Summary:

- On Thursday, Hyzon Motors reported first quarter 2023 results. While the company did not recognize any sales, cash burn remained substantial.

- The company has ceased commercial operations in China due to corporate governance concerns, margin issues and poor payment terms.

- Going forward, Hyzon will predominantly focus on its new 200kW fuel cell system for the trucking markets currently under development while employing an asset-light commercialization approach.

- At the current rate of cash usage, the company would be required to raise additional capital by mid-2024 at the latest point, assuming no major settlement payment to the SEC. Management has retained an advisor to assist with financing options.

- Investors will likely have to prepare for meaningful dilution and a potential reverse stock split later this year or in the first half of 2024 at the latest point. Even when considering market participants’ increased risk appetite in recent weeks, investors should avoid the shares for the time being.

Scharfsinn86/iStock via Getty Images

Note:

I have covered Hyzon Motors Inc. (NASDAQ:HYZN) previously, so investors should view this as an update to my earlier articles on the company.

Last week, I discussed Hyzon Motors Inc.’s (“Hyzon”) recent efforts to revitalize the company and become current in its regulatory filings following severe disruptions caused by shortseller allegations and a related SEC-investigation as well as an internal investigation into revenue recognition, corporate governance and internal control issues.

In addition, the U.S. Attorney’s Office for the Southern District of New York recently notified the company that it is also investigating matters raised by the shortseller report.

On Thursday, Hyzon released first quarter 2023 results and filed its quarterly report on form 10-Q.

In addition, the company held its first earnings conference call in over a year and provided investors a new presentation outlining the company’s new business approach:

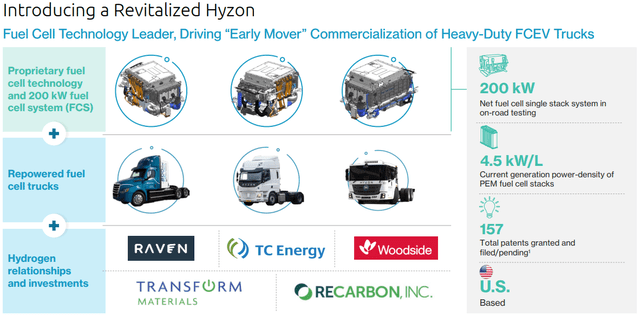

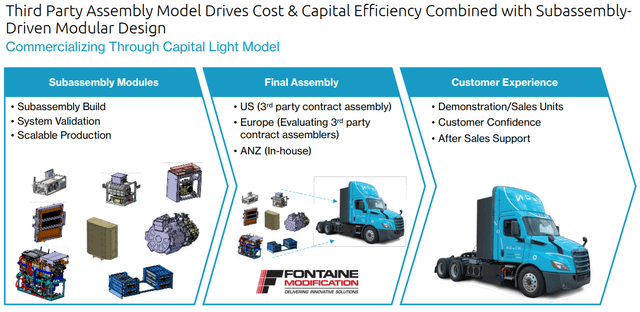

Going forward, Hyzon will predominantly focus on its new 200kW fuel cell system for the trucking markets currently under development while employing an asset-light commercialization approach:

As disclosed on the conference call, the company has decided to leave the Chinese market which is quite surprising given the fact that the company remains controlled by Singapore-based Horizon Fuel Cell Technologies PTE Ltd. (“Horizon”), an entity with significant business interests in China which has been the company’s sole fuel cell system supplier since inception (emphasis added by author):

As part of our restructuring assessment and related special committee investigation, we identified commercial governance concerns in our China operation, challenging our ability to operate commercially in China. Additionally FCEV profitability and collectibility in China has been significantly challenged versus the relatively attractive US, Europe and Australia-New Zealand markets on those fronts. This combination of economic and risk challenges led to our decision to exit China commercially to focus on our core markets. (…)

We exited the China commercial vehicle market in part due to the negative gross margin and extended payment terms.

As of today, we have not been successful in collecting the remaining outstanding balances from this customers. We also eliminated research and development programs in China, which were deemed not vital to our fuel cell or vehicle platform commercialization in the near term.

