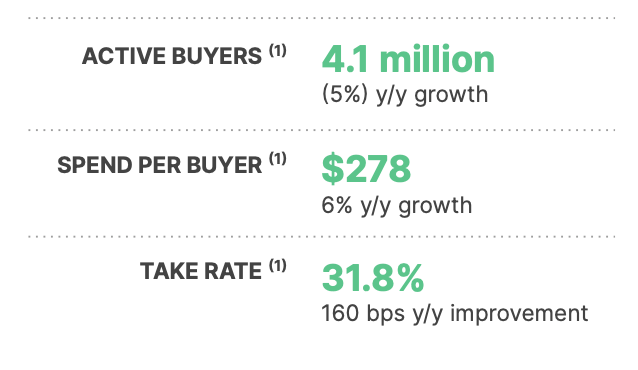

As shown as well in the chart below: Fiverr’s active buyer base shrunk by 5% y/y.

Fiverr key metrics (Fiverr Q4 shareholder letter)

This, meanwhile, was offset by a boost in take rates: up 160bps y/y to 31.8%. The company notes that take rates were lifted by two factors: first, increased attach rates on Promoted Listings (wherein sellers pay to be featured on the Fiverr marketplace), as well as stronger subscriptions for Seller Plus – which for a monthly fee gives sellers the ability to collect payments faster, as well as access to more advanced marketing and analytics tools.

In my view, however, higher take rates will not be a longer-term growth driver. In the long run, Fiverr will have to grow revenue by increasing average spend per buyer (which is going up, albeit in the single digits) and by increasing its buyer pool.

The company continues to believe that AI is a net positive for the company, and that it drove 4% growth in the current quarter net of the cannibalization to “simple services,” which management cited as being down in the mid-teens. Per CEO Misha Kaufman’s remarks on the Q&A portion of the Q4 earnings call:

AI is a net positive for us. And I think that what we’ve identified is there is a difference between what we call simple categories or tasks and more complex ones. And in the complex group, it’s really those categories that require human intervention and human input in order to produce a satisfactory result for the customer. And in these categories, we’re seeing growth that goes well beyond the overall growth that we’re seeing. And really, the simple ones are such where technology can actually do pretty much the entire work, which in those cases they’re usually associated with lower prices and shorter term engagement. So essentially we’re really focusing on these more complex services, doubling down on these categories. And we think that these categories have the potential of driving very nice growth. And the larger they become, the more growth they’ll push. At the same time, we’re using AI across the entire marketplace, the entire experience. The searching experience, matching, personalization, the way our customers are doing briefing, the way our sellers are attending to customer needs.”

Still: I worry that Fiverr’s current uptick in “complex” solutions is more of a temporary tailwind, and when more companies have embedded AI skills into their salaried workforces (and AI is more generally accessible for smaller-sized businesses), Fiverr will see a net loss from simple services suffering from substantially reduced demand.

Key takeaways

Fiverr’s cheap valuation – the only positive draw to this stock – is a signal of the market’s lack of confidence in this flailing freelance marketplace which is undergoing a massive existential threat from the proliferation of generative AI. I’d err on the side of caution here and remain on the sidelines.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.