Summary:

- The Solventum spin-off will help 3M prepare for legal settlements related to defective earplugs and water supply damages.

- 3M is risky due to potential future additional legal battles.

- 3M is a slow grower expected to grow about 4% per year moving forward.

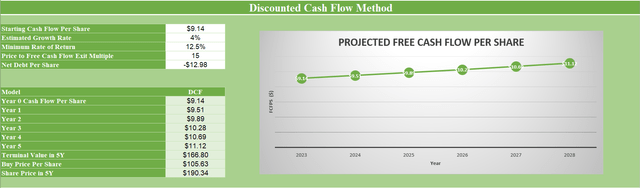

- I rate 3M as a hold based on a 12.5% expected annual return over the next five years as supported by my DCF valuation.

jetcityimage

Investment Thesis

The 3M Company (NYSE:MMM) has had a rough last couple of years that have been stained by legal battles that have resulted in large legal settlements such as a $6 billion lawsuit related to the sale of defective earplugs and a $10.3 billion lawsuit related to damage caused to U.S. drinking water supplies. Over the past five years, 3M’s stock price has decreased nearly 50% and with the upcoming spin-off of Solventum, I thought it would be good to investigate whether 3M is a buy. Based on my analysis the spinoff will help 3M pay upcoming legal settlements as well as any future new settlements that may arise. But this also leaves the question of how much of the earnings will be left for shareholders (dividends and share repurchases).

Currently, I believe 3M stock is a hold based on an estimated annual return of 12.5% per year over the course of the next five years based on my DCF analysis. However, I believe investors should be cautious about any additional legal settlements that could be faced as well as the current legal burden that already exists.

Company Overview

3M is an international conglomerate that has four main business groups. The four business groups are Safety & Industrial, Transportation & Electronics, Health Care and Consumer. The Safety & Industrial includes the sale of products such as adhesives, abrasives, laminates, passive fire protection, personal protective equipment, window films and paint protection films. The Transportation & Electronics includes car care products, electronic circuits and electronic materials, while the Health Care segment focuses on medical products, dental/orthodontic products and healthcare software. 3M faces competition from rivals such as Honeywell (HON) and DuPont (DD).

The Solventum Spin-Off

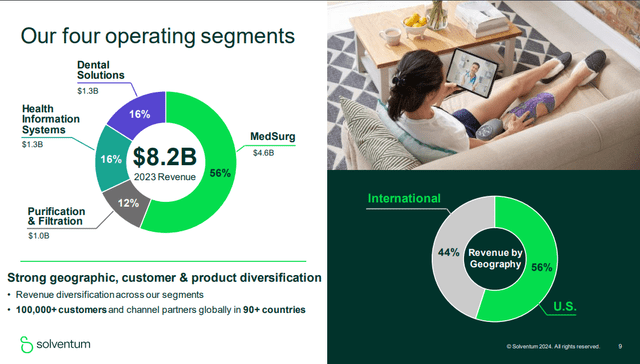

On March 8th, the 3M Board of Directors approved the Solventum spin-off where on April 1st 3M shareholders shall receive their portion of the 80.1% of the outstanding shares of Solventum. The remaining 19.9% of the shares outstanding will be retained by 3M where they plan to ‘monetize’ the shares throughout the next five years. The Solventum spin-off is designed to maximize the future prospects of the Health Care business segment. As we can see below, Solventum has four main business segments being MedSurg, Dental Solutions, Health Information Systems and Purification & Filtration. The business is also quite geographically diversified with 56% of revenue coming from the U.S. and 44% coming from international markets.

Solventum Inaugural Investor Presentation 2024

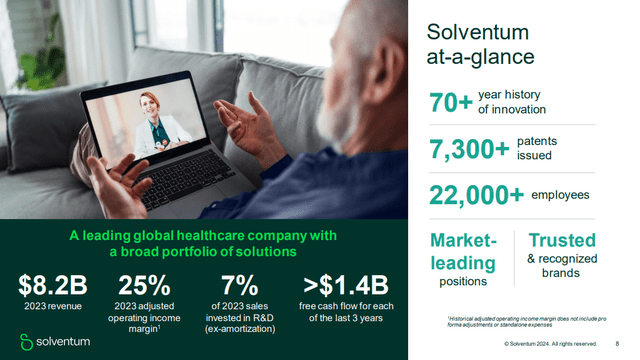

Solventum also looks like it will have solid economics moving forward where in 2023 they had around a 25% adjusted operating income margin as well as greater than $1.4 billion in free cash flow through the last three years.

