Summary:

- Apple Inc. has recently faced some bearish sentiment because of issues related to the DOJ lawsuit, the DMA compliance, and China sales.

- At the same time, there is a lot of hype about Apple’s position in the AI market.

- Long-term shareholders and potential investors alike may fare best if they ignore all this noise and stick to the facts.

ozgurdonmaz

I don’t get the bears. But I don’t get the bulls either. Apple Inc. (NASDAQ:AAPL) is a large enterprise and as such it will enjoy a lot of attention. Consequently, a huge problem that shareholders and potential investors face is noise. Lots and lots of noise.

This article is my attempt to cut through that and provide a more sober view of Apple’s most recent results, how they compare to the previous period, as well as show that both current issues and prospects don’t carry enough weight to justify either a bearish or bullish thesis at the moment.

You may be glad to know that I don’t have skin in the game because of the current price. Then again, you may not. But it’s hard to deny that this could be of value to many investors who need a break from echo chambers.

Let’s get started…

The Performance Hasn’t Been Spectacular, But It’s Not Bad Either

To get an idea of where the business might be heading, let’s first start with the recent results that the company released for its December quarter last year. Keep in mind that the quarter had one less week than the December quarter of 2022.

First of all, its revenue reached $119.6 billion which reflected a modest increase of 2% on a YoY basis. It’s important to note, however, that the previous quarter had the benefit of an additional week and that the iPhone supply was constrained because of factory shutdowns due to COVID, both of which contributed to a 200 bps headwind according to management. At the same time, Apple seems to be enjoying all-time revenue records in Europe and double-digit growth in most emerging markets.

Let’s now break down revenue for a minute. At $69.7 billion, iPhone sales increased by 6% in the last reported quarter since the same quarter the year before. As a reminder, the segment represents the majority of revenue (58.32%). Mac sales had a more modest increase of 1% YoY, reaching $7.8 billion and represented 6.52% of total revenue.

As for iPad, sales were 25% lower YoY, at $7 billion; we should note that during the previous quarter, Apple launched the iPad Pro and iPad 10 generation which contributed to a naturally difficult comparison. Not to mention the extra week of sales on top of that factor. iPad sales represented 5.85% of total revenue.

Another disappointment may have been the 11% YoY decrease in Wearables, Home, and Accessories revenue which came in at $12 billion (10% of total sales). Keep in mind, though, that the December quarter in 2022 enjoyed the benefit brought by the launching of AirPods Pro 2nd generation, the Watch SE, and the first Watch Ultra, plus the extra week of sales.

Last, the Services segment experienced an all-time sales record of $23.1 billion which reflected a YoY increase of 11%. This is important as the segment represents a large contributor to revenue at nearly 20% of total sales for the quarter.

Now, the gross margin was 45.9% for the company, a 70 bps linked-quarter increase. Zooming in, the margin for the products segment was 39.4%, a 280 bps linked-quarter growth, and the margin for services was 72.8%, a 190 bps increase.

Moreover, net income increased by $3.9 billion to $33.9 billion on a YoY basis and diluted EPS came in at $2.18, reflecting a 16% YoY growth as well as an all-time record. Last, cash flow from operations was at $39.9 billion, growing by 17.3% YoY.

Looking forward, management has provided some guidance that is based on at least stable macroeconomic conditions. Shareholders can expect the March quarter to be flat compared to the same quarter in 2023 in terms of total and iPhone sales. However, management expects Services revenue to reflect a similar double-digit growth on a YoY basis as in the previous quarter. Last, some modest to moderate expansion is forecast for the gross margin at 46-47% (up from 45.9% in the last reported quarter).

As you can see, the performance was more or less flat, but some acceleration in growth was experienced in certain segments, potentially offset by lower profitability in others. Although justification for some of those results is available, investors should keep in mind that there is no clear indication of short-term growth. At the same time, I believe that there is nothing that should cause panic for shareholders.

