Summary:

- I reaffirm my “Buy” rating on Block stock, supported by strong commercial performance in FY 2023, with 26% YoY topline and 25% YoY gross profit growth clearly outpacing analyst expectations.

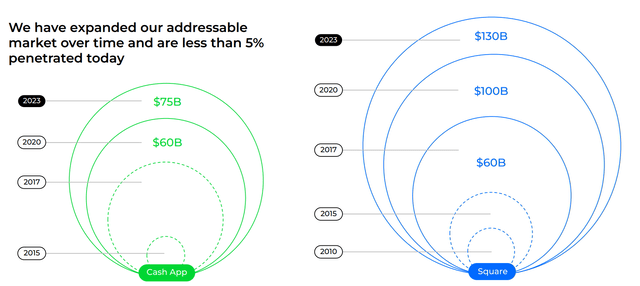

- Heading into 2024 and beyond, I like SQ’s ambition to tap into a $205 billion total addressable market – with a penetration upside of 95%.

- This ambitious plan, paired with strong management execution against objectives, is likely a key driver for uptrending EPS consensus projections.

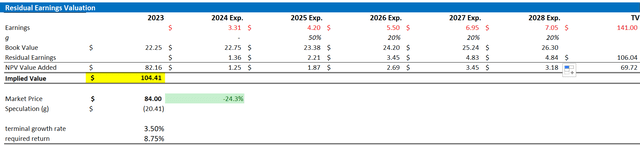

- In conclusion, I revisit my residual earnings model for Block’s valuation; and my calculation now suggests a fair implied target price of $104.

RollingCat/iStock via Getty Images

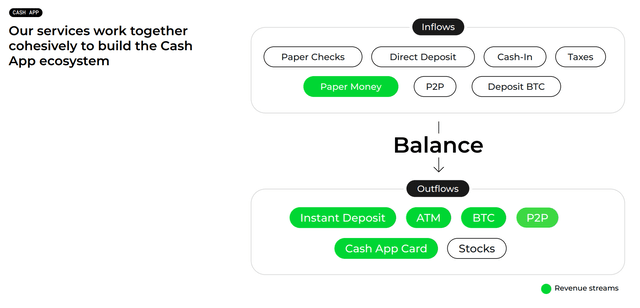

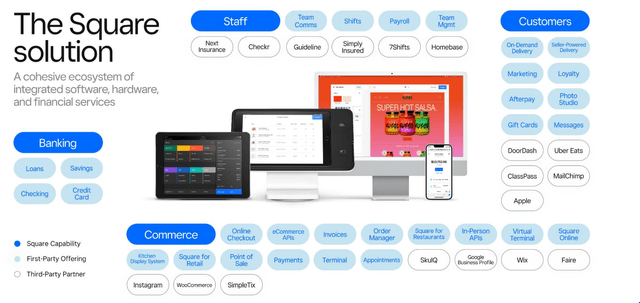

Block (NYSE:SQ) shares are up about 34% since I argued the stock was a Buy about a year ago. Today I am confident to reiterate my “Buy” recommendation, as I see my original thesis on Block supported by strong full year 2023 results, with Block managing to score 26% YoY growth, as well as a positive inflection on operating income. Looking into 2024 and beyond, I am encouraged to note Block management’s ambition to chase after a $205 billion TAM with an estimated 95% penetration whitespace. On that note, management guided a three-part growth strategy, including (1) banking their base, (2) moving upmarket by serving families, and (3) building the next-generation social bank. Or in other words, Block is aiming to convert existing P2P and Cash App Card users into primary banking clients. Against the backdrop of uptrending EPS consensus estimates for Block through 2030, I am updating my residual earnings framework for the company’s stock; and I now calculate a fair implied share price equal to $104.

