Summary:

- Target is returning to the slow, steady sales growth and 6% operating margins that prevailed before the unsustainable growth spurt of 2020-21.

- The retailer has corrected its marketing missteps of the past couple of years, and the trend of growing inventory shrink may be ending.

- While cheaper and more capital-efficient than Walmart, Target looks about fairly valued at around $175.

- 1Q 2024 still faces tough comps with last year, so the stock remains a Hold at least until the next earnings release.

Vertigo3d

Getting Back To Normal

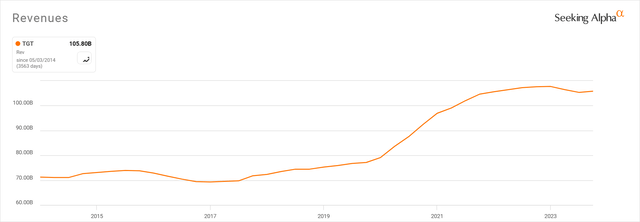

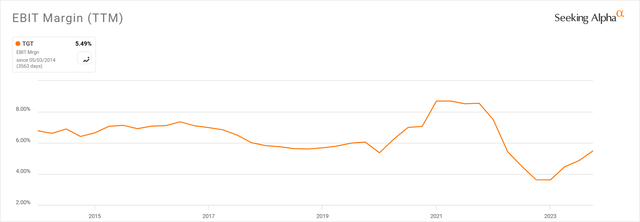

Target Corporation (NYSE:TGT) was a big winner in 2020 and 2021. The store chain did an excellent job adapting to changing customer behavior during the pandemic years, leveraging its stores to fulfill growing online orders by expanding drive-up and same-day delivery options. They also had an advantaged product mix, with more housewares and hard goods desired in the “stay-at-home” economy. This showed up in Target’s financials, with sales increasing 36% over those two years, and operating margins reaching 8% from the 6% that had been typical up to 2019.

While it was tempting to believe this strong performance could continue, the retailer in 2022 got caught with the wrong mix of products as they over-ordered during supply chain disruptions at the same time consumers shifted away from buying higher-margin goods as inflation was setting in. This caused operating margins to plummet to less than half of their peak level, along with a corresponding drop in the share price.

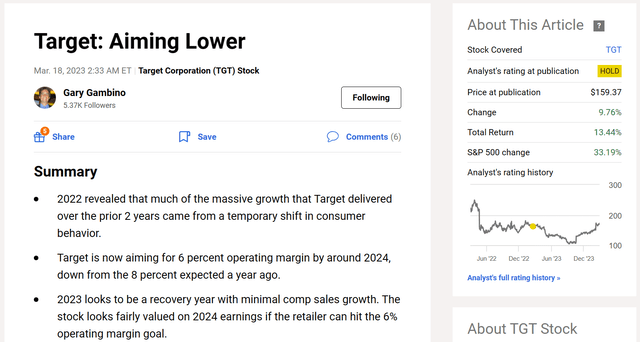

This brings us to the situation when I last covered Target a year ago, rating it a Hold. The company lowered expectations at its 2023 investor day, setting a goal of returning to the 2019 level of 6% operating margin over the next few years. There would also be minimal same-store sales growth. The share price continued its decline over the next couple quarters, getting as low as the $105-$110 range in the fall of 2023. It improved considerably following 3Q results when it started to become clear the company was on track to achieve its less ambitious goals, holding on to most of the sales gains from 2021-22.

It also appears that the company is on track to getting back to pre-pandemic operating margin levels.

The 2024 Investor Day reinforced this message, and the stock is now trading around $175, a below-market return, but close to my $171 price target from last year’s article.

Looking forward, Target will not be the fast grower it was during 2021-22, but they will likely retain the sales picked up during that period. A return to 6% operating margin should deliver above-trend earnings growth for the next couple of years. After that, net income growth will be modest, but the company will continue to have strong cash flow, returning cash to investors through its above-average dividend and a resumption of buybacks, which also enhance EPS and dividend per share growth. The stock is still fairly priced for this scenario, leaving it at a Hold rating.