Issues Are Overblown

What about the long-term headwinds though? Shareholders should keep a close eye on the current events that could have a large impact on Apple’s bottom line. And interested investors should understand how these events contribute to the overall risk profile of the stock.

But as always, the bears are going to exaggerate everything that is going on with large companies to confirm their bias. And this time is no different.

Take China sales, for example. The decrease during the December quarter was 13% on a YoY basis in that market and yet the company managed to compensate and beat iPhone revenues. Sure, 17.41% of total revenue came from China. However, is a recent shrinkage in sales of that magnitude a reason for shareholders to dump their shares and investors to short the stock? At most, it is a cause for concern and the need for close monitoring for shareholders; anything else appears to be fear-mongering.

Another selling point for bears is the compliance of Apple with the European Union’s Digital Markets Act, which involves the allowance of iPhone apps to be downloaded from developers’ websites. Does this open the door for a profit margin compression given that Apple can charge developers as much as 30%? Sure. Can that significantly affect the company’s bottom line? That’s uncertain, but there is a good chance that it won’t.

First, Apple has been clear that it won’t be able to provide customers the same level of security if they don’t opt for its app store, not to mention the resolutions of other issues such as refunds. So, shareholders should keep in mind that it’s up to how the market behaves; the value proposition offered by Apple may be so much better that customers won’t change their habits.

Second, the EU app store market represents a small portion of the global one in terms of revenue, so it’s unlikely that the regulation will cause anything more than a very small dent even if customers do change their habits as a result. In the CFO’s own words:

Just to keep it in context, the changes applied to the EU market, which represents roughly 7% of our global app store revenue.

Last but not least, there is also the antitrust lawsuit that was filed by the DOJ against Apple on March 23, for which the basis is the alleged violation of antitrust laws. For instance, the lawsuit argues that Apple has prevented other corporations from providing services through apps that would compete with Apple’s own apps. It also argues that it’s hard for iPhones to be connected with smartwatches that aren’t Apple Watches. Another example is that Apple doesn’t allow developers to use the iPhone’s NFC with their own digital wallets because they would compete with the Apple Wallet.

Based on the New York Times, legal experts have noted that it is legal for companies to favor their own offerings. Therefore, the government need to be able to articulate why it’s a different case with Apple.

A more specific potential weakness in the lawsuit is revealed by the fact that it has to resort to drawing parallels between this case and the one where Microsoft (MSFT) was restricting the use of other web browsers two decades ago. Quoting from the complaint:

In 1998, Apple co-founder Steve Jobs criticized Microsoft’s monopoly and ‘dirty tactics’ in operating systems to target Apple, which prompted the company ‘to go to the Department of Justice’ in hopes of getting Microsoft ‘to play fair,.

Even though the court found the company in violation of Section 2 of the Sherman Act, now is different. First of all, a Supreme Court ruling that came after that case stated that businesses cannot be sued for merely not assisting competitors to compete against their products or services. If the DOJ fails to argue that Apple does anything more than simply not making it easy for competitors to grab market share, then Apple lawyers may not have to work very hard.

Another thing we should note is that back then, Microsoft had a ~95% share of the OS market for Intel PCs, while the DOJ claims that Apple has about 70% in this case. It seems to me that it’s going to be very hard to prove a monopoly here.

Let’s not also forget that in the Epic Games v. Apple case, the judge ruled in favor of Apple after the latter successfully made a case for the security it is better able to provide by preventing Epic Games from distributing its game outside Apple’s app store. It is almost certain to me, at least, that it will defend its practices by appealing to security concerns here as well.

Last, unless the DOJ has some evidence we’re unaware of, there is also a weakness regarding the alleged monopoly that Apple is allegedly maintaining unlawfully because the DOJ implies that the company obtained its monopoly lawfully. As Lloyd Constantine, an attorney, told Payments Dive:

If they got their monopoly lawfully, which … is tacitly admitted in this complaint, then, in what ways did they begin to maintain that monopoly unlawfully?

It appears that the DOJ will have its hands full for the next few years. For now, Apple has stated that it would file a motion to dismiss, probably within the next couple of weeks.

