Summary:

- The boycott has triggered a notable slowdown in U’s new contract signings and renewals, as observed in the moderating dollar-based net expansion rate.

- It is unsurprising that the new management has embarked on a strategic business reset to drive top/bottom line growth while laying off -25% of its headcount.

- This is on top of the new opportunities in advertising, XR headsets, and industrial applications in the automotive platform.

- Assuming that the reset is successful and departed developers return, it appears that there may be great upside potential to our bullish PT of $51.60.

- It goes without saying that anyone who chooses to add here must also be comfortable with moderate volatility due to the stock’s elevated short interest of 12.87%.

We previously covered Unity Software Inc. (NYSE:U) in January 2024, discussing the impacted Create Solutions revenue, with the boycott triggering a notable slowdown in its new contract signings and renewals. The ongoing conflict in Israel had also affected a significant portion of its Grow Solutions, naturally triggering the miss in its top line in FQ3’23.

Combined with the elevated short interest and immense rally then, we had preferred to downgrade the U stock as a Hold despite our conviction surrounding its long-term prospects.

In this article, we shall discuss why the U stock remains speculative in the intermediate term, with it remaining to be seen if the business reset may be successful in boosting its top/bottom lines while convincing developers to return.

However, with the stock still well supported at this bottom, it appears that there is an improved margin of safety for those looking to add, for so long that the portfolio is sized according to their risk appetite.

The U Investment Thesis Remains Speculative At This Bottom

For now, U reported a mixed FQ4’23 earnings call, with the revenues of $609.26M (+11.9% QoQ/+35% YoY) only boosted by the $99M incremental revenue from Wētā FX, resulting in a one-time overall EBITDA of $185.64M (+41.7% QoQ/+796.3% YoY).

As a result, readers should not expect the FY2023 revenues of $2.18B (+56.8% YoY) and EBITDA of $448M (+463.2% YoY) to be replicated in the near term, with the management already laying out the FY2023 Strategic Portfolio: the Engine, Cloud and Monetization revenues of $1.73B and adj EBITDA of $274M.

Readers must note that after the recent fiasco, the new U management has deemed the strategic exit in the businesses that do not “provide unique value to customers or generate a sound return to investors” to be highly critical. This is especially since these businesses supposedly operate at significant adj EBITDA losses.

Maybe this is why the management has been able to offer a relatively optimistic FY2024 Strategic Portfolio guidance, with the revenues of $1.78B (+2.8% YoY) and adj EBITDA of $412.5M (+50.5% YoY) implying richer adj EBITDA margins of 23.1% (+7.3 points YoY).

We suppose much of U’s bottom line tailwinds may be attributed to the drastic headcount reduction by approximately -25%, along with other structural cost savings through cloud/license optimization and office footprint consolidation.

It is apparent that while the boycott may have an irreversible impact on the game developer industry, the new management is laser-focused to right-size the company while driving bottom-line growth.

At the same time, U has also introduced Unity 6, the next Long Term Support release of the game engine in Game Developers Conference 2024, with multiple “performance enhancements, accelerated multiplayer game creation, early access WebGPU support, deeper XR device support, and innovative AI tools.”

This is on top of the expanded advertising campaigns and incentives to drive improved engagements and monetization through Unity Ads Network, ironSource Ads, and Tapjoy.

Lastly, the U management has also expanded their industrial applications beyond games, attributed to the massive tailwinds from the XR Vision Pro partnership with Apple (AAPL) and the real-time 3D implementation in the automotive cockpit platform, amongst others.