Remembering The Customer

The return to normal starts with Target management understanding and delivering for their customers, where they appear to be doing a better job, given the presentations from the 2024 investor day. Target’s pandemic-driven sales growth in 2020 and 2021 covered up what seemed to be marketing missteps that catered to a small demographic subset of their customers while ignoring the broad, diverse customer base. For example, the 2022 Investor Day discussed favored vendor selection and brand placement under the justification of “Accelerating opportunity and equity”.

Even in 2023, the retailer experienced backlash from customers over “rainbow” themed products and ended up scaling back these displays.

Now, of course, all customers should have a nice place to shop regardless of their background or income level, but the retailer seemed to have swung too far in the direction of focusing on small groups at the expense of pleasing their overall customer base. Target course-corrected in their 2024 investor presentation, where the marketing discussion led off with the theme of “Help all families discover the joy of everyday life”.

Target now has a strong mix of its own brands, national brands, and partnerships with other retailers that appeal to a wide base of customers. Its fully-owned brands are increasing in number and now include 11 brands with over $1 billion in annual sales. Altogether, own brands make up about 1/3 of Target’s sales.

Partnerships with other retailers include store-within-a-store displays for companies such as Levi’s (LEVI), Ulta Beauty (ULTA), Apple (AAPL), and Disney (DIS).

Target has also pivoted in its capital investment strategy following theft and vandalism problems that it experienced in 2020 and 2021. In 2Q 2020, this was big enough to note in the earnings release, when the company noted $25 million, or $0.04 of EPS from “store damage and inventory losses related to civil unrest“. More persistent has been the growing rate of inventory shrink. At the 2024 investor day, management noted that just the increase in shrink for 2023 was $500 million compared to 2022. Since 2019, shrink has reduced Target’s operating margin by 1.2 percentage points. Recent trends are a bit more optimistic, and the company forecasts no further degradation in 2024. Still, until shrink starts decreasing, that creates a headwind to return to the 6% operating margin goal.

Even before the pandemic, Target was looking at small, mostly urban stores as a source of growth. Given the experience over the past few years, the chain is now moving back to full-size stores, of which they expect to open 300 new ones over the next decade.

Earnings Model Update

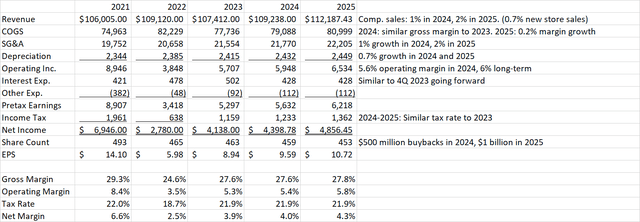

2023 turned out better than I or the company expected one year ago. Although sales declined slightly, operating margin improved to 5.3% for the full-year average, and EPS was $8.94, 49.5% better than 2022 and 15% better than my estimate last March. For 2024, the company is again giving conservative guidance to start the year. As stated in the 4Q earnings release, they are forecasting only 0 to 2% same-store sales growth and EPS of $8.60 to $9.60. It is important to note that 2024 is a 52-week fiscal year, while fiscal 2023 had 53 weeks. Based on my modeling, the top of the range should be easily achievable. I assume 1% same-store sales growth and 0.7% growth from new stores and other revenue like the Roundel ad business. Gross margins are similar to last year. SG&A grows 1% and effective tax rate is similar to last year. This takes operating margin to 5.4%, a slight improvement from 2023 but still below the long-term average goal of 6%.

I also show the company resuming share buybacks this year in the amount of $500 million. This compares to no buybacks last year and $2.6 billion worth in 2022. With these conservative assumptions, I estimate 2024 EPS of $9.59. That is 7.3% growth over 2023. It is also more conservative than my 2024 estimate of $11.59 that I made last year, which assumed 3% sales growth and 6% operating margin.