The Other Source of Noise

Regardless, the bulls are speculating as well. What we can be quite confident about is that Apple is committed to driving shareholder value through share repurchases. For instance, the company bought back $76.6 billion worth of common stock during the fiscal year 2023. In the December quarter, it bought 118 million shares for $20.5 billion. These things are quantifiable.

Regarding Apple’s investments in AI technology, however, things are not as certain yet. There is talk that Vision Pro is going to outperform both Meta Quest 2 and Sony VR in sales in the long term. There are also rumors surrounding the preorder sales numbers. In any case, these can only serve speculators and are of little value to shareholders and investors.

Management doesn’t help much here either because it is very secretive about its plans; all they will share at the moment is how excited they are to be working in that area, but this won’t cut it. While there might be a good reason for that, the fact remains we don’t have access to solid data yet.

There is no denying on my part that Apple will have a good opportunity to capture significant AI technology market share in the future. But basing my investment decisions on this reasonable yet vague statement would be a bad idea; even if things work out alright. I think it’s better to wait for the company to announce more financial data regarding Vision Pro before we even start thinking about the long-term impact the product will have on its bottom line.

The Issue of Price

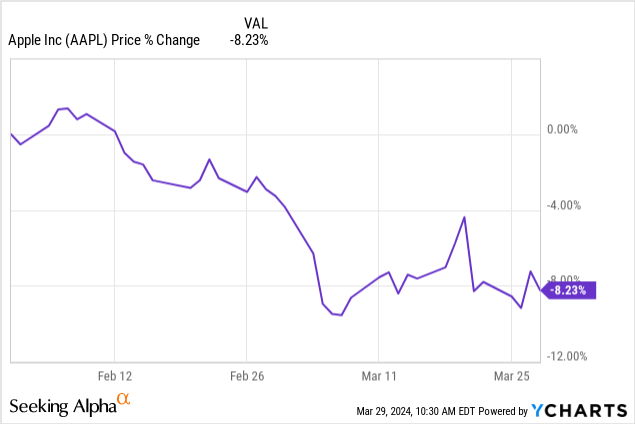

The other problem with being bullish is the current price. It’s true that the fall was significant for AAPL recently:

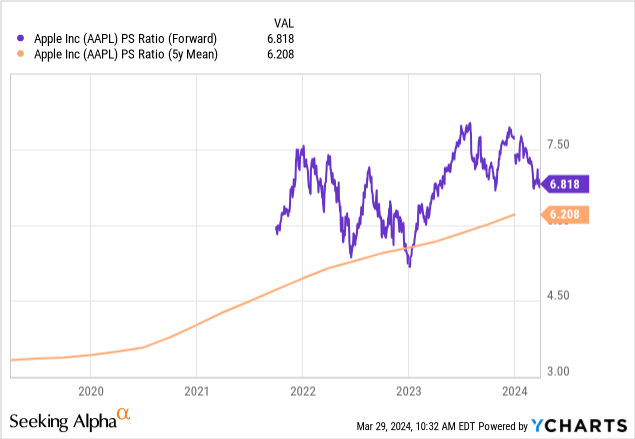

Perhaps the market is becoming more conservative with the stock. However, the price hasn’t experienced much pressure in the last couple of years. It is still overvalued based on a few metrics. For instance, its revenue multiple is above its 5-year mean:

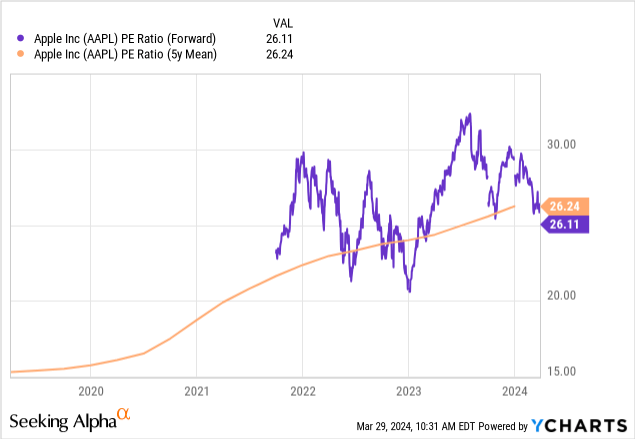

And the same goes for the earnings multiple, which is almost the same as the 5y mean:

