Summary:

- Intel Corporation is making a massive bet on its foundry business and it has invested tens of billions of dollars in building new facilities.

- The company has received strong backing by U.S. and other Western governments who see the chip manufacturing as a national security issue.

- However, the cost of running these factories in the western countries is a lot more expensive compared to Taiwan or South Korea.

- This can lead to poor returns on investment on an ongoing basis which would be difficult to sustain the facilities unless Intel receives continuous subsidies over a long period.

- It is still highly probable that geopolitical tensions will reduce and the Taiwan issue will be resolved, which can limit the ability of Intel to gain big subsidies for chip manufacturing.

JHVEPhoto/iStock Editorial via Getty Images

Intel Corporation (NASDAQ:INTC) has invested heavily in building its own foundry business. Most of the investment will be in the U.S. and other European nations. One of the main reasons for this push is the subsidies offered by governments to bring this industry back within their jurisdiction. It has recently received a grant of $8.5 billion under the U.S. Chips Act. Chip manufacturing is considered a national security issue and governments have given subsidies worth tens of billions of dollars to Intel, Taiwan Semiconductor Manufacturing Company Limited (TSM) aka TSMC, and other manufacturers. However, a key issue will be the labor cost and labor training over the next few quarters. Even TSMC had to delay its $40 billion investment in Arizona, as there is a shortage of trained workers. Intel’s new chips have also failed to excite Wall Street, which puts more pressure on the foundry business.

Our last update about Intel stock had a Sell rating and was published on 18th December. Since then, Intel stock has declined by 6%, while Advanced Micro Devices (AMD) has increased by 27% and Nvidia (NVDA) by 80%. In most of 2023, Intel was able to ride the wave of bullish sentiment toward chip stocks. However, the recent AI chips launched by Intel have not impressed Wall Street. Intel also faces a significant headwind in the foundry business. Investors looking to make a value play in Intel need to look at this divergence and gauge the bearish sentiment towards the stock.

There is a very significant difference in the labor cost structure for a chip facility built in Taiwan and those built in the U.S. or European Union. Morris Chang, the founder of TSMC, mentioned that it costs 50% more to manufacture chips in U.S. All the recent headlines from TSMC’s manufacturing plans in U.S. are also negative. Intel will face a similar labor issue when it scales up its own chip manufacturing.

There is still an overwhelming probability that geopolitical tensions between U.S. and China will reduce and the Taiwan issue will be resolved amicably. If there is business as usual, we could see Intel’s factories at a big disadvantage compared to those in Taiwan or South Korea. Intel plans to be the second-largest foundry player by 2030. Any major labor cost headwinds can reduce the growth trajectory of Intel and Wall Street could react very negatively to this.

Intel is a geopolitical stock

Intel’s stock performance will depend a lot on the evolving geopolitical situation between China and other Western governments. The company will receive billions of dollars in subsidies to set up manufacturing in the U.S. It has also received billions of dollars from Germany to set up manufacturing within the country. However, there have been some budget issues in Germany that could derail these subsidies.

It is not enough to receive subsidies for the construction of these facilities. The Western governments would need to prepare to make a long-term commitment by giving additional incentives to Intel and other chip manufacturing companies. The total cost could easily run into tens of billions of dollars over the next decade. Few governments can afford this scale of incentives even for a strategic industry like chip manufacturing. This year will be very important for Intel and other chip manufacturers as we get greater clarity on the cost structure to produce these chips domestically in the U.S. or other close Western allies.

Cost, cost, and cost

The labor cost is the most important issue while building a manufacturing plant within U.S. or European Union. Morris Chang, founder of TSMC, has already mentioned that the labor cost for chips manufactured within U.S. is 50% higher than those in Taiwan. This cost will inevitably be passed on to customers. It is difficult to see customers paying 50% more for their electronics without it becoming a major issue for their governments. If the labor cost is very expensive, the governments will need to provide an ongoing incentive to companies in order to operate these facilities.

Currently, national security is front and center in the minds of the voters and politicians due to the Ukraine war. However, lower geopolitical tensions could change the priorities and governments would hesitate in giving multi-year subsidies worth billions of dollars.