Longer term, Target expects 4% average annual sales growth over the next 10 years and a return to the 6% operating margin level. For 2025, I am still a bit more conservative, estimating 2% same-store sales growth and an operating margin of 5.8%. That gets us to $10.72 EPS in 2025, an 11.8% growth from 2024.

Valuation And Capital Management

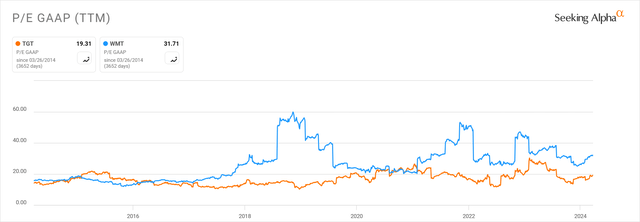

At $175, Target is valued at 18.2 times 2024 earnings. This is above the 15 average that existed in the years before the pandemic. However, considering the 9.5% average annual growth rate from 2023 to 2025, the PEG ratio is 1.9, below the level of 2 where I get concerned about overvaluation. Target is also cheap compared to Walmart (WMT).

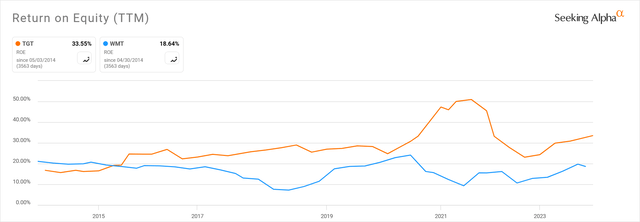

My $171 price target from last year was based on higher 2024 earnings and a lower P/E, however, I am now comfortable with the higher P/E as Target has become more efficient with its capital, as measured by return on equity. Since last year, ROE has resumed its steady upward trend after the unsustainable spike during the pandemic followed by the fall afterward. Compared to 10 years ago, Target’s ROE has doubled. It is also considerably above Walmart’s ROE, which has gone nowhere in the past 10 years.

After a negative 2022, Target’s 2023 free cash flow returned to positive territory, at $3.8 billion. Working capital provided a positive boost to operating cash flow as the retailer right-sized its inventories after the earlier missteps. Capex also declined to $4.8 billion from $5.5 billion in 2022. The company paid $2 billion in dividends and reduced debt slightly, retaining the remaining cash balance with no buybacks. The current $1.10 quarterly dividend was only a $0.02 raise from the previous level, even less than the $1.15 I predicted in my article last year.

For 2024, capex is coming down further, to a range of $3 to $4 billion. I am predicting operating cash flow to increase to $8.9 billion, in line with the $260 million increase in net income this year. That results in an FCF estimate of $5.4 billion assuming capex at the midpoint. The improved cash picture will allow Target to do a better dividend raise this year. I estimate $1.25 quarterly for a forward yield of 2.9%. Target will use $2.15 billion of cash on dividends this year. They also have $1.12 billion of debt coming due this year, which they will be able to pay off. That leaves another $2.13 billion available for buybacks, but I am conservatively assuming only $0.5 billion. If the year progresses as I expect, there is an upside to the buyback amount.

Conclusion

Target has gotten through its disappointing post-pandemic phase where they overbought inventory and made some marketing missteps. The retailer now looks like they will sustain the sales gains made in 2020 and 2021 but slow to a more typical low-single-digit growth rate going forward. The company has also realized that the high operating margins achieved in 2020-2021 are unsustainable, but they can return to pre-pandemic levels around 6% provided they continue to get shrink under control.

At the current price of $175, Target stock is not cheap, but it is a fair price for a slow steady grower that has plenty of cash to return to its shareholders through both dividends and buybacks. The company warned at the 2024 investor day that 1Q results face tough comps and may still show negative same-store sales growth and EPS of $1.70-$2.10, or 8% below last year at the midpoint. Given some of the large moves the stock has made on earnings release days in the past several quarters, there is a risk of a share price drop when the company next reports on 5/22. For now, the stock is a Hold, with the possibility of moving to Buy if the forward outlook is at least affirmed in the next earnings release.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TGT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.