Summary:

- Judging future performance of Block’s share price based on recent returns is very dangerous.

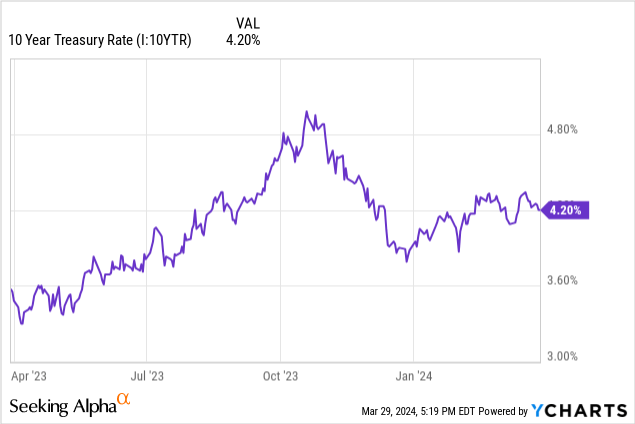

- Falling term premium since November of last year had a profound impact on Block’s share price.

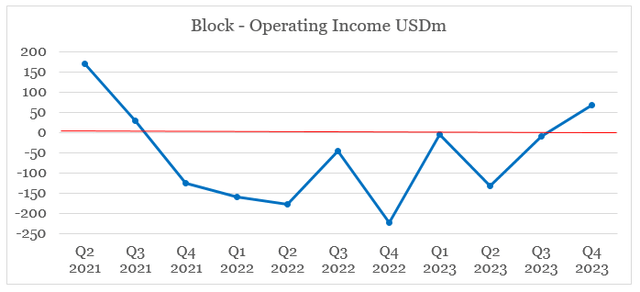

- At the same time, the last reported quarter has shown that little progress is being made on achieving profitability.

Anna Webber

Investors buying Block, Inc. (NYSE:SQ) at current levels are taking two enormous risks – one related to the growth stocks more broadly and one related to the business specifically.

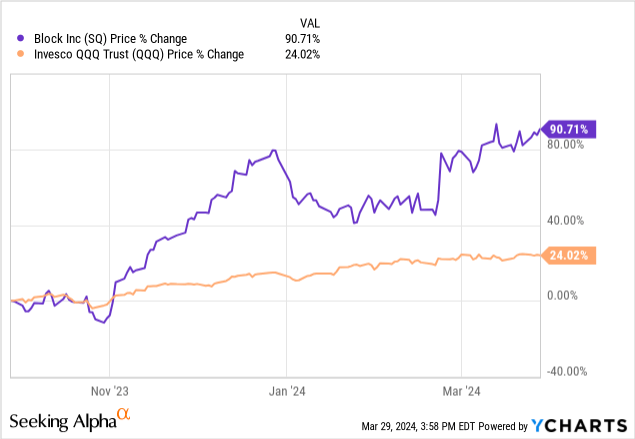

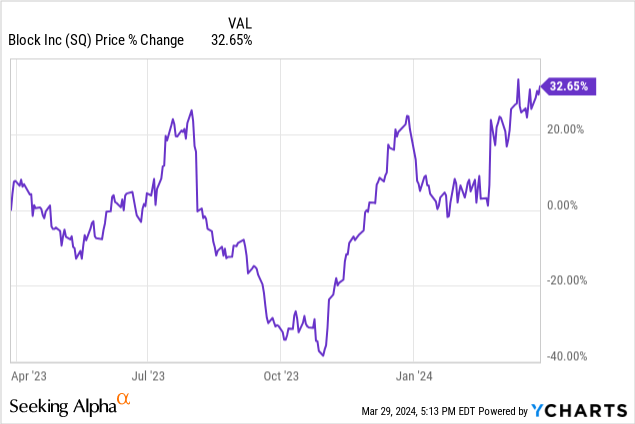

These, however, are hard to conceptualize as the stock skyrocketed by more than 90% over the past 6-month alone, when the Invesco QQQ Trust ETF (QQQ) appreciated by only 24% during the same period.

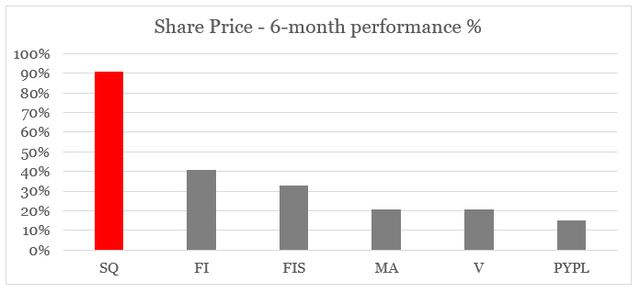

This performance makes it nearly impossible for investors chasing momentum to properly account for risks. It also creates the illusion that SQ has one of the best business models in the sector since it has significantly outperformed all other peers in the electronic payments space.