Chip manufacturing is an important part of the overall economy. However, any decoupling between China and U.S. will also have a ripple effect on a vast range of goods and services traded between the countries. This can force all politicians to try to find palatable solutions without hurting their respective economies.

Business as usual would hurt Intel’s strategy

If there is business as usual, despite rhetoric around Taiwan, then the factories set by Intel in U.S. and European Union would be at a massive disadvantage compared to TSMC’s facilities in Taiwan and Samsung’s facilities South Korea. It is unlikely that governments would be ready to invest billions of dollars in sustaining these new chip manufacturing facilities if the geopolitical tensions were reduced.

The geopolitical relations between the U.S. and China depend a lot on the White House administration. It is still highly likely that geopolitical tensions will reduce significantly over the next few quarters. The recent meeting between Chinese leadership and U.S. CEOs can be taken as a sign of the importance of good business relations between U.S. and China. Any major escalation of tensions between China and Taiwan can have an overwhelmingly negative impact on the economy in China as well as other parts of the world.

While we cannot estimate the future goals of political leadership, it is still highly likely that Taiwan issue will be resolved amicably without significant disruptions to the chip supply chain. The ability of governments to fund new chip manufacturing in their countries is overhyped. Even a minor fiscal crisis can reduce the subsidy support given to Intel and other chip manufacturers. The high labor cost and training required in U.S. and European Union can make chip manufacturing quite expensive for Intel.

Impact on stock price

Intel’s stock has seen a nice bull run in 2023 but it is significantly lagging other chip stocks in the YTD. Most of the jump in INTC stock in 2023 was on the back of positive hype around all chip companies. In 2023, Nvidia’s stock has increased by 240%, AMD’s stock has risen by 130% and Intel’s stock has risen by 90%. Even TSMC’s stock has risen by 40% despite the geopolitical tensions. As the AI hype comes back to reasonable levels, we could see the returns in stock reflect the actual monetization and profitability.

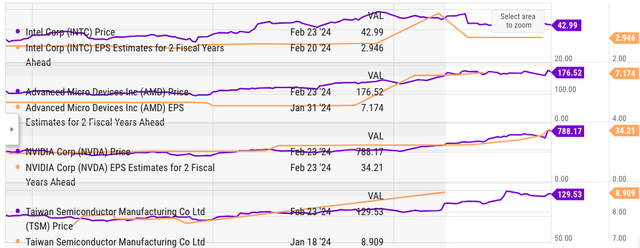

Figure: Comparison of EPS estimates 2 fiscal years ahead and the price level. Source: YCharts.

We can look at the key metric of EPS estimate for 2 fiscal years ahead. Intel is trading at 14.8 times its EPS estimate of 2 fiscal years ahead. On the other hand, Nvidia is trading at 22.6, AMD at 24.5, and TSM at 14.5 times their EPS estimate of 2 fiscal years ahead. Despite the recent correction, Intel is not very cheap. The EPS estimates can also change significantly if the margins in the foundry business are not as expected.

As mentioned above, the profitability of this business does not seem robust unless it receives massive ongoing subsidies from governments. Any reduction in geopolitical tensions will significantly reduce the incentive to give massive subsidies to chip manufacturers including Intel. TSMC in Taiwan and Samsung in South Korea have significant labor advantages which will make it difficult for Intel to compete effectively.

Investor Takeaway

Intel has bet a lot on growing its foundry business and has invested tens of billions of dollars in this strategy. The company has also received significant subsidies from the U.S. and other governments. However, Intel faces a labor cost disadvantage in this highly competitive field. It is unlikely that customers will be willing to pay 50% more for chips manufactured by Intel compared to TSMC or other competitors.

There is still an overwhelming probability that geopolitical tensions will ease. If this does not happen, we could see a complete decoupling between the U.S. and China. This will have a significant impact on a vast number of industries and stocks. Under the business-as-usual scenario, Intel’s foundry business will continue to face challenges in expanding. It is unlikely that the company will reach its goal of becoming the second-biggest chip manufacturer by 2030. Intel stock is quite expensive when we look at other peer comparisons, making it a Sell at this price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.