Solventum Inaugural Investor Presentation 2024

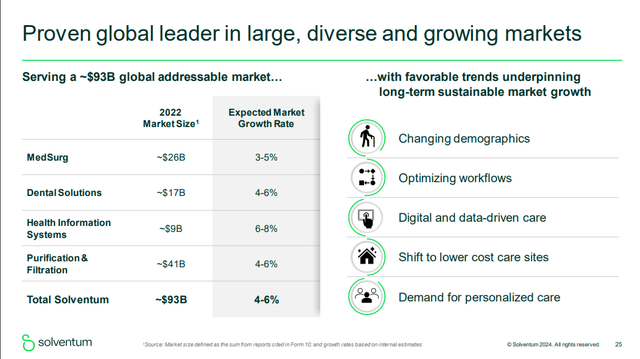

MedSurg, the largest business segment for Solventum is a provider wound care and surgical equipment/consumables. Within the industry MedSurg is in a very strong position given that it is the world leader in advanced wound care market and has been first to market with negative pressure wound therapy and transparent film dressings. Within the Dental Solutions segment, Solventum is a market leader in orthodontic bonding solutions. In the Health Information Systems segment, more than 75% of hospitals in the U.S. use at least one of Solventum’s software solutions. As you can see below, the markets in which Solventum operates are collectively expected to grow at a rate of 4-6% annually moving forward meaning that Solventum should be able to benefit from future organic growth, especially given the large total addressable market that Solventum are a part of.

Solventum Inaugural Investor Presentation 2024

This spin-off I believe will strengthen 3M’s balance sheet which will help them prepare for any future legal settlements. Recently 3M was ordered to pay a $6 billion lawsuit as a result of the sale of defective earplugs. Similarly, 3M also has agreed to pay $10.3 billion over the next ten years to clean up toxic PFAS chemicals in public water supplies. I believe the spinoff will help 3M pay upcoming legal settlements as well as any future new settlements that may arise.

Financial Analysis

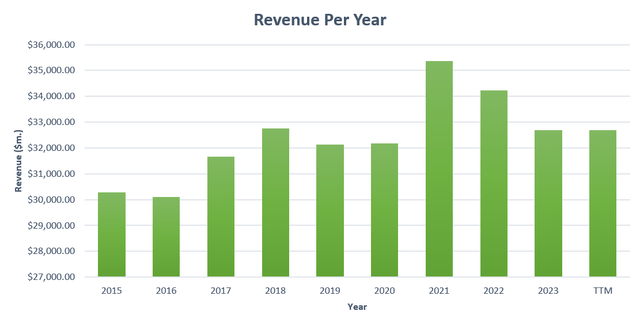

MMM’s revenue has been flat over the previous five years where the revenue marginally weakened $32,765.00 million in 2018 to $32,681.00 million over the last twelve months. From my perspective, 3M is a slow grower and definitely more of a defensive kind of play.

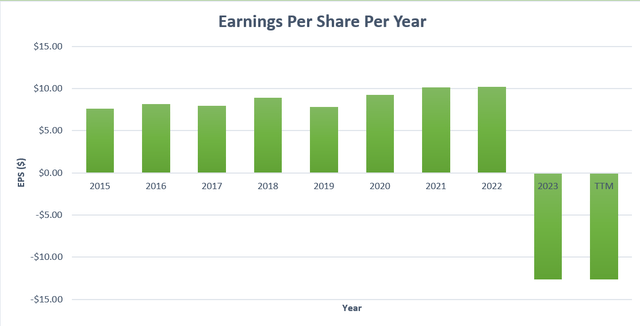

We can also see that in general there has been a slow uptrend in earnings per share which strengthened from $8.89 in 2018 to $10.18 in 2022, representing a CAGR of around 3.5% through this period. In 2023 there was a sharp decline in EPS where the company reported a figure of -$12.63 per share. This large loss was driven by $14,500 million legal settlement that was paid during 2023. The adjusted EPS that 3M delivered that does not take legal expenses into account was $9.24 per share. Gross margins for 3M have decreased in the last couple of years, this is mainly due to the costs of goods sold growing faster than revenue mainly as a result of heightened inflation that has in turn increased the cost of raw materials.