prepared by the author, using data from Seeking Alpha

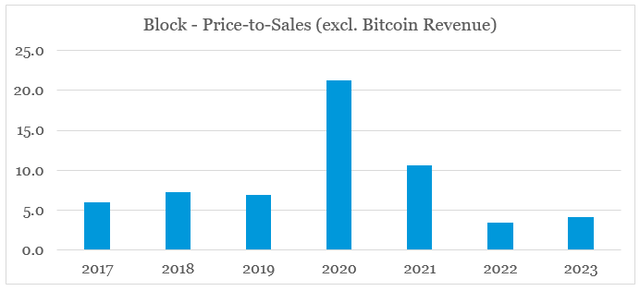

On top of all that, on the surface things are also looking good for SQ. When adjusting total revenue for bitcoin operations (due to the revenue from bitcoin being reported on a gross basis), we could easily be led to the conclusion that SQ is trading at a discount as its price/sales multiple is now at one of its lowest levels in recent years.

prepared by the author, using data from SEC Filings and Seeking Alpha

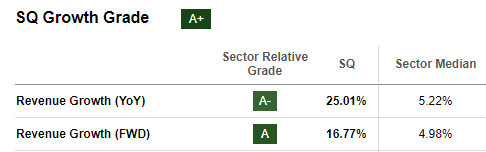

Expected revenue growth remains high, although it’s significantly lower than the last year reported one and is also heavily influenced by bitcoin operations.

Seeking Alpha

Lastly, the company reported a tiny operating profit during the last quarter which gives investors hope that Block could soon become a highly profitable growth stock.

prepared by the author, using data from Seeking Alpha

Apart from the obvious problems with all that, there are two major issues with the bullish thesis. First and foremost, you should not judge the quality of the business and potential future returns based on recent share price performance. Even worse, in the case of SQ the stock has been heavily influenced by outside forces, which are bringing valuations of many growth stocks to unsustainable levels. Secondly, SQ business model has not changed much over the past year and it seems that the slight improvement in profitability comes with significant risk-taking by Square’s management.

Share Price Driven By Momentum

When we zoom back a year, Square’s stock price return is not as spectacular as it was during the past 6 months. As it happens October of last year marked a bottom in SQ share price and this wasn’t a fluke.

Moreover, as we see on the graph below, SQ stock has been extremely volatile which should be a major red flag for investors that things are not as smooth as it might seem.

As a matter of fact, SQ share price deeply in negative territory by early November of last year. The stock then quickly reversed its course and has been consistently going up since then.

Unfortunately, share price return since 1st of November has little to do with actual business performance. In fact, it was the U.S. Treasury Quarterly Refunding Announcement from early November that had a profound impact on all growth stocks by impacting the term premium and long-dated bond yields.

I recently showed how this is impacting growth stocks in particular and why it is a major risk for the current momentum. In that regard, SQ has been heavily influenced by these developments as the stock has been growing at double digit rates for quite some time and is not yet profitable. This significantly increases its duration and results in very high variance of returns based on expectations about future financial conditions.

Fading Growth And Risk Taking

When it comes to Block’s business itself, things have not changed materially over the past year and as growth in certain areas slows down, the management has a very strong incentive to take on more risk in order to meet its growth targets.

As a starting point, Square is now faced with significant slowdown in revenue growth as it’s expected to further slowdown in FY 2024.

(…) we expect Cash App to grow faster than Square but for growth to moderate from 2023 as we lap pricing changes and other initiatives that improved our cost structure.

Source: Block Q4 2023 Earnings Transcript

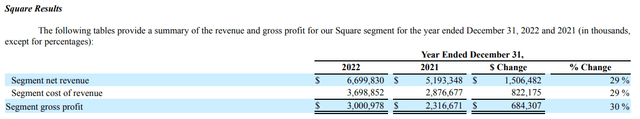

The reason why I say this is because the segment grew at nearly 30% in 2022.

Block 10-K SEC Filing

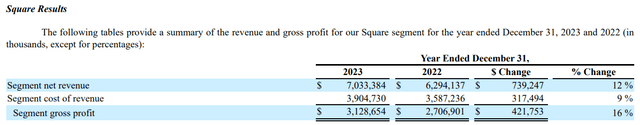

Than in 2023, the total Square segment experienced a notable slowdown to only 12% on an annual basis (see below). If we add the more than 3% inflation during the period, we have real revenue growth of below 10%.

Block 10-K SEC Filing

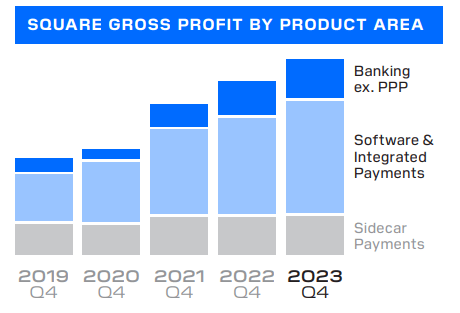

To offset this slowdown, Block’ management is now making a stronger push to banking and loans, which is currently the key growth driver for Square’s gross profit.

