Summary:

- Comcast Corporation is currently trading at bargain levels despite being a leader in various industries such as wireless phone services, cable TV, and movie studios.

- The stock is trading around the 50-day and 200-day moving averages, indicating stability and potential for a catch-up trade.

- Highlights from Q4 2023 include Universal ranking #1 in worldwide box office, strong performance in theme parks, and the expansion of internet connectivity.

Cindy Ord/Getty Images Entertainment

Comcast Corporation (NASDAQ:CMCSA) is a well-known company and it offers products and services that are used by so many people. It offers wireless phone services, cable TV, and other services. It owns NBC, Peacock, and Universal Pictures as well as the famed Universal Studios theme parks. It is a best in class leader in many areas and yet the stock is currently trading at bargain levels. The company might not be seeing significant growth lately, but at the same time, it doesn’t deserve to be trading like a tobacco stock in terms of price to earnings. It also does not deserve to be trading for less than half the valuation of Disney (DIS) which might be its closest peer. Comcast has world class movie studios and theme parks and is a leader in just about every division it owns. Let’s take a closer look:

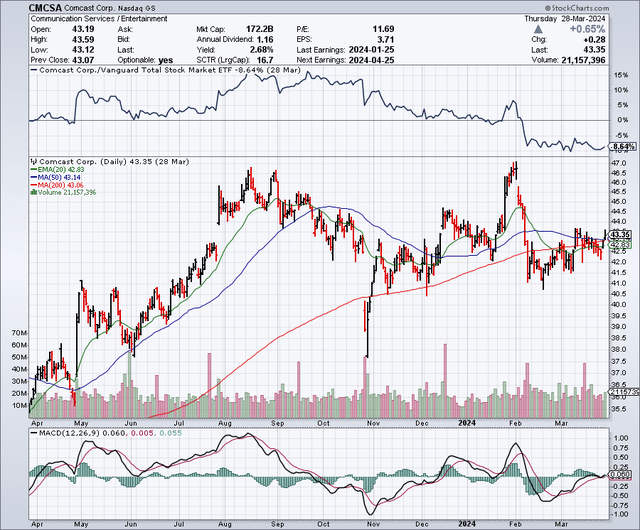

The Chart

As the chart below shows, Comcast is trading for about $43 per share and this is right around the 50-day moving average of $43.14 and the 200-day moving average of $43.06. This stock did spike up to around $47 in January, but it has been treading water around $43 per share lately. When I look at most stock charts these days, many are in overbought territory, so it is refreshing to see a stock like Comcast trading at a level where you are not paying up because you missed a big run. Comcast could end up being a ‘catch up” trade and could also end up outperforming many stocks going forward, due to the fact that it has not run up and remains very undervalued when looking at peers and fundamentals such as the price to earnings ratio.

StockCharts.com

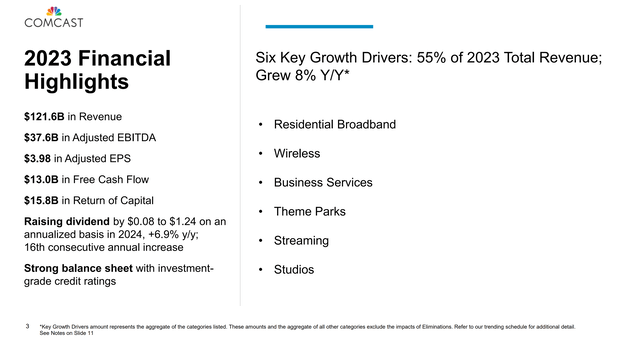

Here are some highlights that stood out to me in the Q4, 2023 Investor Presentation:

Universal: This Comcast division ranked #1 worldwide box office for the full year (2023). This was due to hits such as the Super Mario Bros. Movie, Oppenheimer, Trolls Band Together, Migration, and more.

Theme Parks: This division experienced strong performance and generated the highest adjusted EBITDA for the full year which increased by 24.7% for the full year.

Internet Connectivity: This division started deploying new technology upgrades which provide “…a giant leap forward in Internet connectivity that can deliver multi-gigabit symmetrical speeds to customers over the connections that already exist in tens of millions of homes.” Comcast continues with the expansion of its network and it increased home and business usage by 1.1 million to about 62.5 million.

Comcast

Earnings Estimates And The Balance Sheet

Analysts expect Comcast to earn $4.24 per share in 2024, with revenues coming in at $124.31 billion. For 2025, earnings are expected to rise to $4.58 per share, on revenues of $124.08 billion. In 2026, earnings estimates are at $5.10 per share with revenues climbing to $126.78 billion.

These estimates imply a price to earnings ratio of 10 times earnings or less, and that is very undervalued especially considering the current price to earnings ratio for the S&P 500 Index (SPY) is currently around 28 times earnings.

As for the balance sheet, Comcast has about $103.68 billion in debt and around $6.22 billion in cash.

I think Comcast should focus on paying down debt, but the balance sheet appears reasonable considering this company generates about $124 billion in revenue each year. Comcast has an investment grade credit rating, so it is able to borrow and refinance with some of the best rates and terms available.

The Dividend

Comcast pays a quarterly dividend of $0.31 per share, which totals $1.16 per share on an annual basis. This offers a yield of about 2.7%. The dividend has been growing over the years and the payout ratio is very low considering that earnings per share estimates are well above $4, and the annual dividend payout is just $1.16 per share. In 2014, the quarterly dividend was just $0.225 per share, but thanks to consistent increases the dividend has jumped to about 50% over the last ten years. Comcast typically raises the dividend at this time of year and it just did raise it from $0.29 to $0.31 per share for the dividend that will be paid on April 24, to shareholders of record as of April 3, 2024.

Comcast VS. Disney

I think Disney is the most direct comparison that can be made to Comcast. Disney has TV networks, it has a movie studio, streaming with Disney+ and it has theme parks. Analysts expect Disney to earn $4.68 per share in 2024, on revenues of $91.8 billion. Disney shares currently trade for about $122, so based on 2024 earnings estimates, this stock trades for around 26 times earnings. Disney has about $47.69 billion in debt and $7.19 billion in cash. In January, 2024, Disney paid a $0.30 per share dividend for the second half of 2023. This was the first dividend Disney has paid in a while since the company suspended dividends when Covid hit. This dividend rate implies a yield of far less than 1%, which is not comparable to the yield offered by Comcast.

When you consider the PE ratio and the dividend yield, Comcast appears to be very undervalued and a more attractive buy when compared to Disney. Comcast’s PE ratio is less than half of Disney’s PE ratio and the dividend yield Comcast offers is far superior.

Potential Downside Risks

A recession could impact ad spending on NBC and it could also reduce attendance at theme parks. Consumers might also cancel or reduce some services when it comes to the cable division. If revenues and profits drop in a recession, it could increase focus on the debt load this company carries. Recession and debt-laden balance sheets don’t make for a great combination, so if a recession occurs investors might pay even less for this stock.

In Summary

It’s rare to be able to buy a best in class company for such a low valuation. Comcast currently trades way below the market multiple and below the PE ratio that Disney enjoys. Comcast is likely to see continued strength in theme parks and its movie studios. The NBC division could see strong results in 2024, due to election year spending. Comcast has been raising the dividend and (based on the low payout ratio), can continue to do so. I see a lot to like in this undervalued stock and as one of the few remaining bargains in the stock market now.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CMCSA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.