Summary:

- My optimism towards Intel remains strong as the company continues to successfully adapt to competitive dynamics, technological advancements, and economic fluctuations.

- I am particularly excited by Intel’s approach towards enterprise artificial Intelligence, which, alongside the prospects of cyclical and product-cycle recoveries, is likely to propel the company’s growth in 2024.

- The strategic benefits stemming from the federal support via the CHIPS Act, coupled with Intel’s determined efforts to expand its foundry operations, highlight Intel’s long-dated moat in chipmaking.

- I update my valuation framework for Intel stock; and I now calculate a fair implied target price of $53/ share.

Leon Neal

Intel (NASDAQ:INTC) shares have returned about 23% since I have upgraded the stock to “Buy”, compared to a gain of about 16% for the S&P 500 (SP500). And as INTC shares are trading very close to my previously established target price of $45.5/ share, I feel it is time for me to revisit my thesis: Overall, I remain bullish on Intel, as I see the company gaining momentum in navigating shifts in competition, technological shifts, and macroeconomic uncertainties. Specifically, I am encouraged by Intel’s strategy to strengthen the company’s focus on enterprise AI, while cyclical and product-cycle recovery prospects support commercial momentum in 2024. In addition, I like the strategic implications of federal support through the CHIPS Act, and Intel’s ambitious expansion of its foundry business. In fact, the significant federal backing Intel has received underscores the company’s critical role in the U.S. technology infrastructure, presenting both opportunities and expectations for domestic semiconductor revitalization. Overall, I think Intel is effectively building the commercial foundation for explosive share price upside.

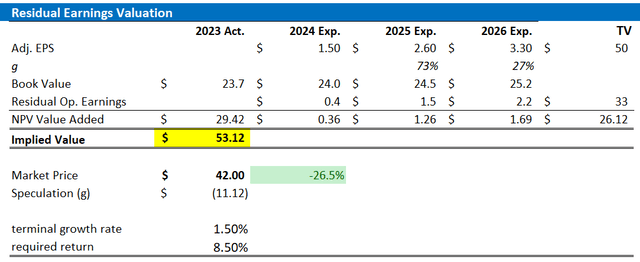

Considering updated valuation metrics, most notably a lower risk requirement for the equity, as well as an accelerated EPS growth through 2025 on the backdrop of the expectation for a cyclical recovery, I update my valuation framework for Intel stock; and I now calculate a fair implied target price of $53/ share.

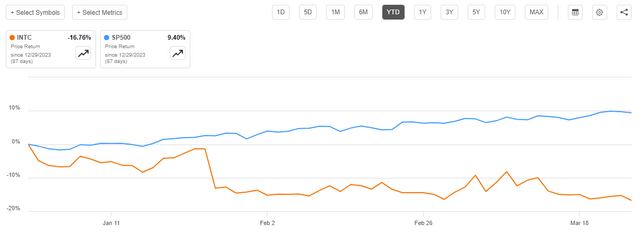

For context: Intel stock has grossly outperformed the broader U.S. stock market YTD. Since the start of the year, INTC shares are down about 17%, compared to a gain of about 9% for the S&P 500.

Intel’s Cyclical and Product-cycle Recovery To Continue Through 2024

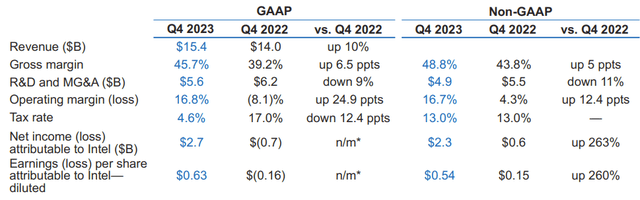

Following Intel’s results for the December quarter, I encouraged in my thesis that we will see a cyclical recovery through 2024: Intel’s sales for the fourth quarter from continuing operations reached $15.4 billion, marking a YoY increase of 10% and a sequential QoQ increase of 9%. Notably, the past quarter marked the third consecutive period of sequential growth and the first YoY increase in eight quarters. Bench marking the actual performance with estimates, I note that sales surpassed the company’s own forecast range of $14.6 billion to $15.6, as well as the $15.15 billion expected by consensus. Intel’s gross profit margin came in at 48.8%, up 3 percentage points from the previous quarter, and beating the expected margin, as modeled by consensus, by 2.3 percentage points. Operating profit stood at $2.5 billion (vs. $2.1 billion consensus), showing a positive inflection for the first time in five quarters with a YoY increase of $3.7 billion.

Investors should note that my positive expectation for Intel’s commercial momentum is driven by factors such as seasonal PC demand. On that note, I see a clear path for cyclical recovery, particularly in the latter half of 2024, underscores a potential cyclical upturn following a period marked by sector-wide challenges relating to inventory re-balancing. In fact, Intel management projection of sequential sales recovery throughout 2024 highlights an expected return to growth dynamics, albeit contingent on broader market conditions and management execution. On a more structural note, Intel should see emerging momentum from new platforms such as Gaudi AI,a platform that collects a suite of Artificial Intelligence processors designed specifically for deep learning workloads. With the increasing importance of AI in enterprise applications, Gaudi platform is engineered to increase data center efficiency and reduce the costs associated with AI training and inference.