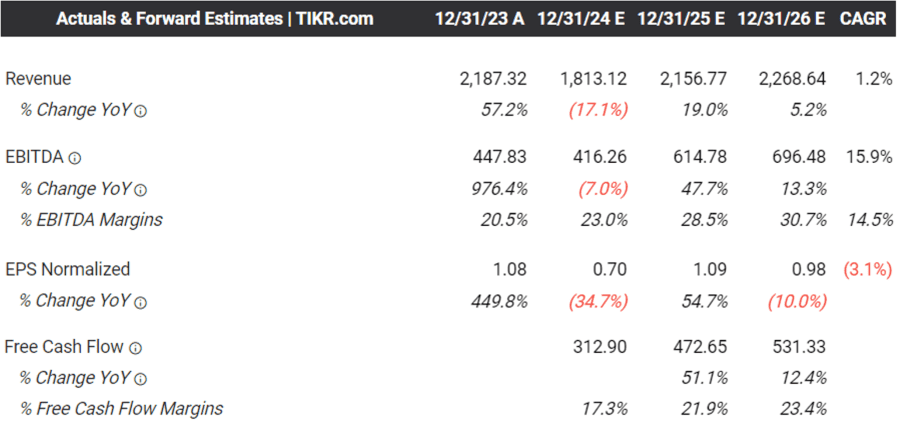

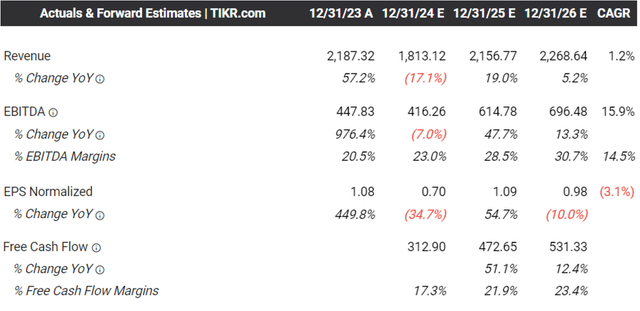

The Consensus Forward Estimates

As a result of the multiple tailwinds and the management’s optimistic projections, it is unsurprising that the consensus has estimated that U may achieve an impressive top/bottom line expansion at a CAGR of +11.9%/+29.4% between FY2024 and FY2026.

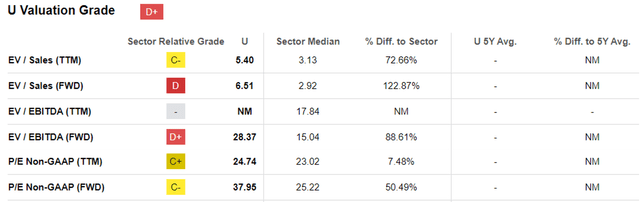

U Valuations

Then again, it is uncertain if the premium awarded to U is warranted here, attributed to its eye-watering FWD EV/Sales valuations of 6.51x, FWD EV/EBITDA of 28.37x, and FWD P/E of 37.95x.

The only plausible method to accurately value U will be to refer to its direct peers, namely Unreal Engine from Epic Games and the open-source Godot.

For example, based on DIS’s latest $1.5B investment in Epic Games, U’s direct competitor, we are looking at an estimated enterprise value of $22.5B. Combined with the estimated $5.62B in 2023 gross revenues, Epic Games is valued at an approximate EV/Sales of 4x.

Based on these numbers, it appears that U is relatively expensive here, especially since its top/bottom line growth remains to be seen attributed to the “boycott and a slowdown of signing new contracts and renewals.”

The latter has resulted in the notable decrease in its dollar-based net expansion rate to 104% (-12 points YoY) in FY2023, with the consensus forward estimates through FY2026 appearing to be rather ambitious indeed.

So, Is U Stock A Buy, Sell, Or Hold?

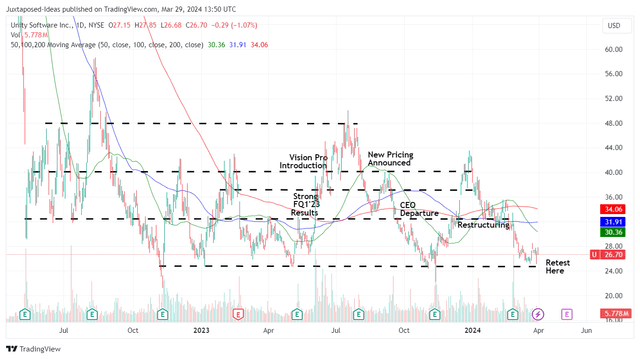

U 2Y Stock Price

For now, U has dramatically lost much of its recent gains, while trading below its 50/100/200-day moving averages.

Based on the FY2023 Strategic Portfolio adj EBITDA of $274M and the latest share count of 381.79M, we are looking at an adj EBITDA per share of $0.71 (+543.7% YoY). Combined with the FWD EV/EBITDA of 28.37x, it appears that the stock is above our fair value estimate of $20.10.

Then again, based on a similar calculation method on the consensus FY2026 adj EBITDA estimates of $696.48M and estimated adj EBITDA per share of $1.82, there appears to be an excellent upside potential of +93.2% to our long-term price target of $51.60.

Combined with the stock’s apparent support at its previous bottom of $26s, we are cautiously re-rating the U stock as a Buy here.

It goes without saying that anyone who chooses to add here must also be comfortable with moderate volatility, due to the stock’s elevated short interest of 12.87% at the time of writing.

At the same time, they must also be patient, since the new management has had to navigate a relatively challenging period of uncertain macroeconomic environment along with the lingering backlash from the poorly communicated price hikes and the abrupt departure of the previous management.

As a result, we believe that the U stock may remain speculative/volatile for a little longer, until it is established that the business reset is successful and departed developers return.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.