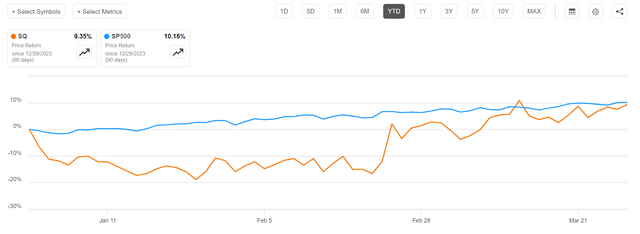

For context, Block’s stock performance has been broadly in line with the U.S. equities market year-to-date, although at a significantly higher volatility. Since the start of the year, SCHW shares are up approximately 9%, compared to a gain of about 10% for the S&P 500 (SP500).

Diving Into Block’s 2023 Performance

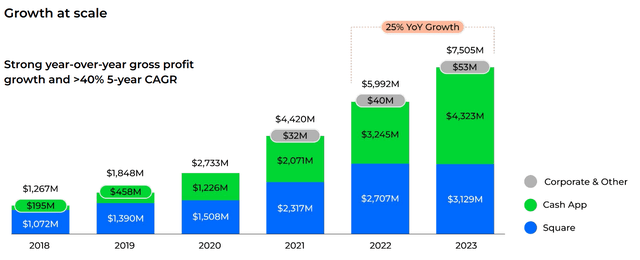

Block delivered strong FY 2023 results, ahead of consensus with regard to both topline and earnings. During the period from January to end of December, the Fintech company led by serial entrepreneur Jack Dorsey accumulated $21.9 billion of sales, up 26% YoY compared to the $17.5 billion in FY 2022. Notably, Block’s topline was about 10% ahead of consensus, which projected $19.8 billion in sales, according to data collected by Refintiv (reference for projection: January 2023). For context, my original bullish thesis on Block called for a 20% topline CAGR through 2030. Thus, Block also delivered on that. Similarly to the revenue growth, Block’s gross profit jumped by about 25% YoY, to $7.5 billion in FY 2023 (34% margin). Dissecting the gross profit by segment, I point out that 57% is attributable to Cash App (up 34% YoY), 41% to Square (up 15% YoY), and 2% to Corporate & Other.

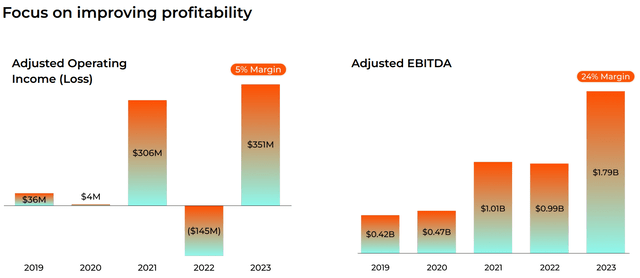

On profitability, I highlight that Block has achieved attractive margin gains in 2023, as management commented:

our investment framework informed decisions throughout the year and led to a heightened focus on efficiency

In FY 2023, Block accumulated $351 million in operating profits, compared to a loss of $145 million in 2022. Adjusted EBITDA jumped to $1.8 billion, up close to 80% from the $1 billion in FY 2022.

Setting Up For A Strong FY 2024

Looking forward, Block sets an optimistic outlook for 2024, with a focus on achieving the ‘Rule of 40’ by 2026. In that context, the company’s guidance calls for gross profit of at least $8.65 billion, up 15% YoY. In my opinion, depending on macro backdrop and management execution, >20% YoY could be achievable. This confidence is driven by projected upside on the integration of commerce offerings into Block’s ecosystem, as well as a broader financial services penetration: Specifically, I see notable near-term upside from deepening Afterpay’s integration with Cash App, which is in my view expected to enhance merchant discovery within Cash App and distribute Buy Now, Pay Later (BNPL) offerings through the Cash App Card. On a broader level, Cash App aims to become a leading provider of banking services to households earning up to ~$150k a year. This expansion, which should address up to 80% of the U.S. base, is underscored by a range of products including Cash App Card, Cash App Borrow, and direct deposit services. Commercial momentum in FY 2023 has been very encouraging: Cash App’s user engagement topped 2 million active users and 56 million monthly transacting activities.