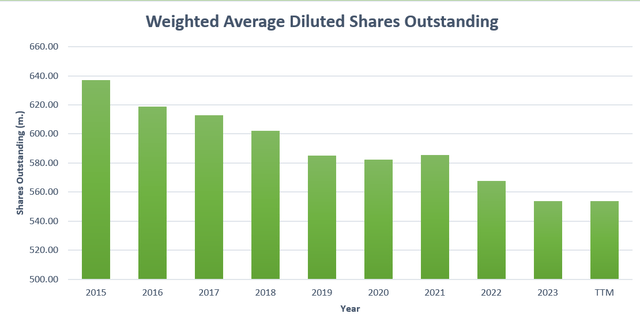

Apart from net income, an additional variable that influences EPS is the number of shares outstanding. We can see that diluted shares outstanding has gone from 602.00 million in 2018 to 553.90 million in the past twelve months. Hence, representing a CAGR of -1.65%, this means that shareholders have not been diluted and that the buyback has been value accretive for shareholders.

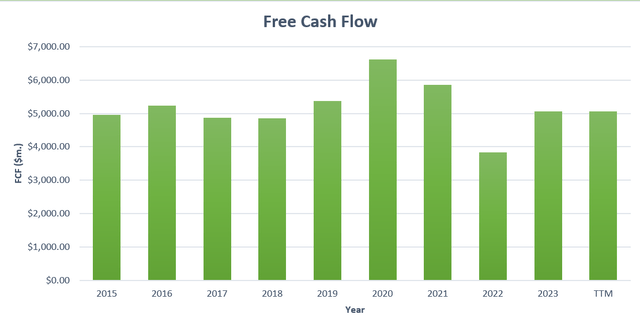

Much like revenue, free cash flow has been pretty flat increasing from $4,862.00 million in 2018 to $5,065.00 million in the preceding 12 months. Most of this free cash flow is allocated towards either dividend payments or share buybacks. In terms of return on invested capital (ROIC) 3M’s five-year median ROIC was 22%, thus this is a sign that the company does efficiently reinvest back into the business, though as previously mentioned this has a minimized positive impact due to the fact that most the free cash flow is paid back to shareholders via dividends and buybacks.

When we look at the balance sheet the previous earnings report delivered cash and cash equivalents to the amount of $5,933.00 million. The total debt that the company owes amounts to $13,176.00 million. Considering that the cash on the balance sheet covers 45 percent of the debt load and that total debt can in repaid with about 3 years’ worth of free cash flow, I think the balance sheet is respectable. 3M’s current ratio stands at 1.07, meaning that the company can afford their current liabilities based off the amount of current assets found on the balance sheet. Overall, I do not think the business is in financial danger and I see the debt load as manageable.

Valuation

MMM’s current free cash flow per share as of Q4, 2023 is $9.14. Moving forward I believe MMM will experience slow growth of likely around 4% per year where I think some of this growth will come from slowly increasing demand from the Safety & Industrial, Transportation & Electronics, Health Care and Consumer business segments. I also think share buybacks will also help aid this growth. Therefore, once factoring in the growth rate by Q4 2028 MMM’s free cash flow per share is expected to be $11.12. If we then apply an exit multiple of 15, which is based on MMM’s mean price to free cash flow ratio for the previous 10 years, this infers a price target in five years of $190.34. Therefore, based on these estimations, if you were to buy MMM at today’s share price of $106.07, this would result in a CAGR of 12.5% over the next five years.

Therefore, for me 3M is a hold based on the fact that I target a return of 15% per year and above hence at current prices 3M does not offer ample margin of safety.

Conclusion

To wrap up, 3M is a leading international conglomerate that provides goods related to their Safety & Industrial, Transportation & Electronics, Health Care and Consumers business segments. The Solventum spin-off is set to execute on April 1st which is a strategic move for 3M to strengthen its balance sheet to help protect 3M from upcoming legal settlements as well as any future new settlements that may arise. Solventum which is basically 3M’s healthcare segment, appears to be a good business with respectable operating margins and organic growth prospects of 4-6% per year. The spin-off should help raise the capital required to meet $6 billion and $10.3 billion lawsuits related to the sale of defective earplugs and damage caused to U.S. drinking water supplies. Based on my DCF model, I am going to rate 3M as a hold based on a predicted annual return of 12.5% per year over the next five years. With that being said, I would approach 3M with caution knowing that much of the future earnings will be used to pay legal settlements as well as it is hard to predict any new legal battles that may arise in the future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.