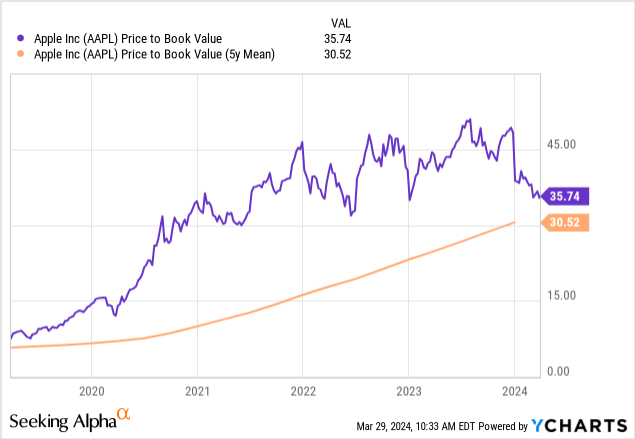

Last, its P/B ratio is not only above the 5-year mean, but is exceptionally high at the moment:

A valid argument could be made against using the past as something relevant on the basis that it doesn’t represent the state of the business in the future. And I could respect that. But I also view the justification of buying AAPL at any price because of potential future business developments as essentially speculative and unfit to serve investors well in their decision-making. In the absence of a better way to gauge price attractiveness, I think the short-term past is all we have. We may miss an opportunity, but we at least won’t be buying a business that is valued based on what could happen instead of what has already happened and what is.

At the end of the day, what is will always be better to base investment decisions on than what is going to be. Often, talk of undervaluation springs from discounted cash flow, or DCF, models. The issue is not always the assumptions that analysts make, but the magnitude of those assumptions to arrive at an “outperform” price target. I have no problem at all with them serving speculative operations. But a line must be drawn between those and investing.

A Few Risks

By now, you probably already understand some of the risks of investing in AAPL, but let’s briefly mention them.

First, it wasn’t my intention to downplay the sales decline in China during the last reported quarter. I just think it’s unsound to use this fact to cause panic. That being said, this does represent a risk because if a trend forms it could have a significant impact on profitability because of how big the reliance is on China. Therefore, I think that shareholders should monitor this from quarter to quarter.

Another risk is related to the DOJ lawsuit. Even though it doesn’t appear to have merit in my opinion based on the information we have, Apple may have to pay a fine. One bullish analyst mentioned the possibility of a “hefty fine” and said that since the case won’t be resolved any time soon, there is also a headline risk.

Last but not least, the current price level also creates a risk. While I don’t think that any selling pressure can persist with AAPL for very long, investors may want to be aware of a potential opportunity cost they might incur.

The Verdict

So, where are we? Based on what we have said so far, long-term Apple Inc. shareholders might be resistant to selling shares and the current noise made by the bears shouldn’t make such resistance unreasonable. Those who don’t yet have a position in Apple Inc. like me might be better served to stay on the sidelines for now because there is also a lot of noise involving prospects without concrete data that ignores the current price of AAPL.

For these reasons, I am rating the stock a hold for now and I’ll eagerly wait for the next quarterly report and earnings call.

Before you go, I have some questions for you:

- What’s your opinion on sales decreasing in China? Do you think it signifies increasing competition that is likely to persist?

- Do you think Apple will have to pay a “hefty” fine in regard to the DOJ lawsuit?

- How do you view the sales potential of the Vision Pro? Do you think it will have a significant impact on Apple’s bottom line at some point?

I want to thank you for reading and, please, if you liked this article, let me know in the comments. It means a lot to me.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.