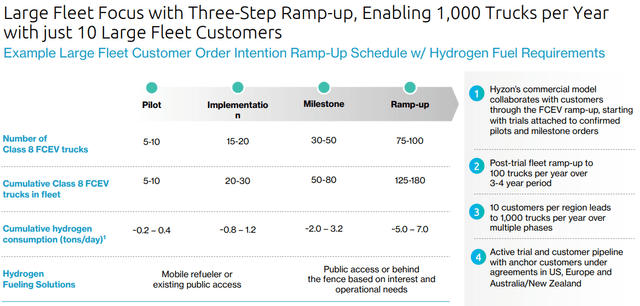

Earlier this week, Hyzon disclosed an agreement with Performance Food Group Company (PFGC) for upfitting 5 trucks with the company’s legacy 110kW fuel cell system and another 15 trucks upon successful trials of the new 200kW fuel cell system which underscores Hyzon’s new focus on large fleet customers:

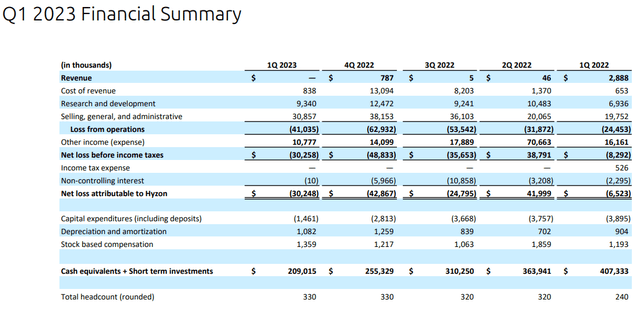

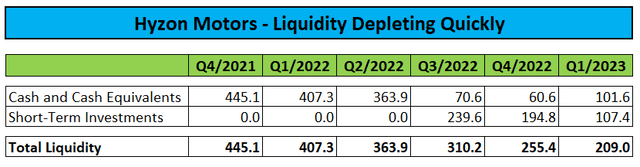

As it has been the case for several quarters now, Hyzon did not recognize any product revenue but continued to burn sizeable amounts of cash:

As of May 31, liquidity was down to $185 million. At the current rate of cash usage, the company would be required to raise additional capital by mid-2024 at the latest point assuming no major settlement payment to the SEC.

On the conference call, management disclosed plans to proactively address the company’s funding needs (emphasis added by author):

Essentially, we are dual tracking our path forward. One, as Jiajia mentioned previously, we have identified additional cash management levers available to us which we are prepared to implement if necessary to extend liquidity balanced against impact to business execution plan, and two, working through strategic options to raise capital being structured or transaction agnostic at this stage as we evaluate these pathways.

To that effect, we have retained a financial adviser and have launched a structured strategic capital raise process proactively. We are currently in confidential discussions with a range of potential strategic counterparties that participate in prioritized segments of the hydrogen ecosystem, ranging from energy producers to technology and product-driven companies.

Current market conditions represent formidable headwinds to raising cash through public markets, not just for us, but for all publicly traded early stage growth companies. Our initial stages of engagement with the prioritized counterparties shows potential interest in Hyzon’s technology and execution plan combined with the value they see in potential joint offerings that our technology can stimulate.

Quite frankly, with the company apparently mostly back to development-stage and considering the current market environment, I am having a tough time envisioning Hyzon raising a material amount of new capital in a non-dilutive manner.

As a result, I would expect the company to pursue some sort of equity-linked offering in case market conditions improve sufficiently going forward.

Bottom Line

Kudos to Hyzon’s new management team for successfully addressing a host of legacy issues and becoming current in the company’s regulatory reporting requirements.

Unfortunately, more work remains to be done as the company lacks the capital to execute on its new business strategy and remains out of compliance with Nasdaq’s $1 minimum bid price requirement.

Given these issues, investors will likely have to prepare for meaningful dilution and a potential reverse stock split later this year or in the first half of 2024 at the latest point.

Even when considering market participants’ increased risk appetite in recent weeks, I would strongly advise investors to avoid the shares for the time being.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.