As a potential drag for Intel’s near-term performance, I acknowledge the recent, negative news flow relating to a potential ban of Intel chips in Chinese government devices. However, I also point out that, firstly, a definite ban has not yet been confirmed, and secondly, the impact Intel’s overall business should be manageable: as estimated by Bernstein, Intel generated approximately 27% of its 2023 sales in China. Out of this $15 billion, only about 10% is government-related sales, bringing the revenue risk into the range of between $1 billion and $1.5 billion (2-3% of Intel’s projected 2023 revenue).

A Note On Intel’s Strategic Positioning in Enterprise AI and Server CPU Market

Building further on Intel’s AI positioning, I point out the company’s broader strategy, and opportunity, to penetrate the AI market in the context of the company’s longstanding dominance in server CPUs. In my opinion, Intel’s leading positioning with data center operators, as well as OEM, could provide a robust foundation for expansion into enterprise-level GenAI. Through Intel’s GPU solutions, Intel may be able to leverage accelerating enterprise AI demand with products such as the company’s Sapphire Rapids, which are tailored for less computationally intensive GenAI tasks. This contrasts with the offering from NVIDIA, which is mostly designed to handle workloads in the cloud. On that note, I highlight Intel’s assertion that Sapphire Rapids could become a preferred server CPU in addressing AI clusters without the prerequisite of cloud-scale model parameters. Overall, although Intel’s position in the GenAI computing space must yet to be established, given Intel’s extensive R&D budget and market reach, in my opinion, there is a realistic pathway for Intel to capture significant opportunities for value creation in this space.

Federal Support Takes Pressure from CAPEX/ R&D Spending

To manage Intel’s broader restructuring efforts and investments in new technologies and foundry capabilities, Intel is required to undertake lots of capital investments. In fact, Intel’s capital outflows for investments since 2020 totalled about $110 billion. In that context, investors will be pleased to learn that the U.S. government plans to provide Intel with approximately $20 billion in grants and potential loans to enhance domestic semiconductor manufacturing. This initiative is part of the Biden administration’s efforts under the CHIPS and Science Act. Intel is set to receive up to $8.5 billion in direct funding to support semiconductor projects in Arizona, New Mexico, Ohio, and Oregon, with an option for an additional $11 billion in federal loans.

The strategic alignment between Intel and U.S. federal initiatives signifies a critical juncture for both Intel and the broader U.S. semiconductor industry. As I see it, the allocation of substantial funds to Intel underscores an enormous U.S. commitment to revitalize domestic semiconductor manufacturing and innovation, which should greatly benefit Intel on a long-term basis, given the company’s leadership role in domestic foundry. For Intel, the strategic importance of doubling-down on foundry suggests revenue protection from fables competition vs. AMD and Nvidia. In addition, the decision looks promising on a loner term perspective, as customers are emphasizing the need for localized manufacturing capabilities.

Valuation Update – Raise Target Price

Accounting for my expectation of accelerating Intel’s EPS momentum in 2024 and 2025, on the backdrop of a robust cyclical recovery, I update my EPS expectations for INTC through 2025: I now estimate that the chipmaker’s EPS in 2024 will likely end up somewhere between $1.4 and 1.6. Moreover, I also adjust and raise my EPS expectations for 2024 and 2025, to $2.6 and $3.3, respectively. For the 2024-2025 growth expectation, I base my starting value for EPS on consensus estimates as collected by Refinitv. On top of this, I model a 10-15% uplift on earnings, as I believe analyst consensus is lagging my expectation for a cyclical recovery. With regard to my rates assumption, I lower my cost of equity assumption by 50 basis points, to 8.5%, mostly as a reflection of a more accommodating interest rate environment. Meanwhile, I continue to anchor on a 1.5% terminal growth rate (still below nominal GDP growth, and still risk-averse, given Intel’s restructuring efforts).

Given the EPS upgrades as highlighted below, I now calculate a fair implied share price for Intel equal to $53/ share.

Refinitiv; Company Financials; Author’s Calculations

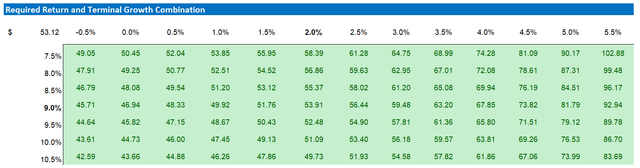

Below also the updated sensitivity table.

Refinitiv; Company Financials; Author’s Calculations

Conclusion

My optimism towards Intel remains strong as the company continues to successfully adapt to competitive dynamics, technological advancements, and economic fluctuations. I am particularly excited by Intel’s approach towards enterprise artificial Intelligence, which, alongside the prospects of cyclical and product-cycle recoveries, is likely to propel the company’s growth in 2024. Furthermore, the strategic benefits stemming from the federal support via the CHIPS Act, coupled with Intel’s determined efforts to expand its foundry operations, highlight Intel’s long-dated moat in chipmaking. Reflecting on the revised valuation parameters, especially the decreased equity risk and anticipated acceleration in EPS growth leading up to 2025 amid a forecasted cyclical rebound, I have reevaluated Intel’s stock valuation. Consequently, I adjust my valuation model, which now suggests a fair target price for Intel shares equal to $53.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.