Software and integrated payments gross profit grew 17% year over year in the fourth quarter of 2023, while gross profit from our banking products, which primarily include Square Loans, Instant Transfer, and Square Debit Card, grew 28% year over year.

Source: Block Shareholder Letter 2023

We could see this trend on the graph below, where Banking appears to be on track to become the main driver of Square’s gross profit growth. As such, it is no surprise that Block’s management is likely to prioritize its efforts in this area.

Block’s Shareholder Letter

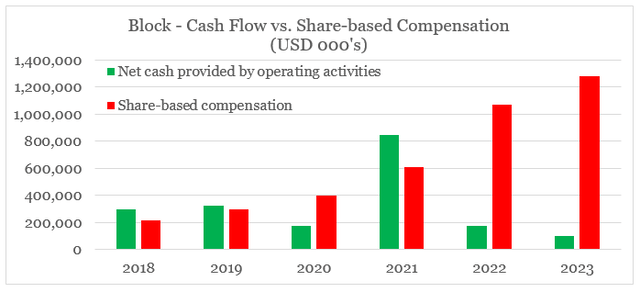

In my opinion this creates significant risk for shareholders as the enormous amount of stock-based compensation creates incentives for pursuing riskier growth opportunities in order to meet targets. Not to mention that stock-based compensation expense skyrocketed in 2023 by more than 19% and now dwarfs Block’s tiny amount of free cash flow from operations.

prepared by the author, using data from SEC Filings

In 2023, about $500m of the cash outflow from operations was due to more originations/purchases of loans than repayments/forgiveness which was much higher than the outflow of $74m reported in 2022. It appears that Block is expending significantly through offering more loans as overall growth of Square slows down. Of course, this creates risk of irresponsible borrowing when considering that Square loans are mostly unsecured.

The business loans provided by Square Loans are generally unsecured obligations of our sellers, and they are not guaranteed or insured in any way.

Source: Block 10-K SEC Filing

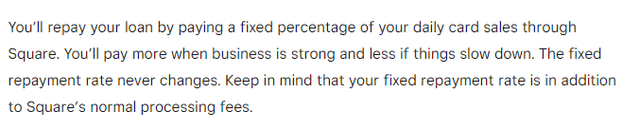

What’s more is that the way these loans are offered makes underperforming loans less visible as struggling borrowers simply repay lower amounts, but that does not mean that their condition would improve over time.

Square Support Website

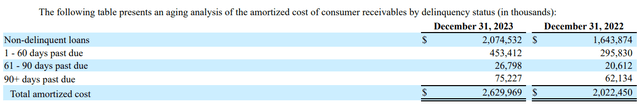

Compare this to Block’s buy now pay later segment, where delinquency and underperforming loans are reported.

Block’s SEC Filing

In addition, the combination of these two services and their larger share of Block’s gross profit dollars makes the company heavily exposed to the wellbeing of the U.S. consumer, which has been in a very good condition in recent years on the back of fiscal and monetary stimulus. Should these conditions change, the downward risk for Block would be enormous.

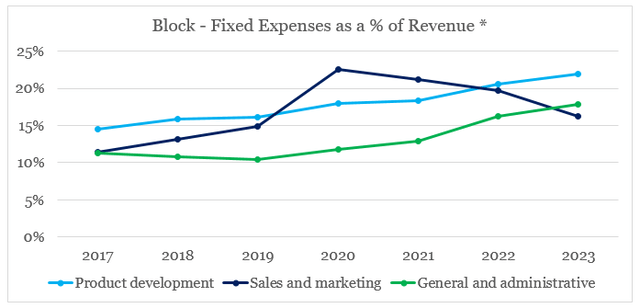

Lastly, the company appears to be struggling to reduce the share of its fixed costs to total sales (excluding bitcoin revenue) as the drop in sales and marketing was offset by increases in product development and general & administrative expenses.

prepared by the author, using data from SEC Filings

This reaffirms my initial view on the company that high and sustainable GAAP profitability would be very hard to achieve.

Conclusion

Investors chasing momentum are now exposed to limited upside and significant downside risk as 2024 progresses. Block share price is right in the epicentre of this trend and as such performance over the past 6-month period is not indicative of future expected returns. The business is still struggling to achieve profitability and the chances of more risk-taking activities through lending is increasing. With all that in mind, I retain a ‘sell’ rating on SQ.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the technology space?

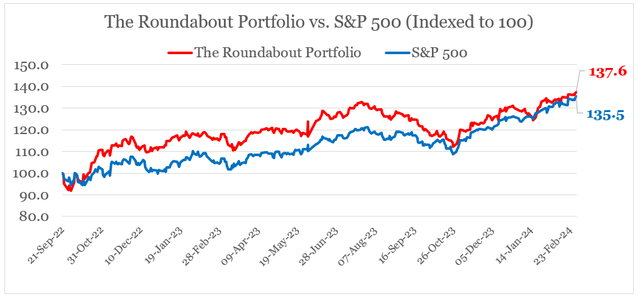

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.