Meanwhile, the Square offering is increasingly looking towards the banking play-book for capturing growth: Block outlined its efforts to attract and retain users by expanding and differentiating its banking features, such as offering a high-yield savings account and free overdraft coverage.

The Market Opportunity Is Enormous

I am excited to note that Block management is bringing the company’s strong commercial momentum to a market of enormous size. According to management commentary, the Block business opportunity could be as large as $205 billion of annual gross profit. The opportunity is further split into $130 billion for Square and $75 billion for Cash App. Furthermore, according to management commentary, there is enormous penetration whitespace within the market, pointing to a less than 5% weighted penetration rates across markets.

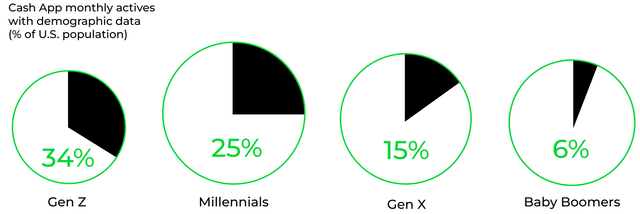

Building on the penetration upside, I like to highlight that Block’s Cash App has a clear user skew toward younger generation. This should help the company capturing more and more user/wallet share as time passes by and generations age up.

Valuation Update: Raise Target Price To $104

Encouraged by a strong financial performance in 2023 and positive earnings revision momentum looking into 2024 and beyond, I am revising my residual earnings forecast for Block stock. I anticipate that for the fiscal year 2024, Block’s earnings will fall within the range of $3.6 to $3.8 (non-GAAP). Looking ahead to fiscal years 2025 and 2026, I project earnings of $4.6 and $5.4, respectively, with an average annual growth rate in earnings of 2.25% thereafter.

For the growth projection between 2024 and 2025, I anchor my initial EPS value on consensus estimates compiled by Refinitiv. Additionally, I incorporate a 10-15% increase in earnings to account for the robust trading and margin momentum observed at Block, as highlighted in recent monthly metric reports. Furthermore, I maintain my equity cost assumption at 8.75%, derived largely from the CAPM framework, considering an adjusted beta of 1.1 to the S&P 500 and a long-term risk-free rate of 2.0 – 2.5%, as guided by the Fed.

With these adjusted parameters, I now estimate the fair stock price for Block to be $75.54, representing a significant increase from my previous estimate of $59.

Refinitiv; Company Financials; Author’s Calculations

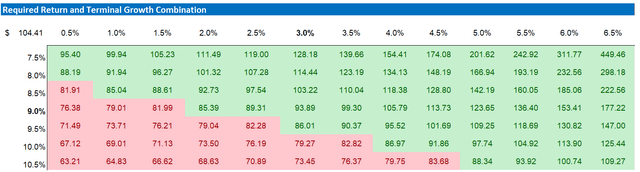

Below is also the updated sensitivity table.

Refinitiv; Company Financials; Author’s Calculations

Investor Takeaway

I reaffirm my “Buy” rating on Block stock, supported by strong commercial performance in FY 2023, with 26% YoY topline and 25% YoY gross profit growth clearly outpacing analyst expectations. Heading into 2024 and beyond, I like Block’s ambition to tap into a $205 billion total addressable market – with penetration upside of 95%. In that context, management has outlined a tripartite strategy for growth: converting peer-to-peer and Cash App Card users into core banking customers, catering to families to move upmarket, and pioneering a next-generation social banking platform. This ambitious plan, paired with strong management execution against objectives, is likely a key driver for uptrending EPS consensus projections. Concluding, I revisit my residual earnings model for Block’s valuation; and my calculation now suggests a fair implied target price of $104.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.